Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

However, the market faces a substantial obstacle regarding the complexity of integrating these solutions with existing legacy infrastructure, a hurdle that frequently leads to extended implementation timelines and technical friction. These integration difficulties can postpone the realization of investment returns and complicate essential data migration strategies, reflecting the current maturity level of the sector. According to the Chartered Institute of Procurement & Supply, in 2024, only 2% of organizations had achieved fully automated procurement processes, even though more than half were actively seeking greater automation. This statistic highlights both the significant implementation barriers currently present and the immense potential for future market penetration as these challenges are addressed.

Market Drivers

The integration of Artificial Intelligence for predictive spend analytics serves as a major catalyst for the growth of the Global Procurement to Pay Software Market. Organizations are increasingly utilizing AI-driven algorithms to process immense datasets, enabling them to pinpoint cost-saving opportunities, forecast pricing trends, and mitigate supply chain risks with exceptional precision. This technological evolution empowers procurement leaders to shift from reactive, transactional functions to strategic decision-making roles focused on optimizing working capital and supplier performance. The drive behind this trend is significant; according to the '2024 State of Procurement Report' by Amazon Business in June 2024, 98% of decision-makers intend to invest in analytics, insights tools, automation, and AI within the next few years.Simultaneously, the rapid adoption of cloud-based and SaaS deployment models is accelerating market expansion by resolving critical inefficiencies found in legacy manual workflows. Modern cloud solutions provide scalable, accessible platforms that remove the bottlenecks inherent in paper-based processing and disparate systems, thereby guaranteeing real-time data visibility and seamless collaboration. This push for modernization directly addresses persistent operational burdens; as noted by the Institute of Financial Operations and Leadership in their 'Accounts Payable Automation Trends 2024' report from June 2024, 60% of AP teams continue to manually enter invoices into their accounting software. The benefits of overcoming these inefficiencies are substantial, with PYMNTS reporting in 2024 that 95% of companies with fully automated accounts payable processes experience improved accuracy, efficiency, and operational performance.

Market Challenges

The complexity of integrating Procurement to Pay (P2P) solutions with existing legacy infrastructure remains a significant barrier to the market's progress. Many enterprises rely on rigid, outdated Enterprise Resource Planning systems that do not naturally communicate with modern, cloud-based P2P platforms, creating a technical misalignment that requires the development of costly, custom middleware. This results in prolonged implementation phases that delay the time-to-value for investing companies, often causing the immediate benefits of spend visibility and automated compliance to be lost. Consequently, potential buyers may delay or scale back their digital transformation initiatives due to the difficulties in establishing seamless data flow between purchasing interfaces and financial back-end systems.This technical friction frequently sustains a reliance on manual workarounds that the software is intended to eliminate. Because the integration process is often complicated by data migration errors and system incompatibility, organizations often revert to isolated, non-automated methods to bridge the gaps. According to the Institute for Supply Management, in 2024, 92% of supply management organizations reported that they still rely on spreadsheets as a primary tool for data handling, despite the availability of advanced automation suites. This persistent dependence on manual legacy tools highlights the severity of the integration barrier, which directly restricts the P2P software market from achieving its full saturation potential.

Market Trends

The integration of Generative AI for Autonomous Procurement Workflows is fundamentally reshaping the market by advancing beyond simple analytics to create self-governing operational tasks. Unlike traditional automation that adheres to rigid rules, this trend utilizes large language models to autonomously draft Requests for Proposals (RFPs), negotiate tail-spend contracts, and manage complex supplier communications with minimal human intervention. This technological leap enables procurement functions to evolve from tactical execution to strategic oversight, significantly lessening the administrative load on category managers. This workforce transformation is becoming central to strategic planning; according to Ivalua's 'Future of Work in Procurement' survey from October 2024, 60% of procurement leaders expect generative AI to reshape job roles in the near future by redefining how teams engage with data and suppliers.Concurrently, the expansion of ESG and Sustainability Compliance Tracking Modules has become a non-negotiable requirement due to tightening global regulations regarding Scope 3 emissions and supply chain transparency. Modern P2P platforms are rapidly embedding carbon footprint calculations and ethical sourcing verifications directly into the purchasing checkout process, requiring suppliers to validate their credentials before a transaction can proceed. This shift ensures that sustainability functions as an active decision-making criterion at the point of requisition rather than merely a retrospective reporting metric, thereby safeguarding organizations against reputational risk and regulatory penalties. This focus on ethical governance is driving significant capital allocation; according to the Chartered Institute of Procurement & Supply's 'Global State of Procurement and Supply 2024' report from July 2024, 69% of organizations plan to invest in sustainability measures in the coming year, outpacing investments in other digital technologies.

Key Players Profiled in the Procurement to Pay Software Market

- SAP SE

- Oracle Corporation

- Coupa Software Inc.

- Basware Corporation

- Ivalua Inc.

- Jaggaer, Inc.

- Tradeshift Inc.

- Zycus Inc.

- GEP Worldwide

- SynerTrade International SA

Report Scope

In this report, the Global Procurement to Pay Software Market has been segmented into the following categories:Procurement to Pay Software Market, by Deployment:

- On-Premises

- Cloud

Procurement to Pay Software Market, by Enterprise:

- SMEs

- Large Enterprise

Procurement to Pay Software Market, by End-User:

- Healthcare

- Oil & Gas

- Telecommunication

- Retail

- Automotive

- Manufacturing

- Others

Procurement to Pay Software Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Procurement to Pay Software Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Procurement to Pay Software market report include:- SAP SE

- Oracle Corporation

- Coupa Software Inc.

- Basware Corporation

- Ivalua Inc.

- Jaggaer, Inc.

- Tradeshift Inc.

- Zycus Inc.

- GEP Worldwide

- SynerTrade International SA

Table Information

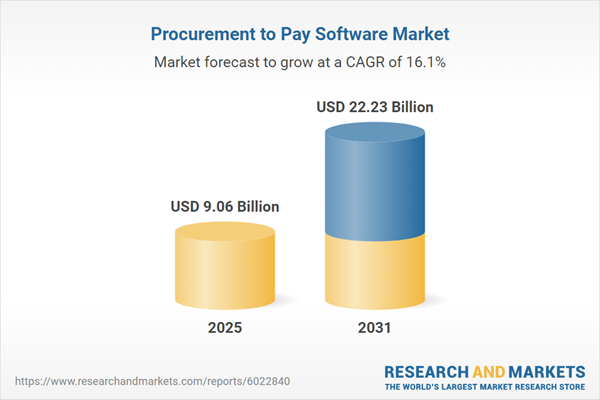

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 9.06 Billion |

| Forecasted Market Value ( USD | $ 22.23 Billion |

| Compound Annual Growth Rate | 16.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |