Increasing Demand for Polished Concrete for Industrial Flooring Fuels North America Industrial Concrete Flooring Market

Over the last decade, polished concrete has become an ideal flooring choice in various industrial environments. Polished concrete is highly used in warehouses, manufacturing plants, healthcare facilities, showrooms, and other places that are subject to high foot traffic. Polished concrete is very economical, especially for large manufacturing facilities, and at the same time, it provides many benefits. In industrial settings, polished concrete is used to create low-maintenance, durable flooring solutions that can withstand high foot traffic, heavy machinery, and other demanding conditions.Polished concrete remains at the forefront as a flooring solution for industrial places as businesses prioritize durability, cost-efficiency, functionality, and aesthetics. Various benefits of polished concrete are cost effectiveness, easy maintenance, aesthetic appeal, operational efficiency, higher slip resistance, and reflective quality. Polished concrete has slip resistance that meets or exceeds industry standards.

Polished concrete offers a smooth, uniform surface that enhances the efficiency of material-handling equipment. Polished concrete's high-gloss finish reduces friction, lowering wear and tear on machinery, thus extending lifespan and minimizing maintenance costs of machinery. This improved operational efficiency saves time and money and contributes to a safer working environment by minimizing the risk of accidents.

In healthcare facilities, such as hospitals, clinics, and medical offices, polished concrete flooring is an ideal choice owing to its hygienic properties and ease of cleaning. The seamless, nonporous surface of polished concrete minimizes the growth of bacteria and mold, thus contributing to a healthier environment for patients and staff. Polished concrete's durability and low maintenance make it a cost-effective solution for these demanding settings. Furthermore, industrial and warehouse environments often involve the use of different chemicals. Polished concrete floors are resistant to chemical spills; they prevent damage and ensure a longer lifespan of the flooring.

Overall, in industrial environments, polished concrete offers a wide range of benefits and design options that make it an ideal choice for various industrial applications. With this, the demand for polished concrete flooring is growing at a robust rate, and more customers are opting for polished concrete for industrial flooring. Therefore, the increasing demand for polished concrete for industrial flooring is mainly driving the industrial concrete flooring market.

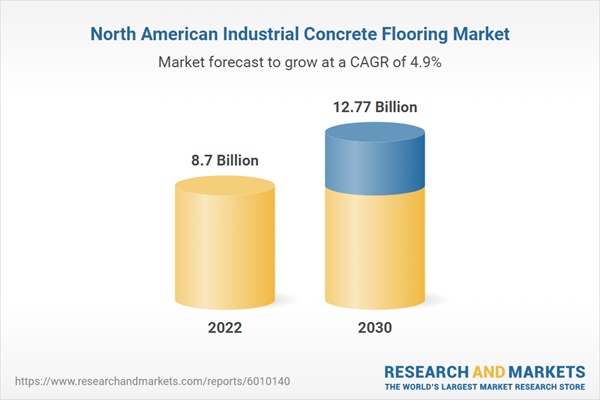

North America Industrial Concrete Flooring Market Overview

North America holds extensive growth opportunities for industrial concrete flooring manufacturers owing to the increasing demand from end-use industries such as food & beverage, transportation, electrical & electronics, and healthcare. The region's robust manufacturing industry, driven by technological advancements and innovation, contributes significantly to the demand for industrial concrete flooring. In North America, passenger vehicles are the most common mode of transportation, and their use is increasing with the rise in per capita income. According to the Organisation Internationale des Constructeurs d'Automobiles (OICA), vehicle production in North America increased by 10%, from ~13.5 million in 2021 to 14.8 million vehicles in 2022.As the automotive sector expands, there is a parallel increase in the demand for industrial concrete flooring, which is utilized in the manufacturing facilities and warehouses of the automotive industry. The food and beverage industry plays a vital role in North America with the presence of three major global manufacturers: PepsiCo, Tyson Foods, and Nestle. Manufacturing plants of these companies require industrial concrete flooring to withstand the weight of fermenters and other types of machinery. The expansion of electronics, aerospace, and healthcare sectors due to technological advancements is increasing the adoption of industrial concrete flooring.

Governments of countries in North America have significantly invested in technology and research programs in the aerospace & defense sector. The region is a hub for major aircraft and aircraft components, and defense equipment manufacturing companies such as Raytheon Technologies Corporation, Boeing, GE Aviation, Bombardier Inc., and Lockheed Martin Corporation. Industrial concrete flooring plays a crucial role in manufacturing facilities and warehouses of aerospace and defense components. The need for concrete flooring to keep the surface clean and stain and slip-resistant is further driving the demand for industrial concrete flooring.

North America Industrial Concrete Flooring Market Segmentation

- The North America industrial concrete flooring market is categorized into type, application, end-use industry, and country.

- Based on type, the North America industrial concrete flooring market is segmented into overlays, polished concrete, epoxy chip flooring, and others. The epoxy chip flooring segment held the largest market share in 2022.

- Based on application, the North America industrial concrete flooring market is segmented into manufacturing facility, warehouses, and others. The manufacturing facility segment held the largest market share in 2022.

- Based on end-use industry, the North America industrial concrete flooring market is segmented into food and beverages, chemicals, healthcare, transportation, and others. The chemicals segment held the largest market share in 2022.

- By country, the North America industrial concrete flooring market is segmented into the US, Canada, and Mexico. The US dominated the North America industrial concrete flooring market share in 2022.

- Becosan UK Ltd, Primekss SIA, RCR Industrial Flooring SLU, Sika AG, Sintokogio Ltd, The Fricks Co, and Twintec Group Ltd are some of the leading companies operating in the North America industrial concrete flooring market.

Market Highlights

- Based on type, the North America industrial concrete flooring market is segmented into overlays, polished concrete, epoxy chip flooring, and others. The epoxy chip flooring segment held 43.6% market share in 2022, amassing US$ 3.79 billion. It is projected to garner US$ 5.62 billion by 2030 to register 5.0% CAGR during 2022-2030.

- The manufacturing facility segment held 68.7% market share in 2022, amassing US$ 5.98 billion. It is projected to garner US$ 9.07 billion by 2030 to register 5.4% CAGR during 2022-2030.

- The chemicals segment held 31.3% market share in 2022, amassing US$ 2.72 billion. It is projected to garner US$ 4.05 billion by 2030 to register 5.1% CAGR during 2022-2030.

- This analysis states that the US captured 84.9% share of North America industrial concrete flooring market in 2022. It was assessed at US$ 7.38 billion in 2022 and is likely to hit US$ 10.92 billion by 2030, registering a CAGR of 5.0% during 2022-2030.

Reasons to Buy

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the North America industrial concrete flooring market.

- Highlights key business priorities in order to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in the North America industrial concrete flooring market, thereby allowing players across the value chain to develop effective long-term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth North America market trends and outlook coupled with the factors driving the North America industrial concrete flooring market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing, and distribution.

Table of Contents

Companies Mentioned

Some of the leading companies in the North America Industrial Concrete Flooring market include:- Becosan UK Ltd

- Primekss SIA

- RCR Industrial Flooring SLU

- Sika AG

- Sintokogio Ltd

- The Fricks Co

- Twintec Group Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 101 |

| Published | August 2024 |

| Forecast Period | 2022 - 2030 |

| Estimated Market Value ( USD | $ 8.7 Billion |

| Forecasted Market Value ( USD | $ 12.77 Billion |

| Compound Annual Growth Rate | 4.9% |

| Regions Covered | North America |

| No. of Companies Mentioned | 8 |