Japan Diabetes Device Overview

Japan boasts one of the world's largest senior populations, making it more prone to the emergence of type 2 diabetes. Diabetes is becoming more common in Japan as the country's population ages. Blood glucose monitoring and treatment are becoming more common in order to prevent adverse outcomes like kidney problems, cardiovascular illnesses, and many other ailments.The need for diabetes devices is being driven by Japan's increasing diabetes prevalence, which has emerged as a serious health concern. Italy's diabetes diagnosis rate has been steadily rising due to changes in lifestyle, such as sedentary behavior, bad eating habits, and an aging population. Japan is one of the Asian nations with the highest prevalence of diabetes, accounting for the disease's burden from both type 1 and type 2 diabetes, according to recent figures. IDF 2021 statistics estimates that 11 million persons in Japan have diabetes.

The need for efficient management and treatment alternatives is rising in tandem with Japan's diabetes population growth. Diabetes devices are essential for managing blood sugar levels and avoiding problems related to the disease. Many patients choose these drugs because they are easy to take, convenient, and can help with glycemic control. The need for affordable and effective therapies to counteract Japan's rapidly spreading diabetes epidemic is reflected in the demand for diabetes gadgets.

Growth Drivers for the Japan Diabetes Device Market

Government campaigns are a major factor in encouraging the use of diabetes management device in Japan.In order to improve the treatment of diabetes, the Ministry of Health, Labour and Welfare (MHLW) has introduced public health campaigns and nationwide screening programs, among other supportive healthcare measures. The ultimate goal of these programs is to lower the long-term consequences linked to diabetes by concentrating on early detection and intervention. The government is promoting awareness and encouraging patients to use accessible technologies by giving diabetes treatment a high priority in public health agendas.

Furthermore, the Japanese healthcare system reimburses the cost of a number of diabetes management devices, such as insulin pumps and continuous glucose monitors. Patients' burdens are lessened by this financial assistance, increasing the accessibility of these gadgets. Reimbursement policies encourage medical professionals to suggest advanced diabetes management strategies, leading to a change in treatment regimens that are more efficacious. Consequently, these government initiatives greatly raise the nationwide adoption rate of cutting-edge diabetes gadgets.

Increased public knowledge of diabetes prevention and management

Governmental and healthcare institutions have launched awareness programs emphasizing the value of knowing about diabetes, its dangers, and practical management techniques. These programs attempt to demystify and lessen the stigma associated with diabetes by emphasizing healthy lifestyles, early identification, and the vital role that technology plays in diabetes treatment. People who are more aware of the dangers of diabetes are more inclined to take preventative steps, such as using cutting-edge medical technology.Furthermore, social media and community health initiatives have been essential in spreading knowledge and promoting conversations about managing diabetes. People are more inclined to take control of their health as a result of this increased awareness, which increases acceptability of devices like insulin pumps and continuous glucose monitors. As a result, the general market demand for these devices is rising as more people become aware of their advantages.

Japan Diabetes Device Company Analysis

The major participants in the Japan Diabetes Device market includes Abbott Laboratories, Roche, Medtronic, Novo Nordisk A/S, Terumo Corporation, Eli Lilly, BD, Dexcom Inc.Japan Diabetes Device Company News

In December 2022, A press statement from Terumo Company states that the Japanese medical insurance system now offers greater payment coverage for the Dexcom G6 CGM System. A larger number of diabetic patients in Japan will be qualified to request reimbursement for utilizing the Dexcom G6 CGM System as a result of the recently established ""C150"" category.In March 2022, The Japanese Ministry of Health, Labour, and Welfare has authorized extending the Freestyle Libre system's payment coverage to encompass all diabetics who take insulin at least once daily, according to a statement from Abbott.

Types - Industry is divided into 4 viewpoints:

1. Self-Monitoring Devices2. Continuous Glucose-Monitoring Devices

3. Insulin Pumps

4. Insulin Pens

Distribution Channel - Industry is divided into 4 viewpoints:

1. Hospital Pharmacies2. Retail Pharmacies

3. Diabetes Clinics/Centers

4. Online Pharmacies

All companies have been covered with 5 Viewpoints

1. Overviews2. Key Person

3. Recent Developments & Strategies

4. Product Portfolio & Product Launch in Last 1 Year

5. Revenue

Company Analysis

1. Abbott Laboratories2. Roche

3. Medtronic

4. Novo Nordisk A/S

5. Terumo Corporation

6. Eli Lilly

7. BD

8. Dexcom Inc

Key Questions Answered in Report:

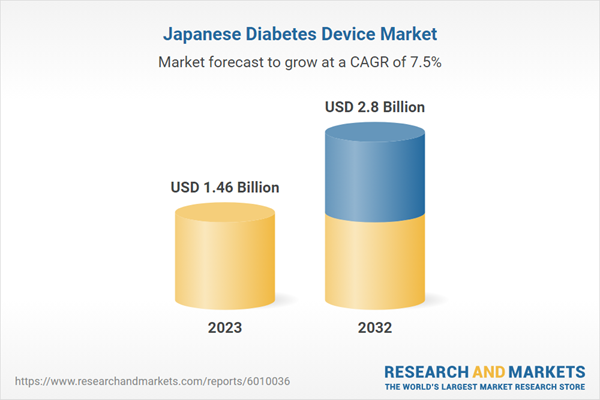

1. How big is the Japan Diabetes Device industry?2. What is the Japan Diabetes Device industry growth rate?

3. Who are the key players in Japan Diabetes Device industry?

4. What are the factors driving the Japan Diabetes Device industry?

5. Which Region held the largest market share in the Japan Diabetes Device industry?

6. What segments are covered in the Japan Diabetes Device Market report?

Table of Contents

Companies Mentioned

- Abbott Laboratories

- Roche

- Medtronic

- Novo Nordisk A/S

- Terumo Corporation

- Eli Lilly

- BD

- Dexcom Inc

Methodology

In this report, for analyzing the future trends for the studied market during the forecast period, the publisher has incorporated rigorous statistical and econometric methods, further scrutinized by secondary, primary sources and by in-house experts, supported through their extensive data intelligence repository. The market is studied holistically from both demand and supply-side perspectives. This is carried out to analyze both end-user and producer behavior patterns, in the review period, which affects price, demand and consumption trends. As the study demands to analyze the long-term nature of the market, the identification of factors influencing the market is based on the fundamentality of the study market.

Through secondary and primary researches, which largely include interviews with industry participants, reliable statistics, and regional intelligence, are identified and are transformed to quantitative data through data extraction, and further applied for inferential purposes. The publisher's in-house industry experts play an instrumental role in designing analytic tools and models, tailored to the requirements of a particular industry segment. These analytical tools and models sanitize the data & statistics and enhance the accuracy of their recommendations and advice.

Primary Research

The primary purpose of this phase is to extract qualitative information regarding the market from the key industry leaders. The primary research efforts include reaching out to participants through mail, tele-conversations, referrals, professional networks, and face-to-face interactions. The publisher also established professional corporate relations with various companies that allow us greater flexibility for reaching out to industry participants and commentators for interviews and discussions, fulfilling the following functions:

- Validates and improves the data quality and strengthens research proceeds

- Further develop the analyst team’s market understanding and expertise

- Supplies authentic information about market size, share, growth, and forecast

The researcher's primary research interview and discussion panels are typically composed of the most experienced industry members. These participants include, however, are not limited to:

- Chief executives and VPs of leading corporations specific to the industry

- Product and sales managers or country heads; channel partners and top level distributors; banking, investment, and valuation experts

- Key opinion leaders (KOLs)

Secondary Research

The publisher refers to a broad array of industry sources for their secondary research, which typically includes, however, is not limited to:

- Company SEC filings, annual reports, company websites, broker & financial reports, and investor presentations for competitive scenario and shape of the industry

- Patent and regulatory databases for understanding of technical & legal developments

- Scientific and technical writings for product information and related preemptions

- Regional government and statistical databases for macro analysis

- Authentic new articles, webcasts, and other related releases for market evaluation

- Internal and external proprietary databases, key market indicators, and relevant press releases for market estimates and forecasts

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | October 2024 |

| Forecast Period | 2023 - 2032 |

| Estimated Market Value ( USD | $ 1.46 Billion |

| Forecasted Market Value ( USD | $ 2.8 Billion |

| Compound Annual Growth Rate | 7.5% |

| Regions Covered | Japan |

| No. of Companies Mentioned | 8 |