Water-borne coatings have gained popularity in the market due to their environmental benefits and ease of use. These coatings use water as the primary solvent, which reduces the emission of volatile organic compounds (VOCs) and minimizes environmental impact. Water-borne coatings are valued for their low odor, quick drying times, and ease of clean-up, making them suitable for both residential and commercial applications. Consequently, the US market utilized 4,624.6 kilo tonnes of water-borne coatings in 2023.

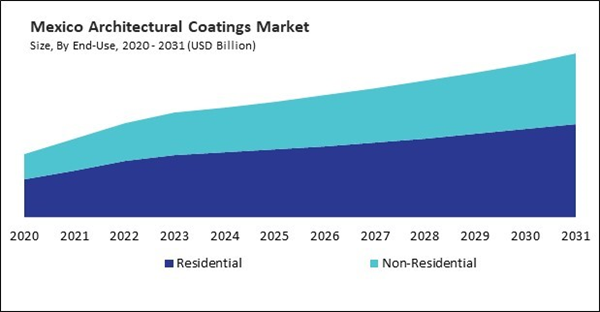

The US market dominated the North America Architectural Coatings Market by Country in 2023, and is expected to continue to be a dominant market till 2031; thereby, achieving a market value of USD21.88 billion by 2031. The Canada market is experiencing a CAGR of 6% during 2024-2031. Additionally, the Mexico market would exhibit a CAGR of 5.8% during 2024-2031.

Architectural coatings include paints, primers, sealers, varnishes, inks, and ceramics. Decorative or these coatings are formulas applied to buildings and homes. Exterior paints protect against weathering elements such as sunlight, rain, snow, and wind. They help prevent damage to the building's surfaces, including deterioration, discoloration, and erosion, extending the structure's lifespan.

Exterior paints offer a wide range of colors, finishes, and textures, allowing architects, designers, and homeowners to enhance the visual appeal of buildings. The aesthetic appeal of a building is crucial for its market value, curb appeal, and overall perception. With the increasing focus on sustainability and environmental responsibility, there is a growing demand for eco-friendly exterior paints. Low-VOC (volatile organic compound) and zero-VOC paints and paints made from sustainable materials are gaining popularity in the market.

Mexico's growing population and urbanization trends are driving demand for residential construction. Urbanization leads to the development of new residential properties and the renovation of existing homes, increasing the demand for these coatings in Mexico. Home renovation and remodeling activities are rising in Mexico, driven by aging housing stock, and changing consumer preferences.

Renovation projects involve painting and redecorating interior and exterior surfaces, contributing to the demand for these coatings in Mexico. Mexico's growing tourism and hospitality industry drives demand for new hotel and resort construction projects. Architectural coatings enhance the aesthetic appeal and durability of Mexico's hotels, resorts, restaurants, and entertainment venues. Hence, the factors mentioned above will drive the regional market growth.

List of Key Companies Profiled

- PPG Industries, Inc.

- Wacker Chemie AG

- Nippon Paint Holdings Co., Ltd.

- The Sherwin-Williams Company

- BASF SE

- The Dow Chemical Company

- 3M Company

- Kansai Paint Co., Ltd.

- Akzo Nobel N.V.

- Arkema S.A.

Market Report Segmentation

By Technology (Volume, Kilo Tonnes, USD Billion, 2020-2031)

- Water Borne

- Solvent Borne

By End-Use (Volume, Kilo Tonnes, USD Billion, 2020-2031)

- Residential

- Non-Residential

By Resin Type (Volume, Kilo Tonnes, USD Billion, 2020-2031)

- Acrylic

- Alkyd

- Epoxy

- Polyurethane

- Polyester

- Other Resin Types

By Function (Volume, Kilo Tonnes, USD Billion, 2020-2031)

- Ceramics

- Inks

- Lacquers

- Paints

- Powder Coatings

- Primers

- Sealers

- Stains

- Varnishes

By Country (Volume, Kilo Tonnes, USD Billion, 2020-2031)

- US

- Canada

- Mexico

- Rest of North America

Table of Contents

Companies Mentioned

Some of the key companies in the North America Architectural Coatings Market include:- PPG Industries, Inc.

- Wacker Chemie AG

- Nippon Paint Holdings Co., Ltd.

- The Sherwin-Williams Company

- BASF SE

- The Dow Chemical Company

- 3M Company

- Kansai Paint Co., Ltd.

- Akzo Nobel N.V.

- Arkema S.A.