Government Regulations Related to Oil Spill Preparedness and Responses Fuels Europe Oil Pollution Remediation Materials Market

In the past few years, governments of various countries have designed oil spill cleanup regulations to ensure a prompt and effective response to environmental emergencies. These regulations typically outline procedures, technologies, and standards that companies must follow to contain, control, and clean up oil spills. Regulations often stipulate the type of remediation materials that must be employed to minimize environmental impact and ensure effective cleanup.Rising need for effective oil spill cleanup propels the demand for remediation materials. As environmental concerns and regulations intensify, there is a growing emphasis on using advanced and eco-friendly materials for remediation. Certain absorbents, dispersants, and barriers may be mandated to meet safety and efficacy standards, promoting the use of environment-friendly and efficient materials in oil spill response efforts.

In 2023, the Transport and Tourism Committee decided to revise EU regulations aimed at preventing ship pollution in European waters and making sure offenders pay fines. By making this change, the International Maritime Organization (IMO) would guarantee that all international rules for preventing illegal ship discharges are included in EU law, making them easier to enforce.

Authorities require companies involved in oil-related operations to develop comprehensive contingency plans. These plans outline strategies, procedures, and use of remediation materials to be implemented in oil spill events. Therefore, government regulations related to oil spill preparedness and responses boost the oil pollution remediation materials market growth.

Europe Oil Pollution Remediation Materials Market Overview

Increasing oil & gas exploration and production activities, growing awareness of the environmental impact of oil spills, and stringent regulations for environmental protection are a few of the factors propelling the demand for oil pollution remediation materials in Europe. Booms, skimmers, and sorbents are widely used remediation materials. On the other hand, European countries also opt for bioremediation products and services.Volumes of oil transported through marine routes have surged in the past decade. The transportation of crude oil is a major cause of oil spills. According to the European Maritime Safety Agency, the region recorded 38 pollution events caused by ships in 2022. According to the European Environment Agency, hull failure, grounding, fire/explosion, and collision were the major causes of oil tanker spills in the European Seas.

Norway is a major exporter of natural gas, with an export value of crude, condensate and natural gas reported as US$ 181.12 billion in 2022, as per Ministry of Energy and the Norwegian Offshore Directorate. As per the US Energy Information Administration, Europe was the major export destination for the US crude oil exports by volume in 2023. The rising imports of crude oil from the US to European countries further drive maritime transportation and shipping activities, thereby increasing the possibility of oil spills or leakages. Thus, the burgeoning demand for oil and gas triggers the demand for transport media, in turn, propelling the oil pollution remediation materials market growth in Europe.

Europe Oil Pollution Remediation Materials Market Segmentation

- The Europe oil pollution remediation materials market is categorized into type and country.

- Based on type, the Europe oil pollution remediation materials market is segmented into physical remediation, chemical remediation, thermal remediation, and bioremediation. The physical remediation segment held the largest market share in 2022. Furthermore, the physical remediation segment is sub segmented into booms, skimmers, and adsorbent materials. Additionally, the chemical remediation segment is bifurcated into dispersants and solidifiers.

- By country, the Europe oil pollution remediation materials market is segmented into Germany, France, the UK, Italy, Russia, and the Rest of Europe. Russia dominated the Europe oil pollution remediation materials market share in 2022.

- Ansell Ltd; Brady Corp; Compania Espanola de Petroleos SA; Cosco Shipping Heavy Industry Co., Ltd; Ecolab Inc; NOV Inc; Oil Technics Ltd; Oil-Dri Corp of America; Regenesis; TOLSA SA; and Verde Environmental Group Ltd are some of the leading companies operating in the Europe oil pollution remediation materials market.

Market Highlights

- Based on type, the Europe oil pollution remediation materials market is segmented into physical remediation, chemical remediation, thermal remediation, and bioremediation. The physical remediation segment held 36.5% market share in 2022, amassing US$ 47.31 million. It is projected to garner US$ 56.68 million by 2030 to register 2.3% CAGR during 2022-2030. Furthermore, the physical remediation segment is sub segmented into booms, skimmers, and adsorbent materials. Additionally, the chemical remediation segment is bifurcated into dispersants and solidifiers.

- This analysis states that Russia captured 51.9% share of Europe oil pollution remediation materials market in 2022. It was assessed at US$ 67.24 million in 2022 and is likely to hit US$ 81.68 million by 2030, registering a CAGR of 2.5% during 2022-2030.

Reasons to Buy

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the Europe oil pollution remediation materials market.

- Highlights key business priorities in order to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in the Europe oil pollution remediation materials market, thereby allowing players across the value chain to develop effective long-term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth Europe market trends and outlook coupled with the factors driving the Europe oil pollution remediation materials market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing, and distribution.

Table of Contents

Companies Mentioned

Some of the leading companies in the Europe Oil Pollution Remediation Materials market include:- Ansell Ltd

- Brady Corp

- Compania Espanola de Petroleos SA

- Cosco Shipping Heavy Industry Co., Ltd

- Ecolab Inc

- NOV Inc

- Oil Technics Ltd

- Oil-Dri Corp of America

- Regenesis

- TOLSA SA

- Verde Environmental Group Ltd

Table Information

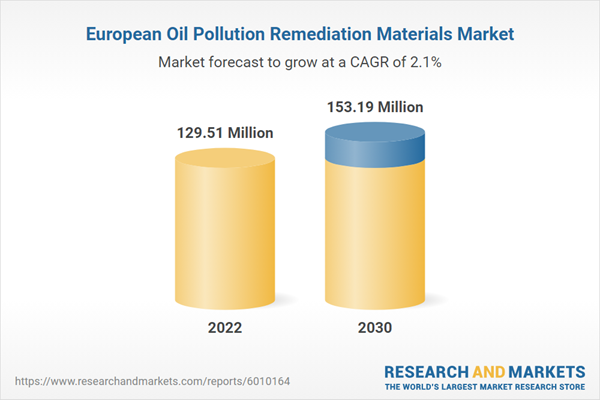

| Report Attribute | Details |

|---|---|

| No. of Pages | 109 |

| Published | August 2024 |

| Forecast Period | 2022 - 2030 |

| Estimated Market Value ( USD | $ 129.51 Million |

| Forecasted Market Value ( USD | $ 153.19 Million |

| Compound Annual Growth Rate | 2.1% |

| Regions Covered | Europe |

| No. of Companies Mentioned | 12 |