Global Foreign Exchange Market - Key Trends & Drivers Summarized

Why Is the Foreign Exchange (Forex) Market So Essential in Global Finance?

The foreign exchange (Forex) market plays a pivotal role in global finance due to its critical function of facilitating international trade, investment, and financial transactions. As the largest and most liquid financial market in the world, with daily trading volumes exceeding $6 trillion, the Forex market enables the exchange of one currency for another, which is essential for businesses, governments, and individuals operating across borders. Whether it's a multinational corporation converting foreign earnings, a government conducting monetary policy, or a traveler exchanging currencies for a vacation, the Forex market ensures that currencies are exchanged seamlessly and efficiently. It provides the liquidity needed to support international trade and investment, allowing companies to hedge against currency risks and ensuring that global markets remain interconnected.Moreover, the Forex market operates 24 hours a day, five days a week, making it unique among financial markets in its continuous availability. This around-the-clock trading, facilitated by a decentralized network of global banks, brokers, and financial institutions, allows for rapid response to global events, news, and economic shifts. Central banks also participate in the Forex market to manage their national currencies, using foreign exchange reserves to stabilize currency values or influence monetary policy. The importance of the Forex market extends beyond financial institutions, as it influences global trade balances, capital flows, inflation, and interest rates, making it a cornerstone of modern economic activity. As international trade and global investment continue to grow, the Forex market remains an essential component of global finance.

How Are Technological Advancements Revolutionizing the Foreign Exchange Market?

Technological advancements have revolutionized the foreign exchange market, making it more efficient, accessible, and transparent for participants worldwide. One of the most significant changes has been the rise of electronic trading platforms, which have largely replaced traditional over-the-counter (OTC) trading conducted via phone or in person. These platforms, such as MetaTrader, Bloomberg Terminal, and Eikon, allow traders to execute transactions instantaneously, access real-time data, and analyze market conditions from anywhere in the world. The increased use of algorithmic trading, where pre-programmed trading strategies automatically execute trades based on set parameters, has enhanced liquidity and reduced the time between trade execution and settlement. This has dramatically improved the efficiency of the market and lowered costs for traders by eliminating the need for intermediaries.Another major technological innovation shaping the Forex market is the application of artificial intelligence (AI) and machine learning (ML). AI-driven algorithms can analyze vast amounts of data at speeds far beyond human capability, enabling more accurate predictions of currency movements based on historical trends, economic indicators, and market sentiment. These predictive analytics tools provide traders and financial institutions with deeper insights into market conditions, allowing them to make more informed trading decisions. Additionally, AI is being used to detect and prevent fraudulent activities in the Forex market, improving security and reducing the risk of financial losses.

Blockchain technology is also emerging as a potential game changer in the Forex market, particularly in terms of enhancing transparency, reducing transaction costs, and speeding up settlement times. By using decentralized ledgers, blockchain could eliminate the need for traditional intermediaries like banks, leading to more direct and secure currency exchanges. Some blockchain-based platforms are already exploring decentralized Forex trading, which could democratize access to currency markets and provide lower transaction fees. Moreover, central bank digital currencies (CBDCs), which are being developed by several countries, could further streamline foreign exchange processes by offering a more secure and efficient means of cross-border transactions. These technological advancements are not only making the Forex market more accessible and efficient but are also transforming the way currencies are traded and exchanged globally.

How Are Changing Economic Policies and Geopolitical Events Shaping the Foreign Exchange Market?

Changing economic policies and geopolitical events have a profound influence on the global foreign exchange market, often leading to volatility and fluctuations in currency values. Central banks play a crucial role in shaping currency markets through monetary policies such as interest rate adjustments, quantitative easing, and foreign currency interventions. For instance, when a central bank raises interest rates, it typically strengthens the national currency, as higher interest rates attract foreign investment. Conversely, monetary easing policies can weaken a currency by increasing the money supply. The decisions made by central banks, particularly in major economies like the United States, the European Union, China, and Japan, are closely monitored by Forex traders and have immediate impacts on exchange rates.Geopolitical events such as trade wars, political instability, and international conflicts also heavily influence currency markets. For example, trade tensions between major economies, like the U.S. and China, can lead to uncertainty and fluctuations in exchange rates as investors seek safe-haven currencies like the U.S. dollar, Japanese yen, or Swiss franc. Political events such as Brexit or elections in key countries can also create volatility in the Forex market, as traders react to shifts in government policies, trade agreements, and economic outlooks. Additionally, geopolitical instability in regions rich in natural resources, such as the Middle East, often affects commodity prices, which in turn impacts the currencies of countries dependent on oil or raw material exports.

Global economic trends, such as inflation rates, unemployment figures, and economic growth data, are other critical drivers that influence the Forex market. Strong economic performance generally boosts a country's currency, while poor economic indicators can lead to depreciation. Economic policy shifts, such as those prompted by the COVID-19 pandemic, have shown how quickly currency markets can react to changes in fiscal stimulus, unemployment rates, and shifts in global trade patterns. As economies recover and adjust to new realities, including rising inflation, supply chain disruptions, and changes in trade policies, these factors continue to play a significant role in shaping currency exchange rates and influencing the global Forex market.

What Is Driving the Growth of the Global Foreign Exchange Market?

The growth of the global foreign exchange market is being driven by several key factors, including the increasing volume of international trade, expanding global investments, advancements in trading technologies, and the rise of retail trading. One of the primary drivers is the growth in international trade and cross-border business activities, which necessitates currency exchange. As globalization expands, businesses and governments require efficient Forex markets to facilitate trade, settle international transactions, and hedge against currency fluctuations. The expansion of e-commerce and the rise of multinational corporations have further amplified the need for efficient currency exchange systems, as businesses operate in multiple currencies across various markets.The growth of global financial markets and cross-border investments is also contributing to the expansion of the Forex market. Investors, institutional and retail alike, increasingly engage in Forex trading as part of their broader investment strategies. Global financial institutions, hedge funds, and investment firms use the Forex market to capitalize on currency fluctuations, diversify portfolios, and mitigate risks associated with changes in currency values. Additionally, the rise of foreign direct investments (FDI) and global mergers and acquisitions has increased the demand for foreign exchange transactions, as companies must convert currencies to complete cross-border deals. As international investment flows grow, so does the volume of Forex transactions, driving the market's expansion.

Technological advancements, particularly the rise of electronic and mobile trading platforms, have democratized access to the Forex market, enabling individual retail traders to participate alongside institutional investors. The introduction of low-cost, user-friendly platforms has fueled a surge in retail trading, with individual traders now accounting for a significant portion of daily Forex transactions. These platforms provide retail investors with real-time data, charting tools, and educational resources, allowing them to trade from anywhere in the world. The increased participation of retail traders, supported by easy access to trading platforms and a broader understanding of the Forex market, has further accelerated the growth of the market.

Moreover, globalization and the increasing complexity of global supply chains are creating a greater need for Forex solutions. Multinational corporations are exposed to currency risk in their day-to-day operations, and the ability to hedge against fluctuations in foreign exchange rates is crucial for maintaining profitability. Businesses rely on Forex markets to mitigate the risks associated with fluctuating exchange rates, which can impact their revenue and operational costs. Central banks, too, engage in Forex markets to stabilize their national currencies, maintain reserves, and execute monetary policy, further contributing to the growth and liquidity of the market.

The combination of expanding international trade, increasing cross-border investments, advancements in trading technologies, and growing retail participation is driving the rapid growth of the global foreign exchange market. As globalization and digitalization continue to shape the future of finance, the Forex market is poised for further expansion, making it an essential component of global economic infrastructure and investment strategies.

Report Scope

The report analyzes the Foreign Exchange market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Participant Type (Reporting Dealers, Non-Financial Customers, Other Participant Types).

- Geographic Regions/Countries:World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Reporting Dealers segment, which is expected to reach US$717.1 Billion by 2030 with a CAGR of a 9.6%. The Non-Financial Customers segment is also set to grow at 6.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $234.3 Billion in 2024, and China, forecasted to grow at an impressive 12.1% CAGR to reach $297.9 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Foreign Exchange Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Foreign Exchange Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Foreign Exchange Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Barclays Bank Plc, BNP Paribas CIB, CurrencyFair, Deutsche Bank AG, FXCM and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 45 companies featured in this Foreign Exchange market report include:

- Barclays Bank Plc

- BNP Paribas CIB

- CurrencyFair

- Deutsche Bank AG

- FXCM

- Goldman Sachs & Co. LLC

- HSBC Holdings Plc

- ICICI Bank Ltd.

- Joyalukkas Exchange

- LuLu Forex Pvt. Ltd

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Barclays Bank Plc

- BNP Paribas CIB

- CurrencyFair

- Deutsche Bank AG

- FXCM

- Goldman Sachs & Co. LLC

- HSBC Holdings Plc

- ICICI Bank Ltd.

- Joyalukkas Exchange

- LuLu Forex Pvt. Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 186 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

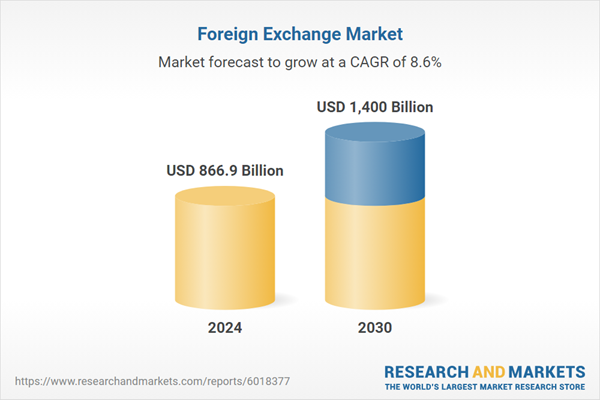

| Estimated Market Value ( USD | $ 866.9 Billion |

| Forecasted Market Value ( USD | $ 1400 Billion |

| Compound Annual Growth Rate | 8.6% |

| Regions Covered | Global |