The water flosser market size has grown strongly in recent years. It will grow from $1.09 billion in 2024 to $1.17 billion in 2025 at a compound annual growth rate (CAGR) of 7.5%. The growth in the historic period can be attributed to increase in prevalence of dental and periodontal diseases, growth in awareness about oral health, rise in disposable incomes, improved product accessibility, endorsements by dental professionals, and an expanding aging population.

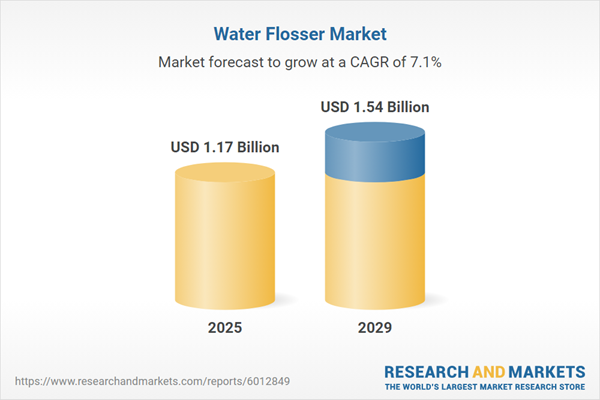

The water flosser market size is expected to see strong growth in the next few years. It will grow to $1.54 billion in 2029 at a compound annual growth rate (CAGR) of 7.1%. The growth in the forecast period can be attributed to growing popularity among dental patients, expansion of dental clinics and hospitals, increasing awareness of oral hygiene, rising prevalence of dental issues, growing disposable incomes, expanding e-commerce platforms, heightened demand for convenient and effective dental care solutions, and favorable recommendations from dental professionals. Major trends in the forecast period include new product developments, advancements in designs, integration of wireless and cordless options, integration of smart technologies, adoption of eco-friendly design, and advancements in water pressure designs.

The growing incidence of dental and periodontal diseases is anticipated to drive the expansion of the water flosser market in the future. These diseases affect the teeth, gums, and supporting structures of the mouth, often resulting from poor oral hygiene, high intake of sugary and acidic foods and drinks, and limited access to regular dental check-ups and professional cleanings. Water flossers help manage these conditions by using a pulsating stream of water to remove plaque, food particles, and bacteria between teeth and along the gum line, which reduces inflammation and prevents gum disease. For example, in September 2023, the National Board of Health and Welfare in Sweden reported that about 3.94 million individuals aged 24 and older sought dental care in 2023, a slight increase from 2022. Thus, the rise in dental and periodontal diseases is driving the demand for water flossers.

Leading companies in the water flosser market are concentrating on creating innovative products, such as cordless water flossers, to improve portability, convenience, and ease of use. These devices allow users to maintain good oral hygiene without the restriction of a power cord. Cordless water flossers operate on rechargeable or disposable batteries, making them portable and cord-free. For instance, in 2022, Philips, a health technology company based in the Netherlands, introduced the Sonicare Power Flosser 3000. This cordless water flosser features Quad stream and pulse wave technology for an efficient and user-friendly flossing experience. It includes a unique Quad Stream nozzle that releases water in an X-shaped pattern, offering a more extensive and thorough clean compared to manual flossing.

In June 2024, AMR Hair & Beauty, an Australian supplier of hair and beauty products, acquired Roaman for an undisclosed sum. This acquisition enables AMR to broaden its product range in the oral care sector, enriching its portfolio with high-quality dental hygiene products. Roaman, a US-based company, specializes in manufacturing electric toothbrushes and water flossers.

Major companies operating in the water flosser market are Procter & Gamble, Panasonic Holdings Corporation, Xiaomi Corporation, Koninklijke Philips N.V, Church & Dwight Co. Inc., Conair LLC, Water Pik Inc., Bestope, Ginsey Home Solutions Inc., ToiletTree Products Inc., Hydro Floss Inc., Fairywill, BURST.USA.Inc., Gurin Products LLC, h2ofloss limited, Homgeek Inc., Jetpik, Mornwell, Nicefeel, Oratec Corporation, Ovonni, Oracura Inc., Waterpulse, AquaSonic Ltd., Perfora.

North America was the largest region in the water flosser market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the water flosser market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the water flosser market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

A water flosser is a tool that utilizes a pulsating stream of water to clean between teeth and along the gumline. Serving as an alternative to traditional flossing, it helps remove food particles, plaque, and bacteria from hard-to-reach areas that a toothbrush alone might miss. This device is especially beneficial for those with braces, implants, or other dental appliances, as it cleans effectively around these devices and enhances overall oral hygiene.

In the water flosser market, the main product types include cordless or battery-operated flossers, countertop flossers, shower flossers, faucet flossers, and others. Cordless or battery-operated flossers are portable oral care devices powered by rechargeable or disposable batteries. These products are available in various outlets, such as drug stores, pharmacies, specialty stores, hypermarkets or supermarkets, convenience stores, and online retailers. They cater to a range of end users, including commercial, residential, and other sectors.

The water flosser market research report is one of a series of new reports that provides water flosser market statistics, including the water flosser industry global market size, regional shares, competitors with water flosser market share, detailed water flosser market segments, market trends, and opportunities, and any further data you may need to thrive in the water flosser industry. These water flosser market research reports deliver a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The water flosser market consists of sales of plaque seeker tips, orthodontic tips, and pik pocket tips. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Water Flosser Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on water flosser market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for water flosser ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The water flosser market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product Type: Cordless or Battery-Operated Flosser; Countertop Flosser; Shower Flosser; Faucet Flosser; Other Products2) By Application: Drug Stores and Pharmacies; Specialty Stores; Hypermarkets or Supermarkets; Convenience Stores; Online Retailers

3) By End Use: Commercial; Residential; Other End-Uses

Subsegments:

1) By Cordless or Battery-Operated Flosser: Rechargeable Battery; Replaceable Battery2) By Countertop Flosser: Large Capacity Reservoir; Adjustable Pressure Settings

3) By Shower Flosser: Wall-Mounted; Handheld

4) By Faucet Flosser: Faucet Adapter Included; Nozzle Control

5) By Other Products: Travel Flosser; Combination Flosser and Toothbrush

Key Companies Mentioned: Procter & Gamble; Panasonic Holdings Corporation; Xiaomi Corporation; Koninklijke Philips N.V; Church & Dwight Co. Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The major companies featured in this Water Flosser market report include:- Procter & Gamble

- Panasonic Holdings Corporation

- Xiaomi Corporation

- Koninklijke Philips N.V

- Church & Dwight Co. Inc.

- Conair LLC

- Water Pik Inc.

- Bestope

- Ginsey Home Solutions Inc.

- ToiletTree Products Inc.

- Hydro Floss Inc.

- Fairywill

- BURST.USA.Inc.

- Gurin Products LLC

- h2ofloss limited

- Homgeek Inc.

- Jetpik

- Mornwell

- Nicefeel

- Oratec Corporation

- Ovonni

- Oracura Inc.

- Waterpulse

- AquaSonic Ltd.

- Perfora

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | April 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 1.17 Billion |

| Forecasted Market Value ( USD | $ 1.54 Billion |

| Compound Annual Growth Rate | 7.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |