Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Despite these positive indicators, the market faces significant headwinds due to the volatility of raw material costs, specifically regarding synthetic fibers and cotton. These fluctuations create uncertainty in production expenses and pressure manufacturer profit margins. According to the National Council of Textile Organizations, the value of U.S. shipments for home furnishings and carpets reached $23.6 billion in 2024. This statistic highlights the industry's immense economic footprint, even as it contends with the complexities of supply chain dynamics and unpredictable input costs.

Market Drivers

The escalating number of residential remodeling and renovation initiatives acts as a major engine for the Global Textiles Home Decor Market, as homeowners increasingly focus on modernizing their living environments. This movement directly fuels the demand for soft furnishings, such as floor coverings, window treatments, and upholstery, which are fundamental to updating interior designs. Continuous spending on home improvements guarantees a reliable income source for textile producers serving both professional designers and DIY enthusiasts. As reported by Houzz in April 2025, the '2025 U.S. Houzz & Home Study' revealed that 54% of homeowners undertook renovations in 2024 with a median expenditure of $20,000, signaling significant investment in property enhancements that often include textile updates.In parallel, the rapid expansion of online retail and e-commerce channels has transformed market accessibility, enabling brands to leverage advanced logistics and digital storefronts to access a wider global customer base. Features like direct-to-consumer shipping and augmented reality visualization on online platforms have become essential for boosting sales in the soft furnishings arena. The success of this shift is reflected in strong sector performance; the National Retail Federation's January 2025 review of 2024 holiday sales noted a 5.6% year-over-year revenue increase for home furnishings and furniture stores. Additionally, the Office of Textiles and Apparel reported in December 2024 that U.S. textile imports rose by 37.2% in October 2024 compared to the prior year, underscoring the intense cross-border trade driven by this physical and digital demand.

Market Challenges

The instability of raw material prices, particularly for synthetic fibers and cotton, presents a significant obstacle to the Global Textiles Home Decor market's growth by causing fluctuations in production costs. When input expenses vary unpredictably, manufacturers face challenges in upholding stable pricing structures, frequently leading to the absorption of increased costs that severely diminish profit margins. This financial volatility hinders companies from committing to capacity expansions or long-term investments, as capital resources must be allocated to hedging against potential material cost spikes rather than funding innovation or market growth.Furthermore, this cost instability hampers the fluidity of supply chains, prompting conservative inventory management strategies that can result in lost sales during peak demand periods. The gravity of this challenge is acknowledged throughout the sector. According to the 'International Textile Manufacturers Federation' in '2024', 27% of global survey respondents pinpointed high raw material costs as a primary operational difficulty. This statistic emphasizes how enduring uncertainty regarding input prices directly obstructs the industry's scalability, forcing manufacturers to focus on financial preservation instead of pursuing aggressive expansion strategies.

Market Trends

The shift toward eco-friendly and sustainable materials is fundamentally transforming the Global Textiles Home Decor Market, with manufacturers increasingly seeking environmental certification to satisfy stricter regulations and consumer demands. This movement encourages the broad incorporation of organic cotton, recycled fibers, and biodegradable textiles into supply chains, elevating these materials from niche options to industry standards. The drive for this transition is highlighted by the rise in third-party validations; according to the 'Annual Report 2024/2025' released by OEKO-TEX in September 2025, the organization granted over 57,000 certificates globally, marking an 8% increase from the prior year. This figure illustrates the sector's deepening dedication to verified sustainable practices as a key competitive tactic.Concurrently, the rise of hypoallergenic and wellness-oriented textiles is heavily impacting product innovation, especially within the upholstery and bedding segments aimed at improving sleep quality and indoor health. Shoppers are actively looking for natural, breathable, and non-toxic fabrics that enhance physical comfort and reduce exposure to allergens in their homes. This inclination toward health-focused materials is directly influencing purchasing patterns; the '2025 Global Lifestyle Monitor Survey' by Cotton Incorporated, published in October 2025, found that 59% of global consumers are willing to pay a premium for natural fiber products, identifying superior quality and comfort as the main reasons for their investment.

Key Players Profiled in the Textiles Home Decor Market

- Mannington Mills, Inc.

- American Textile Company

- Leggett & Platt, Incorporated

- Nitori Holdings Co., Ltd.

- Williams-Sonoma, Inc.

- Mohawk Industries, Inc.

- American Signature, Inc.

- Vescom B.V.

- Mittal International (India) Private Limited

- Kimball International, Inc.

Report Scope

In this report, the Global Textiles Home Decor Market has been segmented into the following categories:Textiles Home Decor Market, by Product Type:

- Bed linen & Bedspread

- Floor Coverings

- Kitchen and Dining Linen

- Bath/Toilet Linen

- Upholstery

- Others

Textiles Home Decor Market, by Application:

- Indoor Decor

- Outdoor Decor

Textiles Home Decor Market, by Sales Channel:

- Supermarkets/Hypermarkets

- Specialty Stores

- Online

- Others

Textiles Home Decor Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Textiles Home Decor Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Textiles Home Decor market report include:- Mannington Mills, Inc.

- American Textile Company

- Leggett & Platt, Incorporated

- Nitori Holdings Co., Ltd.

- Williams-Sonoma, Inc.

- Mohawk Industries, Inc.

- American Signature, Inc.

- Vescom B.V.

- Mittal International (India) Private Limited

- Kimball International, Inc.

Table Information

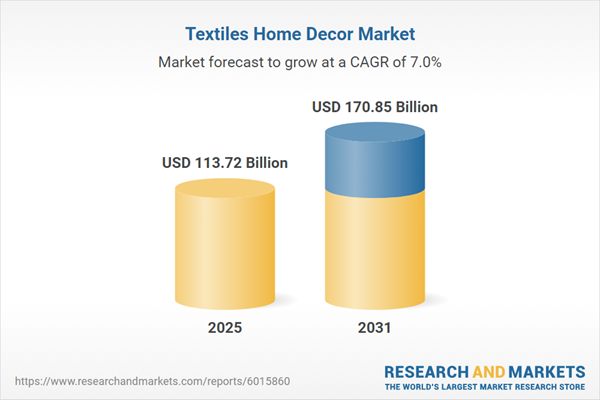

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 113.72 Billion |

| Forecasted Market Value ( USD | $ 170.85 Billion |

| Compound Annual Growth Rate | 7.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |