Global Fixed Income Assets Management Market - Key Trends and Drivers Summarized

Why Is Fixed Income Assets Management Critical for Stable Investment Portfolios?

Fixed income assets management plays a pivotal role in ensuring stability and income generation in investment portfolios, particularly during periods of market volatility. Fixed income instruments, such as government bonds, corporate bonds, and treasury securities, provide regular interest payments and principal protection, making them a reliable source of income for conservative investors. These assets are especially important in managing risk within diversified portfolios, as they typically perform inversely to equities during market downturns. Institutional investors, including pension funds, insurance companies, and wealth managers, heavily rely on fixed income management to meet their long-term financial obligations. In addition, the ability of fixed income strategies to generate consistent returns makes them appealing to retirees and income-focused investors.How Is the Fixed Income Market Segmented?

Key asset types include government bonds, municipal bonds, corporate bonds, and mortgage-backed securities. Each type offers different risk profiles, returns, and tax benefits. Issuers vary from government entities and municipalities to corporations, with sovereign bonds generally considered the safest due to their government backing. Geographically, North America, Europe, and Asia-Pacific lead in terms of market size, with emerging markets offering higher yields but carrying additional risks. Investment strategies are tailored to client needs, ranging from conservative income generation to more aggressive strategies that seek to capitalize on market opportunities in high-yield or emerging market debt.What Technological Advancements Are Impacting Fixed Income Assets Management?

Technological innovations are transforming fixed income management by enhancing trade execution, portfolio management, and risk assessment. The integration of artificial intelligence (AI) and machine learning algorithms is enabling asset managers to analyze vast datasets, identify trends, and make more informed investment decisions. The adoption of electronic trading platforms has improved liquidity and transparency in bond markets, providing faster and more efficient trade execution. In addition, big data analytics are helping managers assess market risks more accurately, while fintech solutions are streamlining compliance and reporting processes. These technological advancements are helping asset managers optimize portfolio performance and adapt to a rapidly changing market environment.What Factors Are Driving Growth in the Fixed Income Assets Management Market?

The growth in the fixed income assets management market is driven by several factors, including rising demand for income-generating investments, increasing institutional allocations to bonds, and the growing popularity of sustainable and ESG-linked fixed income products. The aging global population is driving demand for fixed income assets as retirees seek stable income streams to fund their retirement. Moreover, heightened geopolitical uncertainties and economic volatility are pushing investors toward safe-haven assets like government bonds. Technological advancements in AI and data analytics are also improving the precision and efficiency of fixed income strategies, while the growing focus on green bonds and ESG considerations is expanding the market for socially responsible investments.Report Scope

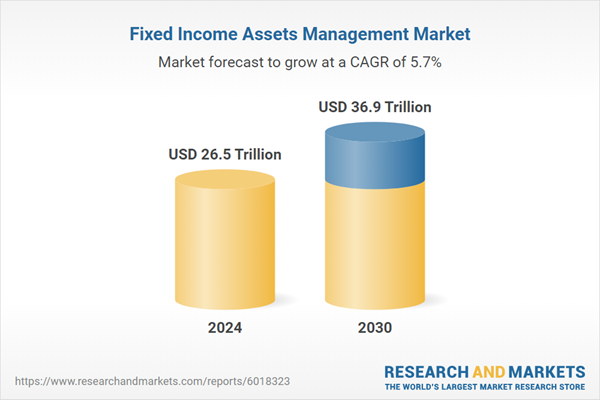

The report analyzes the Fixed Income Assets Management market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Asset Class (Government Bonds, Corporate Bonds, Municipal Bonds, Mortgage-backed Securities, Other Asset Classes); End-User (Enterprises End-User, Individuals End-User).

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Enterprises End-User segment, which is expected to reach US$24.4 Trillion by 2030 with a CAGR of 5.9%. The Individuals End-User segment is also set to grow at 5.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $8.8 Trillion in 2024, and China, forecasted to grow at an impressive 7.7% CAGR to reach $10.6 Trillion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Fixed Income Assets Management Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Fixed Income Assets Management Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Fixed Income Assets Management Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as BlackRock, Inc., BNY Investments, Capital Group, Fidelity Investments, Franklin Templeton and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 79 companies featured in this Fixed Income Assets Management market report include:

- BlackRock, Inc.

- BNY Investments

- Capital Group

- Fidelity Investments

- Franklin Templeton

- Goldman Sachs Asset Management, L.P.

- Guggenheim Investments

- JP Morgan Asset Management, Inc.

- Northern Trust Asset Management

- Pacific Investment Management Company LLC

- PGIM Fixed Income

- State Street Global Advisors

- The Vanguard Group, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- BlackRock, Inc.

- BNY Investments

- Capital Group

- Fidelity Investments

- Franklin Templeton

- Goldman Sachs Asset Management, L.P.

- Guggenheim Investments

- JP Morgan Asset Management, Inc.

- Northern Trust Asset Management

- Pacific Investment Management Company LLC

- PGIM Fixed Income

- State Street Global Advisors

- The Vanguard Group, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 265 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 26.5 Trillion |

| Forecasted Market Value ( USD | $ 36.9 Trillion |

| Compound Annual Growth Rate | 5.7% |

| Regions Covered | Global |