Global Industrial Belt Tensioners Market - Key Trends & Drivers Summarized

What Are Industrial Belt Tensioners and Why Are They Essential in Machinery?

Industrial belt tensioners are mechanical devices designed to maintain the appropriate tension in belt-driven systems used across various industrial machinery. They ensure that belts remain at the optimal tension level, preventing slippage, misalignment, and excessive wear that can lead to equipment failure or decreased efficiency. Belt tensioners are crucial components in power transmission systems, facilitating the smooth operation of machines by transmitting mechanical power between shafts. They are widely used in industries such as manufacturing, automotive, mining, agriculture, and energy, where machinery relies on belt drives for functions like conveyor systems, compressors, pumps, and engines. By keeping the belts properly tensioned, these devices enhance the reliability and longevity of both the belts and the machinery they serve.The importance of industrial belt tensioners lies in their ability to reduce maintenance costs and downtime. Without proper tension, belts can wear out prematurely, leading to frequent replacements and potential machine breakdowns. Belt tensioners mitigate these risks by automatically adjusting to compensate for belt stretch and wear over time, ensuring consistent performance. They come in various types, including manual, spring-loaded, and automatic tensioners, each suited for specific applications and operational demands. For example, automatic tensioners are ideal for systems where constant tension adjustment is required without manual intervention, making them essential for continuous production environments. Overall, industrial belt tensioners play a vital role in maintaining operational efficiency, reducing energy consumption, and ensuring the safe functioning of industrial equipment.

How Are Technological Advancements Transforming Belt Tensioners?

Technological innovations are significantly reshaping the design and functionality of industrial belt tensioners, leading to improved performance and adaptability in various industrial settings. One major advancement is the development of automatic and self-adjusting tensioners, which eliminate the need for manual adjustments by automatically maintaining optimal belt tension throughout the belt's lifecycle. These tensioners use mechanisms such as torsional springs or hydraulic systems to compensate for belt stretch and wear, ensuring consistent operation and reducing maintenance requirements. This automation not only extends the lifespan of belts and associated components but also minimizes downtime and labor costs associated with manual tensioning.Additionally, the integration of smart technologies and IoT capabilities into belt tensioners is revolutionizing maintenance practices. Modern tensioners equipped with sensors can monitor tension levels, temperature, vibration, and other operational parameters in real time. This data can be transmitted to maintenance teams or centralized monitoring systems, enabling predictive maintenance strategies. By identifying potential issues before they lead to equipment failure, companies can schedule maintenance proactively, avoiding unexpected downtime and costly repairs. Furthermore, advancements in materials science have led to the use of high-performance materials like composites and advanced alloys in tensioner construction, enhancing durability and resistance to harsh industrial environments. These technological improvements are making belt tensioners more reliable, efficient, and aligned with the demands of modern industrial operations.

What Industry Trends Are Influencing the Demand for Industrial Belt Tensioners?

The increasing automation and mechanization across industries are significantly influencing the demand for industrial belt tensioners. In the manufacturing sector, the adoption of high-speed, precision machinery necessitates the use of reliable belt tensioners to maintain optimal performance and prevent costly downtime. The trend toward Industry 4.0 and smart manufacturing is driving the integration of advanced tensioners that can communicate with other machine components, supporting automated processes and real-time monitoring. Additionally, the growth of the automotive industry, especially with the surge in electric vehicle production, is boosting the need for efficient belt-driven systems where advanced tensioners are critical for ensuring system reliability and efficiency.Environmental and energy efficiency considerations are also impacting the market. Industries are increasingly focused on reducing energy consumption and minimizing their environmental footprint. Properly tensioned belts operate more efficiently, reducing energy loss due to slippage and friction. This not only lowers operational costs but also contributes to sustainability goals. In sectors like mining and agriculture, where equipment operates under harsh conditions, there is a growing demand for durable tensioners that can withstand extreme environments and reduce maintenance frequency. Furthermore, the rise of renewable energy industries, such as wind and solar power, is expanding the application of belt tensioners in new types of machinery, further driving market demand.

What Factors Are Driving Growth in the Industrial Belt Tensioners Market?

The growth in the industrial belt tensioners market is driven by several factors. Technological advancements, including the development of automatic and smart tensioners with IoT integration, are enhancing equipment efficiency and enabling predictive maintenance, encouraging their adoption across various industries. The increasing automation in manufacturing and the expansion of industries like automotive, mining, and agriculture are boosting demand for reliable power transmission components, including advanced belt tensioners. Additionally, the emphasis on operational efficiency, cost reduction, and energy savings is prompting companies to invest in high-quality tensioners that extend equipment life and reduce downtime.Moreover, the growing focus on Industry 4.0 and the integration of smart technologies in industrial equipment are contributing to market growth, as tensioners become part of interconnected systems that optimize performance and maintenance. Environmental concerns and sustainability goals are also driving the adoption of tensioners that improve energy efficiency and reduce the carbon footprint of industrial operations. The increasing use of heavy machinery in developing economies and the expansion of infrastructure projects worldwide are further fueling demand for industrial belt tensioners. These factors combined are propelling the market forward, meeting the evolving needs of modern industry.

Report Scope

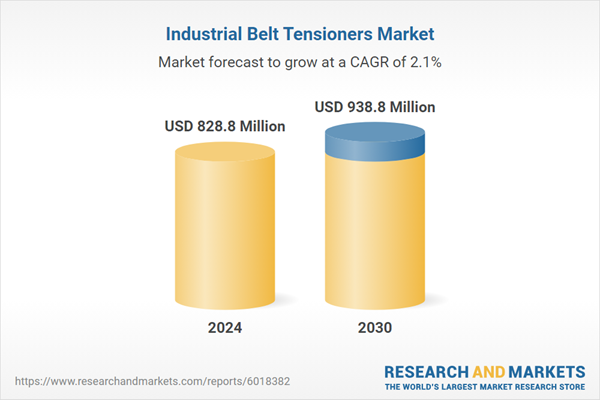

The report analyzes the Industrial Belt Tensioners market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Automatic Tensioners, Non-Automatic Tensioners); End-Use (Material Handling End-Use, Industrial Machinery End-Use, Agriculture End-Use, Mining & Mineral End-Use).

- Geographic Regions/Countries:World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Automatic Tensioners segment, which is expected to reach US$621.4 Million by 2030 with a CAGR of a 2.3%. The Non-Automatic Tensioners segment is also set to grow at 1.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $224.2 Million in 2024, and China, forecasted to grow at an impressive 4.4% CAGR to reach $184.5 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Industrial Belt Tensioners Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Industrial Belt Tensioners Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Industrial Belt Tensioners Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Applied Industrial Technologies, Bando Chemical Industries, Ltd. (Bando Group), Brewer Machine & Gear Company, Continental Engineparts, Dayco IP Holdings, LLC and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 52 companies featured in this Industrial Belt Tensioners market report include:

- Applied Industrial Technologies

- Bando Chemical Industries, Ltd. (Bando Group)

- Brewer Machine & Gear Company

- Continental Engineparts

- Dayco IP Holdings, LLC

- Fenner PLC

- Gates Corporation

- Hangzhou Chinabase Machinery Co., Ltd.

- Litens Aftermarket

- Martin Engineering Company

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Applied Industrial Technologies

- Bando Chemical Industries, Ltd. (Bando Group)

- Brewer Machine & Gear Company

- Continental Engineparts

- Dayco IP Holdings, LLC

- Fenner PLC

- Gates Corporation

- Hangzhou Chinabase Machinery Co., Ltd.

- Litens Aftermarket

- Martin Engineering Company

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 289 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 828.8 Million |

| Forecasted Market Value ( USD | $ 938.8 Million |

| Compound Annual Growth Rate | 2.1% |

| Regions Covered | Global |