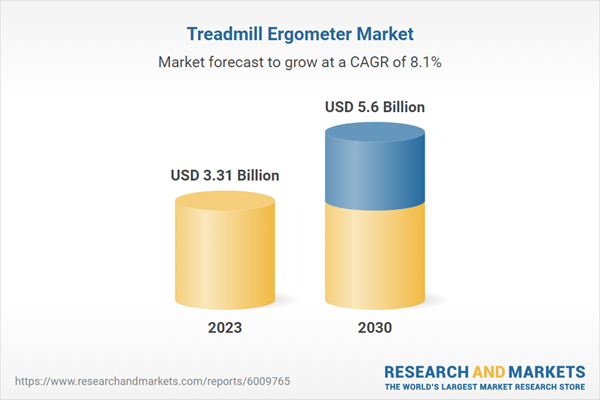

The global treadmill ergometer market size is expected to reach USD 5.60 billion by 2030, registering a CAGR of 8.1% from 2024 to 2030. Rising health consciousness coupled with adoption of a healthy lifestyle is anticipated to drive the growth. Treadmill ergometer provide personalized feedback, which is expected to positively influence the product demand. Increasing preference for physical activities such as walking and running has drawn attention toward fitness tracking and is expected to bode well for the market growth.

Treadmill ergometer provide real-time health metrics such as workout duration, distance travelled, speed, and calories burned. High tech ergometer also showcase blood pressure levels and oxygen uptake. Rising preference for real-time fitness tracking is expected to drive the demand for equipment integrated with advanced technology over their traditional counterparts. This factor is anticipated to propel the demand for treadmill ergometer in the fitness industry over the forecast period.

Walking and running are some of the most popular fitness activities and thus, an increasing number of consumers is likely to opt for exercising tools with real-time data to enhance their overall workout experience. Moreover, increasing product innovation is expected to boost the demand for motorized and smart fitness equipment. For instance, introduction of stair-treadmill ergometer, which is a combination of standard stepper and a treadmill has positively influenced the product demand for effective cardio exercising.

Rising incidence of trauma and deaths caused by cardiovascular diseases is anticipated to create awareness regarding the importance of regular exercise and leading a healthy lifestyle. As a result, rising number of gyms and fitness clubs coupled with demand from hospitals and rehabilitation centers is projected to fuel the global market growth. According to the American Heart Association (AHA), in 2016, Coronary Heart Disease (CHD) was the leading cause of death in U.S. with around 43.2% deaths caused by cardiovascular diseases.

Fitness club application segment held the largest market share of more than 82.9% in 2018. Rising awareness regarding the importance of physical activities coupled with increased participation in fitness and sports activities is projected to drive the growth. Consumer preference for cardiovascular exercises and strength training is expected to bode well for the treadmill ergometer demand in the forthcoming years.

Commercial end user segment held the largest market share of around 85% in 2018. Rising demand for treadmill ergometers from sports clubs, fitness clubs, gyms, offices, and medical centers among others is projected to drive the segment growth. Moreover, increasing construction of such commercial spaces is likely to positively influence the product demand.

North America held the largest share of 41% in the treadmill ergometer market in 2018. Availability of a wide assortment of products to monitor the progress of workout sessions, has fueled the regional market growth. U.S. dominates the global market due to high consumer willingness to spend on fitness and health rehabilitation.

Treadmill Ergometer Market Report Highlights

- In terms of regional revenue, North America held the largest share of the treadmill ergometer market in 2023

- The commercial segment dominated the market having 86.6% share in 2023. This is due to increasing number of health clubs, gyms, and rehabilitation centers

- Sports & fitness clubs dominated the market with 34.5% of revenue share in 2023. The increasing emphasis on physical fitness and wellness has led to a surge in gym memberships globally.

The leading players in the Treadmill Ergometer market include:

- BODYCRAFT

- ergoline GmbH

- h/p/cosmos sports & medical gmbh

- Life Fitness

- TECHNOGYM S.p.A

- ICON Health & Fitness

- Amer Sports

- JohnsonFitness

- Enraf-Nonius

Why should you buy this report?

- Comprehensive Market Analysis: Gain detailed insights into the global market across major regions and segments.

- Competitive Landscape: Explore the market presence of key players worldwide.

- Future Trends: Discover the pivotal trends and drivers shaping the future of the global market.

- Actionable Recommendations: Utilize insights to uncover new revenue streams and guide strategic business decisions.

This report addresses:

- Market intelligence to enable effective decision-making

- Market estimates and forecasts from 2018 to 2030

- Growth opportunities and trend analyses

- Segment and regional revenue forecasts for market assessment

- Competition strategy and market share analysis

- Product innovation listing for you to stay ahead of the curve

- COVID-19's impact and how to sustain in these fast-evolving markets

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The leading players in the Treadmill Ergometer market include:- BODYCRAFT

- ergoline GmbH

- h/p/cosmos sports & medical gmbh

- Life Fitness

- TECHNOGYM S.p.A

- ICON Health & Fitness

- Amer Sports

- www.johnsonfitness.com

- Enraf-Nonius

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 80 |

| Published | September 2024 |

| Forecast Period | 2023 - 2030 |

| Estimated Market Value ( USD | $ 3.31 Billion |

| Forecasted Market Value ( USD | $ 5.6 Billion |

| Compound Annual Growth Rate | 8.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |