Global Heart Attack Diagnostics Market - Key Trends and Drivers Summarized

Why Are Heart Attack Diagnostics a Game-Changer in Cardiovascular Care?

Heart attack diagnostics have become a cornerstone of modern cardiovascular care, offering critical tools for the early and precise detection of myocardial infarction (MI), which can significantly alter patient outcomes. But what exactly makes these diagnostics so impactful, and why is their role in healthcare becoming increasingly indispensable? Heart attacks occur when a blockage restricts blood flow to the heart, causing tissue damage that, if not treated promptly, can lead to irreversible damage or death. Timely diagnosis is crucial because the effectiveness of life-saving interventions like thrombolysis and percutaneous coronary intervention (PCI) hinges on early detection. The concept of the “golden hour” - the critical time window immediately following the onset of symptoms - makes it imperative that clinicians have access to reliable and rapid diagnostic tools to guide treatment decisions. Current diagnostic approaches rely on a combination of electrocardiograms (ECGs), cardiac biomarker testing, and imaging techniques to identify the presence and severity of heart damage. The speed and accuracy of these tools are key in determining whether a patient receives appropriate care in time, highlighting the need for continuous innovation in heart attack diagnostics. This ongoing evolution not only improves survival rates but also minimizes long-term complications, making these technologies vital for both emergency and routine clinical practice.Which Emerging Trends Are Shaping the Heart Attack Diagnostics Market?

The heart attack diagnostics market is undergoing a transformative phase, driven by cutting-edge innovations and shifts in clinical practices aimed at improving patient outcomes. One of the most significant developments is the growing adoption of high-sensitivity cardiac troponin (hs-cTn) assays, which can detect extremely low levels of troponin, a key biomarker for myocardial injury. This enhanced sensitivity allows for earlier and more accurate detection of heart attacks, reducing time-to-treatment and improving prognostic accuracy, especially in patients with atypical symptoms. Another major trend is the proliferation of point-of-care testing (POCT) devices, which enable rapid diagnosis at the bedside or even in pre-hospital settings such as ambulances. These portable devices are transforming emergency care by providing results in minutes, thereby supporting quicker triage and reducing reliance on centralized laboratory testing. In addition, the integration of artificial intelligence (AI) and machine learning in diagnostic platforms is revolutionizing the interpretation of complex data, such as ECG patterns and imaging results, leading to earlier detection of subtle signs that might be overlooked by human clinicians. Moreover, multi-marker panels that combine several biomarkers - such as natriuretic peptides and inflammatory markers - are gaining attention, as they offer a more nuanced view of cardiac health and help differentiate heart attacks from other cardiac conditions. Collectively, these trends are making heart attack diagnostics faster, more accurate, and increasingly personalized, reflecting a shift towards precision medicine in cardiovascular care.How Are New Technologies Redefining Heart Attack Diagnostics?

Technological breakthroughs are reshaping the heart attack diagnostics landscape, making tools more efficient, accessible, and accurate than ever before. One of the most impactful advancements is the miniaturization of diagnostic devices, which has led to the creation of portable and handheld systems that can deliver rapid test results at the patient's side, even in remote or resource-limited settings. These devices, which include point-of-care cardiac biomarker analyzers and portable ECG monitors, are transforming emergency care by enabling immediate diagnosis and treatment decisions without the need for complex laboratory setups. Wearable technologies are another game-changer in this space, with smartwatches and health bands now equipped to monitor cardiac activity continuously, alerting users and healthcare providers to potential heart attack symptoms in real time. This capability is particularly valuable for high-risk patients, as it allows for proactive management and faster response to potential cardiac events. Additionally, artificial intelligence (AI) is enhancing the capabilities of diagnostic imaging, such as echocardiograms, CT scans, and MRIs, by enabling rapid and more precise interpretation of complex cardiac data. AI-driven platforms can detect subtle patterns and anomalies that might be missed by human eyes, leading to earlier and more confident diagnoses. Furthermore, cloud-based platforms and telehealth integration are enabling remote diagnostics, making it easier for clinicians to access and interpret test results from virtually anywhere. These technological innovations are not only improving the accuracy and accessibility of heart attack diagnostics but are also revolutionizing the way cardiovascular care is delivered, paving the way for a more proactive, data-driven approach to patient management.What Are the Key Drivers Behind the Rapid Growth of the Heart Attack Diagnostics Market?

The growth in the heart attack diagnostics market is driven by a variety of factors, primarily fueled by advancements in technology, an increasing burden of cardiovascular diseases, and a shift towards rapid and accessible diagnostic solutions. One of the main growth drivers is the global rise in cardiovascular diseases, which remain the leading cause of death worldwide. The aging population, coupled with the increasing prevalence of lifestyle-related risk factors such as obesity, hypertension, and diabetes, is significantly expanding the patient pool in need of reliable diagnostic tools. Moreover, the heightened awareness of the importance of early detection and prevention is boosting demand for advanced biomarker assays and non-invasive imaging technologies that can identify heart attacks in their earliest stages. Another key driver is the growing adoption of point-of-care testing (POCT) devices, which provide rapid diagnostic capabilities in emergency settings, outpatient clinics, and even home care environments. These portable devices are meeting the need for quicker diagnosis and treatment initiation, reducing the strain on hospital laboratories and improving patient throughput in busy emergency departments. Technological innovations, such as AI-enhanced diagnostic platforms and high-sensitivity biomarker tests, are further propelling market growth by offering improved diagnostic accuracy and enabling personalized risk assessment. Additionally, the rising use of telehealth and remote monitoring solutions is expanding the reach of heart attack diagnostics, particularly in rural and underserved areas where access to traditional healthcare facilities is limited. Favorable regulatory frameworks and reimbursement policies are also encouraging the development and adoption of new diagnostic technologies, making them more accessible to a broader patient base. These factors, combined with ongoing investment in research and development, are driving the heart attack diagnostics market forward, establishing it as a key component in the evolving landscape of cardiovascular care.Report Scope

The report analyzes the Heart Attack Diagnostics market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: End-Use (Hospitals End-Use, Diagnostic Centers End-Use, Ambulatory Surgery Centers End-Use, Other End-Uses).

- Geographic Regions/Countries:World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Hospitals End-Use segment, which is expected to reach US$9.8 Billion by 2030 with a CAGR of a 6%. The Diagnostic Centers End-Use segment is also set to grow at 5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $3.9 Billion in 2024, and China, forecasted to grow at an impressive 8.8% CAGR to reach $4.2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Heart Attack Diagnostics Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Heart Attack Diagnostics Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Heart Attack Diagnostics Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

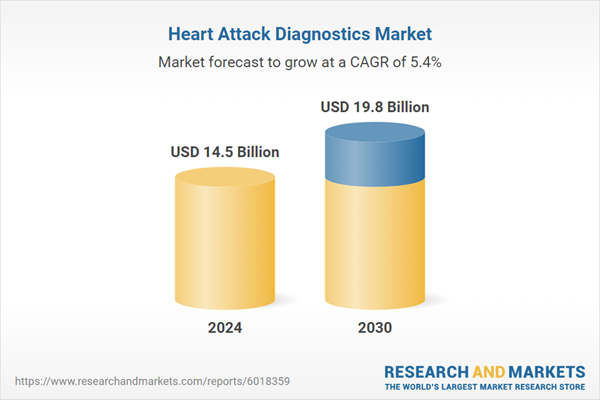

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Abbott Laboratories, Inc., ACS Diagnostics, Baxter International, Inc., Beckman Coulter, Inc., Canon Medical Systems USA, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 35 companies featured in this Heart Attack Diagnostics market report include:

- Abbott Laboratories, Inc.

- ACS Diagnostics

- Baxter International, Inc.

- Beckman Coulter, Inc.

- Canon Medical Systems USA, Inc.

- F. Hoffmann-La Roche AG

- GE Healthcare

- HeartBeam

- Midmark Corporation

- Philips Healthcare

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Abbott Laboratories, Inc.

- ACS Diagnostics

- Baxter International, Inc.

- Beckman Coulter, Inc.

- Canon Medical Systems USA, Inc.

- F. Hoffmann-La Roche AG

- GE Healthcare

- HeartBeam

- Midmark Corporation

- Philips Healthcare

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 179 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 14.5 Billion |

| Forecasted Market Value ( USD | $ 19.8 Billion |

| Compound Annual Growth Rate | 5.4% |

| Regions Covered | Global |