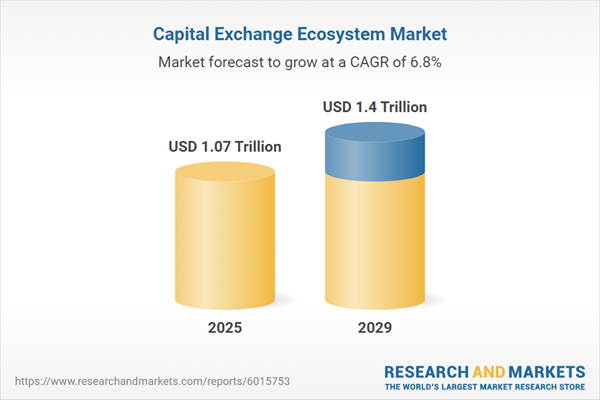

The capital exchange ecosystem market size is expected to see strong growth in the next few years. It will grow to $1.4 trillion in 2029 at a compound annual growth rate (CAGR) of 6.8%. The growth in the forecast period can be attributed to increasing cybersecurity, rise in institutional investments, increasing climate change policies, rise in new regulations and compliance standards, and improve financial infrastructure. Major trends in the forecast period include exchange innovations, advancements in blockchain, integration of AI, use of machine learning, and advanced risk management tools.

The forecast of 6.8% growth over the next five years reflects a slight reduction of 0.2% from the previous projection. This reduction is primarily due to the impact of tariffs between the US and other countries. This is likely to directly affect the US through reduced liquidity in alternative financing markets, as cross-border trading platforms and digital securities settlement systems, primarily sourced from Luxembourg and Hong Kong, become more expensive to operate due to increased technology import costs. The effect will also be felt more widely due to reciprocal tariffs and the negative effect on the global economy and trade due to increased trade tensions and restrictions.

The growing adoption and acceptance of cryptocurrencies are expected to drive the expansion of the capital exchange ecosystem moving forward. Cryptocurrencies are digital or virtual currencies that use cryptographic techniques for security and operate without the control of a central authority, typically leveraging blockchain technology. Their increasing popularity is fueled by the rising demand for decentralized financial systems and advancements in blockchain technology. The capital exchange ecosystem plays a crucial role in supporting cryptocurrencies by promoting their integration into traditional financial markets, thereby enhancing their credibility and accessibility. For example, in September 2024, Security.org, a US-based company, reported that cryptocurrency awareness and ownership have reached record levels, with 40% of American adults owning cryptocurrency in 2024, up from 30% in 2023 - translating to roughly 93 million people. As a result, the growing acceptance and use of cryptocurrencies are propelling the growth of the capital exchange ecosystem market.

Companies within the capital exchange ecosystem are focusing on developing trading platforms to boost transaction efficiency, enhance data security, provide real-time analytics, and offer investors seamless access to a variety of financial instruments. Trading platforms are software applications or systems that facilitate the buying, selling, and management of financial assets such as stocks, bonds, commodities, and cryptocurrencies. For example, in July 2024, Netcapital Inc., a US-based digital private capital markets firm, introduced the beta version of its secondary trading platform. This platform aims to create trading opportunities for investors who have acquired stock through its funding portal, marking a significant advancement in enhancing the functionality and appeal of the capital exchange ecosystem for private investments.

In December 2022, Airwallex, a Singapore-based financial technology company, partnered with Plaid to streamline ACH payments and improve the security and efficiency of bank account verification for U.S. customers. This partnership enhances the payment experience and aligns with Airwallex's goal of providing global financial infrastructure to enable businesses to operate smoothly across borders. Plaid, a US-based financial technology company, contributes to the capital exchange ecosystem through its Plaid Exchange platform.

Major companies operating in the capital exchange ecosystem market are London Stock Exchange Group plc, Intercontinental Exchange Inc., Deutsche Börse AG, Nasdaq Inc., CME Group Inc., Cboe Global Markets Inc., Hong Kong Exchanges and Clearing Limited, B3 S.A., Euronext N.V., SIX Group Ltd., Moscow Exchange MICEX-RTS, Japan Exchange Group Inc., Singapore Exchange Limited, Australian Securities Exchange Ltd., New York Stock Exchange, National Stock Exchange of India Limited, Borsa Italiana S.p.A., Johannesburg Stock Exchange Limited, The Philippine Stock Exchange Inc., Taiwan Stock Exchange Corporation, Qatar Stock Exchange, Saudi Exchange, Shanghai Stock Exchange, Korea Exchange, Warsaw Stock Exchange.

North America was the largest region in the capital exchange ecosystem market in 2024. Europe is expected to be the fastest-growing region in the forecast period. The regions covered in the capital exchange ecosystem market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the capital exchange ecosystem market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The capital exchange ecosystem market consists of revenues earned by entities by providing services such as brokerage, clearing, and settlement services. The market value includes the value of related goods sold by the service provider or included within the service offering. The capital exchange ecosystem market also includes sales of high-performance servers, data storage systems, networking equipment, and specialized trading terminals. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

Note that the outlook for this market is being affected by rapid changes in trade relations and tariffs globally. The report will be updated prior to delivery to reflect the latest status, including revised forecasts and quantified impact analysis. The report’s Recommendations and Conclusions sections will be updated to give strategies for entities dealing with the fast-moving international environment.

The sharp rise in U.S. tariffs and the ensuing trade tensions in spring 2025 are having a considerable impact on the financial sector, particularly in the areas of investment strategies and risk management. The increased tariffs have intensified market volatility, leading institutional investors to adopt more cautious approaches and driving greater demand for hedging solutions. Banks and asset managers are encountering higher costs in cross-border transactions as disrupted global supply chains and declining corporate earnings weigh on equity market performance. At the same time, insurance providers are facing elevated claims risks linked to supply chain interruptions and trade-related business losses. Furthermore, reduced consumer spending and weaker export demand are limiting credit growth and dampening investment appetite. In response to these challenges, the sector must focus on diversification, accelerate digital transformation, and strengthen scenario planning to manage the heightened economic uncertainty and safeguard profitability.

The capital exchange ecosystem refers to a structured framework within capital markets that facilitates the exchange of financial assets, allowing investors to connect with entities seeking capital. Its goal is to optimize capital allocation, enhance liquidity, and foster economic growth. This ecosystem enables investors to diversify their portfolios across various asset classes, industries, and geographic regions, thereby reducing risk.

The main components of the capital exchange ecosystem are primary and secondary markets. The primary market is where new securities are issued and sold directly to investors, such as through initial public offerings (IPOs) or primary bond offerings, helping companies and governments raise capital. In the primary market, investors can acquire various types of stocks, including common, preferred, growth, value, and defensive stocks, as well as different types of bonds, such as government, corporate, municipal, and mortgage bonds.

The capital exchange ecosystem market research report is one of a series of new reports that provides capital exchange ecosystem market statistics, including the capital exchange ecosystem industry global market size, regional shares, competitors with capital exchange ecosystem market share, detailed capital exchange ecosystem market segments, market trends, and opportunities, and any further data you may need to thrive in the capital exchange ecosystem industry. These capital exchange ecosystem market research reports deliver a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 1-3 business days.

Table of Contents

Executive Summary

Capital Exchange Ecosystem Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on capital exchange ecosystem market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as geopolitical conflicts, trade policies and tariffs, post-pandemic supply chain realignment, inflation and interest rate fluctuations, and evolving regulatory landscapes.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for capital exchange ecosystem? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward, including technological disruption, regulatory shifts, and changing consumer preferences? The capital exchange ecosystem market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: technological advancements such as AI and automation, Russia-Ukraine war, trade tariffs (government-imposed import/export duties), elevated inflation and interest rates.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) by Market Composition: Primary; Secondary2) by Stock Type: Common and Preferred Stock; Growth Stock; Value Stock; Defensive Stock

3) by Bond Type: Government; Corporate; Municipal; Mortgage; Other Bond Types

Subsegments:

1) by Primary: Initial Public Offerings (Ipos); Private Placements; Direct Listings2) by Secondary: Stock Exchanges; Over-The-Counter (Otc) Markets; Alternative Trading Systems (Ats)

Companies Mentioned:London Stock Exchange Group plc; Intercontinental Exchange Inc.; Deutsche Börse AG; Nasdaq Inc.; CME Group Inc.; Cboe Global Markets Inc.; Hong Kong Exchanges and Clearing Limited; B3 S.bA.; Euronext N.V.; SIX Group Ltd.; Moscow Exchange MICEX-RTS; Japan Exchange Group Inc.; Singapore Exchange Limited; Australian Securities Exchange Ltd.; New York Stock Exchange; National Stock Exchange of India Limited; Borsa Italiana S.p.bA.; Johannesburg Stock Exchange Limited; The Philippine Stock Exchange Inc.; Taiwan Stock Exchange Corporation; Qatar Stock Exchange; Saudi Exchange; Shanghai Stock Exchange; Korea Exchange; Warsaw Stock Exchange

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The companies featured in this Capital Exchange Ecosystem market report include:- London Stock Exchange Group plc

- Intercontinental Exchange Inc.

- Deutsche Börse AG

- Nasdaq Inc.

- CME Group Inc.

- Cboe Global Markets Inc.

- Hong Kong Exchanges and Clearing Limited

- B3 S.bA.

- Euronext N.V.

- SIX Group Ltd.

- Moscow Exchange MICEX-RTS

- Japan Exchange Group Inc.

- Singapore Exchange Limited

- Australian Securities Exchange Ltd.

- New York Stock Exchange

- National Stock Exchange of India Limited

- Borsa Italiana S.p.bA.

- Johannesburg Stock Exchange Limited

- The Philippine Stock Exchange Inc.

- Taiwan Stock Exchange Corporation

- Qatar Stock Exchange

- Saudi Exchange

- Shanghai Stock Exchange

- Korea Exchange

- Warsaw Stock Exchange

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | September 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 1.07 Trillion |

| Forecasted Market Value ( USD | $ 1.4 Trillion |

| Compound Annual Growth Rate | 6.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |