Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

However, a major obstacle hindering market expansion is the high levelized cost of producing renewable hydrogen relative to established fossil fuel alternatives. This economic gap is largely intensified by the significant initial capital expenditure necessary for deployment and the prevailing costs of renewable electricity inputs, which restrict adoption in sectors sensitive to price fluctuations. Consequently, while the commitment to growth is strong, the financial disparity between renewable and traditional energy carriers remains a critical hurdle that must be addressed to facilitate broader implementation across various industries.

Market Drivers

The deployment of electrolyzers is being substantially accelerated by rising global demand for green hydrogen within hard-to-abate industries. Sectors such as steel manufacturing, chemical refining, and heavy transport are actively substituting fossil-fuel-based feedstocks with low-emission hydrogen to adhere to sustainability goals, necessitating a direct increase in electrolysis capacity to ensure reliable fuel supplies. According to the International Energy Agency's 'Global Hydrogen Review 2024' published in October 2024, the global installed capacity of electrolyzers is anticipated to hit 5 GW by the end of the year, driven largely by these industrial applications. This physical infrastructure expansion highlights the pivotal role electrolyzers play in moving energy-intensive sectors toward carbon neutrality.Market momentum is further sustained by the enactment of supportive government policies and decarbonization mandates designed to bridge the cost differential between renewable and fossil-based hydrogen. Governments are utilizing financial mechanisms, including competitive auctions and tax credits, to subsidize the substantial upfront capital costs linked to electrolyzer plants. For instance, the European Commission's 'Innovation Fund 2023 Auction results' in April 2024 reported the awarding of nearly €720 million to seven renewable hydrogen projects to aid production scaling. These fiscal interventions mitigate investment risks and stimulate private sector engagement, contributing to a global pipeline of over 1,400 announced hydrogen projects in 2024, as noted by the Hydrogen Council.

Market Challenges

A primary restraint on the Global Electrolyzers Market is the significant economic disparity between the costs of producing renewable hydrogen and those of established fossil fuel alternatives. The high levelized cost of hydrogen complicates the business case for potential industrial off-takers, who often operate with tight margins and cannot absorb the price premium attached to electrolytic hydrogen. Consequently, even with available technology, numerous planned projects encounter difficulties in securing the long-term offtake agreements that are essential for financing the massive upfront capital expenditures required for deployment.This cost barrier directly affects market velocity by restricting adoption mainly to heavily subsidized regions or niche applications. According to the Hydrogen Council in 2024, the estimated production cost for renewable hydrogen increased to a range of 4.5 to 6.5 US dollars per kilogram, attributed to higher interest rates and supply chain expenses. Because this price point is significantly higher than that of conventional grey hydrogen, the market is experiencing a slowdown in converting project announcements into active capacity, as high operational and capital costs make unsubsidized projects commercially unviable.

Market Trends

The Global Electrolyzers Market is undergoing a structural disruption fueled by the rapid expansion of cost-competitive Chinese original equipment manufacturers (OEMs), who are actively reshaping the supply chain hierarchy. By leveraging established domestic supply networks and immense production volumes, these manufacturers offer electrolysis stacks at prices far below those of Western competitors, allowing them to aggressively capture market share in price-sensitive regions. This geographical consolidation is highlighted in the 'Global Hydrogen Review 2024' by the International Energy Agency, which notes that China now hosts 60% of global electrolyzer manufacturing capacity. This dominance places intensifying competitive pressure on European and North American suppliers to expedite their own cost-reduction strategies.Simultaneously, the industry is navigating a critical transition from manual, workshop-based assembly to the creation of automated, gigawatt-scale manufacturing plants aimed at achieving necessary economies of scale. Technology developers are heavily investing in standardized, high-throughput production lines that employ robotics and digital quality control to decrease capital expenditure per kilowatt of installed capacity. This industrialization is vital for meeting the volume demands of large-scale industrial off-takers and resolving supply bottlenecks that have historically slowed project execution. As reported by the Hydrogen Council in 'Hydrogen Insights 2024' in September 2024, global electrolyzer manufacturing capacity has grown to nearly 17 GW, signaling a rapid sector shift toward mass-production facilities to support the increasing pipeline of gigawatt-scale projects.

Key Players Profiled in the Electrolyzers Market

- Cummins Inc.

- Siemens AG

- ITM Power PLC

- Plug Power Inc.

- Green Hydrogen Systems A/S

- McPhy Energy

- Sungrow Power Supply Co., Ltd.

- Ballard Power Systems Inc.

- Hitachi Zosen Inova AG

- Enapter S.r.l

Report Scope

In this report, the Global Electrolyzers Market has been segmented into the following categories:Electrolyzers Market, by Type:

- PEM Electrolyzer

- Alkaline Electrolyzer

- Solid Oxide Electrolyzer

Electrolyzers Market, by Capacity:

- ≤ 500 kW

- 500 kW - 2 MW

- Above 2 MW

Electrolyzers Market, by Application:

- Steel Plant

- Power Plants

- Electronics & Photovoltaics

- Energy Storage For Fuel Cells

- Industrial Gases

- Power To Gas

- Others

Electrolyzers Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Electrolyzers Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Electrolyzers market report include:- Cummins Inc.

- Siemens AG

- ITM Power PLC

- Plug Power Inc.

- Green Hydrogen Systems A/S

- McPhy Energy

- Sungrow Power Supply Co., Ltd.

- Ballard Power Systems Inc.

- Hitachi Zosen Inova AG

- Enapter S.r.l

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 182 |

| Published | January 2026 |

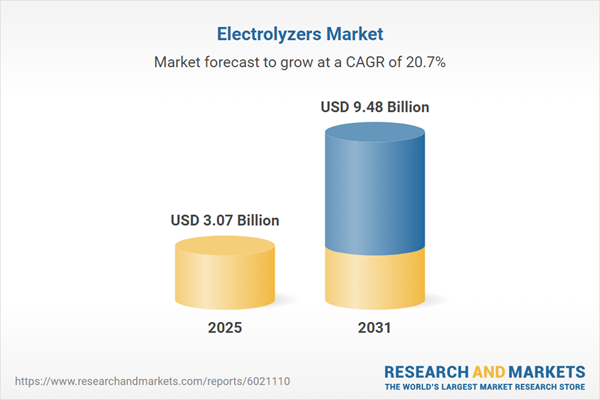

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 3.07 Billion |

| Forecasted Market Value ( USD | $ 9.48 Billion |

| Compound Annual Growth Rate | 20.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |