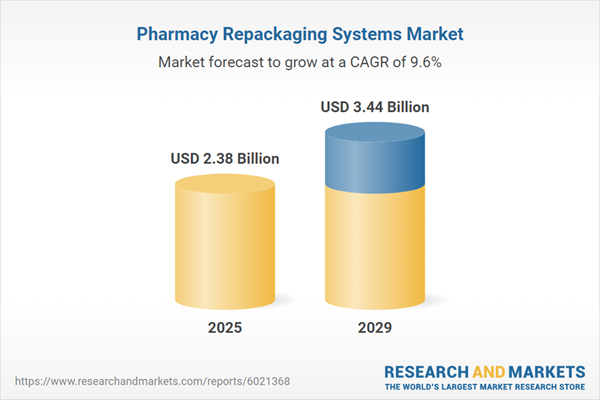

The pharmacy repackaging systems market size has grown strongly in recent years. It will grow from $2.17 billion in 2024 to $2.38 billion in 2025 at a compound annual growth rate (CAGR) of 10%. The growth in the historic period can be attributed to rising awareness of automated systems, increasing cost savings achieved in hospital pharmacies, the growing need for improved dosage accuracy, rising patient adherence to better medication, and the increasing adoption of blister card packaging systems.

The pharmacy repackaging systems market size is expected to see strong growth in the next few years. It will grow to $3.44 billion in 2029 at a compound annual growth rate (CAGR) of 9.6%. The growth in the forecast period can be attributed to increasing adoption of pharmacy automation, the growing need to reduce medication errors, rising demand for efficient and cost-effective medication management solutions, the growing need for customized packaging solutions, and the increasing prevalence of chronic diseases. Major trends in the forecast period include the integration of hyper-automation with robotics, multi-compartment pouches for personalized regimens, a rise in ecological packaging solutions, product innovations, and collaborations between pharmacies.

The increasing prevalence of chronic diseases is projected to drive growth in the pharmacy repackaging systems market. Chronic diseases are long-term medical conditions that typically persist for a year or more and require ongoing medical care or limit daily activities. This rise in chronic diseases is largely due to an aging population, lifestyle changes such as poor diet and physical inactivity, growing urbanization, and related environmental factors. Pharmacy repackaging systems play a crucial role in managing chronic diseases by ensuring accurate medication management, improving patient adherence, and enhancing safety through efficient dispensing into patient-specific doses. For example, in January 2023, the National Institutes of Health projected that the number of individuals with at least one chronic disease in the U.S. would increase by 99.5%, from 71.522 million in 2020 to 142.66 million by 2050. Hence, the growing prevalence of chronic diseases is fueling the demand for pharmacy repackaging systems.

Key players in the pharmacy repackaging systems market are focusing on expanding their facilities with automated repackaging systems to address the increasing need for precise medication management in healthcare settings worldwide. Automated repackaging systems are sophisticated machines designed to package medications accurately and efficiently, reducing human error and enhancing productivity. For instance, in June 2024, MEDISCA Plattsburgh, a U.S.-based pharmaceutical compounding company, opened a new pharmaceutical repackaging facility to cater to the rising demand for personalized medicine. This facility boosts Medisca’s capabilities with advanced equipment for precise dosage measurement and sophisticated labeling technology, ensuring accuracy and compliance. The new facility will enable Medisca to deliver high-quality, customized pharmaceutical solutions globally, adhering to regulatory standards and ensuring timely delivery. It features custom-designed, ISO-rated production rooms and advanced warehouse management systems for complete traceability, ensuring high product quality and personnel safety.

In July 2022, Becton, Dickinson, and Company, a U.S.-based medical technology firm, acquired Parata Systems for $1.525 billion. This acquisition aims to expand BD’s pharmacy automation solutions, advance its strategic goals, and improve its financial performance, positioning the company for future growth in the evolving healthcare sector. Parata Systems, a U.S.-based provider of pharmacy automation solutions, is known for its comprehensive pharmacy repackaging systems.

Major companies operating in the pharmacy repackaging systems market are McKesson Corporation, Becton Dickinson & Company, Baxter International Inc., Syntegon Technology GmbH, Omnicell Inc., ACG Worldwide, Swisslog Holding Ltd., Scriptpro LLC, Capsa Healthcare, Dossier Systems, Healthmark, ARxIUM, Fulcrum Inc., Yuyama Co. Ltd., Kirby Lester, Medical Packaging inc. LLC, RxSafe LLC, Deenova S.r.l., Meditec, Noritsu Pharmacy Automation, Pearson Medical Technologies, Takazono Corporation.

North America was the largest region in the pharmacy repackaging systems market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the pharmacy repackaging systems market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the pharmacy repackaging systems market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Pharmacy repackaging systems involve the equipment and processes used to repackage medications from bulk containers into smaller, patient-specific containers. These systems are designed to ensure accurate dosing, improve medication management, and enhance patient safety.

The primary types of pharmacy repackaging systems include blister card packaging systems, pouch packaging automation systems, liquid medication packaging systems, and bottle filling automation systems. Blister card packaging systems specifically involve machinery and processes that create blister packs, with individual doses of medication separated into compartments. This system includes various dosage types, such as unit dose packaging and multiple unit packaging, and is used by retail or community pharmacies, hospital pharmacies, long-term care (LTC) pharmacies, and mail-order pharmacies.

The pharmacy repackaging systems market research report is one of a series of new reports that provides pharmacy repackaging systems market statistics, including pharmacy repackaging systems industry global market size, regional shares, competitors with a pharmacy repackaging systems market share, detailed pharmacy repackaging systems market segments, market trends and opportunities, and any further data you may need to thrive in the pharmacy repackaging systems industry. This pharmacy repackaging systems market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The pharmacy repackaging systems market consists of sales of unit dose packaging systems, multi-dose packaging systems, blister packaging systems, pill counters, and automated dispensing cabinets. Values in this market are ‘factory gate’ values, that is, the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Pharmacy Repackaging Systems Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on pharmacy repackaging systems market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for pharmacy repackaging systems ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The pharmacy repackaging systems market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Blister Card Packaging Systems; Pouch Packaging Automation Systems; Liquid Medication Packaging Systems; Bottle Filling Automation Systems2) By Dosage Type: Unit Dose Packaging; Multiple Unit Packaging

3) By End Use: Retail or Community Pharmacies; Hospital Pharmacies; Long-Term Care (LTC) Pharmacies; Mail Order Pharmacies

Subsegments:

1) By Blister Card Packaging Systems: Manual Blister Card Packaging; Semi-Automatic Blister Card Systems; Fully Automatic Blister Packaging Systems2) By Pouch Packaging Automation Systems: Single-Use Pouch Packaging; Multi-Dose Pouch Systems; Automatic Pouch Sealing and Filling Systems

3) By Liquid Medication Packaging Systems: Vial Filling Systems; Syringe and Ampoule Filling Systems; Bottle Liquid Filling and Capping Systems; Bottle Filling Automation Systems

4) By Bottle Filling Systems: Single-Stage Bottle Filling Systems; Multi-Stage Filling and Capping Systems; High-Speed Bottle Filling Systems

Key Companies Mentioned: McKesson Corporation; Becton Dickinson & Company; Baxter International Inc.; Syntegon Technology GmbH; Omnicell Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The major companies featured in this Pharmacy Repackaging Systems market report include:- McKesson Corporation

- Becton Dickinson & Company

- Baxter International Inc.

- Syntegon Technology GmbH

- Omnicell Inc.

- ACG Worldwide

- Swisslog Holding Ltd.

- Scriptpro LLC

- Capsa Healthcare

- Dossier Systems

- Healthmark

- ARxIUM

- Fulcrum Inc.

- Yuyama Co. Ltd.

- Kirby Lester

- Medical Packaging inc. LLC

- RxSafe LLC

- Deenova S.r.l.

- Meditec

- Noritsu Pharmacy Automation

- Pearson Medical Technologies

- Takazono Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | April 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 2.38 Billion |

| Forecasted Market Value ( USD | $ 3.44 Billion |

| Compound Annual Growth Rate | 9.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 23 |