Global Barrier Materials Market - Key Trends & Drivers Summarized

Why Are Barrier Materials Becoming Essential Across Various Industries?

Barrier materials have become increasingly essential across a wide range of industries due to their critical role in protecting products from environmental factors such as moisture, oxygen, and UV light. These materials are commonly used in packaging, electronics, construction, and automotive sectors, where product protection and longevity are paramount. Barrier materials, which include polymers, metals, and ceramics, are engineered to create an impermeable or semi-permeable layer that shields products from external elements, thereby enhancing their shelf life and durability. In the food and beverage industry, for example, barrier materials are widely used in flexible packaging to prevent spoilage by keeping moisture and oxygen out, preserving the freshness and quality of food products for longer periods. Similarly, in the pharmaceutical industry, barrier materials are used to protect sensitive medications from moisture and oxygen degradation, ensuring their efficacy and safety over time.The growing demand for lightweight, durable, and flexible packaging solutions is one of the primary reasons for the increasing importance of barrier materials. In sectors like food, pharmaceuticals, and personal care, packaging must meet stringent regulations to maintain product quality and safety. Barrier materials, especially multilayer films and laminates, have become indispensable in these industries because of their ability to provide excellent protection while minimizing material use and weight. As consumers demand more convenient, portable, and eco-friendly packaging solutions, barrier materials have evolved to meet these requirements, offering high performance with minimal environmental impact. The rising awareness of sustainability, paired with increasing regulations on single-use plastics, is pushing companies to develop barrier materials that are not only effective but also recyclable or biodegradable, further boosting their adoption across industries.

How Are Technological Innovations Advancing the Use of Barrier Materials?

Technological innovations are driving significant advancements in the use of barrier materials, making them more effective, sustainable, and adaptable to the needs of modern industries. One of the key technological breakthroughs is the development of high-performance nanocomposites, which enhance the barrier properties of materials while reducing overall material use. These nanocomposites incorporate nanoscale fillers, such as clay or graphene, into polymer matrices, improving resistance to gas, moisture, and light penetration. The result is packaging that offers superior protection with reduced thickness, making it lighter and more cost-effective while maintaining excellent barrier properties. This is particularly valuable in industries like food and pharmaceuticals, where maintaining product integrity is crucial, and the demand for lightweight, flexible packaging is growing.Another major advancement is the rise of biodegradable and recyclable barrier materials. As sustainability becomes a top priority for consumers and regulators, manufacturers are focusing on developing eco-friendly barrier solutions that reduce environmental impact. Innovations in bio-based polymers, such as polylactic acid (PLA) and polyhydroxyalkanoates (PHA), are leading the way in creating barrier materials that provide protection similar to conventional plastics but are biodegradable and compostable. Moreover, improvements in coating technologies are enhancing the performance of paper-based and recyclable packaging materials. For example, water-based and bio-based coatings are being used to replace traditional polyethylene coatings, offering moisture and oxygen resistance while making the packaging more environmentally friendly. Additionally, the development of barrier materials for electronics and solar energy applications is expanding, with ultra-thin, transparent films that protect sensitive components from water vapor and oxygen while maintaining electrical conductivity and optical clarity. These technological advancements are not only enhancing the functional capabilities of barrier materials but also aligning them with the growing demand for sustainable solutions.

How Are Changing Consumer Preferences Shaping the Barrier Materials Market?

Shifting consumer preferences toward sustainability, convenience, and product protection are significantly shaping the barrier materials market. As consumers become more environmentally conscious, there is increasing demand for packaging that offers effective protection while minimizing waste and environmental impact. This has led to a growing preference for packaging materials that are recyclable, biodegradable, or compostable, pushing manufacturers to innovate and develop sustainable barrier solutions. In response, many companies are now prioritizing the use of bio-based polymers, recyclable multilayer films, and compostable coatings in their packaging designs, which not only satisfy consumer demand for eco-friendly products but also meet regulatory requirements aimed at reducing plastic waste.In addition to sustainability, consumers are placing greater emphasis on convenience and functionality in packaging. This is particularly evident in the food and beverage industry, where consumers are looking for packaging that keeps products fresh for longer, is easy to open, and is portable. Barrier materials that provide extended shelf life and ensure product safety, such as multilayer laminates that block out oxygen, moisture, and UV light, are in high demand. As consumers increasingly purchase products online, e-commerce has also fueled the need for packaging that can withstand the rigors of shipping while protecting delicate or perishable items. This trend has led to the rise of advanced barrier materials that offer both strength and protection, ensuring products arrive in optimal condition. Additionally, the cosmetics and personal care industries are also seeing a shift in consumer preferences towards natural and preservative-free products, which has increased the need for barrier materials that can protect sensitive formulations from oxidation and contamination without the use of synthetic additives. These evolving consumer demands are driving innovation and shaping the development of next-generation barrier materials that offer both sustainability and superior performance.

What Is Driving the Growth of the Global Barrier Materials Market?

The growth in the global barrier materials market is driven by several key factors, including the rising demand for extended shelf life in food and pharmaceutical products, the increasing emphasis on sustainability and eco-friendly packaging solutions, and technological advancements in material science. One of the primary drivers of growth is the expanding food and beverage industry, where the need to preserve freshness and extend product shelf life is paramount. As global food supply chains become more complex and as consumer preferences shift towards packaged and processed foods, manufacturers are seeking advanced barrier materials that can protect products from oxygen, moisture, and contamination. Multilayer films, high-performance laminates, and nanocomposite coatings are being widely adopted in the packaging of perishable goods, dairy products, beverages, and snacks to meet these demands.Another major factor driving market growth is the pharmaceutical industry's increasing reliance on barrier materials for packaging drugs, medical devices, and biologics. As regulatory standards around drug safety and efficacy become more stringent, barrier materials that can protect medications from moisture, oxygen, and UV degradation are in high demand. The pharmaceutical sector requires packaging solutions that ensure product stability and extend shelf life, especially for sensitive formulations such as vaccines, injectables, and biologics. Additionally, the rise of home healthcare and the growing popularity of over-the-counter medications have further boosted the need for protective, user-friendly packaging that can safely store products for extended periods.

Furthermore, the global push toward sustainability is another significant growth driver for the barrier materials market. As industries across the board face increasing pressure to reduce their environmental footprint, there is a growing demand for barrier materials that are recyclable, biodegradable, or derived from renewable sources. This is especially important in the packaging industry, where single-use plastics are being phased out in favor of more sustainable options. Innovations in biodegradable polymers, recyclable multilayer films, and compostable coatings are making it possible for companies to meet both performance and environmental standards. Moreover, advancements in material science, including the development of lightweight, durable, and transparent barrier films, are opening up new opportunities in sectors such as electronics, where protection from moisture and oxygen is critical. These factors, combined with the expanding applications of barrier materials across various industries, are driving the sustained growth of the global barrier materials market.

Report Scope

The report analyzes the Barrier Materials market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (PVDC Barrier Material, EVOH Barrier Material, PEN Barrier Material, Other Types); End-Use (Food & Beverages End-Use, Pharmaceuticals End-Use, Cosmetics End-Use, Agricultural End-Use, Other End-Uses).

- Geographic Regions/Countries:World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the PVDC Barrier Material segment, which is expected to reach US$1.7 Billion by 2030 with a CAGR of a 5.6%. The EVOH Barrier Material segment is also set to grow at 4.7% CAGR over the analysis period.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Barrier Materials Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Barrier Materials Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Barrier Materials Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

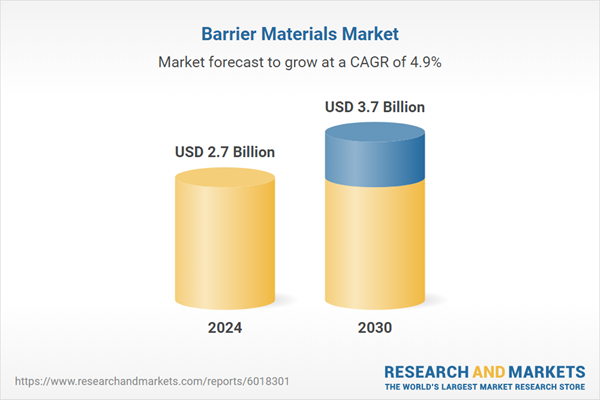

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as 3M Company, Arkema Group, Asahi Kasei Corporation, Chang Chun Petrochemical Co., Ltd., Coexpan, S.A. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 46 companies featured in this Barrier Materials market report include:

- 3M Company

- Arkema Group

- Asahi Kasei Corporation

- Chang Chun Petrochemical Co., Ltd.

- Coexpan, S.A.

- Dow, Inc.

- DuPont de Nemours, Inc.

- Kuraray Co., Ltd.

- Kureha Corporation

- Mondi PLC

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 3M Company

- Arkema Group

- Asahi Kasei Corporation

- Chang Chun Petrochemical Co., Ltd.

- Coexpan, S.A.

- Dow, Inc.

- DuPont de Nemours, Inc.

- Kuraray Co., Ltd.

- Kureha Corporation

- Mondi PLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 292 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 2.7 Billion |

| Forecasted Market Value ( USD | $ 3.7 Billion |

| Compound Annual Growth Rate | 4.9% |

| Regions Covered | Global |