Global Heart Defect Closure Devices Market - Key Trends and Drivers Summarized

Why Are Heart Defect Closure Devices Crucial in Cardiovascular Health Management?

Heart defect closure devices are critical tools in the treatment of structural heart anomalies, providing minimally invasive solutions that significantly reduce the risks associated with congenital and acquired heart defects. These devices are primarily used to treat conditions such as atrial septal defects (ASD), patent foramen ovale (PFO), and ventricular septal defects (VSD), all of which can impair normal cardiac function and lead to complications like stroke, heart failure, and arrhythmias if left untreated. Traditionally, such defects required open-heart surgery, which carries a high risk of complications and a prolonged recovery period. Heart defect closure devices, however, offer a less invasive alternative by allowing cardiologists to seal these defects using catheter-based procedures. This approach not only minimizes trauma but also enables faster recovery times, making it a preferred option for both pediatric and adult patients. The ability of these devices to deliver safe and effective outcomes has revolutionized the treatment landscape, reducing the need for complex surgical interventions and making heart defect management more accessible. As a result, these devices have become a cornerstone of modern cardiovascular care, with ongoing advancements aiming to expand their indications and improve procedural efficiency.What Are the Key Trends and Technological Advancements Shaping the Heart Defect Closure Device Market?

The heart defect closure device market is witnessing rapid advancements, driven by a combination of evolving clinical needs, technological innovations, and increased focus on patient-centric care. One of the most prominent trends is the development of next-generation, bioresorbable devices that offer temporary support and gradually dissolve after the defect is closed, eliminating the need for permanent implants. These bioresorbable devices reduce long-term complications, such as device erosion and interference with future procedures, thereby enhancing patient safety and outcomes. Another significant trend is the miniaturization of devices, which is enabling the treatment of smaller defects and expanding their use in neonatal and pediatric patients. These smaller, more flexible devices are designed to navigate complex anatomies with greater ease, reducing procedural risks and improving the success rate of defect closure in younger populations. In addition, the integration of advanced imaging technologies, such as 3D echocardiography and real-time MRI, is enhancing procedural precision by providing detailed visualizations of the heart's structure during device placement. This is particularly beneficial for complex cases where precise positioning is critical for optimal outcomes. Furthermore, there is a growing emphasis on hybrid procedures that combine catheter-based and surgical techniques to treat multi-faceted or high-risk defects. These hybrid approaches allow for tailored treatment strategies, offering new possibilities for patients who were previously considered inoperable. Collectively, these trends and innovations are not only expanding the capabilities of heart defect closure devices but are also reshaping the clinical approach to congenital and structural heart defect management.How Are Technological Innovations Improving the Performance and Safety of Heart Defect Closure Devices?

Technological innovations are playing a pivotal role in enhancing the performance, safety, and versatility of heart defect closure devices, addressing some of the longstanding challenges associated with traditional approaches. One of the most significant advancements is the use of new materials, such as nitinol, which offer superior flexibility and shape memory, allowing devices to conform more effectively to the contours of the heart. Nitinol's biocompatibility also minimizes the risk of adverse reactions and promotes better integration with the cardiac tissue. Additionally, bioresorbable polymers are being increasingly utilized to create devices that provide temporary scaffolding and then degrade harmlessly over time, reducing the risk of long-term complications and the need for secondary procedures. Another breakthrough is the incorporation of coating technologies that enhance the hemocompatibility of devices, reducing the risk of thrombus formation and the need for long-term anticoagulation therapy. Moreover, real-time imaging integration, such as the use of intravascular ultrasound (IVUS) and 3D mapping systems, is providing clinicians with unparalleled accuracy during device deployment, ensuring precise placement and minimizing procedural errors. The development of remote-controlled and robotic-assisted systems is further improving procedural safety by offering enhanced maneuverability and stability, especially in complex anatomical settings. These advancements are not only making heart defect closure devices safer and more effective but are also paving the way for broader adoption in challenging cases, thereby improving the overall treatment landscape for patients with congenital and structural heart defects.What Is Driving the Growth of the Heart Defect Closure Device Market?

The growth in the heart defect closure device market is driven by several factors, primarily influenced by increasing prevalence of congenital heart defects, advancements in minimally invasive technologies, and growing awareness of early intervention options. One of the main growth drivers is the rising incidence of congenital heart anomalies globally, which is leading to greater demand for safe and effective treatment options. Advances in diagnostic techniques, such as the use of high-resolution imaging in prenatal care, are enabling earlier detection of heart defects, thereby increasing the number of patients eligible for closure procedures. Additionally, the ongoing shift towards minimally invasive cardiac interventions is significantly boosting market growth, as these procedures offer reduced recovery times, lower complication rates, and improved patient satisfaction compared to traditional open-heart surgeries. Another critical factor is the growing adoption of catheter-based techniques in pediatric populations, driven by the need for safe, effective, and less invasive solutions for younger patients. The increasing availability of specialized pediatric devices is opening up new treatment possibilities for neonatal and infant patients, who often present unique anatomical and clinical challenges. Furthermore, rising healthcare expenditure and the expansion of specialized cardiac care centers in emerging markets are creating new opportunities for the adoption of these advanced therapeutic devices. The continuous investment in research and development by key market players is also contributing to the growth, as new devices with enhanced safety features and broader indications enter the market. Favorable reimbursement policies and regulatory support in regions like North America and Europe are further driving adoption, making heart defect closure devices a rapidly expanding segment within the broader cardiovascular device industry. These factors, combined with the growing focus on patient-centric care and long-term outcomes, are propelling the market forward, ensuring that heart defect closure devices remain at the forefront of innovative cardiovascular health management.Report Scope

The report analyzes the Heart Defect Closure Devices market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Closure Type (Left Atrial Appendage (LAA) Closure, Congenital Heart Defect (CHD) Closure, Patent Foramen Ovale (PFO) Closure).

- Geographic Regions/Countries:World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Left Atrial Appendage (LAA) Closure segment, which is expected to reach US$3.5 Billion by 2030 with a CAGR of a 14.3%. The Congenital Heart Defect (CHD) Closure segment is also set to grow at 12.8% CAGR over the analysis period.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Heart Defect Closure Devices Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Heart Defect Closure Devices Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Heart Defect Closure Devices Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Abbott Cardiovascular, AtriCure, Inc., Boston Scientific Corporation, Encore Medical, Lepu Medical Technology (Beijing) Co., Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 36 companies featured in this Heart Defect Closure Devices market report include:

- Abbott Cardiovascular

- AtriCure, Inc.

- Boston Scientific Corporation

- Encore Medical

- Lepu Medical Technology (Beijing) Co., Ltd.

- Lifetech Scientific Corporation

- Meril Life Sciences Pvt., Ltd.

- MicroPort Scientific Corporation

- Occlutech US LLC

- Sahajanand Medical Technologies Pvt., Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Abbott Cardiovascular

- AtriCure, Inc.

- Boston Scientific Corporation

- Encore Medical

- Lepu Medical Technology (Beijing) Co., Ltd.

- Lifetech Scientific Corporation

- Meril Life Sciences Pvt., Ltd.

- MicroPort Scientific Corporation

- Occlutech US LLC

- Sahajanand Medical Technologies Pvt., Ltd.

Table Information

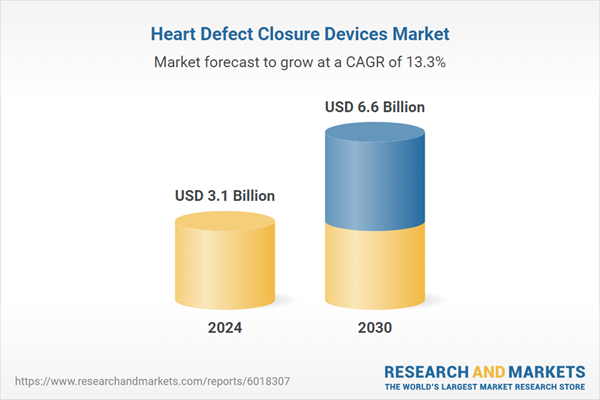

| Report Attribute | Details |

|---|---|

| No. of Pages | 177 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 3.1 Billion |

| Forecasted Market Value ( USD | $ 6.6 Billion |

| Compound Annual Growth Rate | 13.3% |

| Regions Covered | Global |