Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The escalating volume of unstructured data across enterprises underscores the need for scalable, reliable, and secure storage architectures, particularly in light of global IoT proliferation, which further amplifies edge-generated data. SDS addresses these challenges by enhancing deployment flexibility and allowing organizations to utilize software across various storage platforms through a unified interface. Enterprises and IT entities undergoing digital transformation are increasingly inclined towards SDS adoption due to its advantages over traditional storage methods. However, challenges such as the scarcity of skilled operators for SDS deployment and lingering security concerns are anticipated to impede market growth.

Key Market Drivers

Automation and Simplification

Automation and simplification are poised to be powerful drivers of the global Software-Defined Storage (SDS) market. In a data-centric world characterized by exploding data volumes and increasingly complex storage needs, automation and simplification offer a compelling solution to the challenges faced by organizations. Automation within SDS streamlines the management of storage resources, reducing the administrative burden and enhancing operational efficiency. Tasks such as provisioning, data replication, and load balancing can be automated, minimizing the risk of human error and ensuring that storage operations run smoothly. This not only saves time but also optimizes resource utilization, ultimately leading to cost savings.Automation is critical in ensuring data consistency and integrity. It enables rapid data backup, recovery, and disaster mitigation, which is vital for business continuity. By automating these processes, organizations can minimize downtime and data loss, bolstering their resilience in the face of unforeseen disruptions. Simplification, on the other hand, makes the adoption and management of SDS more accessible to a broader range of organizations. SDS abstracts the complexities of underlying hardware, making storage resources easier to configure and manage. Through a unified interface, IT administrators can oversee storage across various hardware platforms, leading to a more streamlined and user-friendly experience.

The integration of self-service portals and policy-based management simplifies storage provisioning, enabling various departments within an organization to request and allocate storage resources as needed, without needing in-depth storage expertise. This democratization of storage management empowers organizations to be more agile in responding to changing business requirements. Automation and simplification, when combined, create a potent synergy that drives the adoption of SDS. They enable organizations to focus on strategic initiatives rather than routine maintenance tasks, and they reduce the barrier to entry for those looking to implement SDS solutions. As businesses seek greater agility, cost-efficiency, and operational resilience, automation and simplification in SDS will continue to be central factors propelling the growth of the global SDS market.

Disaster Recovery and High Availability

Disaster recovery (DR) and high availability (HA) capabilities are poised to be significant drivers of the global Software-Defined Storage (SDS) market. In an era where data is the lifeblood of businesses and any downtime can result in substantial financial losses and damage to reputation, the need for robust DR and HA solutions has never been greater.SDS offers advanced DR and HA features that are crucial for ensuring business continuity and data integrity. These capabilities are central to the SDS market for several reasons. SDS allows for data replication and snapshotting across different locations, whether on-premises or in the cloud. This ensures that data remains accessible and unharmed even in the event of system failures, natural disasters, or cyberattacks. SDS enables the creation of geographically dispersed data copies, enhancing data resilience.

The automation and orchestration capabilities of SDS play a vital role in disaster recovery and high availability. SDS can detect failures and trigger automated failover processes, minimizing downtime and ensuring uninterrupted access to critical data. This automated failover and failback reduce the need for manual intervention and decrease the risk of human error. Thirdly, the scalability and flexibility of SDS are essential for high availability. SDS allows organizations to easily scale their storage resources up or down to meet changing demand. This adaptability is especially valuable in maintaining performance during traffic spikes or equipment failures.

Moreover, SDS solutions often offer integration with cloud services, which can act as off-site backups and additional disaster recovery sites. This flexibility in deployment options gives organizations peace of mind, knowing that their data is secure and accessible even in the face of catastrophic events. In today's hyper-connected and data-driven business landscape, downtime is not an option. DR and HA are critical for maintaining data integrity and operational continuity. SDS, with its automation, replication, and scalability, provides a comprehensive solution to these challenges, making it a pivotal driver of the global SDS market. As businesses prioritize resilience and seek to mitigate the risks associated with data loss and downtime, the demand for SDS solutions with robust disaster recovery and high availability features will continue to grow.

