In the oil and gas industry, anti-corrosion coatings are essential for protecting infrastructure such as pipelines, storage tanks, drilling rigs, and refineries from the corrosive effects of hydrocarbons, chemicals, and harsh environmental conditions. These coatings are designed to withstand extreme temperatures, high pressures, and constant exposure to corrosive substances, ensuring the safe and efficient operation of facilities. Thus, the Germany market is expected to utilize kilo tonnes 167.75 of Anti-corrosion coating in oil and gas industry by 2031.

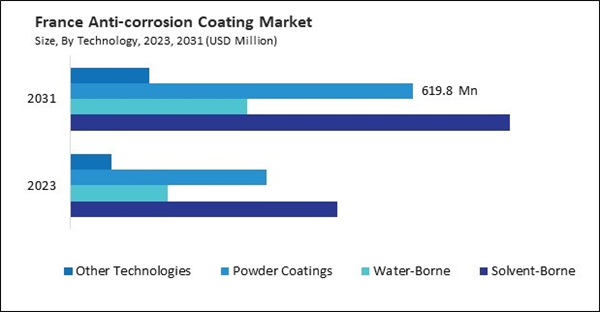

The Germany market dominated the Europe Anti-corrosion Coating Market by Country in 2023, and is expected to continue to be a dominant market till 2031; thereby, achieving a market value of USD2.87 billion by 2031. The UK market is exhibiting a CAGR of 5.5% during 2024-2031. Additionally, the France market would experience a CAGR of 7.2% during 2024-2031.

Anti-corrosion coatings are applied to the underwater hulls of ships to protect against the corrosive effects of seawater and prevent biofouling, which can decrease speed and fuel efficiency. Coatings above the waterline protect against salt spray, UV radiation, and atmospheric conditions, ensuring the longevity of the vessel’s exterior.

Additionally, these tanks are critical for maintaining a vessel’s stability and are constantly exposed to seawater. Anti-corrosion coatings prevent rust and corrosion, essential for the ship’s structural integrity. Cargo holds, especially in bulk carriers, need protection from corrosive cargoes and seawater. Coatings prevent damage and contamination, ensuring safe and efficient transportation.

The UK’s extensive coastline means many infrastructure projects, such as bridges, ports, and offshore wind farms, are exposed to harsh marine environments. Anti-corrosion coatings protect metal components from saltwater and moisture-induced corrosion in the UK. Advances in anti-corrosion technology, such as developing high-performance coatings with enhanced protective properties, contribute to their increased use in infrastructure projects in the UK. The UK’s extensive network of roads, bridges, tunnels, and railways requires robust protection against corrosion. Anti-corrosion coatings ensure these critical transportation links' structural integrity and safety in the UK.

List of Key Companies Profiled

- The Sherwin-Williams Company

- 3M Company

- Hempel A/S

- PPG Industries, Inc.

- The Dow Chemical Company

- Kansai Paint Co., Ltd.

- Wacker Chemie AG

- BASF SE

- Akzo Nobel N.V.

- Nippon Paint Holdings Co., Ltd.

Market Report Segmentation

By Technology (Volume, Kilo Tonnes, USD Billion, 2020-2031)

- Solvent-Borne

- Water-Borne

- Powder Coatings

- Other Technologies

By Type (Volume, Kilo Tonnes, USD Billion, 2020-2031)

- Epoxy

- Polyurethane

- Acrylic

- Alkyd

- Zinc

- Chlorinated Rubber

- Other Types

By End Use Industry (Volume, Kilo Tonnes, USD Billion, 2020-2031)

- Marine

- Oil & Gas

- Industrial

- Construction

- Energy

- Automotive

- Others

By Country (Volume, Kilo Tonnes, USD Billion, 2020-2031)

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

Table of Contents

Companies Mentioned

Some of the key companies in the Europe Anti-corrosion Coating Market include:- The Sherwin-Williams Company

- 3M Company

- Hempel A/S

- PPG Industries, Inc.

- The Dow Chemical Company

- Kansai Paint Co., Ltd.

- Wacker Chemie AG

- BASF SE

- Akzo Nobel N.V.

- Nippon Paint Holdings Co., Ltd.