Alzheimer's Drugs Market Overview

Alzheimer's disease is a progressive neurodegenerative disorder that primarily affects older adults. It is the most common cause of dementia, accounting for 60-70% of cases. According to an article published by Alzheimer's A ssociation, an estimated 6.9 million Americans are living with Alzheimer's dementia.Alzheimer's disease affects millions of people worldwide, with numbers expected to increase significantly as populations age. This demographic shift is a major driver of market growth. Moreover, the market for Alzheimer's drugs is substantial, driven by the high cost of drug development and the potential for significant returns due to the large patient population in need of effective treatments.

Despite availability of treatments, there remains a significant unmet need for therapies that can slow or halt disease progression. This increases the demand for drugs and hence augmenting the market growth. Moreover, the advances in understanding disease mechanisms, biomarker identification, and personalized medicine offer promising avenues for future drug development. Digital health technologies and patient-centric approaches are also expected to play a significant role in shaping the future of Alzheimer's treatments.

Alzheimer's Drugs Market Growth Drivers

Rising Disease Prevalence

Alzheimer's disease is one of the leading causes of dementia, accounting for a substantial portion of dementia cases globally. The increasing prevalence of Alzheimer's disease, particularly in developed countries where populations are aging rapidly, contributes to the growing demand for effective treatments. The World Health Organization reports that, more than 55 million people have dementia worldwide currently, over 60% of whom, live in low-and middle-income countries.The rising prevalence of Alzheimer's disease stimulates research and development efforts in the pharmaceutical and biotechnology sectors. Pharmaceutical companies and research institutions are motivated to invest in novel therapeutic approaches, biomarkers, and diagnostic tools aimed at addressing the complex challenges posed by Alzheimer's disease.

Alzheimer's disease imposes a substantial burden on healthcare systems due to its progressive nature and long-term care needs. This burden includes healthcare costs associated with diagnosis, treatment, caregiving, and management of disease-related complications. The economic impact drives investments in research and development of new therapies that can alleviate the market demand.

Growing Geriatric Population is Expected to Propel Alzheimer's Drugs Market Demand

The primary demographic driver for the Alzheimer's drugs market is the increasing aging population worldwide. Alzheimer's disease predominantly affects older adults, and as life expectancy rises globally, the number of people living with Alzheimer's and other dementias is expected to grow significantly. According to the 2019 World Population Prospects, by 2050, 1 in 6 people in the world will be over age 65, up from 1 in 11 in 2019.The prevalence of Alzheimer's disease is directly correlated with age. As people live longer, the overall prevalence of the disease increases. According to statistics, the prevalence doubles approximately every five years after the age of 65, and about one-third of people aged 85 and older have Alzheimer's disease. This demographic trend amplifies the demand for effective treatments to manage the symptoms and slow the progression of the disease.

This demographic shift amplifies the need for effective interventions to address the cognitive decline associated with Alzheimer's disease within this growing population. Hence, growing geriatric population is expected to drive the market growth.

Alzheimer's Drugs Market Trends

The market is witnessing several trends and developments to improve the current global scenario. Some of the notable trends are as follows:Combination Therapies

Given the complex nature of Alzheimer's disease pathology, combination therapies are being explored to target multiple disease mechanisms simultaneously. This approach seeks to enhance treatment efficacy, potentially slow disease progression more effectively, and address the heterogeneity of Alzheimer's disease among different patient populations and driving the market growth.Precision Medicine Approaches

The move towards precision medicine involves tailoring treatments based on individual genetic, and molecular characteristics. Personalized approaches aim to optimize therapeutic outcomes, minimize side effects, and enhance patient response to Alzheimer's drugs. Genetic testing and biomarker profiling are becoming increasingly integrated into clinical practice and research, expected to drive market demand.Alzheimer's Drugs Market Segmentation

The report titled “Alzheimer's Drugs Market Report and Forecast 2025-2034” offers a detailed analysis of the market based on the following segments:Market Breakup by Drug Class

- Memantine

- Cholinergic

- Combined Drug

- Others

Market Breakup by Route of Administration

- Oral

- Parenteral

Market Breakup by Distribution Channel

- Retail Pharmacies

- Hospital Pharmacies

- Others

Market Breakup by Region

- United States

- EU-4 and the United Kingdom

- Germany

- France

- Italy

- Spain

- United Kingdom

- Japan

- India

Alzheimer's Drugs Market Share

Market Segmentation Based on Drug Class is Anticipated to Witness Substantial Growth

By drug class, the market is segmented into memantine, cholinergic, combined drugs, and others. The cholinergic segment is expected to dominate the market for its ability to enhance cholinergic neurotransmission. It works by inhibiting the breakdown of acetylcholine, a neurotransmitter essential for memory and cognitive functions. These drugs have demonstrated efficacy in improving cognitive symptoms, such as memory loss and cognitive impairment, in patients with Alzheimer's disease and thus driving the segmental growth.Alzheimer's Drugs Market Analysis by Region

Regionally, the market report offers an insight into the United States, EU-4 and the United Kingdom, Germany, France, Italy, Spain, United Kingdom, Japan, and India. The United States, having a robust healthcare infrastructure and a strong presence of prominent pharmaceutical companies, is estimated to hold a high market value in the forecast period. Increasing collaborations among the key market players boost research initiatives that are expected to fuel the region's market share. Numerous clinical trials and research initiatives are often initiated and conducted in the country, leading to early access to novel therapies for patients leading to regional growth in the market.Germany holds a significant Alzheimer's drugs market value due to its significant and rapidly growing aging population and growing awareness of Alzheimer's disease. Increased awareness leads to earlier diagnosis, better management strategies, and greater demand for effective treatments.

Additionally, Japan is expected to witness substantial market growth due to ageing population, rising awareness and government initiatives.

Leading Players in the Alzheimer's Drugs Market

The key features of the market report include patent analysis, clinical trials analysis, grants analysis, fundings and investment analysis, and strategic initiatives such as partnerships, and collaborations analysis by the key players. The major companies in the market are as follows:F. Hoffmann-La Roche Ltd

F. Hoffmann-La Roche Ltd, commonly known as Roche, is a prominent pharmaceutical company that has been actively involved in the development and commercialization of drugs for Alzheimer's disease.Novartis AG

Novartis AG, a global healthcare company headquartered in Switzerland, has been actively involved in Alzheimer's disease research and drug development.Other key players in the market include Merck Sharp & Dohme Corp., Biogen Inc., AbbVie Inc., Eisai Co. Ltd, Johnson & Johnson Services, Inc., Daiichi Sankyo Company Limited, and Ono Pharmaceutical Co. Ltd. among others.

Key Questions Answered in the Alzheimer's Drugs Market Report

- What was the Alzheimer's drugs market value in 2023?

- What is the Alzheimer's drugs market forecast outlook for 2025-2034?

- What are the regional markets covered in the report?

- What is market segmentation based on drug class?

- What is market segmentation based on route of administration?

- What is market segmentation based on distribution channel?

- What are the major factors aiding the Alzheimer's drugs market demand?

- How has the market performed so far and how is it anticipated to perform in the coming years?

- What are the major trends influencing the market?

- What are the market's major drivers, opportunities, and restraints?

- Which regional market is expected to lead the market share in the forecast period?

- Which country is expected to experience expedited growth during the forecast period?

- How does the growing geriatric population affect the market landscape?

- How does the clinical trials impact the market size?

- Who are the key players involved in the Alzheimer's drugs market?

- What are the current unmet needs and challenges in the market?

- How are partnerships, collaborations, mergers and acquisitions among the key market players shaping the market dynamics?

This product will be delivered within 3-5 business days.

Table of Contents

Companies Mentioned

- F. Hoffmann-La Roche Ltd

- Novartis AG

- Merck Sharp & Dohme Corp.

- Biogen Inc.

- AbbVie Inc.

- Eisai Co. Ltd

- Johnson & Johnson Services, Inc.

- Daiichi Sankyo Company Limited

- Ono Pharmaceutical Co. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 350 |

| Published | July 2025 |

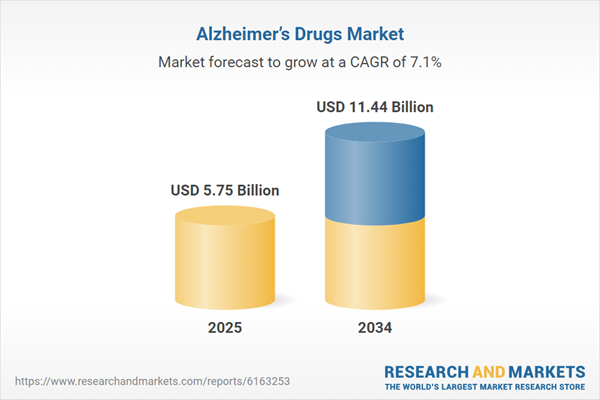

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 5.75 Billion |

| Forecasted Market Value ( USD | $ 11.44 Billion |

| Compound Annual Growth Rate | 7.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 9 |