Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Despite strong demand, the market encounters a major obstacle due to the volatility of production costs. High energy prices and unstable raw material expenses, especially in glass manufacturing, exert significant pressure on profit margins and pricing strategies. This economic instability compels bottle manufacturers to make complex adjustments to their supply chains to remain viable while striving to keep prices competitive for beverage producers. As a result, the unpredictable cost environment presents a formidable challenge that threatens to limit future market expansion and delay investments in new manufacturing infrastructure.

Market Drivers

The accelerating global demand for premium and super-premium spirits acts as a primary catalyst for the liquor bottles market. As consumers place greater emphasis on quality over quantity, beverage manufacturers are prioritizing high-grade, aesthetically unique glass packaging to distinguish their high-value products in a competitive retail environment. This trend forces bottle producers to innovate by utilizing intricate molds, heavier glass weights, and enhanced clarity to reflect the perceived value of the spirits. Highlighting the financial significance of this procurement shift, the Distilled Spirits Council of the United States reported in its February 2024 'Annual Economic Briefing' that revenue for high-end Tequila and Mezcal suppliers in the US grew by 7.9% to USD 6.5 billion in 2023, indicating sustained investment in premium packaging.Concurrently, the market is significantly shaped by a growing consumer preference for sustainable and recyclable packaging. This driver motivates manufacturers to adopt circular economy principles, such as using a higher percentage of cullet in production and creating lightweight glass containers that lower transportation emissions without sacrificing structural strength.

These sustainability efforts are essential for meeting environmental regulations and attracting eco-conscious consumers, necessitating major technological upgrades in manufacturing plants. The industry's progress in circularity is evident in the European Container Glass Federation's June 2024 'Close the Glass Loop' report, which noted a record 80.2% glass packaging recycling rate in the EU for 2022. Additionally, Verallia reported a full-year 2023 revenue of EUR 3.9 billion in 2024, reflecting the operational scale needed to address these evolving market needs.

Market Challenges

The volatility of production costs serves as a significant barrier to the expansion of the Global Liquor Bottles Market. Producing rigid containers for distilled spirits, particularly glass bottles, requires energy-intensive melting and forming processes, leaving manufacturers highly susceptible to fluctuating energy tariffs and raw material prices. This financial instability severely squeezes profit margins, forcing producers to frequently recalibrate pricing strategies to maintain viability. Consequently, the uncertain cost environment discourages the long-term capital investment necessary for new furnaces and facility upgrades, effectively stalling the capacity expansion required to meet the growing international demand for premium spirits packaging.The negative impact of these economic pressures is clearly visible in key manufacturing regions. In 2024, the Bundesverband Glasindustrie e.V. reported that the German glass industry experienced a 2.9% drop in total production tonnage and an 8.3% decrease in revenue, attributing these declines to the challenging operating environment. This contraction in output within a major production hub demonstrates how prohibitive costs are directly curtailing manufacturing activity, thereby restricting the market's ability to supply the necessary volume of bottles to support global growth.

Market Trends

The commercial adoption of paper and fiber-based bottle alternatives marks a structural shift in the market, driven by the critical need to decarbonize packaging beyond the limitations of lightweighting glass. Manufacturers are increasingly utilizing bio-based, molded fiber containers that provide significant weight reductions and lower carbon footprints, catering to global spirits brands aiming to meet aggressive net-zero goals. This innovation is swiftly moving from pilot stages to industrial scalability, challenging the dominance of traditional glass in the standard spirits segment by offering a feasible, non-fossil fuel solution. As reported by Sustainable Times in August 2025, in the 'Frugalpac Gears Up for Worldwide Expansion' article, the sustainable packaging firm aims for a 0.58% share of the global market by 2029, equivalent to an annual production of 191 million paper bottles.Simultaneously, the rollout of circular refillable and deposit-return bottle systems is transforming logistics and bottle design to comply with regulatory mandates for waste reduction. Governments are enforcing mandatory collection schemes that favor durable, reusable glass containers over single-use options, compelling producers to standardize bottle shapes for efficient reverse logistics and washing. This regulatory pressure is particularly strong in European markets, where legislation is establishing the financial framework for these closed-loop systems. According to an Osborne Clarke article from June 2025, 'Deposit Return System in Poland: New Regulations from 2025', the country's new mandatory system applies a deposit of PLN 1.00 specifically for reusable glass bottles up to 1.5 liters, distinguishing them from single-use plastics to actively promote circularity.

Key Players Profiled in the Liquor Bottles Market

- The Cary Company

- Rockwood & Hines Glass Group

- O-I Glass, Inc.

- ORBIS Corporation

- Ardagh Group S.A.

- Vidrala, S.A.

- Berlin Packaging L.L.C.

- Saxco International LLC.

- SKS Bottle & Packaging, Inc.

- United Bottles and Packaging

Report Scope

In this report, the Global Liquor Bottles Market has been segmented into the following categories:Liquor Bottles Market, by Glass Type:

- Clear Glass

- Cosmetic Flint Glass

Liquor Bottles Market, by Application:

- Beer

- Spirits

Liquor Bottles Market, by Capacity:

- Up to 180 ml

- 180 ml to 500 ml

Liquor Bottles Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Liquor Bottles Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Liquor Bottles market report include:- The Cary Company

- Rockwood & Hines Glass Group

- O-I Glass, Inc.

- ORBIS Corporation

- Ardagh Group S.A.

- Vidrala, S.A.

- Berlin Packaging L.L.C.

- Saxco International LLC.

- SKS Bottle & Packaging, Inc.

- United Bottles and Packaging

Table Information

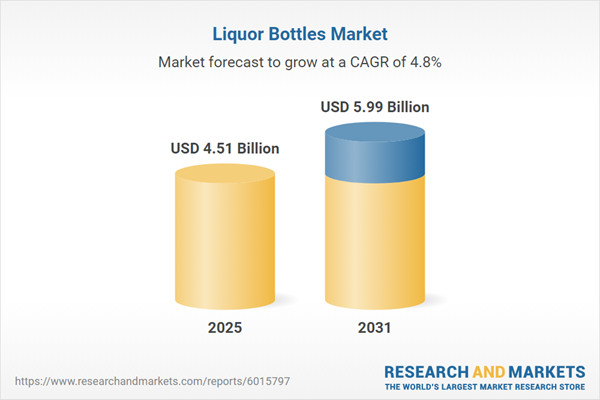

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 4.51 Billion |

| Forecasted Market Value ( USD | $ 5.99 Billion |

| Compound Annual Growth Rate | 4.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |