Lipase Testing Market Overview

Lipase testing measures the level of lipase, an enzyme produced by the pancreas in the blood. Lipase plays a key role in digesting dietary fats by breaking them into smaller components for absorption. Elevated lipase levels often indicate pancreatic conditions, such as pancreatitis, or issues with nearby organs, like the gallbladder or intestines. The test is usually ordered when symptoms like abdominal pain, nausea, or loss of appetite suggest a potential pancreatic problem. Blood is drawn from a vein and analysed in a laboratory. Results help diagnose, monitor, or rule out pancreatic disorders, guiding appropriate treatment plans.Lipase Testing Market Growth Drivers

Rising Prevalence Driving Demand for Lipase Testing

The growing prevalence of the disease is a major factor driving market growth for lipase testing. As estimated by the National Cancer Institute, around 66,400 people are expected to be diagnosed with pancreatic cancer, and nearly 51,750 deaths are projected to occur due to the disease in the United States. Along with pancreatic cancer, the rising prevalence of chronic diseases like diabetes, and others are collectively contributing to the market demand for lipase testing, propelling market surge.Product Launches to Fuel Lipase Testing Market Demand

The market growth is expected to be driven by the introduction of new lipase testing technologies that offer great accuracy, faster turnaround times, and improved diagnostics capabilities. These innovations enhance early detection and treatment of pancreatic disorders, leading to increased adoption across clinical and home settings, further propelling market expansion. For instance, in June 2024, IDEXX Laboratories, Inc., a global leader in pet healthcare innovation, launched the Catalyst® Pancreatic Lipase Test, a single-slide solution for canine and feline patients suspected of pancreatitis. The innovative load-and-go workflow of the Catalyst analyzers ensures that tests run effortlessly alongside chemistry profiles, leading to a faster path to diagnosis and enhanced patient outcomes. The Catalyst Pancreatic Lipase Test is projected to be available in the U.S. and Canada by September 2024, with a global rollout to the over 70,000 Catalyst installed base planned to begin in the fourth quarter of 2024.Lipase Testing Market Trends

The market is witnessing several trends and developments to improve the current scenario. Some of the notable trends are as follows:Growing Demand for Advanced Diagnostic Tools Driving Market Growth

The increasing prevalence of pancreatic and gastrointestinal disorders has led to a surge in demand for advanced diagnostic tools, including lipase testing. Technological advancements, such as high-sensitivity assays and point-of-care testing kits, have improved the accuracy and convenience of lipase testing, further driving adoption. Growing awareness among healthcare professionals and patients about early detection's role in effective disease management is boosting global lipase testing market growth. Additionally, the rising emphasis on personalised medicine has prompted increased use of specific enzyme-level tests, including lipase. These factors collectively contribute to a significant expansion of the global lipase testing market.Rising Prevalence of Chronic Conditions to Fuel Lipase Testing Market Demand

The growing burden of chronic conditions, such as pancreatitis, diabetes, and obesity-related complications, is spurring lipase testing market development. These conditions often require timely diagnostic interventions, increasing the reliance on enzyme-level testing like lipase. Governments and healthcare organisations worldwide are implementing initiatives to improve access to diagnostic services, enhancing market development. Moreover, the expansion of healthcare infrastructure in emerging economies has broadened the reach of lipase testing. With an ageing population and lifestyle changes contributing to chronic disease prevalence, the lipase testing market is poised for sustained growth and development.Technological Innovations to Drive Lipase Testing Market Value

Ongoing advancements in diagnostic technology are significantly increasing the market value of lipase testing. Innovations such as automated platforms, rapid testing kits, and advanced biomarker detection methods have improved efficiency and reliability. These advancements cater to the growing demand for quicker and more accurate diagnostics, particularly in emergency and acute care settings. Integration with digital health tools, including electronic medical records and remote monitoring systems, further enhances market value. Additionally, investments in research and development by key players have led to innovative solutions, strengthening the global market’s competitive landscape and increasing its overall valuation.Expansion of Medical Tourism to Augment Lipase Testing Market Size

The rise of medical tourism, especially in regions with advanced healthcare facilities and affordable costs, is creating significant opportunities in the global lipase testing market. Countries like Malaysia, India, and Thailand are becoming key destinations for diagnostics and treatments, including lipase testing. The availability of state-of-the-art laboratories and skilled professionals in these regions attracts international patients. Additionally, partnerships between diagnostic centres and travel agencies enhance service offerings, contributing to market expansion. As more individuals seek cost-effective yet high-quality healthcare solutions abroad, medical tourism continues to bolster growth in the lipase testing market.Lipase Testing Market Segmentation

Lipase Testing Market Report and Forecast 2025-2034 offers a detailed analysis of the market based on the following segments:Market Breakup by Type

- Product

- Instruments

- Kits and Reagents Colorimetric Reagents Fluorometric Reagents Enzyme-Linked Immunosorbent Assay (ELISA) Kits Others

- Others

- Testing Services

Market Breakup by Technology

- Spectrophotometric

- ELISA

- Others

Market Breakup by Application

- Clinical Diagnostics

- Drug Development

- Research Applications

- Others

Market Breakup by End User

- Hospitals and Clinics

- Diagnostic Laboratories

- Research Centers

- Others

Market Breakup by Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Lipase Testing Market Share

Kits and Reagents to Dominating the Segment by Type

Kits and reagents hold the largest market share in the global lipase testing market by type, driven by their widespread use in clinical diagnostics and research. Colourimetric and fluorometric reagents, alongside ELISA kits, are favoured for their accuracy, ease of use, and compatibility with automated systems. The rising prevalence of pancreatic disorders and demand for quick, reliable testing solutions further bolster this segment. As diagnostic laboratories expand globally, particularly in emerging economies, the kits and reagents market is poised for robust growth during the forecast period, ensuring consistent market dominance through innovation and increased accessibility.Lipase Testing Market Segmentation by Technology to Witness Significant Market Growth

ELISA (enzyme-linked immunosorbent assay) is expected to dominate the market by technology due to its high sensitivity, specificity, and scalability in enzyme detection. This technology is extensively used for diagnosing pancreatic conditions, supported by advancements in automated ELISA systems that streamline testing workflows. Increasing adoption in clinical laboratories and the development of novel assay kits further enhance its market presence. The growing focus on early disease detection and personalised medicine ensures that ELISA remains a key driver of market growth, with significant potential for innovation in test development over the forecast period.Clinical Diagnostics Leading the Segment by Application

Clinical diagnostics will likely hold a substantial share in the global lipase testing market by application, driven by the increasing prevalence of pancreatic and gastrointestinal disorders. Lipase testing is crucial for diagnosing conditions such as pancreatitis and gallbladder diseases, making it indispensable in routine medical practice. The rising awareness of preventive healthcare and advancements in diagnostic technologies strengthen this segment’s market position. As healthcare systems worldwide focus on early detection and management of chronic conditions, clinical diagnostics continues to dominate, with significant growth opportunities fuelled by technological innovation and expanding access to healthcare services.Lipase Testing Market Share by End User to Undergo Notable Growth

Hospitals and clinics are predicted to hold the largest share of the market by end-user due to their role as primary points of care. These settings are equipped with advanced diagnostic tools and skilled professionals, ensuring accurate and timely results for patients. The growing burden of chronic diseases and increasing patient footfall in hospitals drive demand for lipase testing. Additionally, the expansion of hospital networks, particularly in developing regions, enhances accessibility to these diagnostic services. This segment is poised to sustain its dominance during the forecast period, supported by continuous advancements in healthcare infrastructure.Lipase Testing Market Analysis by Region

North America is estimated by the largest share in the market, primarily due to its advanced healthcare infrastructure and strong emphasis on early diagnostics. High prevalence rates of pancreatic disorders, coupled with increasing awareness about preventive healthcare, drive demand for lipase testing. Significant investments in research and development, particularly in the United States, have led to innovative diagnostic solutions and enhanced testing accuracy. Additionally, the region benefits from the widespread adoption of automated technologies and well-established reimbursement policies, making diagnostic services more accessible. With a focus on personalised medicine and ongoing technological advancements, North America is poised to maintain its market leadership during the forecast period.Leading Players in the Lipase Testing Market

The key features of the market report comprise patent analysis, grant analysis, funding and investment analysis, and strategic initiatives by the leading players. The major companies in the market are as follows:Creative Biomart Inc

Creative Biomart is a leading biotechnology company specialising in providing high-quality proteins, enzymes, and other biological products to researchers and scientists globally. Within its extensive portfolio, Creative Biomart offers a range of lipase testing products, including recombinant lipases, assay kits, and related reagents. These products are designed to support various research applications, including drug discovery, diagnostics, and academic research, ensuring accurate and reliable results in lipase activity measurement.LifeSpan BioSciences, Inc

LifeSpan BioSciences is a prominent provider of antibodies, ELISA kits, and other life science research tools. The company has a comprehensive portfolio for lipase testing, offering a variety of lipase-specific antibodies, ELISA kits, and detection reagents. The company’s products are widely used in clinical research and diagnostics, providing researchers with precise tools to study lipase activity in various biological samples, aiding in the understanding of metabolic disorders and pancreatic function.Athenese-Dx Private Limited

Athenese-Dx Private Limited is an innovative diagnostic company focused on developing and manufacturing diagnostic assays and kits. The company’s portfolio includes advanced lipase testing kits that are designed for accurate and rapid diagnosis of conditions such as pancreatitis. Athenese-Dx’s products are known for their ease of use and reliability, making them a preferred choice for clinical laboratories and healthcare providers seeking efficient and dependable diagnostic solutions.BioAssay Systems

BioAssay Systems is a globally recognised provider of high-quality assay kits for the quantification of bioactive molecules. The company offers a range of lipase assay kits that are used in both research and clinical settings to measure lipase activity in various samples. The company’s lipase testing products are highly valued for their simplicity, accuracy, and compatibility with high-throughput screening methods, making them ideal for large-scale studies and routine diagnostics.Other key players in the market include Abbott, Beckman Coulter, Randox Laboratories, DiaSys Diagnostic Systems, DIALAB GmbH, Anamol Laboratories Pvt. Ltd, and F. Hoffmann-La Roche Ltd

Key Questions Answered in the Lipase Testing Market

- What was the global lipase testing market value in 2024?

- What is the global lipase testing market forecast outlook for 2025-2034?

- What is market segmentation based on type?

- How is the market segmented based on technology?

- How is the market segmented based on application?

- How is the market segmented based on end users?

- What are the major factors aiding the global lipase testing market demand?

- How has the market performed so far and how is it anticipated to perform in the coming years?

- What are the market's major drivers, opportunities, and restraints?

- What are the major global lipase testing market trends?

- Which type will lead the market segment?

- Which technology will lead the market segment?

- Which application will lead the market segment?

- Which end user will lead the market segment?

- Who are the key players involved in the global lipase testing market?

- What is the patent landscape of the market?

- What are the current unmet needs and challenges in the market?

- How are partnerships, collaborations, mergers, and acquisitions among the key market players shaping the market dynamics?

This product will be delivered within 3-5 business days.

Table of Contents

Companies Mentioned

- Creative Biomart Inc.

- LifeSpan BioSciences, Inc.

- Athenese-Dx Private Limited

- BioAssay Systems

Table Information

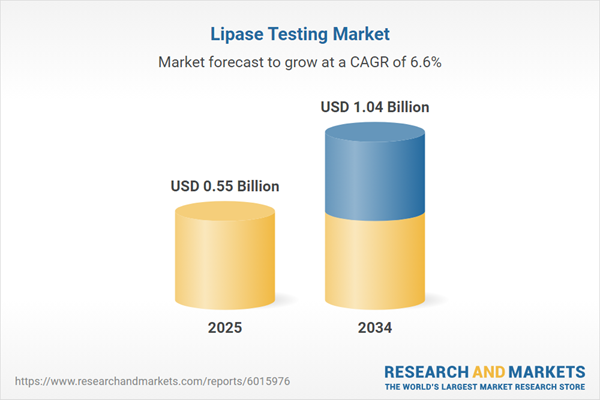

| Report Attribute | Details |

|---|---|

| No. of Pages | 400 |

| Published | June 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 0.55 Billion |

| Forecasted Market Value ( USD | $ 1.04 Billion |

| Compound Annual Growth Rate | 6.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 4 |