Rising Demand for Abrasives from Electrical and Electronics Industry Boosts Asia Pacific Abrasive Market

Abrasives are used in a variety of electronics and photonics applications such as mounting, precision grinding, polishing, production lapping, and wafer polishing. In the electronics industry, mounting devices require high precision to ensure their stability during testing and analysis. Aluminum oxide and silicon carbide are generally used in mounting processes due to their high hardness and dimensional stability.Boron carbide is also used for mounting sensitive components such as ceramics and semiconductor materials due to its low density, high hardness, and chemical resistance. The rising sales of electrical and electronic components due to the transition toward electric vehicles and growing demand for electronic consumer durables have fueled the demand for high-efficiency materials required for component production.

As per the Parker Hannifin Corporation report, the global market for computer numerically controlled (CNC) machine tools is projected to reach US$ 129 billion by 2026. China is the largest manufacturing hub of electronics in the world. Factors such as low labor costs, availability of skilled labor, and prevalent supply chains are driving the growth of the electronics industry. The government of India is also showing an aggressive approach to promoting the country as an alternative market to China.

According to Invest India, the global electronics manufacturing services market is anticipated to reach US$ 1.14 trillion by 2026, recording a CAGR of 5.4% during 2021-2026. The India Brand Equity Foundation states that the Indian electronics manufacturing industry is projected to reach US$ 520 billion by 2025. According to the Japan Electronics and Information Technology Industries Association, the production by the global electronics and IT industries was projected to reach US$ 3.52 trillion in 2023.

Asia Pacific Abrasive Market Overview

The market in Asia Pacific is driven by accelerating automotive, marine, aerospace, and construction industries. Asia Pacific is a hub for automotive manufacturing with a large presence of international and domestic players operating in the region. According to a report published by the China Passenger Car Association, in 2022, Tesla Inc delivered 83,135 made-in-China electric vehicles, indicating growth in sales of electric vehicles compared to 2021.According to the Organisation Internationale des Constructeurs d'Automobiles (OICA), Asia-Oceania's vehicle production increased from 46.8 million in 2021 to 50 million in 2022. The automotive sector's growth, coupled with the demand for lightweight materials and electrical vehicles, further propels the utilization of specialized abrasives tailored to these evolving requirements.

Moreover, the construction boom in Asia Pacific is another major driver. Under the Sustainable Development Goals 2030, the Asian Development Bank has planned to build resilient infrastructure, promote inclusive and sustainable industrialization, and foster innovation in Asia Pacific. Infrastructure development has been a focal point for many governments across Asia Pacific. Investments in large-scale projects, such as transportation networks, energy facilities, and public amenities, have driven demand for construction materials. These projects are essential for improving connectivity, fostering economic growth, and enhancing the overall quality of life.

As a result, abrasives are in high demand to support the planning and execution of these vital infrastructure initiatives. According to the report by the Department for Promotion of Industry and Internal Trade (DPIIT), the Government of India has planned to boost the infrastructure and construction services through several policies such as open FDI norms, large budget allocation to the infrastructure sector, and smart cities mission. The report also stated that the real estate industry in India is projected to reach US$ 1 trillion by 2030, along with an increased year-on-year infrastructure Capex by 34% to reach US$ 6.7 million.

With ongoing infrastructure development and urbanization projects, there is an increased requirement for abrasives in construction applications. From shaping and smoothing concrete surfaces to cutting and finishing metal structures, abrasives play a vital role in enhancing the quality and precision of construction projects. In addition, as the maritime trade and transportation sectors expand, there is an increasing need for ship construction and maintenance, stimulating the demand for abrasives in various applications. China, Japan, and South Korea are leading countries in the shipbuilding sector.

According to the States Council of the People's Republic of China, the shipbuilding output of China was 9.61 million deadweight tons (dwt) in 2022, i.e., up by 2.8 percentage points year-on-year, accounting for 46.2% of the global total. Abrasives play a crucial role in smoothing and polishing the metal surfaces of ship components. This is essential not only for aesthetic purposes but also for preventing corrosion and ensuring the longevity of the vessels. The intricate and large-scale nature of ship construction requires abrasives that can handle diverse materials used in shipbuilding, including steel and various alloys.

Furthermore, Asia Pacific's metalworking industry is another major force driving the demand for abrasives due to the diverse and expansive nature of metal-related manufacturing processes across the region. Abrasives are indispensable for precision machining, whether grinding down rough edges, cutting through thick metal sheets, or shaping intricate parts. This foundational role in metalworking operations contributes significantly to the consistent demand for abrasives in Asia Pacific.

Asia Pacific Abrasive Market Segmentation

- The Asia Pacific abrasive market is categorized into material, type, application, sales channel, and country.

- By material, the Asia Pacific abrasive market is bifurcated into natural and synthetic. The synthetic segment held a larger share of Asia Pacific abrasive market in 2022.

- In terms of type, the Asia Pacific abrasive market is bifurcated into bonded abrasives and coated abrasives. The bonded abrasives segment held a larger share of Asia Pacific abrasive market in 2022. Furthermore, the bonded abrasives segment is subcategorized into discs, wheels, and others. Additionally, the coated abrasives segment is subcategorized into flap discs, fiber discs, hook a loop discs, belts, rolls, and others.

- By application, the Asia Pacific abrasive market is segmented into automotive, aerospace, marine, metal fabrication, woodworking, electrical & electronics, and others. The automotive segment held the largest share of Asia Pacific abrasive market in 2022.

- Based on sales channel, the Asia Pacific abrasive market is bifurcated into direct and indirect. The indirect segment held a larger share of Asia Pacific abrasive market in 2022.

- By country, the Asia Pacific abrasive market is segmented into Australia, India, Malaysia, and the Rest of Asia Pacific. The Rest of Asia Pacific dominated the Asia Pacific abrasive market share in 2022.

- Deerfos Co., Ltd; CUMI AWUKO Abrasives GmbH; Robert Bosch GmbH; Tyrolit Schleifmittelwerke Swarovski AG & Co KG; Sun Abrasives Co Ltd; Compagnie de Saint-Gobain S.A.; sia Abrasives Industries AG; RHODIUS Abrasives GmbH; 3M Co; and Ekamant AB are some of the leading companies operating in the Asia Pacific abrasive market.

Market Highlights

- By material, the Asia Pacific abrasive market is bifurcated into natural and synthetic. The synthetic segment held 59.1% share of Asia Pacific abrasive market in 2022, amassing US$ 12.56 billion. It is projected to garner US$ 19.67 billion by 2030 to expand at 5.8% CAGR from 2022 to 2030.

- In terms of type, the Asia Pacific abrasive market is bifurcated into bonded abrasives and coated abrasives. The bonded abrasives segment held 57.9% share of Asia Pacific abrasive market in 2022, amassing US$ 12.31 billion. It is anticipated to garner US$ 19.01 billion by 2030 to expand at 5.6% CAGR during 2022-2030. Furthermore, the bonded abrasives segment is subcategorized into discs, wheels, and others. Additionally, the coated abrasives segment is subcategorized into flap discs, fiber discs, hook a loop discs, belts, rolls, and others.

- The automotive segment held 23.6% share of Asia Pacific abrasive market in 2022, amassing US$ 5.03 billion. It is projected to garner US$ 7.79 billion by 2030 to expand at 5.6% CAGR from 2022 to 2030.

- The indirect segment held 57.5% share of Asia Pacific abrasive market in 2022, amassing US$ 12.24 billion. It is predicted to garner US$ 18.83 billion by 2030 to expand at 5.5% CAGR between 2022 and 2030.

- This analysis states that the Rest of Asia Pacific captured 94.2% share of Asia Pacific abrasive market in 2022. It was assessed at US$ 20.03 billion in 2022 and is likely to hit US$ 29.84 billion by 2030, registering a CAGR of 5.1% during 2022-2030.

- In January-2024, Tyrolit acquired a majority stake in Abrasive Tools Specialists, an importer, wholesaler, and converter of abrasive tools, to strengthen its presence in the Australian market, diversify its product offerings, and cater to diverse customer needs.

- In September-2023, Tyrolit Schleifmittelwerke Swarovski AG & Co KG acquired a complete stake in Acme Holding Company, a specialized abrasive producer and supplier, to enhance its portfolio for the foundry, steel, and rail sectors.

- In July-2020, Tyrolit Schleifmittelwerke Swarovski AG & Co KG completed the acquisition of Bibielle SpA, a producer of three-dimensional abrasive products, to meet all polishing, grinding, finishing, and surface conditioning needs.

Reasons to Buy

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the Asia Pacific abrasive market.

- Highlights key business priorities in order to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in the Asia Pacific abrasive market, thereby allowing players across the value chain to develop effective long-term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth Asia Pacific market trends and outlook coupled with the factors driving the Asia Pacific abrasive market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing, and distribution.

Table of Contents

Companies Mentioned

Some of the leading companies in the Asia Pacific Abrasive market include:- Deerfos Co., Ltd

- CUMI AWUKO Abrasives GmbH

- Robert Bosch GmbH

- Tyrolit Schleifmittelwerke Swarovski AG & Co KG

- Sun Abrasives Co Ltd

- Compagnie de Saint-Gobain S.A.

- sia Abrasives Industries AG

- RHODIUS Abrasives GmbH

- 3M Co

- Ekamant AB

Table Information

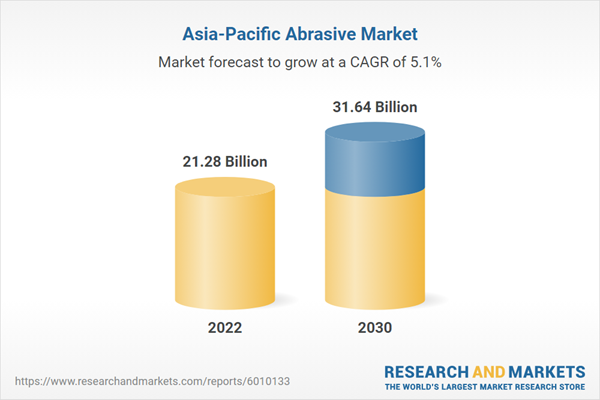

| Report Attribute | Details |

|---|---|

| No. of Pages | 128 |

| Published | August 2024 |

| Forecast Period | 2022 - 2030 |

| Estimated Market Value ( USD | $ 21.28 Billion |

| Forecasted Market Value ( USD | $ 31.64 Billion |

| Compound Annual Growth Rate | 5.1% |

| Regions Covered | Asia Pacific |

| No. of Companies Mentioned | 11 |