Global Helicopter Simulators Market - Key Trends and Drivers Summarized

Why Are Helicopter Simulators Crucial for Pilot Training and Aviation Safety?

Helicopter simulators have become a cornerstone in the aviation industry, playing a vital role in training pilots, enhancing their operational proficiency, and ensuring aviation safety. These simulators replicate real-world flight scenarios with high fidelity, allowing pilots to practice complex maneuvers, emergency procedures, and challenging environmental conditions without exposing them to the risks associated with live training. As helicopter operations are inherently complex due to the aircraft's unique aerodynamics and the diverse missions they undertake, ranging from search and rescue to offshore transport and military operations, the need for comprehensive training is paramount. Helicopter simulators offer a safe and controlled environment for pilots to gain experience in handling various types of helicopters, from single-engine models to advanced multi-engine variants, making them an essential tool for both novice and experienced pilots. Moreover, simulators are cost-effective compared to real aircraft training, as they minimize fuel costs, reduce wear and tear on actual helicopters, and allow for continuous training sessions regardless of weather conditions. This ability to train pilots in a wide range of simulated scenarios has made helicopter simulators indispensable for flight schools, military training programs, and commercial operators who prioritize safety and skill development.Which Sectors Are Driving the Demand for Helicopter Simulators?

The demand for helicopter simulators is driven by multiple sectors, including civil aviation, military, emergency services, and offshore operations, each requiring specialized simulation systems to meet their unique training needs. In the civil aviation sector, the growing number of helicopter operators providing charter services, corporate transport, and tourism has created a robust market for advanced simulators that can replicate real-world flying conditions and air traffic scenarios. This demand is particularly strong in regions where helicopter-based tourism is popular, such as North America and parts of Europe. The military sector, however, remains the largest consumer of helicopter simulators, using them to train pilots for complex combat, reconnaissance, and logistical missions. The ability to simulate diverse combat environments, such as urban warfare and mountainous terrain, and rehearse emergency procedures in a risk-free environment makes simulators a valuable asset for military training. Emergency services, including air ambulances and search-and-rescue operations, also heavily rely on simulators to train their pilots for high-risk missions that often involve challenging weather conditions and precision landings in confined spaces. Additionally, offshore operations in the oil and gas industry are a key driver of simulator demand, as helicopters are frequently used to transport personnel and equipment to remote platforms. In these scenarios, training on simulators helps pilots become proficient in handling difficult weather conditions and low-visibility landings, thereby ensuring the safety of both crew and passengers. These diverse use cases highlight the critical role that helicopter simulators play across sectors, making them essential for maintaining high levels of pilot competency and operational safety.How Are Technological Innovations Shaping the Helicopter Simulator Market?

The helicopter simulator market is undergoing rapid transformation, driven by technological innovations that are enhancing training realism, safety, and flexibility. One of the most significant advancements is the incorporation of virtual reality (VR) and augmented reality (AR) technologies, which provide immersive training experiences that closely mimic actual flight conditions. These technologies enable pilots to interact with a virtual cockpit and experience 360-degree visuals, making the training experience more engaging and effective. Another key development is the integration of artificial intelligence (AI) in simulator software, allowing for dynamic scenario generation and real-time feedback. AI-driven systems can adapt training scenarios based on the pilot's actions, creating a more personalized and challenging learning environment. Additionally, advancements in motion platform technology have made simulators more capable of replicating the physical sensations of flight, including turbulence, sudden maneuvers, and vibration effects. This high degree of realism helps pilots develop muscle memory and reflexes, which are crucial for handling emergency situations. The use of modular simulator designs is also gaining traction, enabling operators to quickly reconfigure systems for different helicopter models or mission types, thereby enhancing training versatility and reducing costs. Cloud-based simulation platforms are another emerging trend, allowing remote access to training sessions and collaboration among instructors and pilots located in different parts of the world. These innovations are making helicopter simulators more adaptable and accessible, ensuring that they meet the evolving training needs of a global aviation industry that is becoming increasingly complex and interconnected.What's Driving the Growth of the Helicopter Simulator Market?

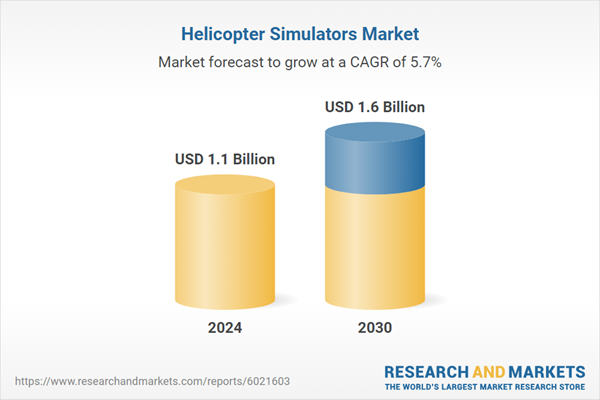

The growth in the helicopter simulator market is driven by several factors, primarily the increasing emphasis on pilot safety, rising demand for cost-effective training solutions, and the expanding use of helicopters across various industries. One of the main drivers is the growing focus on aviation safety, as helicopter operations often involve challenging environments and complex maneuvers that require rigorous training. Simulators provide a safe and effective platform for pilots to hone their skills and practice emergency procedures without putting lives at risk. The rising demand for cost-effective training solutions is another major factor, as simulators significantly reduce the need for expensive flight hours on actual helicopters. This is particularly beneficial for commercial operators and training academies, which are looking to optimize their training budgets while maintaining high standards of pilot competency. The military sector also plays a crucial role in driving market growth, as armed forces around the world continue to invest heavily in state-of-the-art simulation systems to train pilots for increasingly complex and diversified missions. Additionally, the expanding use of helicopters in sectors such as offshore oil and gas, emergency medical services, and tourism is fueling demand for simulators that can replicate specific operational scenarios and environments. Technological advancements, such as the integration of VR and AR, AI-based training tools, and modular simulator designs, are further boosting market growth by enhancing the realism and adaptability of simulators. Moreover, the increasing adoption of simulators for recurrent training and proficiency checks, in line with regulatory requirements, is sustaining demand from both commercial and military operators. These factors, coupled with the rising need for skilled helicopter pilots and the ongoing expansion of the global helicopter fleet, are expected to drive significant growth in the helicopter simulator market in the coming years.Report Scope

The report analyzes the Helicopter Simulators market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Simulator Type (Full Flight Simulators, Fixed Base Simulators); Application (Military Helicopters Application, Commercial Helicopters Application).

- Geographic Regions/Countries:World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Regional Analysis

Gain insights into the U.S. market, valued at $309.3 Million in 2024, and China, forecasted to grow at an impressive 9.1% CAGR to reach $336.5 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Helicopter Simulators Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Helicopter Simulators Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Helicopter Simulators Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Airbus SE, CAE, Inc., Elbit Systems Ltd., FlightSafety International, Inc., Flyit Simulators, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 46 companies featured in this Helicopter Simulators market report include:

- Airbus SE

- CAE, Inc.

- Elbit Systems Ltd.

- FlightSafety International, Inc.

- Flyit Simulators, Inc.

- Frasca International, Inc.

- Indra Sistemas SA

- L3Harris Technologies, Inc.

- Leonardo SpA

- Lockheed Martin Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Airbus SE

- CAE, Inc.

- Elbit Systems Ltd.

- FlightSafety International, Inc.

- Flyit Simulators, Inc.

- Frasca International, Inc.

- Indra Sistemas SA

- L3Harris Technologies, Inc.

- Leonardo SpA

- Lockheed Martin Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 277 |

| Published | March 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.1 Billion |

| Forecasted Market Value ( USD | $ 1.6 Billion |

| Compound Annual Growth Rate | 5.7% |

| Regions Covered | Global |