Free Webex Call

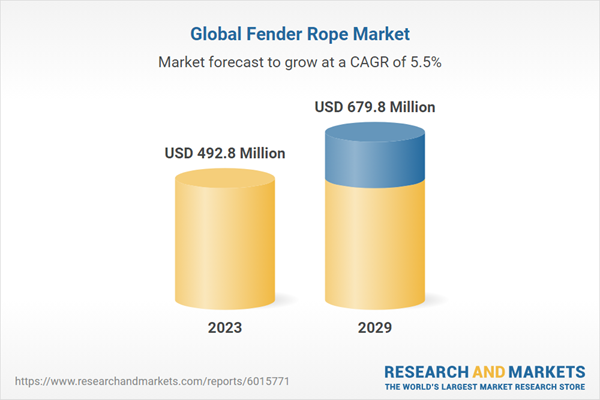

The Global Fender Rope Market was valued at USD 492.8 Million in 2023, and is expected to reach USD 679.8 Million by 2029, rising at a CAGR of 5.50%. The global fender rope market plays a crucial role in maritime and shipping industries, providing essential safety and protection to vessels, docks, and other marine structures. Fender ropes, also known as mooring lines, are integral components used in conjunction with fenders to cushion and safeguard ships from impact while docking or in rough waters. The market for these specialized ropes encompasses various materials, designs, and functionalities, catering to diverse marine applications. Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Increasing Maritime Trade and Transportation

One of the primary drivers propelling the global fender rope market is the steady growth in maritime trade and transportation worldwide. With a substantial portion of global trade conducted through seaborne routes, the demand for vessels, including cargo ships, tankers, and container vessels, continues to rise. As maritime traffic increases, so does the need for reliable and durable fender ropes to safeguard these vessels from collisions and impacts during berthing and docking procedures.The expansion of international trade, coupled with the growing number of port infrastructure developments, drives the demand for fender ropes. These ropes play a crucial role in ensuring the safety of vessels, protecting them from damage against docks, piers, or other vessels when they are berthed or moored. The necessity for dependable fender ropes to withstand varying environmental conditions and provide effective cushioning against impact fuels the market's growth.

Technological Advancements and Material Innovations

The evolution of materials and technology in the manufacturing of fender ropes is another significant driver influencing the global market. Manufacturers are constantly engaged in research and development to create high-performance fender ropes using advanced materials and innovative designs. Traditional materials like natural fibers such as cotton and manila have given way to synthetic fibers like polyester, nylon, and polypropylene due to their superior strength, durability, and resistance to environmental elements.Technological advancements have led to the production of fender ropes with enhanced properties, including higher tensile strength, increased abrasion resistance, better UV stability, and improved elasticity. These innovations enable fender ropes to endure harsh maritime conditions, extending their lifespan and performance, thereby meeting the stringent demands of the maritime industry.

Safety Regulations and Standards in Maritime Operations

Stringent safety regulations and industry standards imposed by maritime governing bodies worldwide act as a significant driver for the fender rope market. Regulations stipulate specific safety requirements and guidelines for vessels, ports, and terminals to ensure the protection of maritime assets and personnel during berthing and mooring operations.Compliance with these regulations mandates the use of high-quality and certified fender ropes that meet specified standards for strength, durability, and performance. As a result, there is a growing emphasis on the use of fender ropes that adhere to these standards, creating a demand for reliable and certified products in the market.

The adherence to safety standards not only promotes the use of superior quality fender ropes but also drives innovation as manufacturers strive to develop ropes that surpass regulatory requirements, offering enhanced safety and reliability in maritime operations.

Key Market Challenges

Market Fragmentation and Competition

The fender rope market faces challenges stemming from market fragmentation and intense competition among manufacturers and suppliers. The industry comprises numerous players, ranging from small-scale local manufacturers to established global entities. This diversity contributes to market fragmentation, leading to price wars, varied product quality, and differences in service offerings. Competition often pushes companies to focus on cost-cutting measures, potentially compromising on the quality of materials and manufacturing processes. Additionally, the presence of counterfeit or substandard products in the market poses a challenge to established manufacturers, impacting their market share and credibility. Maintaining a competitive edge amid this landscape requires consistent innovation, stringent quality control, and differentiation in product offerings to meet varying customer needs.Raw Material Price Volatility and Supply Chain Challenges

Another significant challenge faced by the global fender rope market revolves around raw material price volatility and supply chain disruptions. Fender ropes are predominantly made from materials like nylon, polyester, polypropylene, and other synthetic fibers, which are susceptible to fluctuations in raw material prices. Price volatility in these materials can impact manufacturing costs, thereby affecting product pricing and profit margins for manufacturers.Additionally, supply chain disruptions, influenced by geopolitical tensions, natural disasters, or global events (as seen in the COVID-19 pandemic), can lead to delays in raw material procurement and production. These disruptions not only affect the timely delivery of fender ropes to customers but also impact inventory management and overall operational efficiency. Companies often need to adopt robust supply chain management strategies, diversify sourcing options, and hedge against raw material price fluctuations to mitigate these challenges.

Regulatory and Compliance Hurdles

The global fender rope market encounters challenges related to regulatory standards and compliance. Maritime regulations, safety standards, and industry-specific norms vary across regions and countries. Compliance with these regulations poses a challenge for manufacturers and suppliers, necessitating adherence to stringent quality control measures and certifications.Moreover, evolving environmental regulations and sustainability concerns drive the need for eco-friendly and biodegradable materials, which can pose challenges in terms of sourcing and manufacturing. Ensuring compliance with diverse regulatory frameworks while maintaining product quality and innovation becomes a complex task for companies operating in the fender rope market. Continuous monitoring of regulatory changes, investment in research and development for sustainable materials, and adherence to industry standards are crucial to navigate these challenges successfully.

Key Market Trends

Technological Advancements in Material and Design

The evolution of materials used in fender ropes has been a significant trend driving the global market. Manufacturers are continuously exploring advanced materials with enhanced durability, strength, and resistance to environmental factors like abrasion, UV radiation, and saltwater corrosion. Traditional natural fibers such as manila and hemp are gradually being replaced by synthetic fibers like polyester, polypropylene, and nylon due to their superior strength, longevity, and resistance to degradation.Furthermore, advancements in design play a crucial role. Innovative construction techniques, braiding methods, and splicing technologies contribute to the development of high-performance fender ropes. These ropes are engineered to withstand intense pressures and impacts, ensuring maximum protection for vessels against collisions and berthing stresses.

The integration of nanotechnology and composite materials in fender rope production is another emerging trend. Nanocomposite fibers offer exceptional strength-to-weight ratios and improved resistance properties, enabling the creation of lightweight yet robust ropes capable of withstanding extreme conditions in marine environments.

Focus on Sustainable and Eco-friendly Solutions

The global emphasis on sustainability and environmental responsibility has impacted the fender rope market. Manufacturers are increasingly adopting eco-friendly materials and production processes to align with evolving environmental regulations and consumer preferences.The development of biodegradable and recyclable fender ropes using eco-friendly materials is gaining traction. Companies are exploring natural and renewable fibers like jute, sisal, and recycled polyester to create ropes that minimize environmental impact without compromising performance. Additionally, the implementation of sustainable manufacturing practices, including reduced energy consumption and waste management, contributes to the market's eco-conscious direction.

Furthermore, the shift towards circular economy principles promotes the recycling and repurposing of used fender ropes. Initiatives focused on reusing old ropes for secondary applications or recycling them to create new ropes reduce waste and support sustainable practices within the industry.

Adoption of Innovative Manufacturing Processes and Customization

The trend toward innovative manufacturing processes and customization caters to the diverse needs of different marine applications and vessels. Manufacturers are investing in advanced machinery and technologies that enable precise customization of fender ropes according to specific requirements, including size, length, strength, and color.Additionally, the advent of 3D printing technology is revolutionizing the production of fender ropes. This technology allows for intricate designs and customization of rope structures, optimizing their performance for various vessel types and port conditions. Custom-designed ropes, tailored for specific berthing systems and vessel sizes, enhance safety and efficiency in maritime operations.

Moreover, the integration of smart technologies and sensors into fender ropes is an emerging trend. Smart ropes equipped with sensors for monitoring tension, wear, and environmental conditions provide real-time data, enabling proactive maintenance and ensuring optimal fender performance.

Segmental Insights

Material Insights

Cotton undeniably holds a considerable share within the global fender rope market, marking its significance due to several intrinsic qualities that make it an optimal choice in this niche industry.Fender ropes, essential components in maritime settings, require robust, durable materials capable of withstanding harsh marine conditions while ensuring reliable performance. Cotton's prominence in the fender rope market stems from its inherent characteristics that align well with the demands of marine applications.

One of the primary reasons for cotton's substantial share in the fender rope market is its natural strength and durability. Cotton fibers possess commendable tensile strength, making them resilient against the forces exerted during docking and mooring activities. This strength ensures that cotton-based fender ropes offer reliable support and protection for vessels against impact, abrasion, and strain, thereby enhancing safety in marine environments.

Moreover, cotton fibers exhibit excellent resistance to abrasion, a crucial feature for ropes subjected to constant friction against docks, pilings, or other vessels. This resistance minimizes wear and tear, prolonging the lifespan of fender ropes and ensuring their effectiveness in safeguarding vessels from potential damage.

Additionally, the high absorbency of cotton fibers is advantageous in marine settings. Cotton-based fender ropes can absorb moisture, preventing the accumulation of water that might compromise the ropes' integrity or cause degradation. This feature reduces the risk of rotting, mildew formation, or corrosion, enhancing the longevity of the fender ropes and maintaining their structural integrity in maritime environments.

Cotton's natural buoyancy also adds to its appeal in the fender rope market. In scenarios where ropes might fall into the water or be submerged, cotton's buoyant nature helps prevent sinking, facilitating easier retrieval and maintenance.

Furthermore, the availability and affordability of cotton as a raw material contribute to its prevalence in the fender rope market. Its widespread cultivation and cost-effectiveness make cotton an attractive option for manufacturers seeking durable yet economically viable materials for producing fender ropes.

In conclusion, cotton's significant share in the global fender rope market is attributed to its inherent strength, durability, resistance to abrasion, moisture management capabilities, buoyancy, and cost-effectiveness. As an ideal material meeting the stringent demands of marine applications, cotton continues to maintain a stronghold in the production of fender ropes, ensuring safety and reliability in maritime operations worldwide.

Distribution Channel Insights

The rise of e-commerce has also led to increased product visibility and enhanced marketing strategies for fender rope manufacturers. Online platforms allow companies to showcase their products with detailed descriptions, images, and customer reviews, aiding consumers in making informed purchasing decisions. Additionally, targeted marketing efforts and promotions further drive consumer interest and boost sales within the online segment.Furthermore, the convenience of doorstep delivery and efficient logistics associated with online purchases has significantly contributed to the segment's growth. Customers appreciate the ease of having fender ropes delivered directly to their doorstep, saving time and effort typically involved in purchasing from physical stores.

The impact of the COVID-19 pandemic further accelerated the adoption of online shopping for fender ropes. Restrictions on in-person shopping and a shift towards contactless transactions prompted more consumers to turn to online platforms, thereby amplifying the segment's market share and overall growth.

Regional Insights

North America holds a notable position within the global fender rope market, wielding substantial influence owing to several key factors that underscore its dominance in this sector. Fender ropes, critical components in maritime and dockside operations, are indispensable for securing vessels, protecting against collisions, and ensuring safe berthing. The region's robust maritime industry, coupled with its penchant for innovation and high-quality manufacturing, positions North America as a significant contributor to the global fender rope market.One of the primary drivers behind North America's stronghold in this market is its expansive coastline and thriving maritime trade. The region boasts numerous ports, harbors, and maritime facilities, fostering a bustling marine transportation network. This extensive maritime infrastructure necessitates the use of durable and reliable fender ropes, creating a substantial demand within the region.

Moreover, North America's focus on technological advancements and quality manufacturing processes further cements its position in the global fender rope market. The region is home to several prominent manufacturers renowned for producing high-performance ropes using innovative materials and manufacturing techniques. These ropes are engineered to withstand harsh marine conditions, ensuring safety and reliability in berthing and docking operations.

Additionally, the stringent safety regulations and standards prevalent in North America drive the demand for top-notch fender ropes that comply with rigorous quality benchmarks. This emphasis on safety and adherence to industry standards reinforces the region's reputation for providing premium-grade fender ropes.

Furthermore, North America's diverse marine landscape, encompassing a range of maritime activities such as shipping, fishing, offshore drilling, and recreational boating, fuels the demand for fender ropes across various sectors. The versatility of these ropes, tailored to meet the specific requirements of different applications, contributes to their widespread adoption throughout the region.

The region's proactive approach toward sustainability also influences the fender rope market. Manufacturers in North America increasingly focus on eco-friendly materials and production processes, aligning with the growing global consciousness about environmental conservation.

Key Market Players

- Samson Rope Technologies, Inc.

- Novatec Braids, Ltd. (Novabraid)

- Namah Ropes

- TEUFELBERGER Fiber Rope Corp.

- Marlow Ropes Ltd

- Touwfabriek Langman B.V. (Langman Ropes)

- Nantong Guangming Steel Wire Products Co.Ltd

- WireCo WorldGroup

- Yale Cordage, Inc.

- Lippert Components, Inc.

Report Scope:

In this report, the global fender rope market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Fender Rope Market, By Material:

- Nylon

- Polypropylene

- Polyester

- Cotton

- Others

Fender Rope Market, By End Use:

- Recreational Boating

- Commercial Shipping

- Naval Defense

- Others

Fender Rope Market, By Distribution Channel:

- Online

- Offline

Fender Rope Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Turkey

- Egypt

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the global fender rope market.Available Customizations:

Global Fender Rope Market report with the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

1. Introduction

2. Research Methodology

3. Executive Summary

4. Voice of Customer

5. Global Fender Rope Market Outlook

6. North America Fender Rope Market Outlook

7. Europe Fender Rope Market Outlook

8. Asia-Pacific Fender Rope Market Outlook

9. South America Fender Rope Market Outlook

10. Middle East and Africa Fender Rope Market Outlook

11. Market Dynamics

13. SWOT Analysis

14. Competitive Landscape

15. Strategic Recommendations

Companies Mentioned

- Samson Rope Technologies, Inc.

- Novatec Braids, Ltd. (Novabraid)

- Namah Ropes

- TEUFELBERGER Fiber Rope Corp.

- Marlow Ropes Ltd

- Touwfabriek Langman B.V. (Langman Ropes)

- Nantong Guangming Steel Wire Products Co.Ltd

- WireCo WorldGroup

- Yale Cordage, Inc.

- Lippert Components, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 181 |

| Published | October 2024 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 492.8 Million |

| Forecasted Market Value ( USD | $ 679.8 Million |

| Compound Annual Growth Rate | 5.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |