The North America HVAC System for Bus market is segmented into the US, Canada, and Mexico. Rising investments in public transport, increasing focus on commuter comfort, improving level of service, and growing use of public transport across the region are driving the adoption of HVAC systems for buses. In late 2022 and early 2023, several US transit agencies - including TransLink, Edmonton Transit Service, Chicago Transit Authority, Metropolitan Transportation Authority, and Southwest Ohio Regional Transit Authority - reported a consistent increase in ridership. Countries in the region are focusing on deploying more and more electric buses on the roads for public transit to meet their net-zero emission goals.

In January 2022, CALSTART published its annual inventory of zero-emission buses (ZEBs) - Zeroing in on ZEBs - providing insight on the current state of ZEBs ahead of US$ 5.25 billion funding under the Infrastructure Investment and Jobs Act through the Federal Transit Administration's Low-No Program. The number of full-size ZEBs has grown to 3,533 buses nationally in Canada, an increase of 27% since 2020. The report stated that most ZEB fleets are small (10 or fewer), so the coming funding will be instrumental in scaling fleets. Moreover, in 2024, a US$ 174 billion initiative to support EVs generally has been proposed by the Biden administration.

In the meantime, as part of an effort to move the country toward zero-emission transportation, two prominent U.S. Senate Democrats have proposed investing $73 billion to electrify the country's 70,000 transit buses and other transit vehicles. Public transportation system development and improvement initiatives in Mexico have been pursued by several governmental branches.

A plan was introduced in March 2022 for the installation of an electric fleet in Mexico City's "Metrobús" L3 and L4 lines. Such initiatives across North America to deploy more electric buses on the roads and enhance public transport infrastructure to encourage more and more commuters to use public transport are leading the market growth of HVAC systems for buses.

The North America HVAC System for Bus market analysis has been carried out by considering the following segments: component, type, unit type, and drive type.

Based on component, the market is segmented into controls, convectors, compressors, heaters, and others. A compressor is considered the heart of the bus HVAC system. It is responsible for pressurizing the refrigerant and initiating the cooling process. Its function is to raise discharge pressure above ambient temperature, allowing heat to be rejected and the refrigerant to condense into a liquid. The growing bus market is contributing to the need for HVAC systems. Leading market players are developing compressors to cater to the demand. For example, in August 2021, Italian compressor manufacturer Dorin launched theBOXÉR series of CO2 compressors aimed at mobile HVAC applications such as air conditioning in trains and e-buses.

Moreover, factors such as rise in use of public transport in North America and increase in demand for comfort and luxury propel the North America HVAC System for Bus market growth. Also, use of IoT sensors in HVAC systems is expected to bring new North America HVAC System for Bus market trends in the coming years.

In terms of type, the market is categorized into transit bus, coach, shuttle bus, and school bus. Coach is a specific type of bus built for long-distance transportation. AC coaches are preferred over non-AC coaches as AC provides a better and more comfortable environment during a long journey. The bus HVAC system manufacturers also provide solutions to circulate clean air inside the bus to make traveling by bus and coach safer. These air purifier solutions are also used to eliminate viruses. Such benefits provided by the HVAC systems lead to their demand in the coaches. Population growth and urbanization in the region are among the prominent factors propelling the demand for intercity transportation services, fueling the requirements for coaches and their HVAC systems.

Thermo King; Guchen Industry; MAHLE GmbH; Denso; Valeo; Bus Climate Control; Eberspächer; WABCO; TKT HVAC Co., Ltd.; and Shinano Kenshi Co., Ltd. are among the key players profiled in the North America HVAC system for bus market HVAC System for Bus market report.

The North America HVAC System for Bus market forecast is estimated on the basis of various secondary and primary research findings such as key company publications, association data, and databases. Exhaustive secondary research has been conducted using internal and external sources to obtain qualitative and quantitative information related to the North America HVAC System for Bus market growth. The process also helps obtain an overview and forecast of the market with respect to all the market segments.

Also, multiple primary interviews have been conducted with industry participants to validate the data and gain analytical insights. This process includes industry experts such as VPs, business development managers, market intelligence managers, and national sales managers, along with external consultants such as valuation experts, research analysts, and key opinion leaders, specializing in the North America HVAC System for Bus market.

Reasons to buy:

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players and segments in the HVAC system for bus market.

- Highlights key business priorities in order to assist companies to realign their business strategies

- The key findings and recommendations such as specific country and segmental insight highlights crucial progressive industry trends in the HVAC system for bus market, thereby allowing players across the value chain to develop effective long-term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets

- Scrutinize in-depth market trends and outlook coupled with the factors driving the market, as well as those hindering it

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing and distribution

Table of Contents

Companies Mentioned

Some of the leading companies in the North America HVAC System for Bus Market include:- Arctic Traveler Canada

- Bergstrom Climate Control Systems

- Guchen Industry

- MAHLE GmbH

- Denso Corp

- Valeo SE

- ZF Friedrichshafen AG

- Eberspächer Group

- Trane Technologies Plc

- TKT HVAC Co., Ltd.

- SUTRAK Corporation

- VBG Group

- BITZER Kuhlmaschinenbau GmbH

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 150 |

| Published | September 2024 |

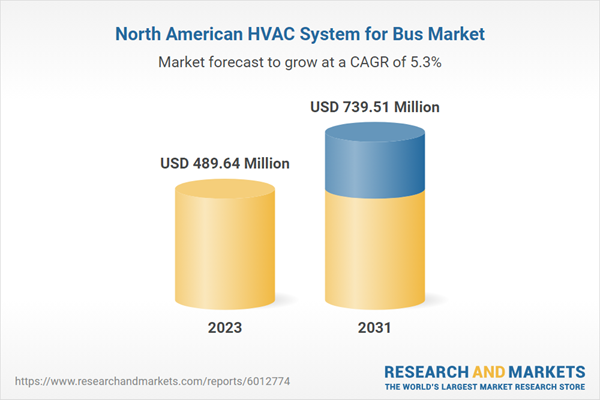

| Forecast Period | 2023 - 2031 |

| Estimated Market Value ( USD | $ 489.64 Million |

| Forecasted Market Value ( USD | $ 739.51 Million |

| Compound Annual Growth Rate | 5.3% |

| Regions Covered | Global, North America |

| No. of Companies Mentioned | 14 |

![North America HVAC System for Bus Market Size and Forecast, Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component, Type, Unit Type [Packaged Unit and Split Unit], and Drive Type, and Country- Product Image](http://www.researchandmarkets.com/product_images/12694/12694083_115px_jpg/north_america_hvac_system_for_bus_market.jpg)