The demand for premium loafers has significantly increased in European markets, notably in Italy, France, and the UK, due to the European consumer's reputation for their appreciation of quality craftsmanship. Therefore, the Europe segment acquired more than 1/4th revenue share in the market in 2023. In terms of volume, 193.97 million units of loafers are expected to be utilized by the year 2031 in this region. European brands are increasingly offering loafers that are made from sustainable or vegan materials. Furthermore, the consistent demand for loafers across a variety of consumer segments in European fashion has contributed to the region's substantial revenue share in the market, as they are a popular component of both formal and casual attire.

The growing emphasis on comfort in fashion has further amplified the appeal of loafers. As consumers prioritize comfort alongside style, loafers provide a practical solution by offering cushioned insoles, flexible designs, and breathable materials, all without compromising on elegance. Additionally, the e-commerce environment allows brands to test new styles, offer exclusive online collections, and reach niche markets. Using data analytics to track consumer preferences and buying behavior, brands can tailor their offerings more effectively, ensuring their loafers align with current fashion trends. The global demand for loafers is anticipated to be further bolstered by the ongoing expansion of e-commerce and digital marketing innovations, particularly as a greater number of consumers transition to online purchasing. Thus, the rise of e-commerce and casual fashion trends are driving the growth of the market.

However, the rise of sneakers has been fueled by several factors, including their ability to combine comfort with style, which appeals to a broad demographic. Brands like Nike, Adidas, and Puma have capitalized on this trend by releasing collections that offer performance benefits and cater to fashion-conscious consumers. Collaborations with designers and influencers have turned sneakers into must-have fashion items, further enhancing their appeal. This has eroded the market share for loafers, often perceived as more formal and less versatile than their sneaker counterparts. Thus, as these alternative footwear options dominate, loafers face an uphill battle to retain their foothold in the market.

Driving and Restraining Factors

Drivers- Rise of Casual Fashion Trends

- Growth of Online Retail Platforms

- Influence of Social Media and Fashion Influencers

- Substantial Production Costs of Loafers

- Competition from Alternative Footwear

- Expanding Middle-Class Population

- Rapid Development of Innovative Materials

- Growing Concerns Regarding Environmental Impact

- Low Demand Due to Economic Uncertainty

Product Outlook

Based on product, the market is classified into leather, fabric/suede, and others. The leather segment garnered 67% revenue share in the market in 2023. In terms of volume, 691.08 million units of Leather loafers are expected to be utilized by the year 2031. Leather loafers have long been associated with luxury, durability, and timeless style, making them popular among consumers who prioritize quality and elegance. Leather loafers are particularly appealing in formal and smart-casual attire, as they provide a polished appearance that is appropriate for professional settings or affluent events.End Use Outlook

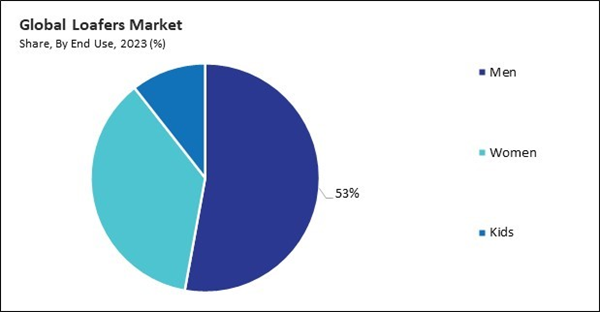

On the basis of end use, the market is divided into men, women, and kids. The women segment recorded 37% revenue share in the market in 2023. In terms of volume, 611.73 million units of loafers will be worn by women by the year 2031. The increasing popularity of women loafers can be attributed to shifting fashion trends emphasizing comfort without sacrificing style. Women’s loafers are often available in more diverse designs, colors, and materials, making them a versatile choice for casual and professional settings. As more women seek out fashionable yet practical footwear for daily use, the demand for loafers in this segment has grown considerably.Distribution Channel Outlook

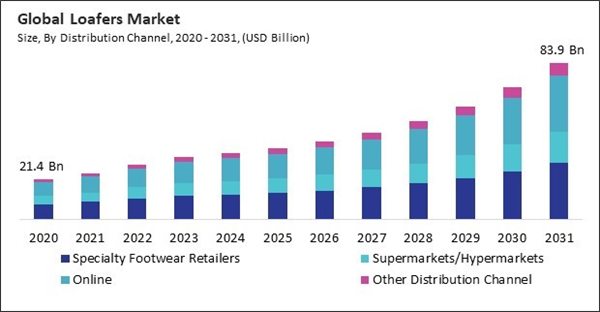

By distribution channel, the market is segmented into supermarkets/hypermarkets, specialty footwear retailers, online, and others. The specialty footwear retailers segment witnessed 38% revenue share in the market in 2023. In terms of volume, 606.78 million units of loafers are expected to be sold through specialty footwear retailers by the year 2031. Specialty footwear stores provide an exclusive shopping experience, offering a curated selection of loafers that appeal to consumers looking for expert guidance, premium brands, and personalized service.Regional Outlook

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific segment procured 38% revenue share in the market in 2023. In terms of volume, 1.18 billion units of loafer are expected to be utilized by this region by the year 2031. There are numerous factors that contribute to this expansion, such as the region's expanding middle-class population, rising disposable incomes, as well as a growing demand for comfortable yet fashionable footwear. Countries such as China, India, and Japan have seen a rising demand for both luxury and affordable loafers, driven by urbanization and the influence of global fashion trends.List of Key Companies Profiled

- Guccio Gucci S.p.A. (Kering Group)

- Cole Haan (Apax Partners LLP)

- Church & Co Ltd. (Prada S.p.A.)

- Salvatore Ferragamo S.p.A

- Tommy Hilfiger Licensing, LLC (PVH Corp.)

- PUMA SE (Groupe Artémis S.A.)

- Tod's S.p.A.

- Bally

- Allen Edmonds Corporation

- SEBAGO Srl

Market Report Segmentation

By Distribution Channel (Volume, Million Units, USD Billion, 2020-2031)- Specialty Footwear Retailers

- Supermarkets/Hypermarkets

- Online

- Other Distribution Channel

- Men

- Women

- Kids

- Leather

- Fabric/Suede

- Other Products

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

Some of the key companies profiled in this Loafers Market include:- Guccio Gucci S.p.A. (Kering Group)

- Cole Haan (Apax Partners LLP)

- Church & Co Ltd. (Prada S.p.A.)

- Salvatore Ferragamo S.p.A

- Tommy Hilfiger Licensing, LLC (PVH Corp.)

- PUMA SE (Groupe Artémis S.A.)

- Tod's S.p.A.

- Bally

- Allen Edmonds Corporation

- SEBAGO Srl