Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Additionally, there is rising demand for specialized vessels for offshore activities such as oil and gas exploration, renewable energy projects, and maritime defense, prompting conversions to adapt vessels for specific roles. Economic considerations also play a crucial role as shipowners seek cost-effective alternatives to purchasing new vessels. Technological advancements in ship design and retrofitting techniques further support market growth by enabling more complex conversions with reduced downtime and improved safety standards. Geographically, regions with significant maritime activities and offshore industries, such as Asia-Pacific, Europe, and North America, are witnessing substantial investments in ship conversion projects. Overall, the global ship conversion market is poised for expansion as the maritime industry continues to evolve and adapt to emerging regulatory and operational challenges.

Key Market Drivers

Regulatory Compliance and Environmental Standards

One of the primary drivers propelling the global ship conversion market is the stringent regulatory landscape governing maritime operations. As global environmental concerns escalate, regulatory bodies worldwide are imposing strict standards to reduce emissions, improve fuel efficiency, and enhance environmental sustainability in shipping. Older vessels often fail to meet these evolving requirements, necessitating comprehensive conversions to retrofit advanced technologies such as exhaust gas cleaning systems (scrubbers), ballast water treatment systems, and energy-efficient propulsion systems. These conversions not only ensure compliance with international regulations like IMO (International Maritime Organization) conventions but also enhance operational efficiency and reduce the ecological footprint of maritime operations.Regional emissions control areas (ECAs) in places like North America and Europe mandate even stricter emission limits, compelling shipowners to invest in retrofitting existing fleets to avoid penalties and maintain operational licenses. This regulatory pressure drives significant demand for ship conversion services from specialized engineering firms and shipyards capable of implementing complex retrofit projects while minimizing downtime. The continuous evolution of environmental regulations globally ensures a sustained demand for ship conversions aimed at meeting and exceeding stringent compliance standards, thereby driving growth in the ship conversion market.

Technological Advancements and Innovation

Technological advancements play a pivotal role as a driver in the global ship conversion market, facilitating the integration of cutting-edge solutions to enhance vessel performance, safety, and efficiency. Innovations in propulsion systems, digitalization, and automation are transforming the capabilities of converted ships, making them more competitive and adaptable to modern operational demands. For instance, the adoption of LNG (liquefied natural gas) as a cleaner fuel source in place of traditional marine fuels is driving conversions to LNG-powered engines, which require modifications to existing vessels' fuel systems and infrastructure.Advancements in digital twin technology enable ship operators and engineers to simulate and optimize conversion designs before implementation, reducing risks and enhancing project outcomes. Digitalization also supports remote monitoring and predictive maintenance of converted vessels, improving operational reliability and lifecycle management. Furthermore, the integration of smart technologies such as IoT (Internet of Things) sensors and connectivity enhances data-driven decision-making and operational efficiency during and after the conversion process. Innovation extends beyond environmental compliance to include improvements in vessel capabilities for specific operational needs, such as offshore wind farm support, deep-sea exploration, or military applications. As technological innovation continues to accelerate across the maritime sector, the demand for specialized ship conversion services that can leverage these advancements to enhance vessel performance and sustainability will drive further growth in the global ship conversion market.

Aging Fleet Replacement and Modernization

Another significant driver for the global ship conversion market is the aging fleet of vessels worldwide, particularly in sectors such as commercial shipping, offshore oil and gas, and naval fleets. Many existing vessels are reaching the end of their economic lifespan or becoming obsolete due to technological advancements and changing market demands. Shipowners often opt for conversion projects as a cost-effective alternative to purchasing newbuilds, especially in economic downturns or when capital investment is constrained.Ship conversion allows operators to extend the operational life of existing vessels by upgrading them with state-of-the-art equipment, modern amenities, and advanced safety features. This approach not only preserves capital but also leverages existing infrastructure and operational familiarity, reducing the learning curve associated with new vessels. Furthermore, conversions can adapt ships for new roles or operational environments, such as converting bulk carriers into floating production storage and offloading (FPSO) units for offshore oil extraction or repurposing container ships for specialized transport roles.

The trend towards fleet modernization is further bolstered by advancements in conversion techniques and materials that enhance efficiency, reduce fuel consumption, and improve overall performance metrics. Ship conversion projects also create opportunities for shipyards and engineering firms specializing in retrofitting services, stimulating employment and economic activity in maritime regions globally. As the global fleet continues to age and regulatory pressures mount, the demand for strategic fleet renewal through ship conversion is expected to remain robust, driving growth in the market for conversion services.

Flexibility and Adaptability of Converted Vessels

The flexibility and adaptability of converted vessels represent another key driver in the global ship conversion market. Conversions enable shipowners to repurpose existing vessels for niche markets or specific operational requirements quickly and efficiently. For example, the versatility of converted vessels allows them to be deployed in diverse sectors such as offshore wind installation and maintenance, aquaculture support, or cruise ship refurbishments.The ability to modify vessel designs and configurations during conversion projects offers significant advantages over newbuilds, which typically require longer lead times and higher initial capital investments. Shipowners can customize conversions to optimize cargo capacities, install specialized equipment, or enhance passenger accommodations according to market demands and operational preferences. This flexibility is particularly appealing in dynamic industries where rapid adaptation to changing market conditions or regulatory requirements is essential for maintaining competitiveness and profitability.

Converted vessels often benefit from reduced environmental impact compared to newbuilds, as they utilize existing hulls and infrastructure, thereby minimizing material consumption and waste generation. This sustainability aspect aligns with growing corporate social responsibility initiatives and environmental stewardship goals across the maritime sector, further driving demand for conversion projects that enhance operational efficiency while reducing carbon footprints. Overall, the inherent flexibility and adaptability of converted vessels position them as strategic assets for shipowners seeking agile solutions to meet evolving market demands and operational challenges. As industries continue to diversify and expand, the market for versatile and customized ship conversion solutions is expected to grow, supported by innovations in design, technology, and operational management practices.

Key Market Challenges

High Initial Investment Costs

One of the primary challenges facing the global ship conversion market is the high initial investment costs associated with retrofitting existing vessels. Converting a ship involves significant expenditures for engineering design, equipment procurement, labor-intensive modifications, and potential dry-docking expenses. Compared to building new vessels, where costs can be estimated upfront and financed through structured loans, ship conversions often present greater financial uncertainties and variability in project budgets. The complexity of ship conversion projects further compounds cost considerations. Each vessel may require unique modifications depending on its size, age, and intended operational upgrades.For example, converting older vessels to comply with stringent environmental regulations, such as installing exhaust gas cleaning systems (scrubbers) or ballast water treatment systems, involves substantial engineering and retrofitting efforts. These technological upgrades not only require specialized equipment but also entail integration with existing ship systems, posing technical challenges and cost escalations if unforeseen complications arise during the conversion process. The availability and cost of skilled labor and specialized expertise can impact project timelines and budgets. Shipyards and engineering firms capable of performing complex conversions may have limited capacity or face resource constraints, potentially leading to project delays and additional costs. In regions with stringent regulatory requirements or high labor costs, such as Europe or North America, these challenges are particularly pronounced, influencing the feasibility and profitability of ship conversion projects.

Regulatory Compliance and Certification

Navigating regulatory compliance and obtaining necessary certifications represent significant challenges for participants in the global ship conversion market. Maritime regulations governing vessel modifications are stringent and constantly evolving, requiring shipowners and operators to ensure that converted vessels meet current safety, environmental, and operational standards set by international maritime organizations and national authorities.The complexity of regulatory compliance varies depending on the type of conversion and the intended operational use of the vessel. Converting ships for offshore oil and gas operations, for instance, involves adherence to strict safety and operational guidelines imposed by regulatory bodies such as the Offshore Petroleum Regulator for Environment and Decommissioning (OPRED) in the UK or the Bureau of Safety and Environmental Enforcement (BSEE) in the US. Compliance with environmental regulations, including emissions limits and wastewater discharge standards, adds another layer of complexity to conversion projects, requiring thorough planning and documentation to obtain necessary approvals.

Obtaining classification society approvals and certifications for converted vessels is critical for ensuring seaworthiness and operational integrity. Classification societies such as Lloyd's Register, DNV GL, and ABS impose rigorous standards for structural modifications, equipment installations, and operational procedures during conversions. Achieving compliance and certification involves rigorous inspections, tests, and documentation reviews, which can prolong project timelines and increase administrative burdens. The dynamic nature of regulatory requirements, coupled with the global nature of the shipping industry, presents ongoing challenges for stakeholders in the ship conversion market. Shipowners must stay abreast of regulatory updates and invest in compliance strategies to mitigate risks and ensure successful project outcomes. Collaboration with experienced maritime consultants and classification societies is essential for navigating regulatory complexities and securing necessary approvals throughout the conversion process.

Technical Complexity and Integration Risks

The technical complexity and integration risks associated with ship conversion projects present significant challenges for stakeholders in the global market. Converting existing vessels involves integrating new technologies, systems, and equipment into often aging infrastructure, which can pose compatibility issues and operational risks if not managed effectively. One of the primary technical challenges in ship conversions is ensuring seamless integration of new equipment with existing ship systems. This includes retrofitting advanced propulsion systems, upgrading electrical and mechanical systems, and installing complex environmental control technologies. Each vessel presents unique design and engineering considerations based on its original build specifications, maintenance history, and structural integrity, requiring customized solutions and meticulous planning to achieve optimal performance and reliability post-conversion.The technical complexity extends to ensuring compliance with safety standards and operational protocols. Modifications to vessel structures or systems during conversion must adhere to classification society rules, regulatory guidelines, and industry best practices to maintain vessel integrity and operational safety. Failure to address technical challenges adequately can result in operational disruptions, safety incidents, or costly retrofits post-conversion. Another critical aspect of technical complexity is managing project timelines and minimizing downtime during conversion. Shipowners and operators often face pressure to complete conversions within tight schedules to resume commercial operations or meet contractual obligations. Delays in procurement, engineering design changes, or unforeseen technical issues can impact project timelines and escalate costs, underscoring the importance of robust project management and risk mitigation strategies throughout the conversion process.

Market Volatility and Economic Uncertainty

Market volatility and economic uncertainty present ongoing challenges for stakeholders in the global ship conversion market. Fluctuations in oil prices, geopolitical tensions, trade policies, and economic downturns can influence shipping demand, vessel utilization rates, and investment decisions related to fleet modernization and retrofitting. During periods of economic downturns or reduced shipping activity, shipowners may delay or scale back conversion projects to conserve capital or prioritize essential operational expenditures. This cyclicality in market demand can lead to fluctuations in demand for conversion services, affecting the capacity utilization of shipyards and engineering firms specializing in retrofitting.Uncertainties surrounding future regulatory changes and environmental policies can influence investment decisions in ship conversions. Rapidly evolving environmental regulations, such as emissions controls and fuel efficiency standards, require continuous adaptation and investment in new technologies and compliance measures. The uncertainty surrounding future regulatory landscapes can impact long-term planning and investment strategies for ship conversions, as stakeholders assess potential risks and opportunities associated with regulatory compliance. Competition within the ship conversion market can intensify during periods of economic uncertainty, as shipyards and service providers vie for a limited number of conversion projects. Pricing pressures and margin constraints may arise as stakeholders seek to secure contracts amidst fluctuating market conditions and competitive dynamics.

Key Market Trends

Increasing Demand for Eco-friendly Conversions

A prominent trend in the global ship conversion market is the rising demand for eco-friendly conversions that enhance vessel sustainability and compliance with stringent environmental regulations. With growing awareness of climate change and environmental impacts, shipowners and operators are increasingly prioritizing green initiatives to reduce emissions and improve fuel efficiency. Eco-friendly conversions often involve retrofitting vessels with technologies such as exhaust gas cleaning systems (scrubbers), LNG propulsion systems, and ballast water treatment systems to meet international standards like IMO's MARPOL Annex VI.The push towards eco-friendly conversions is driven by regulatory mandates that aim to curb air and water pollution from maritime activities. Regulations such as the IMO's sulfur cap regulations for marine fuels and Emission Control Areas (ECAs) enforce strict limits on sulfur emissions and other pollutants, prompting shipowners to invest in retrofitting older vessels to comply with these standards. Additionally, market pressures from stakeholders including investors, customers, and regulatory bodies are incentivizing the adoption of sustainable practices in the maritime industry. This trend is reshaping the ship conversion market, driving innovation in green technologies and creating opportunities for engineering firms and shipyards specializing in environmentally friendly retrofitting solutions.

Rise of Offshore Wind Farm Support Vessels

Another significant trend in the global ship conversion market is the increasing demand for offshore wind farm support vessels (OSVs). As the renewable energy sector expands globally, there is a growing need for specialized vessels to support offshore wind farm operations, including installation, maintenance, and servicing of wind turbines. Ship conversions play a crucial role in repurposing existing vessels, such as offshore supply vessels (OSVs) or multipurpose platforms, into dedicated OSVs equipped with dynamic positioning systems, crane capacities, and accommodation facilities tailored to offshore wind industry requirements.The trend towards OSV conversions is driven by the rapid growth of offshore wind energy installations, particularly in regions like Europe, North America, and Asia-Pacific. Governments and energy companies are investing heavily in offshore wind projects to meet renewable energy targets and reduce dependence on fossil fuels, creating a robust market for converted vessels that can support these operations efficiently and cost-effectively. Converting existing vessels for offshore wind farm support offers advantages in terms of cost savings and shorter project lead times compared to building new specialized vessels from scratch.

