Global Alpha Glucosidase Inhibitors Market - Key Trends and Drivers Summarized

How Are Alpha Glucosidase Inhibitors Shaping Diabetes Treatment?

Alpha glucosidase inhibitors (AGIs) are a class of oral medications commonly prescribed to manage Type 2 diabetes. By delaying carbohydrate absorption in the small intestine, AGIs help control blood glucose levels, making them essential in diabetes management, especially for postprandial glucose spikes. These inhibitors are particularly effective for patients who struggle to maintain glycemic control through diet and exercise alone. Acarbose, miglitol, and voglibose are the most commonly prescribed AGIs, with their application primarily targeting patients in regions with high diabetes prevalence, such as North America and Asia. Given the global rise in diabetes, the demand for AGIs is expected to continue increasing as healthcare providers seek effective, non-insulin therapies to combat this chronic condition.What Are the Key Market Segments for Alpha Glucosidase Inhibitors?

The alpha glucosidase inhibitors market can be segmented by type, including acarbose, miglitol, and voglibose, with acarbose being the most widely used due to its long-established effectiveness and market penetration. In terms of end-users, hospitals, clinics, and retail pharmacies are key distribution channels, with retail pharmacies holding a substantial market share due to ease of access and affordability. The growing focus on outpatient care and the shift toward home management of diabetes further expands the retail pharmacy segment. Regionally, North America dominates the market, driven by high diabetes prevalence and advanced healthcare systems, while the Asia-Pacific region is poised for the fastest growth, fueled by rising diabetes rates and expanding healthcare infrastructure.How Are Technological and Healthcare Trends Impacting AGI Usage?

Innovations in diabetes care are significantly impacting the use of alpha glucosidase inhibitors. With the increasing emphasis on personalized medicine, AGIs are being prescribed as part of combination therapies tailored to individual patient profiles. Additionally, continuous glucose monitoring (CGM) systems and wearable health technologies are allowing for better management of diabetes, indirectly boosting demand for AGIs as patients and healthcare providers seek comprehensive solutions for glucose control. The trend toward earlier diagnosis of Type 2 diabetes, driven by improved screening techniques and increased public health awareness, has also widened the use of AGIs in early-stage interventions, making them an integral part of a holistic treatment plan.What Factors Are Driving the Growth in the Alpha Glucosidase Inhibitors Market?

The growth in the alpha glucosidase inhibitors market is driven by several factors, including the rising global prevalence of Type 2 diabetes, particularly in emerging economies. Advances in diagnostic technologies are enabling earlier detection, increasing the pool of patients eligible for AGI therapy. The growing preference for oral, non-insulin therapies among patients and healthcare providers, coupled with the rise in combination therapy approaches, is further expanding the market. Additionally, increased awareness of diabetes complications and the emphasis on long-term glycemic control are encouraging the adoption of AGIs. Expanding healthcare infrastructure in regions like Asia-Pacific and Latin America, combined with supportive government policies aimed at diabetes management, are also propelling market growth.Report Scope

The report analyzes the Alpha Glucosidase Inhibitors market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies); Application (Type 2 Diabetes Application, Dumping Syndrome Application).

- Geographic Regions/Countries:World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Hospital Pharmacies segment, which is expected to reach US$2.9 Billion by 2030 with a CAGR of a 2.3%. The Retail Pharmacies segment is also set to grow at 1.9% CAGR over the analysis period.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Alpha Glucosidase Inhibitors Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Alpha Glucosidase Inhibitors Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Alpha Glucosidase Inhibitors Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

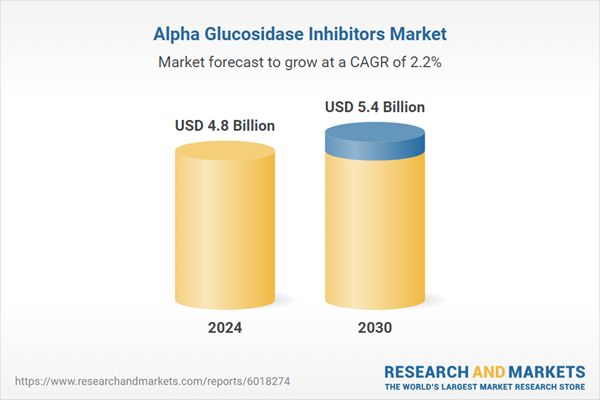

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Abcam PLC, Arlak Corazon, Astellas Pharma, Inc., Biocon Ltd., Biosynth Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 51 companies featured in this Alpha Glucosidase Inhibitors market report include:

- Abcam PLC

- Arlak Corazon

- Astellas Pharma, Inc.

- Biocon Ltd.

- Biosynth Ltd.

- Cipla Ltd.

- Creative Enzymes

- Curvio Healthcare

- Kikkoman Biochemifa Company

- NARK Pharmaceuticals Pvt. Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Abcam PLC

- Arlak Corazon

- Astellas Pharma, Inc.

- Biocon Ltd.

- Biosynth Ltd.

- Cipla Ltd.

- Creative Enzymes

- Curvio Healthcare

- Kikkoman Biochemifa Company

- NARK Pharmaceuticals Pvt. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 285 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 4.8 Billion |

| Forecasted Market Value ( USD | $ 5.4 Billion |

| Compound Annual Growth Rate | 2.2% |

| Regions Covered | Global |