Global Port and Industrial Tires Market - Key Trends & Drivers Summarized

Why Are Port and Industrial Tires Becoming a Strategic Asset for Heavy-Duty Operations?

Port and industrial tires have become a critical component of heavy-duty machinery used in a variety of high-intensity environments, such as ports, warehouses, logistics centers, and construction sites. These tires are specifically engineered to withstand the unique challenges of demanding industrial applications, including carrying heavy loads, navigating rough terrain, and enduring long operational hours without compromising performance. As global trade and logistics activities continue to grow, driven by the expansion of port infrastructure and the increase in e-commerce, the need for reliable and durable tires that can support heavy-duty equipment like forklifts, reach stackers, terminal tractors, and straddle carriers is rising significantly. The ability of these specialized tires to enhance the safety, stability, and efficiency of industrial vehicles makes them a strategic asset in maximizing productivity and reducing downtime.The growth of port infrastructure, particularly in emerging markets such as Asia-Pacific and Latin America, is a key factor driving the demand for port and industrial tires. Ports serve as critical nodes in the global supply chain, handling massive volumes of goods and commodities that require the seamless operation of heavy machinery. As ports expand and modernize to accommodate larger vessels and increased cargo throughput, there is a corresponding need for high-performance tires that can support the intense operational demands of port environments. Furthermore, the rise in automation and the adoption of advanced material-handling equipment in ports and logistics centers are influencing the specifications and performance requirements of industrial tires. Manufacturers are responding by developing tires with enhanced load-carrying capacities, greater resistance to punctures and wear, and improved traction on both paved and unpaved surfaces. As a result, port and industrial tires are becoming a cornerstone in supporting the efficiency and reliability of global trade and industrial operations.

What Technological Innovations Are Enhancing the Performance and Longevity of Port and Industrial Tires?

Technological advancements are playing a crucial role in enhancing the performance, durability, and longevity of port and industrial tires, making them more suited to the rigorous demands of heavy-duty operations. One of the key innovations is the development of advanced rubber compounds and tread designs that provide superior resistance to wear, cuts, and punctures. These compounds are formulated to withstand extreme conditions such as heavy loads, abrasive surfaces, and exposure to chemicals, ensuring that the tires maintain their structural integrity and performance over extended periods. Additionally, manufacturers are incorporating reinforced sidewalls and bead designs to enhance stability and minimize the risk of blowouts, which is particularly important in applications involving high loads and rough terrain. The use of non-marking tires, which prevent rubber traces from being left on warehouse floors, is also gaining popularity in indoor applications where cleanliness and minimal surface damage are priorities.Another significant technological innovation is the integration of tire pressure monitoring systems (TPMS) and digital sensors, which provide real-time data on tire pressure, temperature, and load conditions. These systems enable operators to monitor tire health continuously, detect potential issues such as underinflation or overloading, and take preventive measures before they lead to costly downtime or accidents. The ability to track and manage tire performance remotely is particularly valuable in large-scale industrial operations where maintaining optimal tire conditions is essential for safety and efficiency. Furthermore, advancements in tire construction, such as the use of radial and solid tires, are enhancing the load-bearing capacity and stability of port and industrial tires. Radial tires offer greater flexibility and lower rolling resistance, making them ideal for long-distance transport and high-speed applications, while solid tires provide maximum puncture resistance and durability, making them suitable for harsh and abrasive environments. The continuous innovation in materials, design, and digital technology is elevating the capabilities of port and industrial tires, making them more resilient and adaptable to diverse industrial needs.

How Are Market Dynamics and Industry Regulations Shaping the Port and Industrial Tires Market?

The port and industrial tires market is being shaped by several dynamic factors, including increasing global trade, evolving industrial activities, and stringent safety regulations. The expansion of global trade, driven by the growth of e-commerce and the demand for faster logistics, is resulting in higher volumes of goods being transported through ports and logistics hubs. This surge in trade is leading to an increased need for robust and reliable tires that can support heavy machinery operating in these high-traffic environments. As a result, logistics companies and port authorities are prioritizing the selection of high-performance tires that offer durability, reduced maintenance, and enhanced fuel efficiency to ensure smooth operations. This trend is particularly pronounced in key trade hubs such as North America, Europe, and Asia-Pacific, where ports are investing in advanced material-handling equipment and expanding infrastructure to keep pace with rising cargo volumes.Regulatory standards and safety guidelines are also playing a critical role in shaping the port and industrial tires market. Many countries have implemented stringent regulations regarding tire quality, safety, and environmental impact, which are influencing the types of tires used in industrial applications. For instance, regulations in the European Union mandate the use of tires that comply with specific standards for rolling resistance, noise emissions, and wet grip, promoting the adoption of eco-friendly and high-performance tires. Similarly, safety standards set by organizations like the Occupational Safety and Health Administration (OSHA) in the United States require regular inspection and maintenance of industrial tires to prevent accidents and ensure workplace safety. Compliance with these regulations is prompting manufacturers to develop tires that not only meet performance requirements but also adhere to environmental and safety standards. Additionally, the growing focus on sustainability is driving the adoption of retreaded and recyclable tires, which reduce waste and promote resource efficiency. These regulatory and market dynamics are creating new challenges and opportunities for manufacturers, pushing them to innovate and offer products that align with industry standards and customer expectations.

What Are the Key Growth Drivers Fueling the Expansion of the Port and Industrial Tires Market?

The growth in the global port and industrial tires market is driven by several key factors, including the expansion of port infrastructure, increasing automation in material handling, and the rising demand for durable and long-lasting tires. One of the primary growth drivers is the ongoing expansion and modernization of port facilities worldwide. Ports are investing in state-of-the-art equipment and infrastructure to handle larger vessels and higher cargo volumes, which is generating substantial demand for high-performance tires that can support heavy machinery and intensive operations. The growing number of container terminals, dry ports, and logistics hubs is also contributing to the demand for industrial tires, as these facilities require specialized tires for equipment such as gantry cranes, container handlers, and forklifts. The construction of new ports and the expansion of existing ones, particularly in emerging markets such as Southeast Asia, the Middle East, and Africa, are creating significant opportunities for tire manufacturers.Another major growth driver is the increasing adoption of automation and advanced material-handling technologies in ports and industrial facilities. Automated guided vehicles (AGVs), autonomous forklifts, and robotic material handlers are being deployed to improve operational efficiency and reduce labor costs. These automated systems require tires that offer precise handling, low rolling resistance, and extended service life to operate effectively. The integration of smart tire technologies, such as sensors and predictive maintenance tools, is also supporting the growth of the port and industrial tires market. These technologies enable operators to monitor tire conditions in real-time, optimize maintenance schedules, and reduce unplanned downtime, leading to improved overall operational efficiency. Additionally, the rising demand for energy-efficient and low-emission solutions is driving the development of eco-friendly tire options, such as low rolling resistance tires, which help reduce fuel consumption and greenhouse gas emissions.

Furthermore, the increasing focus on reducing total cost of ownership (TCO) is influencing purchasing decisions in the port and industrial tires market. Businesses are seeking tires that offer a balance of durability, performance, and cost-effectiveness to minimize operational expenses and maximize productivity. The trend towards using retreaded and remanufactured tires is gaining traction, as these options provide cost savings and environmental benefits by extending the lifecycle of tires. The development of innovative retreading processes and high-quality tread compounds is enhancing the performance and reliability of retreaded tires, making them a viable alternative for heavy-duty applications. As the global demand for port and industrial tires continues to rise, driven by expanding industrial activities, technological advancements, and a focus on sustainability, the market is expected to experience sustained growth, with manufacturers and service providers capitalizing on emerging opportunities in both developed and developing regions.

Report Scope

The report analyzes the Port and Industrial Tires market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: End-Use (Aftermarket End-Use, OEM End-Use).

- Geographic Regions/Countries:World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Aftermarket End-Use segment, which is expected to reach US$7.1 Billion by 2030 with a CAGR of a 3.8%. The OEM End-Use segment is also set to grow at 2.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $2.5 Billion in 2024, and China, forecasted to grow at an impressive 6.8% CAGR to reach $2.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Port and Industrial Tires Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Port and Industrial Tires Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Port and Industrial Tires Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Balkrishna Industries Ltd., Bridgestone Corporation, Camso, Inc., Cheng Shin Rubber Ind. Co., Ltd., Continental Reifen Deutschland GmbH and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 25 companies featured in this Port and Industrial Tires market report include:

- Balkrishna Industries Ltd.

- Bridgestone Corporation

- Camso, Inc.

- Cheng Shin Rubber Ind. Co., Ltd.

- Continental Reifen Deutschland GmbH

- Cooper Tire & Rubber Company Europe Ltd.

- Ecomega Europe Industries Srl

- Goodyear Tire & Rubber Company, The

- Magna Tyres Group

- Malhotra Rubbers Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Balkrishna Industries Ltd.

- Bridgestone Corporation

- Camso, Inc.

- Cheng Shin Rubber Ind. Co., Ltd.

- Continental Reifen Deutschland GmbH

- Cooper Tire & Rubber Company Europe Ltd.

- Ecomega Europe Industries Srl

- Goodyear Tire & Rubber Company, The

- Magna Tyres Group

- Malhotra Rubbers Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 163 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

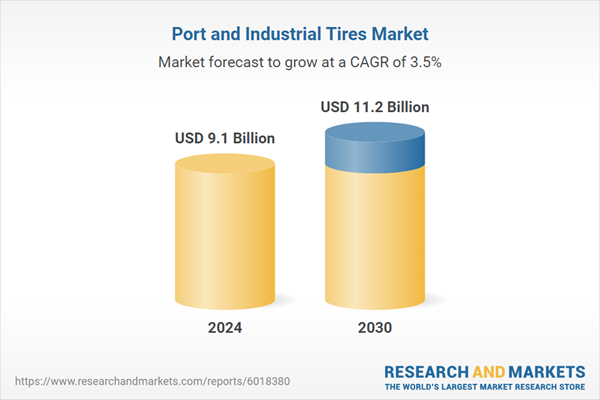

| Estimated Market Value ( USD | $ 9.1 Billion |

| Forecasted Market Value ( USD | $ 11.2 Billion |

| Compound Annual Growth Rate | 3.5% |

| Regions Covered | Global |