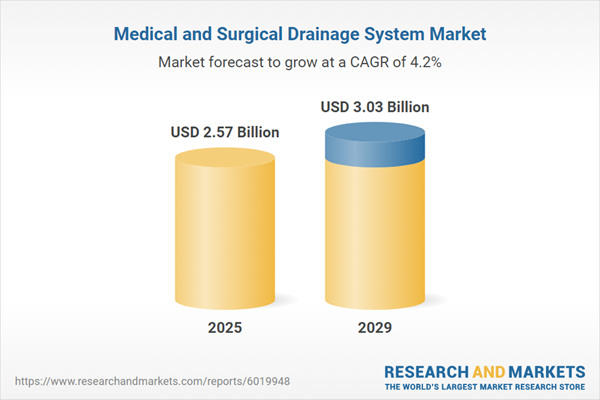

The medical and surgical drainage system market size has grown steadily in recent years. It will grow from $2.46 billion in 2024 to $2.57 billion in 2025 at a compound annual growth rate (CAGR) of 4.5%. The growth in the historic period can be attributed to the increased use of these devices in numerous applications, the number of surgeries increases the routine use of reusable equipment near patients, to remove fluid and prevent air accumulation at the surgical site.

The medical and surgical drainage system market size is expected to see steady growth in the next few years. It will grow to $3.03 billion in 2029 at a compound annual growth rate (CAGR) of 4.2%. The growth in the forecast period can be attributed to the increasing volume of surgical procedures, evolving healthcare needs, the prevalence of chronic diseases, procedures for gastrointestinal and gynecological surgeries, and the rising penetration of healthcare businesses' spending. Major trends in the forecast period include technological advancements in the medical and surgical drainage systems, innovations in traditional drainage systems, high-performance solutions, reduced risk of complications, and the development of high-performance pumps.

The growth of the medical and surgical drainage system market is projected to be driven by the increasing number of surgical procedures. This rise in surgical procedures is attributed to an aging population, a higher prevalence of chronic diseases, and advancements in medical technology. Medical and surgical drainage systems play a crucial role in removing excess fluids, blood, and pus from surgical sites to prevent infection, reduce swelling, and facilitate healing. For example, in May 2024, the Government of British Columbia, a Canada-based administrative body, reported that 365,825 surgeries were performed, including both scheduled and unscheduled procedures. This total includes 284,844 scheduled surgeries, an increase of 24,380 compared to the same period in 2019-20. Furthermore, the overall number of surgeries, both scheduled and unscheduled, was 14,939 more than in 2022-23. Thus, the growing volume of surgical procedures is fueling the expansion of the medical and surgical drainage system market.

Leading companies in the medical and surgical drainage system market are focusing on the development of innovative products, such as the IRRAflow system. The next-generation IRRAflow system by IRRAS improves fluid management for patients with intracranial bleeding by combining automated irrigation with controlled drainage, which reduces complications and ensures effective fluid removal. It includes a user-friendly interface, step-by-step tutorials, and an improved drainage collection design to optimize treatment workflows. For example, in February 2022, IRRAS, a Sweden-based medical device company, introduced the next-generation IRRAflow system. This cutting-edge device is designed to manage intracranial pressure (ICP) and cerebrospinal fluid (CSF) drainage, enhancing intracranial bleeding treatment. The advanced technology integrates automated irrigation to dilute and clear toxic materials while preventing drainage blockages.

In November 2022, IRRAS, a US-based medical technology company, entered into a partnership with Medtronic plc to promote IRRAS' IRRAflow system in the United States. This collaboration aims to leverage Medtronic's extensive market presence and expertise in healthcare technology to boost the distribution and marketing of the IRRAflow system. The IRRAflow system combines automated irrigation, controlled drainage, and continuous intracranial pressure (ICP) monitoring into a single advanced platform. It uses recurring irrigation to prevent catheter blockages and dilute toxic materials for easier removal. Medtronic plc, a US-based healthcare technology company, provides medical and surgical drainage products.

Major companies operating in the medical and surgical drainage system market are McKesson Medical-Surgical Inc., Cardinal Health Inc., Johnson & Johnson, Medtronic plc, Becton, Dickinson, and Company, Stryker Corporation, Medline Industries LP, Zimmer Biomet Holdings Inc., Olympus Corporation, Smith & Nephew plc, Braun SE, Cook Medical, Teleflex Incorporated, ConvaTec Group, Medela AG, Vygon SA, Poly Medicure Limited, Redax S.p.A., Hangzhou Fushan Medical Appliances Co. Ltd., Ningbo Luke Medical Co. Ltd., Centese Inc.

Asia-Pacific was the largest region in the medical and surgical drainage systems market in 2024. The regions covered in the medical and surgical drainage system market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the medical and surgical drainage system market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

A medical and surgical drainage system is a device designed to remove excess fluids, blood, pus, or other substances from a wound, body cavity, or surgical site. This helps prevent infection and supports healing. These systems can be either open or closed and may function passively through gravity or actively using suction mechanisms.

The main categories of medical and surgical drainage systems include drainage systems and accessories. Drainage systems refer to devices and equipment used to eliminate excess fluids, blood, or air from the body to prevent infection and promote healing. These systems are made from materials such as silastic, rubber, and others. They operate through different flow types, including active and passive flow, and are used in various applications, including cardiac and thoracic surgery, abdominal surgery, orthopedic surgery, and other procedures.

The medical and surgical drainage system market research report is one of a series of new reports that provides medical and surgical drainage system market statistics, including medical and surgical drainage system industry global market size, regional shares, competitors with a medical and surgical drainage system market share, detailed medical and surgical drainage system market segments, market trends, and opportunities, and any further data you may need to thrive in the medical and surgical drainage system industry. This medical and surgical drainage system market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The medical and surgical drainage system market consists of sales of catheters, tubes, collection bags, filters, connectors, and collection devices. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Medical and Surgical Drainage System Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on medical and surgical drainage system market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for medical and surgical drainage system ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The medical and surgical drainage system market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product Type: Drainage Systems; Accessories2) By Material Type: Silastic; Rubber; Other Materials

3) By Flow Type: Active; Passive

4) By Application: Cardiac and Thoracic Surgery; Abdominal; Orthopedic; Other Surgeries

Subsegments:

1) By Drainage Systems: Wound Drainage Systems or Surgical Drainage Systems or Chest Drainage Systems or Peritoneal Drainage Systems2) By Other Drainage Systems

3) By Accessories: Drainage Tubes or Drainage Bags or Drainage Clamps or Collection Chambers

Key Companies Mentioned: McKesson Medical-Surgical Inc.; Cardinal Health Inc.; Johnson & Johnson; Medtronic plc; Becton, Dickinson, and Company

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The major companies featured in this Medical and Surgical Drainage System market report include:- McKesson Medical-Surgical Inc.

- Cardinal Health Inc.

- Johnson & Johnson

- Medtronic plc

- Becton, Dickinson, and Company

- Stryker Corporation

- Medline Industries LP

- Zimmer Biomet Holdings Inc.

- Olympus Corporation

- Smith & Nephew plc

- Braun SE

- Cook Medical

- Teleflex Incorporated

- ConvaTec Group

- Medela AG

- Vygon SA

- Poly Medicure Limited

- Redax S.p.A.

- Hangzhou Fushan Medical Appliances Co. Ltd.

- Ningbo Luke Medical Co. Ltd.

- Centese Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | April 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 2.57 Billion |

| Forecasted Market Value ( USD | $ 3.03 Billion |

| Compound Annual Growth Rate | 4.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 22 |