Technological advancements in OSV conversions are enhancing operational capabilities and safety standards, making converted vessels increasingly attractive for offshore wind developers and operators. The versatility of converted OSVs allows them to perform multiple functions within the offshore wind sector, from transporting personnel and equipment to conducting maintenance and repair tasks offshore. As the offshore wind industry continues to mature and expand into new markets, the demand for purpose-built OSVs through ship conversions is expected to grow, presenting opportunities for stakeholders in the ship conversion market to capitalize on this emerging trend.

Integration of Digitalization and Smart Technologies

The integration of digitalization and smart technologies is transforming the landscape of the global ship conversion market. Increasingly, shipowners and operators are leveraging digital solutions and IoT (Internet of Things) capabilities to enhance the efficiency, safety, and performance of converted vessels. Digitalization in ship conversions encompasses a range of technologies, including digital twins for virtual modeling and simulation of conversion designs, IoT sensors for real-time monitoring of vessel systems and environmental conditions, and data analytics for predictive maintenance and operational optimization.Digital twins enable engineers and operators to visualize and simulate various conversion scenarios, allowing for iterative design improvements and risk mitigation before physical modifications begin. This technology minimizes uncertainties and reduces the potential for costly errors during the conversion process, enhancing project outcomes and operational reliability post-conversion. IoT-enabled sensors and connectivity further enable remote monitoring and control of critical systems onboard converted vessels, providing real-time insights into performance metrics, fuel consumption, and environmental impacts.

Moreover, the adoption of smart technologies in ship conversions enhances operational safety and crew welfare by automating routine tasks, improving situational awareness, and enabling faster response to emergencies. Advanced automation systems and autonomous capabilities are being integrated into converted vessels to optimize energy use, maneuverability, and operational efficiency, thereby reducing operational costs and enhancing competitiveness in the maritime industry. As digitalization continues to advance across the maritime sector, the demand for integrated digital solutions in ship conversions is expected to grow. Shipyards and engineering firms specializing in digital transformation and smart technologies are well-positioned to capitalize on this trend by offering innovative solutions that streamline conversion processes, improve operational efficiencies, and deliver sustainable performance benefits to shipowners and operators.

Focus on Passenger Vessel Refurbishments

There is a noticeable trend towards refurbishing and upgrading passenger vessels in the global ship conversion market. As the cruise and ferry industries recover from disruptions caused by the COVID-19 pandemic, shipowners are investing in refurbishment projects to enhance passenger comfort, safety, and onboard amenities. Refurbishments typically involve modernizing cabin interiors, upgrading entertainment facilities, installing energy-efficient lighting and HVAC systems, and implementing enhanced sanitation measures to meet evolving health and safety standards.The focus on passenger vessel refurbishments is driven by the growing demand for unique travel experiences and premium onboard services among cruise and ferry passengers. Ship conversions enable operators to differentiate their offerings in a competitive market by providing modern, luxurious, and environmentally sustainable cruise experiences. Converting older vessels into state-of-the-art passenger ships equipped with advanced technology, entertainment options, and sustainable practices appeals to environmentally conscious travelers seeking memorable and socially responsible vacation experiences. Refurbishing existing passenger vessels allows shipowners to extend the operational lifespan of their fleets while maintaining compliance with international safety and environmental regulations. By investing in refurbishment projects, operators can enhance the attractiveness and marketability of their vessels, attract new customer segments, and achieve higher occupancy rates and revenue generation potential.

Segmental Insights

Vessel Type Insights

The segment of Offshore Vessels dominated the global ship conversion market and is poised to maintain its dominance during the forecast period. Offshore vessels encompass a diverse range of ships converted for specialized roles in offshore industries such as oil and gas, renewable energy, and maritime infrastructure projects. The dominance of offshore vessels in the conversion market is driven by increasing investments in offshore wind farms, oil and gas exploration, and marine construction activities worldwide.Ship conversions for offshore purposes often involve repurposing existing vessels, such as offshore supply vessels (OSVs) or platform supply vessels (PSVs), to meet specific operational requirements including dynamic positioning capabilities, accommodation for offshore personnel, and heavy-lift crane installations. These conversions enable operators to enhance the versatility and operational efficiency of vessels while minimizing costs compared to building new specialized ships.

