Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Despite this positive growth outlook, a major obstacle hindering market expansion is the technical complexity associated with thermal management in high-speed charging applications. As device manufacturers aim to provide faster charging speeds within increasingly smaller form factors, the challenge of effectively dissipating generated heat without jeopardizing component reliability or user safety remains a significant engineering barrier.

Market Drivers

The widespread adoption of mobile devices and consumer electronics acts as a fundamental catalyst for the lithium battery charger IC sector, driven by continuous demand for smartphones, laptops, and wearables that require efficient power management. Modern consumer electronics necessitate increasingly complex integrated circuits to handle thermal performance and prolong battery life while fitting into compact designs. According to the Consumer Technology Association's 'U.S. Consumer Technology One-Year Industry Forecast' from January 2024, U.S. retail revenues for the consumer technology industry were expected to reach $512 billion in 2024, indicating strong hardware consumption that directly boosts charger IC volumes. This reliance on battery-operated hardware sustains the wider semiconductor ecosystem, with the Semiconductor Industry Association reporting global sales of $53.1 billion in August 2024, emphasizing the vital supply chain role of charger ICs in meeting expansive demand.The rapid uptake of e-mobility solutions and electric vehicles serves as the second primary factor driving market growth, shifting the industry focus toward high-current and high-voltage charging capabilities. As the automotive sector transitions away from internal combustion engines, manufacturers are incorporating complex battery management systems that depend on advanced charger ICs to ensure grid interoperability and safe rapid charging. This shift is highlighted by the European Automobile Manufacturers’ Association's October 2024 press release, which noted that battery-electric cars achieved a 17.3% market share in the European Union in September 2024. This rising penetration of electric drivetrains demands a parallel increase in the production of automotive-grade charger ICs capable of meeting the rigorous efficiency and safety standards of modern e-mobility platforms.

Market Challenges

The technical difficulty of managing heat during high-speed charging operations serves as a significant constraint on the expansion of the Global Lithium Battery Charger ICs market. As manufacturers strive to increase charging speeds to satisfy consumer demands, the power density within charger integrated circuits rises sharply. This increase generates substantial heat that is challenging to dissipate, especially within the diminishing form factors of contemporary wearables and smartphones. The engineering resources necessary to address these thermal risks without sacrificing device safety or battery longevity result in increased development costs and prolonged product release cycles, effectively slowing the commercialization rate of advanced charging solutions.This thermal bottleneck directly affects the ability of suppliers to meet the high-volume demands of the automotive and electronics sectors. The Semiconductor Industry Association reported that global semiconductor industry sales reached 137.7 billion dollars in the first quarter of 2024, highlighting the massive scale of component demand. However, charger ICs that fail to maintain stable operations under intense thermal loads encounter integration barriers, restricting their adoption in this vast market. Consequently, the inability to effectively manage heat dissipation limits the addressable market for high-performance charger ICs, preventing the sector from realizing its full revenue potential.

Market Trends

The widespread adoption of Power Delivery (PD) protocols and USB Type-C is fundamentally transforming the market as regulators enforce universal charging standards to reduce electronic waste. This regulatory environment requires semiconductor manufacturers to design charger ICs that support bidirectional power flows and higher voltage rails necessary for PD specifications. These advanced ICs must now incorporate complex protocol controllers to negotiate power needs between devices, evolving from simple voltage regulation to intelligent power contract management. In December 2024, the European Commission announced in its 'Common Charger Directive' enforcement that the mandatory switch to USB-C ports for portable electronics is expected to save consumers approximately 250 million euros annually by removing the need for duplicate charging hardware.Simultaneously, the integration of wireless power transfer features is accelerating the creation of highly integrated charger ICs tailored for the Qi2 standard. This trend emphasizes the optimization of magnetic power profiles, requiring ICs to handle precise coil alignment and foreign object detection while preserving thermal stability during high-efficiency energy transmission. The industry focus has moved toward building interoperable charging ecosystems that operate seamlessly across various device brands, necessitating strict adherence to the latest wireless protocols. According to the Wireless Power Consortium's January 2025 press release regarding 'Qi2's Wireless Charging Benefits,' adoption has extended to over 1.5 billion devices globally, driving a six-fold rise in certified product releases compared to earlier generation standards.

Key Players Profiled in the Lithium Battery Charger ICs Market

- Texas Instruments Incorporated

- Analog Devices, Inc.

- Maxim Integrated Products, Inc.

- ON Semiconductor Corporation

- STMicroelectronics N.V.

- Infineon Technologies AG

- Microchip Technology Inc.

- Renesas Electronics Corporation

- ROHM Co., Ltd.

- Skyworks Solutions, Inc.

Report Scope

In this report, the Global Lithium Battery Charger ICs Market has been segmented into the following categories:Lithium Battery Charger ICs Market, by Charger Type:

- Switching Battery Chargers

- Linear Battery Chargers

- µ Module Battery Chargers

- Pulse Battery Chargers

- SMBus/I2C/SPI Controlled Battery Chargers

- Buck/Boost Battery Chargers

Lithium Battery Charger ICs Market, by Appliance:

- Power Tools

- Vacuum Cleaners

- Electric Vehicle

- Small Appliances

- Gardening Tools

- Others

Lithium Battery Charger ICs Market, by End-user:

- Consumer Electronics

- Energy & Power

- Automotive

- Others

Lithium Battery Charger ICs Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Lithium Battery Charger ICs Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Lithium Battery Charger ICs market report include:- Texas Instruments Incorporated

- Analog Devices, Inc.

- Maxim Integrated Products, Inc.

- ON Semiconductor Corporation

- STMicroelectronics N.V.

- Infineon Technologies AG

- Microchip Technology Inc.

- Renesas Electronics Corporation

- ROHM Co., Ltd.

- Skyworks Solutions, Inc.

Table Information

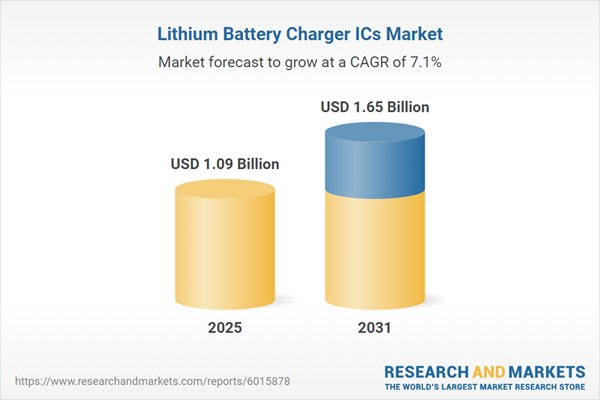

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 1.09 Billion |

| Forecasted Market Value ( USD | $ 1.65 Billion |

| Compound Annual Growth Rate | 7.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |