Global Geriatric Medicines Market - Key Trends & Drivers Summarized

What Are Geriatric Medicines, and Why Are They Vital for an Aging Population?

Geriatric medicines are specialized drugs designed to address the unique health challenges faced by elderly patients. As people age, they often encounter multiple health issues, including chronic conditions like hypertension, diabetes, arthritis, and cognitive disorders, requiring a multidisciplinary approach to treatment. Geriatric medicines cater specifically to this demographic, focusing on conditions that are prevalent in older adults and providing therapies that are more appropriate for their physiological and metabolic needs. These medicines not only address disease management but also improve the overall quality of life for aging individuals by ensuring that treatment minimizes side effects and interactions with other medications. With the global population aging rapidly, especially in developed countries, the demand for geriatric medicines continues to grow, making it a crucial sector within the healthcare industry.How Are Advances in Pharmaceuticals Shaping Geriatric Medicine Development?

Advances in pharmaceutical research and development are having a profound impact on the creation of more effective and safer geriatric medicines. One major area of innovation is the development of personalized medications that are tailored to the specific needs of elderly patients, taking into account their unique health conditions and the polypharmacy issues often associated with aging. Slow-release drug formulations, combination therapies, and easier-to-administer medications, such as patches and dissolvable tablets, are being developed to address compliance challenges that older adults face. Furthermore, biotechnology is playing a key role in creating targeted therapies for conditions such as Alzheimer's, osteoporosis, and cardiovascular diseases, which are more prevalent in the geriatric population. These advancements not only improve treatment outcomes but also reduce the risk of drug interactions and side effects, ensuring that older adults can manage their conditions more effectively.Why Are Changing Demographics and Healthcare Systems Driving Demand for Geriatric Medicines?

The aging global population is a significant driver of the demand for geriatric medicines. As life expectancy increases, the proportion of elderly individuals is growing rapidly, particularly in regions like North America, Europe, and East Asia. This demographic shift is creating an urgent need for healthcare systems to adapt and provide adequate medical care for older adults. Governments and healthcare providers are investing more in geriatric healthcare, with a focus on preventive care and the management of age-related chronic diseases. Additionally, as healthcare infrastructure improves in emerging markets, access to geriatric care is expanding, further fueling demand for specialized medicines. Public awareness of age-related health conditions is also increasing, leading to greater demand for early diagnosis and treatment options for conditions such as dementia, arthritis, and cardiovascular diseases. This growing focus on elderly care is transforming the healthcare landscape and making geriatric medicine a priority for healthcare providers and pharmaceutical companies alike.What Is Driving the Growth of the Global Geriatric Medicines Market?

The growth in the global geriatric medicines market is driven by several factors, including advancements in drug development, an aging global population, and increased healthcare investment. One of the key growth drivers is the expanding elderly population, which is leading to a higher prevalence of chronic diseases that require long-term medical treatment. Pharmaceutical companies are responding by developing more targeted therapies and innovative drug delivery systems that cater to the specific needs of geriatric patients. Additionally, advancements in biotechnology and personalized medicine are opening new avenues for creating drugs that are more effective and have fewer side effects. The increasing focus on healthcare infrastructure improvements, especially in developing countries, is making geriatric medicines more accessible to a broader population. Furthermore, governments and healthcare organizations are placing a greater emphasis on preventive care and chronic disease management for the elderly, further driving the demand for specialized medicines. These factors, combined with growing public awareness of geriatric health issues, are contributing to the sustained growth of the global geriatric medicines market.Report Scope

The report analyzes the Geriatric Medicines market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Therapeutic Type (Antihypertensive Therapeutics, Analgesics Therapeutics, Antidiabetic Therapeutics, Anticoagulant Therapeutics, Statins Therapeutics, Proton Pump Inhibitors Therapeutics, Antipsychotic Therapeutics, Other Therapeutic Types); Distribution Channel (Retail Pharmacies, Hospital Pharmacies, Online Pharmacies).

- Geographic Regions/Countries:World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Antihypertensive Therapeutics segment, which is expected to reach US$49.9 Billion by 2030 with a CAGR of a 6.7%. The Analgesics Therapeutics segment is also set to grow at 5.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $43.8 Billion in 2024, and China, forecasted to grow at an impressive 8.9% CAGR to reach $47.2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Geriatric Medicines Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Geriatric Medicines Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Geriatric Medicines Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AbbVie, Inc., Adare Pharma Solutions, Akums Drugs & Pharmaceuticals Ltd., Bausch Health Companies Inc., Boehringer Ingelheim International GmbH and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 52 companies featured in this Geriatric Medicines market report include:

- AbbVie, Inc.

- Adare Pharma Solutions

- Akums Drugs & Pharmaceuticals Ltd.

- Bausch Health Companies Inc.

- Boehringer Ingelheim International GmbH

- Bristol-Myers Squibb Company

- Eli Lilly and Company

- Endo Pharmaceuticals, Inc.

- Ferring International Center SA

- Fortis Healthcare Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AbbVie, Inc.

- Adare Pharma Solutions

- Akums Drugs & Pharmaceuticals Ltd.

- Bausch Health Companies Inc.

- Boehringer Ingelheim International GmbH

- Bristol-Myers Squibb Company

- Eli Lilly and Company

- Endo Pharmaceuticals, Inc.

- Ferring International Center SA

- Fortis Healthcare Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 304 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

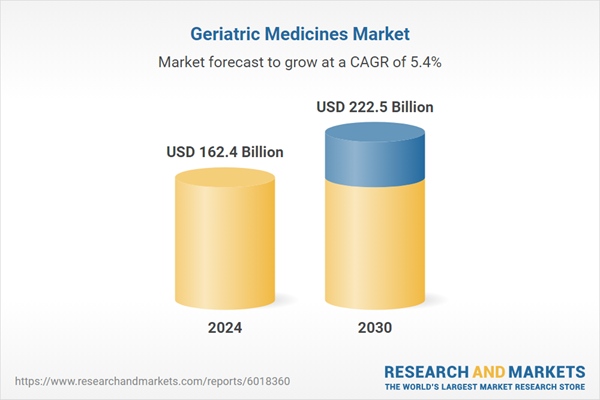

| Estimated Market Value ( USD | $ 162.4 Billion |

| Forecasted Market Value ( USD | $ 222.5 Billion |

| Compound Annual Growth Rate | 5.4% |

| Regions Covered | Global |