Government Initiatives to Develop Aquaculture Industry Boost Asia Pacific Aquatic Veterinary Market

The high demand for seafood and the decreasing annual catch of wild fish are crucial factors that can drive the growth of the aquaculture industry at an exponential rate. Thus, governments are taking initiatives to improve and support the growth of the aquacultural industry. Following are a few recent initiatives:An Indian Council of Agricultural Research Institute, the Central Institute of Freshwater Aquaculture, Bhubaneswar (India), and Indian Immunologicals Ltd., a vaccine manufacturer, have announced a partnership for the commercial development of a vaccine against hemorrhagic septicemia, also known as Aeromonas septicemia, ulcer disease, or red-sore disease in freshwater fish.

In 2023, Over the next four years, the McGowan Government will invest $8.5 million to further aquaculture research and development throughout Western Australia, including renovating Broome, Pemberton, and Albany facilities.

In 2022, the Singapore Food Agency (SFA) unveiled the Singapore Aquaculture Plan to promote the aquaculture sector. The three strategies outlined in the plan aim to revolutionize the industry: expanding and improving aquaculture sites, funding research and development, and assisting the sector in implementing improved farming techniques and technology. Thus, an increase in government initiatives to support developments in the aquaculture industry drives the aquatic veterinary market growth.

Asia Pacific Aquatic Veterinary Market Overview

Aquaculture businesses in China are focusing on partnerships, mergers and acquisitions, and collaborations with companies from other countries to develop fish farms. In December 2020, Nordic Aqua Partners A/S, a Norwegian company with a subsidiary in Ningbo, Zhejiang province, began the construction of China's first land-based salmon farm. This facility aims to provide ~36,000 metric ton of salmon annually to China. An increase in the production of seafood is also attributed to the growing consumption of seafood in China, in addition to the rise in aquaculture activities.As per a 2020 report from the Stockholm Resilience Centre, China is expected to face an issue of overconsumption of seafood by 2030. According to the East Asia Forum, the total production output of the fishing industry in China was 65.49 million metric ton in 2020, 52.24 million metric ton of which came from domestic freshwater and offshore aquaculture. Therefore, progressing aquaculture activities in China fuel the demand for aquatic veterinary products and services in China.

Asia Pacific Aquatic Veterinary Market Segmentation

- The Asia Pacific aquatic veterinary market is categorized into type, species, diseases source, route of administration, and country.

- Based on type, the Asia Pacific aquatic veterinary market is bifurcated diagnostic and treatment. The treatment segment held a larger market share in 2022. The diagnostic segment is further sub segmented into serological, molecular, DNA sequencing, and other diagnostics. The treatment segment is further sub segmented into vaccines, medications, and supplements.

- By species, the Asia Pacific aquatic veterinary market is segmented into fish, crustaceans, mollusca, and others. The fish segment held the largest market share in 2022.

- Based on diseases source, the Asia Pacific aquatic veterinary market is segmented into bacterial, viral, parasites, and others. The bacterial segment held the largest market share in 2022.

- In terms of route of administration, the Asia Pacific aquatic veterinary market is segmented into water medication, medicated feed, and other route of administrations. The water medication segment held the largest market share in 2022.

- By country, the Asia Pacific aquatic veterinary market is segmented into China, Japan, India, Australia, South Korea, and Rest of Asia Pacific. China dominated the Asia Pacific aquatic veterinary market share in 2022.

- Aquatic Diagnostics Ltd, Ceva Polchem Pvt Ltd, Elanco Animal Health Inc, HIPRA SA, Merck KGaA, Phibro Animal Health Corp, Thermo Fisher Scientific Inc, Virbac SA, and Zoetis Inc are among the leading companies operating in the Asia Pacific aquatic veterinary market.

Market Highlights

- Based on type, the Asia Pacific aquatic veterinary market is bifurcated diagnostic and treatment. The treatment segment held 83.6% market share in 2022, amassing US$ 242.11 million. It is projected to garner US$ 348.01 million by 2030 to register 4.6% CAGR during 2022-2030. The diagnostic segment is further sub segmented into serological, molecular, DNA sequencing, and other diagnostics. The treatment segment is further sub segmented into vaccines, medications, and supplements.

- The fish segment held 56.7% share of Asia Pacific aquatic veterinary market in 2022, amassing US$ 164.23 million. It is anticipated to garner US$ 243.13 million by 2030 to expand at 5.0% CAGR during 2022-2030.

- The bacterial segment held 54.3% share of Asia Pacific aquatic veterinary market in 2022, amassing US$ 157.10 million. It is projected to garner US$ 235.43 million by 2030 to expand at 5.2% CAGR from 2022 to 2030.

- In terms of route of administration, the Asia Pacific aquatic veterinary market is segmented into water medication, medicated feed, and other route of administrations. The water medication segment held 45.3% share of Asia Pacific aquatic veterinary market in 2022, amassing US$ 131.20 million. It is projected to garner US$ 194.96 million by 2030 to expand at 5.1% CAGR from 2022 to 2030.

- This analysis states that China captured 24.9% share of Asia Pacific aquatic veterinary market in 2022. It was assessed at US$ 72.19 million in 2022 and is likely to hit US$ 111.62 million by 2030, registering a CAGR of 5.6% during 2022-2030.

Reasons to Buy

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the Asia Pacific aquatic veterinary market.

- Highlights key business priorities in order to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in the Asia Pacific aquatic veterinary market, thereby allowing players across the value chain to develop effective long-term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth Asia Pacific market trends and outlook coupled with the factors driving the Asia Pacific aquatic veterinary market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing, and distribution.

Table of Contents

Companies Mentioned

Some of the leading companies in the Asia Pacific Aquatic Veterinary market include:- Aquatic Diagnostics Ltd

- Ceva Polchem Pvt Ltd

- Elanco Animal Health Inc

- HIPRA SA

- Merck KGaA

- Phibro Animal Health Corp

- Thermo Fisher Scientific Inc

- Virbac SA

- Zoetis Inc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 111 |

| Published | August 2024 |

| Forecast Period | 2022 - 2030 |

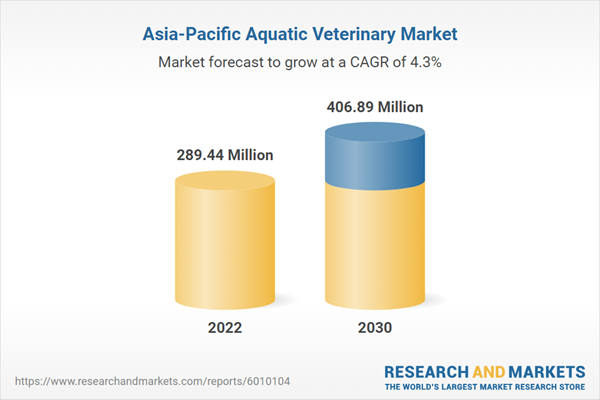

| Estimated Market Value ( USD | $ 289.44 Million |

| Forecasted Market Value ( USD | $ 406.89 Million |

| Compound Annual Growth Rate | 4.3% |

| Regions Covered | Asia Pacific |

| No. of Companies Mentioned | 10 |