This can be attributed to the high consumer footfall in these large retail outlets, which offer various chocolate syrup brands and flavors at competitive prices. Hypermarkets and supermarkets provide the convenience of one-stop shopping, often featuring promotions or discounts that attract price-conscious consumers. Their ability to stock a broad range of products, including conventional and organic options, ensures that they cater to diverse customer preferences, driving significant sales. Thus, the hypermarkets/supermarkets segment witnessed 44% revenue share in the chocolate syrup market in 2023. In terms of volume 609.18 kilo tonnes of chocolate syrup are expected to be sold by hypermarket/supermarket by 2031.

The versatility of chocolate syrup also contributes to its widespread appeal in various culinary applications. It can be used as a key ingredient in baked goods, such as brownies, cakes, and pastries, adding richness and depth to recipes. Its use extends to home cooking and the food service industry, where it is seen as a go-to ingredient for chefs and bakers looking to quickly and efficiently create crowd-pleasing desserts. Additionally, with the convenience of food delivery apps, consumers now expect restaurant-quality desserts and beverages to be delivered straight to their doorsteps. This has prompted restaurants to innovate and offer more appealing, customizable dessert options, often featuring chocolate syrup, such as chocolate-drenched pancakes, brownies, or personalized sundae kits. Thus, this sector's growth is propelling the market's growth.

However, despite the health benefits of cacao or chocolate, many chocolate syrups use less than 5% of chocolate compounds to render any benefits to the syrup. Moreover, artificial colors and flavors are added to the syrup to treat the lack of color caused by low cacao content. While the FDA approves colors like E150, colors like E154 and E155 are known to have some side effects and, consequently, are not approved by the FDA. Therefore, the presence of high sugar and low cacao in many syrup variants is slowing down the growth of the chocolate syrup market.

Driving and Restraining Factors

Drivers- Rising consumer demand for confectionery products

- Growth of the foodservice industry

- Increasing popularity of DIY beverages and desserts

- Significant disadvantages related to the excessive consumption of chocolate syrup

- Volatility of raw material prices

- Innovations in packaging and product variety

- Increasing demand for chocolate syrup during the festive season

- Competition from substitute products

- Sustainability and ethical sourcing issues

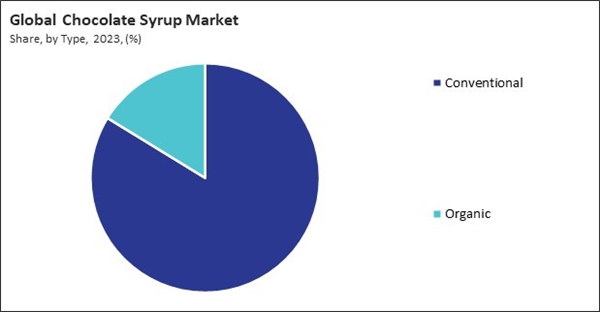

Type Outlook

Based on type, the market is bifurcated into conventional and organic. The organic segment procured 16% revenue share in the market in 2023. In terms of volume, 173.73 kilo tonnes of organic chocolate syrup are expected to be utilized by 2031. As more consumers become conscious of the environmental and ethical implications of their purchasing decisions, organic chocolate syrup is increasingly considered a premium option.Distribution Channel Outlook

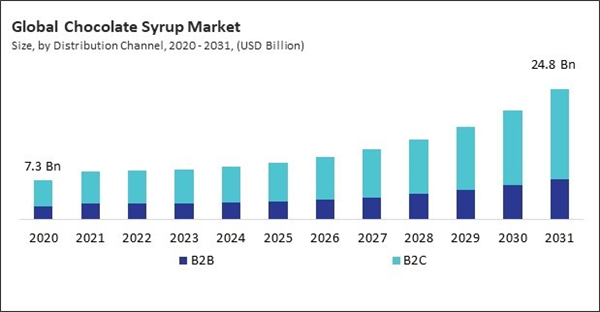

On the basis of distribution channel, the market is classified into B2C and B2B. The B2C segment acquired 68% revenue share in the market in 2023. In terms of volume, 1,463.35 kilo tonnes of chocolate syrup is expected to be sold by hypermarket/supermarket by 2031. The increasing popularity of home cooking, baking, and dessert-making, particularly as consumers seek convenience and indulgent delights at home, can be attributed to this growth.B2C Distribution Channel Outlook

The B2C segment is subdivided into hypermarkets/supermarkets, convenience stores, specialty stores, and online. The convenience stores segment garnered 23% revenue share in the market in 2023. In terms of volume, 345.47 kilo tonnes of chocolate syrup are expected to be sold by convenience stores by 2031 Convenience stores, known for their accessibility and extended hours, appeal to consumers looking for quick, on-the-go purchases.Regional Outlook

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Europe segment acquired 31% revenue share in the market in 2023. Thus, the Europe market is expected to utilize 348.46 kilo tonnes of chocolate syrup by 2031. Europe has a long-standing tradition of chocolate consumption, particularly in countries like Switzerland, Belgium, and Germany, where the demand for high-quality chocolate products remains robust.List of Key Companies Profiled

- Nestle S.A.

- The Hershey Company (Hershey Trust Company)

- The Kroger Co.

- The J.M Smucker Company

- R.Torre & Co. (Torani)

- Bosco Products, Inc.

- Hollander Chocolate, Inc.

- Walden Farms, LLC (PANOS Brands)

- Noushig, Inc. (Amoretti)

- Gold Pure Food Products Co., Inc.

Market Report Segmentation

By Distribution Channel (Volume, Kilo Tonnes, USD Billion, 2020-2031)- B2B

- B2C

- Hypermarkets/Supermarkets

- Convenience stores

- Specialty Stores

- Online

- Conventional

- Organic

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

Some of the key companies profiled in this Chocolate Syrup Market include:- Nestle S.A.

- The Hershey Company (Hershey Trust Company)

- The Kroger Co.

- The J.M Smucker Company

- R. Torre & Co. (Torani)

- Bosco Products, Inc.

- Hollander Chocolate, Inc.

- Walden Farms, LLC (PANOS Brands)

- Noushig, Inc. (Amoretti)

- Gold Pure Food Products Co., Inc.