The increasing demand for natural treatment options in the UAE is restructuring the insurance setting for CAM therapies. As awareness grows and consumer preferences shift toward holistic health solutions, insurance providers are responding by incorporating these therapies into their coverage plans. This evolution reflects a broader acceptance of CAM in the healthcare system, driven by demographic trends and government initiatives aimed at enhancing the overall health & wellness of the population. For instance, EBP in Dubai now includes coverage for treatments, such as homeopathy & Ayurveda, making these services more accessible to low-income residents. In addition, insurance providers, such as Oman Insurance Company, are now covering a wide range of CAM therapies, including homeopathy, Ayurveda, and Traditional Chinese Medicine (TCM). This coverage is offered through networks of recognized clinics, making these therapies more accessible to the public.

Health Insurance For UAE Complementary And Alternative Therapy Market Report Highlights

- On the basis of treatment, the physiotherapy segment held the largest market share in 2023. This is attributed to the growing population, increasing prevalence of lifestyle-related musculoskeletal disorders, and enhanced health coverage due to government initiatives improving accessibility and reducing out-of-pocket costs.

- The homeopathy segment is projected to experience the fastest growth due to its potential to lower hospitalization duration, medication use, and overall healthcare costs, alongside its effectiveness in enhancing well-being and managing chronic conditions, driving rising patient interest and demand for coverage.

- For instance, in September 2022, Policybazaar partnered with Adamjee Insurance to offer comprehensive health coverage to Pakistani nationals in the UAE. This partnership aims to facilitate access to inclusive health coverage plans for their dependents, covering both UAE and Pakistan, through Policybazaar.

The leading players in the Health Insurance for UAE Complementary and Alternative Therapy market include:

- Cigna Healthcare

- Daman

- GIG

- MetLife UAE (Gulf)

- Allianz Care

- Aetna Inc.

- Sukoon Insurance PJSC

- Nextcare

- Salama Islamic Arab Insurance Company

- MEDGULF

- United Fidelity Insurance PSC

- Al Buhaira National Insurance Company (ABNIC)

- Adamjee Insurance

- ADNIC

- Takaful Emarat

- Watania

- RAKINSURANCE

- Oriental Insurance

- Arabia Insurance Company

Why should you buy this report?

- Comprehensive Market Analysis: Gain detailed insights into the global market across major regions and segments.

- Competitive Landscape: Explore the market presence of key players worldwide.

- Future Trends: Discover the pivotal trends and drivers shaping the future of the global market.

- Actionable Recommendations: Utilize insights to uncover new revenue streams and guide strategic business decisions.

This report addresses:

- Market intelligence to enable effective decision-making

- Market estimates and forecasts from 2018 to 2030

- Growth opportunities and trend analyses

- Segment and regional revenue forecasts for market assessment

- Competition strategy and market share analysis

- Product innovation listing for you to stay ahead of the curve

- COVID-19's impact and how to sustain in these fast-evolving markets

Table of Contents

Companies Mentioned

The leading players in the Health Insurance for UAE Complementary and Alternative Therapy market include:- Cigna Healthcare

- Daman

- GIG

- MetLife UAE (Gulf)

- Allianz Care

- Aetna Inc.

- Sukoon Insurance PJSC

- Nextcare

- Salama Islamic Arab Insurance Company

- MEDGULF

- United Fidelity Insurance PSC

- Al Buhaira National Insurance Company (ABNIC)

- Adamjee Insurance

- ADNIC

- Takaful Emarat

- Watania

- RAKINSURANCE

- Oriental Insurance

- Arabia Insurance Company

Table Information

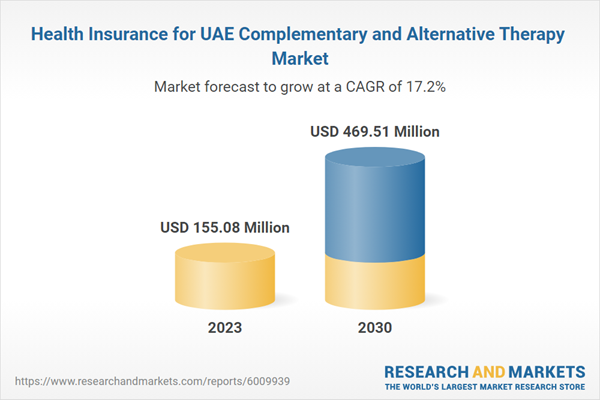

| Report Attribute | Details |

|---|---|

| No. of Pages | 172 |

| Published | September 2024 |

| Forecast Period | 2023 - 2030 |

| Estimated Market Value ( USD | $ 155.08 Million |

| Forecasted Market Value ( USD | $ 469.51 Million |

| Compound Annual Growth Rate | 17.1% |

| Regions Covered | United Arab Emirates |

| No. of Companies Mentioned | 19 |