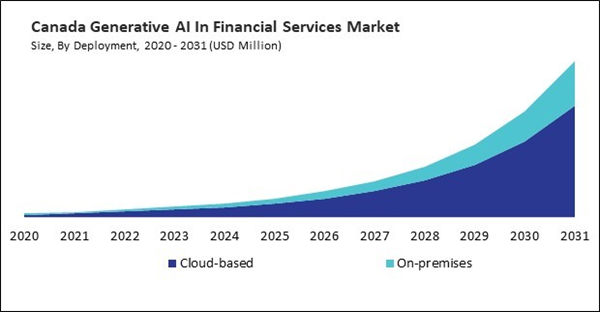

The US market dominated the North America Generative AI In Financial Services Market by Country in 2023, and is expected to continue to be a dominant market till 2031; thereby, achieving a market value of USD5.99 billion by 2031. The Canada market is experiencing a CAGR of 40.6% during 2024-2031. Additionally, the Mexico market would exhibit a CAGR of 39.8% during 2024-2031.

Unlike traditional forecasting methods that rely on static models, Generative AI can dynamically generate forecasts based on changing market conditions and real-time data inputs. This enables financial institutions to quickly adapt their strategies to market volatility, providing a competitive edge. Generative AI can analyze individual customer profiles, financial goals, and market trends to create personalized wealth management strategies. Financial advisors can offer more relevant and effective guidance by generating tailored investment plans that align with each customer’s risk tolerance and preferences.

Using Generative AI, financial institutions can automate the mapping of customer journeys by analyzing interaction data across various touchpoints. This application helps identify friction points and opportunities for improvement, allowing organizations to enhance customer experiences and streamline service delivery. Generative AI can simulate fraud scenarios by generating data on potentially fraudulent activities. Financial institutions can use these simulations to test and improve their fraud detection algorithms, allowing them to mitigate risks proactively before they occur.

The collaboration between traditional banks and fintech firms creates a fertile environment for Generative AI development. Partnerships enable sharing knowledge and resources, fostering innovation in product development. This collaborative approach enhances the overall quality of financial services available to consumers. As the financial services industry embraces digital transformation, workforce training becomes essential. Financial institutions are investing in upskilling employees to work effectively with AI technologies. This investment in human capital ensures that firms can maximize the benefits of Generative AI in their operations. Therefore, the rising financial services sector and expansion of AI adoption in the region are driving the market's growth.

List of Key Companies Profiled

- Amazon Web Services, Inc.

- Google LLC

- IBM Corporation

- Intel Corporation

- Microsoft Corporation

- Salesforce, Inc.

- OpenAI, LLC

- SAP SE

- Oracle Corporation

- Accenture PLC

Market Report Segmentation

By Deployment

- Cloud-based

- On-premises

By End User

- Retail Banking

- Corporate Banking

- Insurance Companies

- Investment Firms

- Hedge Funds

- FinTech Companies

By Application

- Risk Management

- Fraud Detection

- Credit Scoring

- Forecasting & Reporting

- Customer Service & Chatbots

By Country

- US

- Canada

- Mexico

- Rest of North America

Table of Contents

Companies Mentioned

Some of the key companies in the North America Generative AI In Financial Services Market include:- Amazon Web Services, Inc.

- Google LLC

- IBM Corporation

- Intel Corporation

- Microsoft Corporation

- Salesforce, Inc.

- OpenAI, LLC

- SAP SE

- Oracle Corporation

- Accenture PLC