Moreover, technological advancements in offshore vessel conversions, including the integration of advanced navigation systems, environmental control technologies, and safety enhancements, further bolster their appeal in demanding offshore environments. As offshore industries continue to expand and evolve, driven by regulatory mandates for renewable energy adoption and infrastructure development, the demand for converted offshore vessels is expected to grow steadily. This trend positions offshore vessels as a key segment driving growth and innovation in the global ship conversion market, supported by ongoing investments in sustainable energy solutions and offshore logistics infrastructure globally.

Regional Insights

Asia-Pacific region dominated the global ship conversion market and is anticipated to maintain its dominance during the forecast period. Asia-Pacific's dominance in the ship conversion market is driven by several key factors. Firstly, the region hosts a significant share of the global shipbuilding and repair industry, with established shipyards and engineering firms capable of handling complex conversion projects. Countries such as China, South Korea, and Singapore are renowned for their expertise in shipbuilding and have expanded their capabilities to include sophisticated conversion services for both commercial and military vessels.Rapid industrialization and economic growth in Asia-Pacific have spurred demand for converted vessels across diverse sectors including offshore oil and gas, shipping logistics, and marine infrastructure development. The region's strategic location along major shipping routes and its proximity to emerging markets further bolster its position as a hub for ship conversion activities. Government initiatives and investments in infrastructure development, particularly in renewable energy and offshore wind farms, drive demand for specialized offshore vessels and platforms converted from existing fleets. These initiatives align with global trends towards sustainable energy solutions and environmental stewardship, reinforcing Asia-Pacific's role in supporting green technologies through ship conversion projects.

Asia-Pacific benefits from a skilled labor force and competitive operational costs, making it an attractive destination for shipowners seeking cost-effective and efficient conversion services. The region's ability to offer a wide range of conversion capabilities, from basic refurbishments to complex modernizations and life extensions, positions it favorably in the global market. Asia-Pacific is expected to continue dominating the ship conversion market as it expands its capabilities in digitalization, smart technologies, and eco-friendly solutions. Investments in infrastructure and port facilities further support the region's growth trajectory, enabling it to meet rising demand for converted vessels and maintain its leadership position in the global maritime industry.

Key Market Players

- Damen Shipyards Group

- Seatrium Limited

- COSCO Shipyard Group Co., Ltd.

- China Shipbuilding Industry Corporation

- Fincantieri S.p.A.

- Navantia S.A.

- BAE Systems plc

- Detyens Shipyards, Inc.

- Singapore Technologies Engineering Ltd

- Gulf Island Fabrication, Inc.

Report Scope:

In this report, the Global Ship Conversion Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Ship Conversion Market, By Vessel Type:

- Container Vessels

- Tankers

- Bulk Carriers

- Ferries & Passenger Ships

- Offshore Vessels

- Naval Vessels

- Others

Ship Conversion Market, By Services:

- Conversion

- Repair

- Maintenance

- Refurbishment

- Modernization

- Life Extension

- Others

Ship Conversion Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Belgium

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Vietnam

- South America

- Brazil

- Argentina

- Colombia

- Chile

- Peru

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Turkey

- Israel

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Ship Conversion Market.Available Customizations:

Global Ship Conversion market report with the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

Some of the key companies profiled in this Ship Conversion Market report include:- Damen Shipyards Group

- Seatrium Limited

- COSCO Shipyard Group Co., Ltd.

- China Shipbuilding Industry Corporation

- Fincantieri S.p.A.

- Navantia S.A.

- BAE Systems plc

- Detyens Shipyards, Inc.

- Singapore Technologies Engineering Ltd

- Gulf Island Fabrication, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 181 |

| Published | October 2024 |

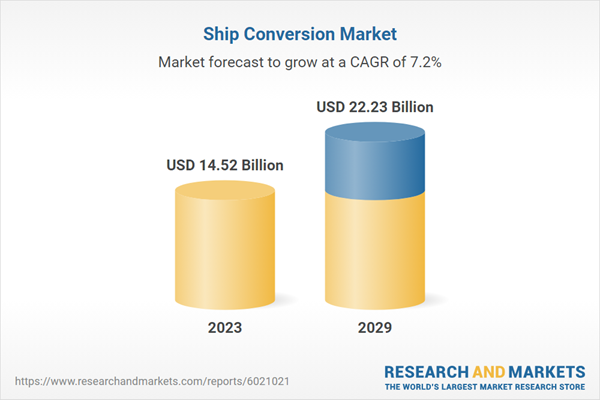

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 14.52 Billion |

| Forecasted Market Value ( USD | $ 22.23 Billion |

| Compound Annual Growth Rate | 7.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |