Educational institutions increasingly incorporate DAWs into their curricula, teaching student’s essential skills in music production and sound engineering. Therefore, the music school segment is expected to capture 16% revenue share in the market by the year 2031. This segment's growth reflects the broader trend of digitalization in education, where practical, hands-on learning experiences with industry-standard software are crucial for training the next generation of musicians and audio professionals.

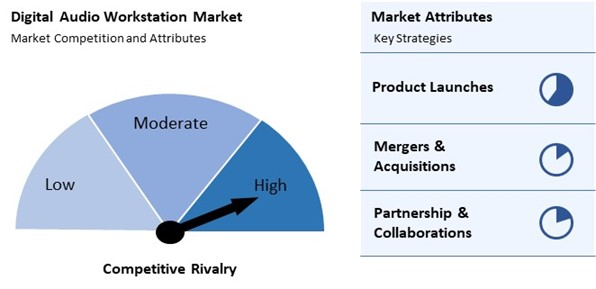

The major strategies followed by the market participants are Product Launches as the key developmental strategy to keep pace with the changing demands of end users. For instance, In July, 2024, Image-Line revealed FL Studio 2024. This update aims to enhance the functionality of FL Cloud by adding new plugins and collaborative features. FL Cloud now supports more advanced cloud-based collaboration, allowing users to share projects and work together in real-time with new tools designed to streamline the production process. Additionally, In September, 2024, Ableton announced the release of Live 12, the latest version of its popular digital audio workstation. This update introduces new features such as enhanced automation, improved sound design tools, and expanded device support, aimed at boosting creativity and workflow efficiency.

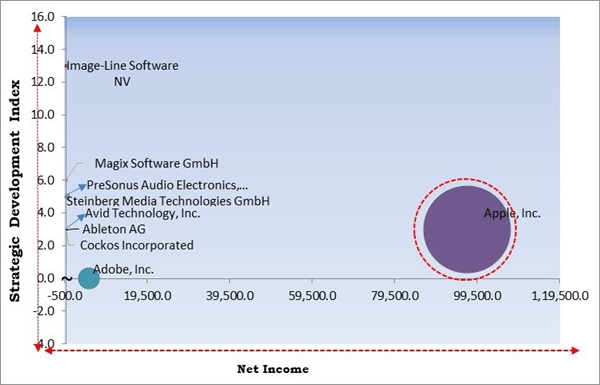

KBV Cardinal Matrix - Market Competition Analysis

Based on the Analysis presented in the KBV Cardinal matrix; Apple, Inc. is the forerunner in the Digital Audio Workstation Market. In May, 2020, Apple unveiled the biggest update to Logic Pro X since its launch. This major update aims to enhance the functionality and user experience of Logic Pro X, a leading digital audio workstation. Companies such as Image-Line Software NV, Magix Software GmbH, PreSonus Audio Electronics, Inc. are some of the key innovators in Digital Audio Workstation Market.

Market Growth Factors

Advancements in technology have made high-quality recording equipment and software more affordable and accessible. Musicians and producers can now set up home studios with minimal investment, utilizing DAWs that offer professional-grade features. This accessibility encourages more individuals to explore music production independently, expanding the demand for DAW software. The rise of independent artists has been fuelled by a shift in the music industry towards self-production and distribution. Therefore, the increasing adoption of home studios and independent music production drives the market's growth.The global music industry has grown substantially, driven by the proliferation of streaming services, digital downloads, and live events. This increased consumption creates a higher demand for new music, prompting more individuals to enter production. As the music industry expands, so does the need for DAWs, essential music creation and production tools. According to the International Federation of the Phonographic Industry (IFPI), 2023, global recorded music revenues grew by 10.2%. This was the ninth consecutive year of global growth. Revenues increased in every region. Thus, the growth of the global music industry and the increasing number of music producers are propelling the market's growth.

Market Restraining Factors

Professional-grade DAW software, such as Pro Tools, Logic Pro, or Cubase, often has a hefty price tag. These advanced programs offer many features, plugins, and tools necessary for high-quality music production, but their cost can be prohibitive. For instance, a single license for professional DAW software can range from several hundred to over a thousand dollars. Users often need to invest in high-performance hardware to utilize DAW software fully. This includes powerful computers with fast processors, ample RAM, and large storage capacities. Thus, the high initial software and hardware costs drive the market's growth.The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Product Launches and Product Expansions.

Driving and Restraining Factors

Drivers

- Increasing Adoption of Home Studios and Independent Music Production

- Rising Prominence of Live Streaming Events

- Growth of the Global Music Industry and Increasing Number of Music Producers

Restraints

- High Initial Costs of Software and Hardware

- Compatibility Issues with Different Platforms

Opportunities

- Rising Popularity of Podcasting and Online Content Creation

- Expansion of the Gaming Industry and Demand for High-Quality Audio Production

Challenges

- Limited Processing Power on Older Devices

- Steep Learning Curve for Complex Software

Component Outlook

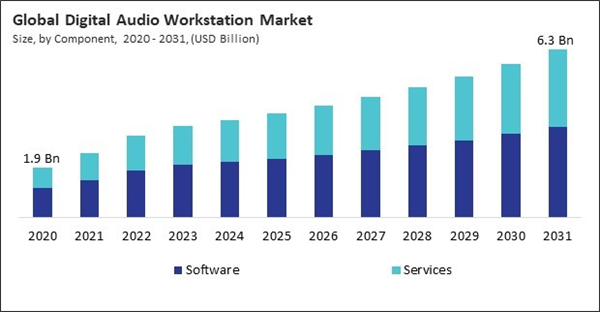

Based on component, the market is divided into software and services. In 2023, the software segment garnered 57% revenue share in the market. This dominance can be attributed to the proliferation of user-friendly DAW software that caters to a wide range of users, from amateur musicians to professional sound engineers. The software segment includes various applications that offer functionalities like audio recording, mixing, editing, and mastering.Operating System Outlook

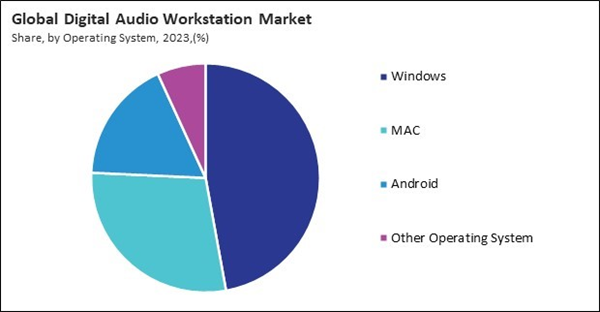

On the basis of operating system, the market is segmented into MAC, windows, android, and others. The windows segment recorded 47% revenue share in the market in 2023. This dominance can be attributed to the widespread use of Windows operating systems in home studios and professional settings. Many DAW software applications are optimized for Windows, offering many features that appeal to diverse users, including music producers, sound designers, and content creators.End Use Outlook

By end use, the market is categorized into professional audio engineers and mixers, electronic musicians, music studios, music schools, broadcasting and media companies, game developers. and others. The music studios segment procured 19% revenue share in the digital audio workstation market in 2023. Music studios are equipped with state-of-the-art technology and often rely on DAWs to facilitate everything from recording to mastering.Market Competition and Attributes

The Digital Audio Workstation (DAW) market is highly competitive, with key players dominating and emerging alternatives gaining popularity. Competition is driven by pricing, features, ease of use, and hardware integration. Companies target various segments, from professionals to hobbyists, and are increasingly adopting subscription models to enhance customer retention. Innovation in features and flexibility continues to shape the market landscape.

By Regional Analysis

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. In 2023, the North America region witnessed 35% revenue share in the market. This can be attributed to the region's robust music and entertainment industry, where advanced audio production techniques are essential. The presence of major software developers and a strong music production culture contribute to the high demand for DAWs.Recent Strategies Deployed in the Market

- Jun-2024: Avid launched Pro Tools 2024.6, introducing new track-based workflows and enhanced production tools. This update aims to streamline audio editing and production with improved automation features, offline bounce enhancements, and increased control for Dolby Atmos mixing.

- Mar-2024: FL Studio partnered with Native Instruments, a leading name in music production technology, to integrate Native Instruments' plugins into FL Studio. This partnership aims to provide FL Studio users with seamless access to Native Instruments' acclaimed plugins, including their virtual instruments and effects and will enhance FL Studio’s workflow with advanced tools for music creation, mixing, and sound design.

- Apr-2024: PreSonus Audio Electronics announced the release of Studio One 6.6, an update packed with new features and enhancements. This update introduces improved performance, enhanced MIDI capabilities, and new workflow tools to streamline the production process.

- Apr-2024: Image-Line acquired MSXII Sound Design, known for its distinctive sound libraries and sample packs, to expand FL Studio’s sound library. This acquisition aims to enhance FL Studio’s offering by integrating MSXII’s unique sound design resources and strengthens its position in the music production market with this addition.

- Jan-2024: Magix Software unveiled a groundbreaking update with the release of Sequoia 17. This update aims to provide enhanced features for professional audio production, including improved editing tools and new effects. Sequoia 17 reinforces Magix’s position as a leader in high-end digital audio workstations designed for mastering, broadcast, and post-production.

List of Key Companies Profiled

- Apple, Inc.

- Adobe, Inc.

- Avid Technology, Inc. (STG Partners, LLC)

- Image-Line Software NV (FL Studio)

- Steinberg Media Technologies GmbH (Yamaha Corporation)

- Native Instruments GmbH

- Magix Software GmbH

- PreSonus Audio Electronics, Inc. (Fender Musical Instruments Corporation)

- Cockos Incorporated

- Ableton AG

Market Report Segmentation

By Component

- Software

- Services

By End Use

- Professional Audio Engineers & Mixers

- Electronic Musicians

- Music Studios

- Music Schools

- Broadcasting & Media Companies

- Game developers

- Other End Use

By Operating System

- Windows

- MAC

- Android

- Other Operating System

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

Some of the key companies in the Digital Audio Workstation Market include:- Apple, Inc.

- Adobe, Inc.

- Avid Technology, Inc. (STG Partners, LLC)

- Image-Line Software NV (FL Studio)

- Steinberg Media Technologies GmbH (Yamaha Corporation)

- Native Instruments GmbH

- Magix Software GmbH

- PreSonus Audio Electronics, Inc. (Fender Musical Instruments Corporation)

- Cockos Incorporated

- Ableton AG