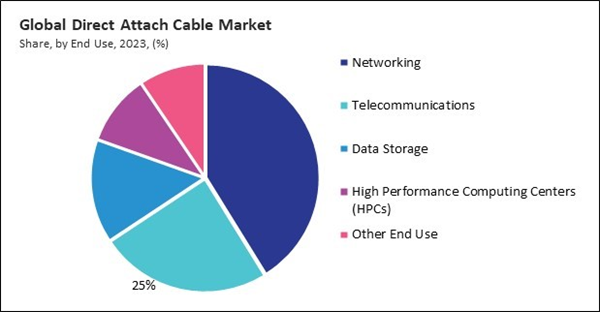

Direct attach cables are essential in telecommunications to support high bandwidth and low latency connections, which are crucial for the efficient operation of modern communication systems. Therefore, in 2023, the telecommunications segment registered 25% revenue share in the market. This can be attributed to the growing demand for high-speed internet and advanced communication networks. The expansion of 5G networks and the continuous upgrade of telecom infrastructure have further driven the demand for direct attach cables in this segment.

As applications become more latency-sensitive - particularly in gaming and AR/VR experiences - DACs are crucial in reducing latency through their efficient short-range connections, providing a competitive edge in sectors demanding instantaneous data access. Organizations opt for localized data processing with rising concerns about privacy and sovereignty. DACs facilitate quick interconnections within regional data centres, enabling organizations to manage data in compliance with local regulations while maintaining high-speed access. Additionally, 5G is expected to drive the proliferation of Internet of Things (IoT) devices, as it can support many simultaneous connections with minimal latency. The increasing deployment of IoT solutions in various industries (e.g., healthcare, manufacturing, smart cities) necessitates reliable and high-performance connectivity, which DACs can provide. Hence, adopting 5G technology and its infrastructure requirements drives the market's growth.

However, each connector standard has technical specifications, such as bandwidth, transmission distance, and power consumption. Compatibility with legacy systems may require using specific DACs that conform to older standards, limiting users’ ability to upgrade to newer technologies without incurring additional costs. DACs must work seamlessly with various networking equipment, including switches, routers, and servers. Multiple connector standards and variations can lead to a fragmented market, making it challenging for users to select the right DAC for their specific needs. Therefore, dependence on specific connector standards and compatibility issues hamper the market's growth.

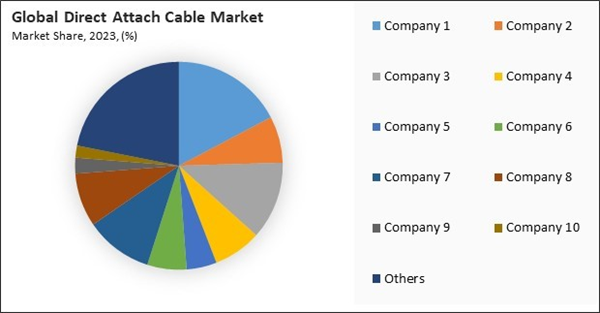

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The illustration above shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions, and Partnerships & Collaborations.

Driving and Restraining Factors

Drivers- Increasing Demand for High-Speed Data Transmission

- Adoption of 5G Technology and its Infrastructure Requirements

- Expansion of Data Center Infrastructure Driven by Cloud Computing

- Dependence on Specific Connector Standards and Compatibility Issues

- Vulnerability to Electromagnetic Interference (EMI) and Signal Degradation

- Increasing Adoption of High-Performance Computing (HPC) Solutions

- Integration with Software-Defined Networking (SDN) Solutions

- Intense Competition from Advanced Fiber Optic Technologies

- High Thermal Output and Associated Cooling Costs

Form Factor Outlook

On the basis of form factor, the market is segmented into SFP, QSFP, CXP, Cx4, CFP, and CDFP. The QSFP segment recorded 34% revenue share in the direct attach cable market in 2023. This is primarily due to the QSFP's ability to support high data transfer rates and scalability, making it highly suitable for data centres and high-performance computing applications. The QSFP (Quad Small Form-factor Pluggable) form factor is versatile, supporting multiple data rates and various networking applications, which has driven its widespread adoption and dominance in the market.End Use Outlook

By end use, the market is divided into networking, telecommunications, data storage, high-performance computing centers (HPCs), and others. In 2023, the data storage segment held 15% revenue share in the market. Direct attach cables connect storage devices to servers and networks, ensuring high-speed data transfer and reliability. As organizations expand their data storage capacities to accommodate the growing volume of digital information, the demand for direct attach cables in this segment is expected to remain strong, contributing to its promising revenue share in the market.Direct-attach Copper Cable Outlook

The direct-attach copper cable segment is further subdivided into passive direct-attach copper cable and active direct-attach copper cable. The passive direct attach copper cable segment held 63% revenue share in the direct-attach cable market. These cables are favoured for their cost-effectiveness and simplicity, as they do not require additional power for signal amplification. They are typically used for short-distance connections within data centres, such as linking servers and switches within the same rack or between adjacent racks.Type Outlook

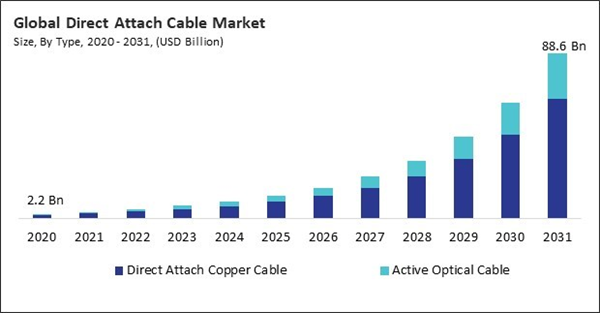

Based on type, the market is divided into direct attach copper cable and active optical cable. In 2023, the direct attach copper cable segment garnered 74% revenue share in the market. This dominance can be attributed to several factors, including cost-effectiveness, ease of installation, and high reliability for short-distance data transmission. Due to their low latency and power efficiency, direct-attach copper cables are widely used in data centres and high-performance computing environments.Regional Outlook

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America region witnessed 34% revenue share in the market in 2023. This can be attributed to several factors, including a robust telecommunications infrastructure, high data centre investments, and the rapid adoption of cloud computing and advanced networking technologies. The demand for high-speed connectivity and low-latency solutions in various industries, including finance, healthcare, and technology, has further fuelled market growth in this region.List of Key Companies Profiled

- Cisco Systems, Inc.

- Hitachi, Ltd

- Juniper Networks, Inc.

- Molex, LLC (Koch Industries, Inc.)

- The Siemon Company

- 3M Company

- Broadcom, Inc.

- TE Connectivity Ltd.

- Sumitomo Electric Industries, Ltd.

- Fujitsu Limited

Market Report Segmentation

By Type- Direct Attach Copper Cable

- Passive Direct Attach Copper Cable

- Active Direct Attach Copper Cable

- Active Optical Cable

- Networking

- Telecommunications

- Data Storage

- High Performance Computing Centers (HPCs)

- Other End Use

- QSFP

- SFP

- CXP

- Cx4

- CFP

- CDFP

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

Some of the key companies profiled in this Direct Attach Cable Market include:- Cisco Systems, Inc.

- Hitachi, Ltd

- Juniper Networks, Inc.

- Molex, LLC (Koch Industries, Inc.)

- The Siemon Company

- 3M Company

- Broadcom, Inc.

- TE Connectivity Ltd.

- Sumitomo Electric Industries, Ltd.

- Fujitsu Limited