Rising Offshore Oil Exploration and Transportation Activities Fuels North America Oil Pollution Remediation Materials Market

Increased offshore exploration and drilling activities, transportation of oil via pipelines or tankers, and human errors during oil extraction and storage propel the chances of oil spill incidences. As per the Energy Information Administration data, the US oil demand climbed to a four-year high in 2023, and it is anticipated to remain there through 2024. The amount of fuel consumed last year was 20.23 million barrels per day, the most since 2019.According to a report released by the US Energy Information Administration on January 2024, crude oil production has increased since the COVID-19 pandemic as of January 9, 2024, reversing a two-year decline. The US crude oil production rose from 11.27 million barrels/day in 2021 to 13.21 million barrels/day in 2023 and is forecasted to reach 13.44 million barrels/day by 2024.

According to the Canada Energy Regulator, most of the crude oil produced in Canada is shipped using pipelines from western provinces to refineries in the US, Ontario, and Quebec. Inefficient safety measures and aging infrastructure contribute to the occurrence of oil spills or pollution during exploration activities and crude oil production, thereby posing a significant environmental threat and prompting an effective response effort. There is growing emphasis on the development and adoption of effective oil pollution remediation materials and technologies to mitigate the adverse impacts of oil spills. The increased need for remediation solutions due to rising offshore oil exploration and transportation activities fuels the demand for oil pollution remediation materials.

North America Oil Pollution Remediation Materials Market Overview

The utilization of sorbents, dispersants, mechanical remediation, and bioremediation are the prominent approaches adopted by North American countries to control water pollution due to oil spillage. Environmental regulations and growing focus on sustainability encourage government bodies to adopt advanced technologies and materials to tackle oil spill incidents. An increasing number of oil spills and oil pollution incidences in the region drive the emphasis on environmental protection and oil spill responses.North America marks the presence of many environmental authorities and response agencies. These include the Marine Spill Response Corporation, National Environmental Emergencies Center, Canadian Transport Emergency Centre, the US Environmental Protection Agency, the US Coast Guard National Response Center, the US Coast Guard, the US National Response Team, and National Oceanic & Atmospheric Administration.

As per a report by the National Academies of Sciences, Engineering, and Medicine, oil pollution in North American ocean waters is caused by land-based oil runoff along with oil spills, natural oil seeps, and oil and gas site discharge. According to the Pipeline and Hazardous Materials Safety Administration, North America has ?2.6 million miles of pipelines that deliver huge volumes of liquid petroleum products (hundreds of billions of tons) and natural gas (trillions of cubic feet) yearly.

Per the Canada Energy Regulator, most of the crude oil produced in Canada is shipped using pipelines from western provinces to refineries in the US, Ontario, and Quebec. The increasing crude oil production operations, rising exploration activities, and large-scale marine transportation activities are further expected to drive the demand for oil pollution remediation materials in North American countries over the coming years.

North America Oil Pollution Remediation Materials Market Segmentation

- The North America oil pollution remediation materials market is categorized into type and country.

- Based on type, the North America oil pollution remediation materials market is segmented into physical remediation, chemical remediation, thermal remediation, and bioremediation. The physical remediation segment held the largest market share in 2022. Furthermore, the physical remediation segment is sub segmented into booms, skimmers, and adsorbent materials. Additionally, the chemical remediation segment is bifurcated into dispersants and solidifiers.

- By country, the North America oil pollution remediation materials market is segmented into the US, Canada, and Mexico. The US dominated the North America oil pollution remediation materials market share in 2022.

- Ansell Ltd; Brady Corp; CL Solutions, LLC; Compania Espanola de Petroleos SA; Cosco Shipping Heavy Industry Co., Ltd; Cura Inc; Ecolab Inc; NOV Inc; Oil Spill Eater International Corp; Oil-Dri Corp of America; Osprey Spill Control; Regenesis; Sarva Bio Remed LLC; SkimOIL LLC; and TOLSA SA are some of the leading companies operating in the North America oil pollution remediation materials market.

Market Highlights

- Based on type, the North America oil pollution remediation materials market is segmented into physical remediation, chemical remediation, thermal remediation, and bioremediation. The physical remediation segment held 38.2% market share in 2022, amassing US$ 330.48 million. It is projected to garner US$ 411.04 million by 2030 to register 2.8% CAGR during 2022-2030. Furthermore, the physical remediation segment is sub segmented into booms, skimmers, and adsorbent materials. Additionally, the chemical remediation segment is bifurcated into dispersants and solidifiers.

- This analysis states that the US captured 67.7% share of North America oil pollution remediation materials market in 2022. It was assessed at US$ 585.03 million in 2022 and is likely to hit US$ 729.11 million by 2030, registering a CAGR of 2.8% during 2022-2030.

Reasons to Buy

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the North America oil pollution remediation materials market.

- Highlights key business priorities in order to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in the North America oil pollution remediation materials market, thereby allowing players across the value chain to develop effective long-term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth North America market trends and outlook coupled with the factors driving the North America oil pollution remediation materials market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing, and distribution.

Table of Contents

Companies Mentioned

Some of the leading companies in the North America Oil Pollution Remediation Materials market include:- Ansell Ltd

- Brady Corp

- CL Solutions LLC

- Compania Espanola de Petroleos SA

- Cosco Shipping Heavy Industry Co., Ltd

- Cura Inc

- Ecolab Inc

- NOV Inc

- Oil Spill Eater International Corp

- Oil-Dri Corp of America

- Osprey Spill Control

- Regenesis

- Sarva Bio Remed LLC

- SkimOIL LLC

- TOLSA SA

Table Information

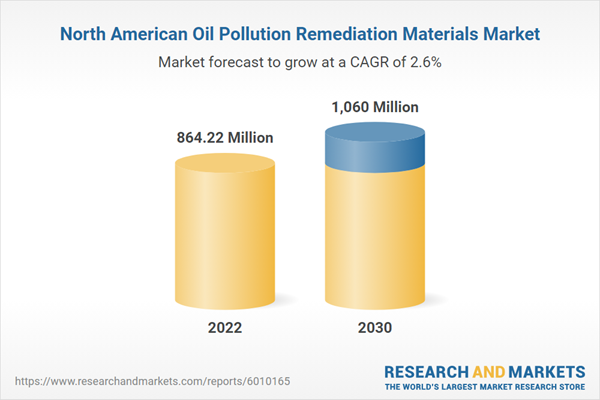

| Report Attribute | Details |

|---|---|

| No. of Pages | 122 |

| Published | August 2024 |

| Forecast Period | 2022 - 2030 |

| Estimated Market Value ( USD | $ 864.22 Million |

| Forecasted Market Value ( USD | $ 1060 Million |

| Compound Annual Growth Rate | 2.6% |

| Regions Covered | North America |

| No. of Companies Mentioned | 15 |