Key Market Challenges

Lack of Standardization

The lack of standardization within the global Software-Defined Storage (SDS) market poses a significant hurdle to its widespread adoption and growth. The absence of universally accepted standards and interoperability protocols can hamper the seamless integration of SDS solutions into diverse IT environments, affecting the market in several ways. Interoperability Challenges: The absence of standardized interfaces and communication protocols makes it difficult for different SDS solutions to work together seamlessly. This complicates the integration of SDS with existing storage infrastructure and can lead to compatibility issues, making it a time-consuming and costly endeavor.Vendor Lock-In: Without standardized interfaces, some SDS solutions may introduce proprietary technologies that lock organizations into specific vendors. This can limit flexibility and hinder the ability to switch between providers or adopt a multi-vendor approach, ultimately reducing market competitiveness and choice. Complex Decision-Making: Organizations looking to implement SDS solutions are often faced with a bewildering array of options, each with its own proprietary standards and interfaces. This complexity can make it challenging for decision-makers to choose the right SDS solution that aligns with their existing infrastructure and long-term goals.

Integration Costs: The lack of standardization can lead to higher integration costs. Organizations may need to invest more in custom development or third-party tools to bridge the gap between different SDS solutions and their existing systems, adding to the overall expense of SDS adoption. Security and Compliance Risks: The absence of standardized security and compliance measures can introduce risks to data integrity and privacy. It can be challenging for organizations to ensure that their SDS solutions meet the necessary regulatory requirements without clear industry standards.

Complex Data Management: Managing data across multiple SDS solutions with varying standards can be complex and time-consuming. This can lead to inefficiencies, data inconsistencies, and difficulties in maintaining a comprehensive view of data assets. Slower Market Growth: The lack of standardization can slow down the growth of the SDS market by causing hesitation among organizations that are concerned about potential issues with integration, data portability, and long-term vendor dependencies.

To address the standardization challenge and drive the global SDS market forward, industry stakeholders should work toward establishing and adopting common standards for SDS interfaces, protocols, and management. These standards would enable greater interoperability, reduce vendor lock-in, and enhance overall market competitiveness. While progress has been made in the development of standards for SDS, such as the Storage Management Initiative Specification (SMI-S) from the Storage Networking Industry Association (SNIA), further efforts are needed to establish universally accepted standards that encourage broader adoption and a more streamlined SDS market ecosystem. These standards can unlock the full potential of SDS by offering organizations the confidence, flexibility, and cost-efficiency they need to embrace software-defined storage solutions more readily.

Cost Concerns

Cost concerns are a significant challenge that can potentially hamper the growth of the global Software-Defined Storage (SDS) market. While SDS offers various advantages, including flexibility and efficiency, there are several cost-related issues that organizations must grapple with when considering the adoption of SDS solutions. Initial Investment: Implementing an SDS infrastructure often requires a substantial upfront investment. This includes costs for new hardware, software licenses, and sometimes specialized skill development for IT staff. These initial expenses can be daunting for organizations, particularly small and mid-sized enterprises with limited budgets.Total Cost of Ownership (TCO): Although SDS is marketed as a cost-effective storage solution, the total cost of ownership can vary widely based on factors like hardware selection, licensing, and ongoing operational costs. Organizations need to carefully manage and plan their SDS deployment to ensure that it remains cost-effective over the long term. Training and Expertise: SDS solutions may demand a certain level of expertise for installation, configuration, and management. Investing in staff training or hiring experienced professionals can add to the overall cost of SDS adoption.

Scalability Costs: While SDS can provide scalability, organizations may need to invest in additional hardware and software as their storage needs grow. Scaling up an SDS environment can lead to increased costs, especially if not done efficiently. Data Migration Expenses: Moving data from existing storage systems to SDS can be costly and time-consuming. Data migration projects often require specialized tools and expertise, which can add to the overall cost.

Risk of Overprovisioning: In an attempt to ensure that they have sufficient storage resources available, organizations may overprovision their SDS environment. This results in underutilized resources and unnecessary expenses.

Maintenance and Support: Ongoing maintenance, support, and updates for SDS solutions can contribute to operational expenses. Organizations must factor in these costs to ensure the reliability and performance of their SDS environment. Vendor Lock-In: To reduce initial costs, organizations might opt for SDS solutions with proprietary technologies, which can lead to vendor lock-in. Breaking free from vendor dependencies in the future can be expensive and challenging.

To mitigate these cost concerns and promote the growth of the SDS market, it is crucial for organizations to conduct a thorough cost-benefit analysis. They should evaluate their specific storage needs, potential ROI, and long-term TCO. Additionally, vendors and the industry as a whole should focus on providing more transparent pricing models and options for cost-effective SDS deployment, such as open-source solutions and pay-as-you-go licensing models. Balancing the potential benefits of SDS with the associated costs is essential for making informed decisions regarding SDS adoption. As the technology continues to mature and evolve, addressing these cost challenges will be pivotal in ensuring that SDS remains an accessible and attractive storage solution for a wide range of organizations.

Data Security and Privacy

Data security and privacy concerns pose a substantial challenge that can potentially hinder the growth of the global Software-Defined Storage (SDS) market. As organizations increasingly rely on SDS to manage their data, they must address several critical issues related to the protection and privacy of sensitive information. Data Vulnerabilities: The flexibility of SDS in managing data across various environments, including on-premises and the cloud, can create new vulnerabilities. Organizations need to safeguard data against unauthorized access, data breaches, and cyber threats, which are often evolving and sophisticated. Regulatory Compliance: Organizations must comply with a multitude of data protection regulations and privacy laws, such as GDPR, HIPAA, and CCPA. Adhering to these complex, and at times, conflicting regulations within SDS environments can be challenging, as it requires the development of robust compliance strategies and tools.Encryption Challenges: Encrypting data at rest and in transit is crucial for data security. SDS solutions must support strong encryption mechanisms, but implementing and managing encryption can be complex, and misconfigurations may lead to data exposure. Data Residency and Jurisdiction: In the context of cloud-based SDS, data residency and jurisdiction issues arise. Organizations need to ensure that they have control over where their data is stored to comply with regional data sovereignty laws, potentially leading to complexities in SDS deployment. Identity and Access Management: SDS environments need to implement robust identity and access management controls to prevent unauthorized access to data. Inadequate access control mechanisms can result in data leaks and breaches.

Data Portability and Migration: Moving data within or outside of SDS solutions requires proper security measures to maintain data integrity. Data portability and migration should not compromise security and privacy, which can pose a challenge in heterogeneous SDS environments. Data Retention and Deletion: Proper management of data lifecycle, including secure data deletion, is essential for maintaining privacy and compliance. SDS solutions must have mechanisms for safe data disposal, which can be technically challenging to implement. Security Expertise: Implementing and maintaining SDS security practices requires specialized knowledge and expertise. Organizations may face a shortage of cybersecurity professionals, adding to the challenge of ensuring robust data security and privacy.

To overcome these challenges and foster the growth of the SDS market, organizations need to take a proactive approach to data security and privacy. This includes investing in advanced security measures, encryption technologies, and robust access controls. Additionally, collaborating with vendors to develop SDS solutions that prioritize security and compliance can help alleviate concerns. As data breaches and privacy violations continue to make headlines, ensuring data security and privacy within SDS environments is not only a legal requirement but also a critical component of maintaining trust and confidence among customers and partners. Addressing these concerns will be pivotal in the continued expansion of the SDS market.

Key Market Trends

Hybrid and Multi-Cloud Integration

The integration of hybrid and multi-cloud solutions is poised to drive significant growth in the global Software-Defined Storage (SDS) market. As organizations seek to leverage the advantages of both on-premises and cloud-based storage resources, SDS solutions are adapting to facilitate seamless hybrid and multi-cloud integration. Hybrid and multi-cloud integration is essential for several reasons. It enables organizations to match specific workloads with the most appropriate storage environment, optimizing performance and cost-efficiency. SDS solutions that seamlessly connect on-premises infrastructure with public and private cloud platforms provide flexibility in managing data across diverse environments.The trend toward data mobility and accessibility is being supported by hybrid and multi-cloud integration. SDS solutions allow organizations to move data and workloads easily between on-premises infrastructure and various cloud services, ensuring data is where it's needed when it's needed. Furthermore, businesses are recognizing the need for disaster recovery and business continuity solutions. SDS supports the creation of geographically dispersed data copies across different cloud providers, enhancing data resilience and minimizing downtime in the event of system failures or disasters.

In addition, the growth of edge computing and IoT applications is driving the need for distributed data storage. SDS solutions that can seamlessly extend to edge locations and integrate with cloud platforms enable organizations to manage data closer to the source, reducing latency and improving real-time data processing. The integration of hybrid and multi-cloud solutions into SDS not only addresses the evolving needs of businesses but also ensures the flexibility, scalability, and agility required in today's dynamic IT landscape. As organizations continue to seek a balance between on-premises and cloud-based storage resources, the ability of SDS to facilitate this integration will be a key driver in the ongoing growth of the global SDS market.

AI and Machine Learning Integration

The integration of artificial intelligence (AI) and machine learning (ML) technologies is set to be a driving force in the global Software-Defined Storage (SDS) market. As organizations grapple with the increasing complexity and volume of data, AI and ML offer transformative capabilities that enhance the efficiency, performance, and intelligence of SDS solutions. AI and ML can optimize SDS in several ways. These technologies enable predictive analytics, which help in making intelligent decisions regarding data placement, resource allocation, and capacity management. Automated data tiering based on usage patterns and workloads ensures that critical data is stored in high-performance storage while less-used data is moved to cost-effective, lower-tier storage, saving costs.AI and ML empower SDS solutions to detect and mitigate potential issues proactively. Anomalies and performance bottlenecks can be identified and resolved in real-time, reducing downtime and ensuring high availability. Security is also bolstered by AI-driven threat detection and response mechanisms. AI algorithms can identify unusual access patterns and behaviors that might signify security breaches, enhancing data protection in the SDS environment. As organizations continue to leverage SDS for its scalability and flexibility, the integration of AI and ML not only improves operational efficiency but also provides a competitive edge. The ability to harness insights from data for better decision-making, automate tedious tasks, and enhance security positions AI and ML as catalysts for the ongoing growth and advancement of the global SDS market.

Segmental Insights

End-user Industries Insights

BFSI held the largest share for Global Software-Defined Storage market in 2023, driven by the sector's critical need for data management, security, and operational efficiency. The BFSI industry's reliance on vast amounts of data for daily operations, customer transactions, compliance requirements, and financial analyses necessitates robust and scalable storage solutions. SDS provides a flexible, cost-effective alternative to traditional storage systems, allowing financial institutions to manage and scale their storage infrastructure dynamically.One of the primary reasons for SDS adoption in the BFSI sector is the growing volume of data generated by digital banking, mobile transactions, and online financial services. As customers increasingly prefer digital interactions, the data generated from these activities must be stored, processed, and accessed efficiently. SDS enables financial institutions to handle this data surge effectively by decoupling storage hardware from software, providing better data management, scalability, and reduced costs.

Security and compliance are paramount concerns for the BFSI sector. Financial institutions must adhere to stringent regulations such as GDPR, PCI-DSS, and other regional data protection laws. SDS solutions offer enhanced security features, including encryption, access controls, and automated compliance reporting, ensuring that data management practices meet regulatory requirements. This capability is crucial for maintaining customer trust and avoiding regulatory penalties.

Operational efficiency and cost reduction are also significant drivers for SDS adoption in BFSI. Traditional storage solutions can be expensive and inflexible, leading to higher operational costs and inefficiencies. SDS, on the other hand, offers a more agile and cost-effective solution by allowing financial institutions to leverage existing hardware and scale storage resources according to demand. This flexibility leads to better resource utilization and significant cost savings.

The BFSI sector's need for disaster recovery and business continuity solutions makes SDS an attractive option. SDS provides advanced data replication, backup, and recovery features, ensuring data availability and resilience in the event of hardware failures or cyber-attacks. The BFSI sector's demand for efficient data management, stringent security and compliance requirements, cost reduction, and disaster recovery capabilities positions it to dominate the Software-Defined Storage market during the forecast period. SDS's ability to meet these needs effectively makes it an indispensable technology for the financial industry.

Regional Insights

Asia Pacific dominated the Global Software-Defined Storage market in 2023. The Asia Pacific region stands poised to assert its dominance in the global software-defined storage (SDS) market, a trend expected to unfold prominently throughout the forecast period. SDS represents a paradigm shift in storage infrastructure, offering flexibility, scalability, and cost-effectiveness that traditional storage solutions struggle to match. As businesses across various sectors increasingly prioritize digital transformation initiatives, the demand for agile and adaptable storage solutions intensifies, making the Asia Pacific region a focal point for SDS adoption and expansion.One of the primary drivers behind the expected dominance of Asia Pacific in the SDS market is the region's burgeoning technology landscape. With rapidly growing economies like China, India, and Southeast Asian nations, there's a palpable appetite for cutting-edge IT solutions. As businesses in these countries embrace cloud computing, big data analytics, and other data-intensive technologies, the need for storage solutions capable of seamlessly integrating with such environments becomes paramount. SDS, with its software-driven approach to storage management and provisioning, perfectly aligns with the dynamic requirements of these evolving IT ecosystems.

The Asia Pacific region boasts a diverse array of industries, ranging from manufacturing and healthcare to finance and e-commerce, each with unique storage demands. SDS's inherent flexibility allows organizations to tailor storage infrastructures to suit specific workload requirements, whether it's high-performance storage for real-time analytics or cost-effective archival storage for compliance purposes. This versatility positions SDS as a compelling solution across a wide spectrum of industries, further fueling its adoption in the region.

The Asia Pacific region is home to a thriving ecosystem of technology vendors and service providers, fostering innovation and competition in the SDS market. Local players, as well as global tech giants, are actively investing in SDS research and development, driving product advancements and lowering barriers to adoption. This vibrant market landscape not only expands the availability of SDS solutions but also facilitates customized offerings tailored to the unique needs of Asia Pacific businesses.

Government initiatives aimed at fostering digital infrastructure and innovation are poised to accelerate SDS adoption across the region. Policies promoting cloud computing, data localization, and digital transformation initiatives incentivize businesses to modernize their IT infrastructure, creating fertile ground for SDS deployment. Asia Pacific region's dynamic technology landscape, diverse industry verticals, robust vendor ecosystem, and supportive regulatory environment collectively position it as a dominant force in the global software-defined storage market. As businesses continue to prioritize agility, scalability, and cost-efficiency in their storage infrastructures, SDS is poised to play a central role in driving innovation and growth across the Asia Pacific region and beyond.

Key Market Players

- IBM Corporation

- Oracle Corporation

- Netapp Inc.

- Huawei Technologies Co. Ltd

- Fujitsu Limited

- Genetec Inc.

- Dell Technologies Inc.

- Hitachi Vantara LLC

- Pure Storage Inc.

Report Scope:

In this report, the Global Software-Defined Storage Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Software-Defined Storage Market, By Type:

- Block

- File

- Object

- Hyper-converged Infrastructure

Software-Defined Storage Market, By Size of Enterprise:

- Small and Medium Enterprise

- Large Enterprise

Software-Defined Storage Market, By End-user Industries:

- BFSI

- Telecom and IT

- Government

- Others

Software-Defined Storage Market, By Region:

- North America

- United States

- Canada

- Mexico

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Europe

- Germany

- United Kingdom

- France

- Russia

- Spain

- South America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa

- Egypt

- UAE

- Israel

Competitive Landscape

Company Profiles: Detailed analysis of the major companies presents in the Global Software-Defined Storage Market.Available Customizations:

Global Software-Defined Storage Market report with the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

Some of the key companies profiled in this Software-Defined Storage Market report include:- IBM Corporation

- Oracle Corporation

- Netapp Inc.

- Huawei Technologies Co. Ltd

- Fujitsu Limited

- Genetec Inc.

- Dell Technologies Inc.

- Hitachi Vantara LLC

- Pure Storage Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 188 |

| Published | October 2024 |

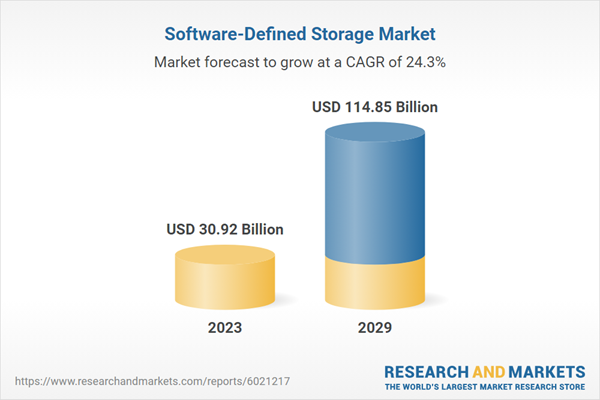

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 30.92 Billion |

| Forecasted Market Value ( USD | $ 114.85 Billion |

| Compound Annual Growth Rate | 24.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |