Sweet oil is the fastest growing product segment owing to its increasing application in cosmetics and personal care products. The segment is expected to register a revenue-based CAGR of 12.3% from 2019 to 2025. Key manufacturers are launching new products in order to cater to the increasing demand from customers. For instance, in November 2018, The Orange Square Company Limited, formally known as Olverum, launched two new products, ‘The Body Oil’ and ‘The Dry Body Oil’, as a part of its essential oil product portfolio.

Asia Pacific is the fastest growing almond oil market and is projected to register a CAGR of 12.8% in terms of revenue from 2019 to 2025. Over the past few years, the region has been witnessing increased investments in marketing campaigns and new product launches in developing countries such as India. For instance in April 2019, Bajaj Corp Ltd launched a new cooling hair oil in India. This product launch is supported by an integrated marketing campaign by the company, which is focusing on celebrity endorsements to increase product visibility as well as penetration in the country. These initiatives are expected to remain key trends over the coming years.

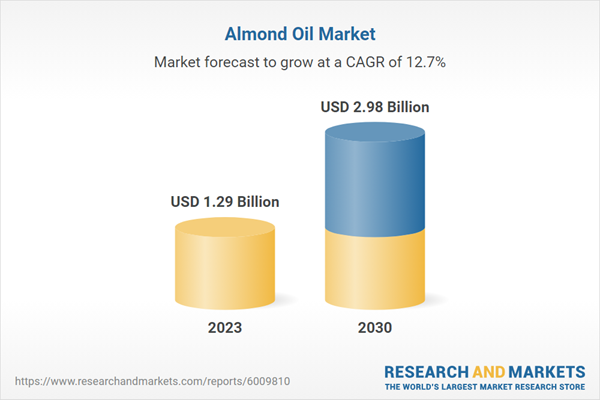

Almond Oil Market Report Highlights

- The sweet oil segment dominated the market and accounted for a revenue share of 67.5% in 2023. owing to its increasing application in cosmetics and personal care products.

- The personal care and cosmetics segment dominated the market and accounted for the largest revenue share in 2023 Growing focus on natural and chemical-free ingredients in these product categories will drive segment growth.

- Asia Pacific is estimated to emerge as the fastest growing regional market over the forecast period, fueled by ongoing marketing and promotional strategies by key manufacturers.

- Key players include Caloy, Inc.; Blue Diamond Growers; Jiangxi Baicao Pharmaceutical Co., Ltd; Bajaj Corp Ltd; Dabur India Ltd; Frontier Natural Products Co-op; Eden Botanicals; Ashwin Fine Chemicals & Pharmaceuticals;TSBE; and Indian Natural Oils.

The leading players in the Almond Oil market include:

- Caloy Company, LP

- Blue Diamond Growers.

- Jiangxi Baicao Pharmaceutical Co., Ltd

- Bajaj Consumer Care Ltd.

- Dabur.com

- Frontier Co-op.

- Eden Botanicals

- Ashwin fine Chemicals & Pharmaceuticals

- TSBE

- Indian Natural Oils

Why should you buy this report?

- Comprehensive Market Analysis: Gain detailed insights into the global market across major regions and segments.

- Competitive Landscape: Explore the market presence of key players worldwide.

- Future Trends: Discover the pivotal trends and drivers shaping the future of the global market.

- Actionable Recommendations: Utilize insights to uncover new revenue streams and guide strategic business decisions.

This report addresses:

- Market intelligence to enable effective decision-making

- Market estimates and forecasts from 2018 to 2030

- Growth opportunities and trend analyses

- Segment and regional revenue forecasts for market assessment

- Competition strategy and market share analysis

- Product innovation listing for you to stay ahead of the curve

- COVID-19's impact and how to sustain in these fast-evolving markets

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The leading players in the Almond Oil market include:- Caloy Company, LP

- Blue Diamond Growers.

- Jiangxi Baicao Pharmaceutical Co., Ltd

- Bajaj Consumer Care Ltd.

- Dabur.com

- Frontier Co-op.

- Eden Botanicals

- Ashwin fine Chemicals & Pharmaceuticals

- TSBE

- Indian Natural Oils

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 100 |

| Published | September 2024 |

| Forecast Period | 2023 - 2030 |

| Estimated Market Value ( USD | $ 1.29 Billion |

| Forecasted Market Value ( USD | $ 2.98 Billion |

| Compound Annual Growth Rate | 12.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |