The Europe segment procured 26% revenue share in the soundbar market in 2023. European consumers have shown a strong interest in enhancing their home entertainment experiences, particularly in the UK, Germany, and France. The demand for soundbars in the region has been driven by the increasing popularity of streaming platforms such as Netflix and Amazon Prime, as well as the increasing adoption of smart TVs.

The major strategies followed by the market participants are Product Launches as the key developmental strategy to keep pace with the changing demands of end users. For instance, In April, 2024, Sony launched its latest Dolby Atmos soundbar range. The new lineup offers advanced audio features, including immersive 3D sound, providing users with a cinematic experience in their living rooms. Sony continues to push the boundaries of home entertainment audio with its innovative soundbars.

Moreover, In September, 2024, Bose unveiled its personal surround sound earbuds and a new soundbar with cutting-edge features. These devices aim to deliver an immersive audio experience with enhanced sound quality and design. Bose’s latest innovations push the boundaries of personal and home audio technology, integrating advanced features for superior sound.

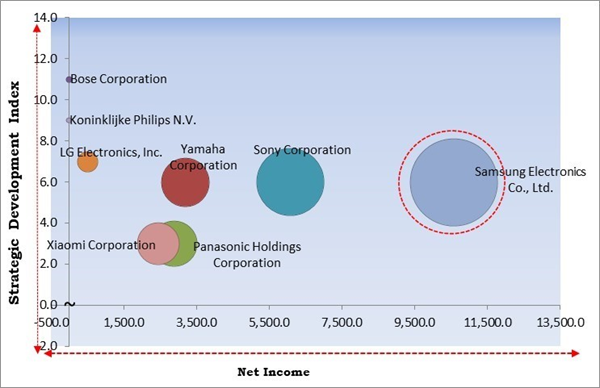

KBV Cardinal Matrix - Market Competition Analysis

Based on the Analysis presented in the KBV Cardinal matrix; Samsung Electronics Co., Ltd. is the forerunner in the Soundbar Market. In March, 2024, Samsung unveiled flagship HW-Q950C Dolby Atmos soundbar, which aims to redefine home audio experiences. This state-of-the-art soundbar features spatial audio technology to create a three-dimensional soundstage that immerses listeners in their favorite movies and music.

Additionally, the HW-Q950C utilizes adaptive sound control and AI sound technology, which analyzes content in real-time to optimize audio output. This ensures that users receive a customized listening experience tailored to their preferences. Companies such as Sony Corporation, Yamaha Corporation, Panasonic Holdings Corporation are some of the key innovators in Soundbar Market.

Market Growth Factors

The demand for high-quality home audio experiences has steadily risen as consumers invest in home entertainment systems. One of the primary benefits of soundbars is their capacity to provide exceptional audio quality without the complexity or high cost of a complete home theater system. While home theater setups typically require multiple speakers and complex wiring, soundbars provide a more affordable, effective, and streamlined solution. Hence, this rising demand for better sound quality in home entertainment is expected to drive the continued growth of the soundbar market.Additionally, the manner in which consumers access and ingest media content has been significantly altered by the rapid expansion of streaming services, including Netflix, Disney+, Spotify, and Amazon Prime Video. With the rise of on-demand platforms, more people are now watching movies, binge-watching TV shows, and streaming music at home. This shift has driven a corresponding demand for high-quality audio experiences that can match the immersive visual content offered by these platforms. Thus, the continued growth of streaming services is expected to keep driving the demand for soundbars, especially as more immersive content becomes available.

Market Restraining Factors

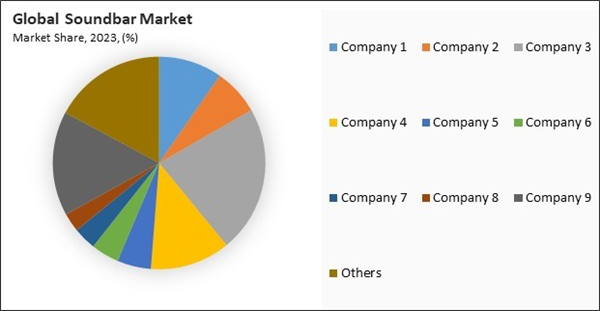

Traditional home theater systems, such as 5.1 and 7.1 surround sound setups, remain popular among audiophiles and home entertainment enthusiasts due to their superior sound quality. These multi-speaker systems provide an immersive audio experience by positioning speakers around the room, which creates true surround sound. Hence, this competition slows the growth of the soundbar market.The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Product Launches and Product Expansions.

Driving and Restraining Factors

Drivers

- Rising Consumer Demand For High-Quality Home Audio Experiences

- Growth In Streaming Services And Online Content

- Expansion Of E-Commerce And Online Retail Channels

Restraints

- Competition From Traditional Audio Systems

- High Price Sensitivity Among Consumers

Opportunities

- Rising Disposable Income And Increased Consumer Spending

- Increasing Adoption Of Smart Homes And Voice-Activated Assistants

Challenges

- Integration Issues With Smart Home Devices

- Rapid Technological Advancements

Type Outlook

Based on type, the soundbar market is bifurcated into tabletop and wall mount. The wall mount segment procured 38% revenue share in the soundbar market in 2023. Wall-mounted soundbars are particularly favored by users who want a clean, minimalist look in their home entertainment setup, especially when paired with a wall-mounted TV. These soundbars help save floor or shelf space, making them ideal for modern living spaces where design and aesthetics are important.Application Outlook

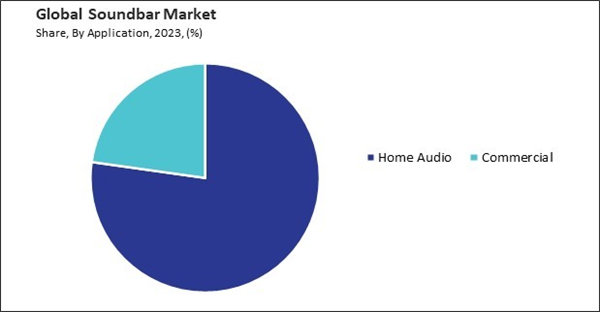

Based on application, the soundbar market is segmented into home audio and commercial. The commercial segment acquired 23% revenue share in the soundbar market in 2023. Soundbars are widely adopted in conference rooms, retail environments, hotels, and restaurants, offering a sleek and efficient audio solution. In the corporate sector, soundbars enhance audio quality in video conferencing systems, which has become especially important with the rise of remote work and hybrid work models.Installation Method Outlook

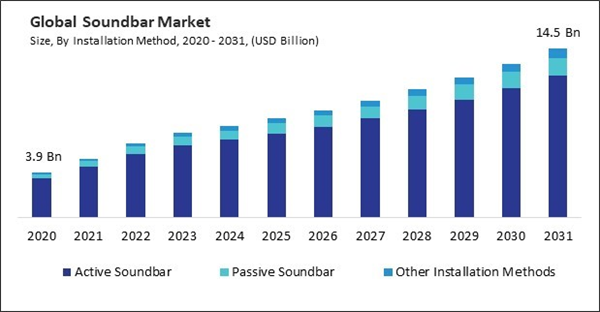

On the basis of installed method, the soundbar market is classified into active soundbar, passive soundbar, and others. The passive soundbar segment recorded 10% revenue share in the soundbar market in 2023. Passive soundbars, which require external amplifiers or receivers, offer greater flexibility in designing a tailored sound system. This segment benefits from consumers looking for superior audio quality and the ability to integrate the soundbar into a more complex home theater setup.Distribution Channel Outlook

On the basis of distribution channel, the soundbar market is bifurcated into online and offline. The offline segment witnessed 37% revenue share in the soundbar market in 2023. Brick-and-mortar stores, particularly specialized electronics retailers, continue attracting consumers who prefer hands-on experience with the product before purchasing. Many customers value the ability to test soundbars in-store and get personalized recommendations from sales staff.Connectivity Outlook

By connectivity, the soundbar market is divided into Wi-Fi, Bluetooth, and others. The Wi-Fi segment garnered 28% revenue share in the soundbar market in 2023. Wi-Fi-enabled soundbars offer higher sound quality and can connect to home networks, allowing for more expansive functionality. These soundbars often support multi-room audio systems, voice assistants, and streaming services directly from the internet, enhancing the user experience.Market Competition and Attributes

The Soundbar market exhibits intense competition among various brands and manufacturers. Emerging players focus on innovative features, superior sound quality, and affordability to capture market share. Companies are investing in advanced technologies like Dolby Atmos and wireless connectivity, enhancing user experience while competing on price and product differentiation.

By Regional Analysis

Region-wise, the soundbar market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America segment garnered 37% revenue share in the soundbar market in 2023. The dominance is due to the high penetration of smart TVs, streaming services, and home entertainment systems. North American consumers are particularly keen on upgrading their audio experiences to match the visual quality of modern 4K and 8K televisions, driving demand for advanced soundbar models.Recent Strategies Deployed in the Market

- Aug-2024: Philips launched the TAB7007 soundbar, featuring a wireless subwoofer, in India. This new model is designed to offer superior sound quality and flexibility for home entertainment setups. The TAB7007 aims to enhance the audio experience with powerful bass and clear dialogue, making it ideal for movies, music, and gaming. With its wireless capabilities, the soundbar provides seamless connectivity, allowing users to enjoy high-quality sound without the clutter of cables.

- Aug-2024: Philips Audio revealed TAB4228 soundbar, which boasts an impressive 160W output and multiple EQ modes to customize the audio experience. This model is designed to deliver powerful sound for a variety of content, from movies to music. The TAB4228 includes features that allow users to adjust settings according to their preferences, ensuring an optimal listening experience. Philips aims to provide consumers with quality audio solutions that enhance home entertainment without compromising on style or performance.

- Jul-2024: LG took over of Athom, a move aimed at advancing its AI-enabled intelligent space business. This strategic acquisition allows LG to enhance its capabilities in smart home technology, integrating Athom's expertise in automation and connectivity into its product lineup. By leveraging AI and IoT innovations, LG seeks to deliver more intuitive and efficient home solutions that improve user experiences and transform living spaces into smarter environments.

- Feb-2024: Yamaha unveiled its latest soundbar lineup, including the SR-B40A and SR-B30A, designed for an immersive home audio experience. These soundbars feature cutting-edge technology that delivers exceptional sound clarity, making them ideal for home entertainment systems. Yamaha continues to enhance its soundbar portfolio by incorporating innovative features, ensuring top-tier audio performance.

- Jan-2024: Philips unveiled a trio of new soundbars, enhancing its audio product lineup with innovative features and cutting-edge technology. The new soundbars are designed to deliver an immersive audio experience, featuring advanced sound processing and support for Dolby Atmos, which allows for a more dynamic soundstage. Philips aims to cater to various consumer needs, providing options that enhance both home entertainment and casual listening, making it easier for users to elevate their audio experience across different settings.

List of Key Companies Profiled

- Bose Corporation

- Sony Corporation

- Intex Technologies

- Yamaha Corporation

- Samsung Electronics Co., Ltd. (Samsung Group)

- LG Electronics, Inc. (LG Corporation)

- Koninklijke Philips N.V.

- Xiaomi Corporation

- Panasonic Holdings Corporation

- Toshiba Corporation

Market Report Segmentation

By Type

- Tabletop

- Wall Mount

By Application

- Home Audio

- Commercial

By Installation Method

- Active Soundbar

- Passive Soundbar

- Other Installation Methods

By Distribution Channel

- Online

- Offline

By Connectivity

- Bluetooth

- Wi-Fi

- Other Connectivity Type

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

Some of the key companies in the Soundbar Market include:- Bose Corporation

- Sony Corporation

- Intex Technologies

- Yamaha Corporation

- Samsung Electronics Co., Ltd. (Samsung Group)

- LG Electronics, Inc. (LG Corporation)

- Koninklijke Philips N.V.

- Xiaomi Corporation

- Panasonic Holdings Corporation

- Toshiba Corporation