Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

However, the market faces a significant hurdle regarding the integration of these systems into legacy infrastructure. Many industrial facilities depend on older machinery that lacks standardized connectivity, making the aggregation of data for reliability analysis technically complex. Furthermore, a shortage of skilled personnel capable of interpreting advanced analytics creates a barrier to realizing the full return on investment. This disconnect between modern software capabilities and existing plant realities remains a substantial challenge that could impede the broader expansion of the global asset reliability software market.

Market Drivers

Advancements in Artificial Intelligence and Machine Learning for Enhanced Failure Prediction are fundamentally reshaping the capabilities of asset reliability software. These technologies facilitate a transition from simple condition monitoring to complex predictive analytics, enabling systems to detect subtle anomalies in asset behavior before failures occur. By utilizing historical data and real-time sensor inputs, AI-driven algorithms can forecast equipment degradation with high precision, thereby optimizing maintenance schedules and reducing unnecessary interventions. This technological shift is fueling significant investment across the industrial sector; according to Rockwell Automation’s '10th Annual State of Smart Manufacturing Report' from June 2025, 95% of manufacturers have either already invested in or plan to invest in artificial intelligence and machine learning technologies within the next five years.The imperative to minimize unplanned downtime and optimize operational expenditures further accelerates market growth. Unplanned outages result in substantial financial losses due to halted production, missed delivery deadlines, and emergency repair costs, compelling organizations to adopt software that ensures continuous asset availability. Reliability software mitigates these risks by providing actionable insights that prevent catastrophic equipment failures. The financial stakes are incredibly high; according to Fluke Corporation’s 'Unplanned Downtime Costs Study' from November 2025, unplanned downtime costs U.S. manufacturers as much as $207 million of capital impact per week. Consequently, industries are prioritizing solutions that extend machinery utility and sustainability, with Siemens reporting in 2025 that predictive maintenance solutions designed to extend asset life have been adopted by 60% of organizations.

Market Challenges

The primary factor hampering the growth of the Global Asset Reliability Software Market is the technical difficulty of integrating modern digital solutions with legacy infrastructure. Asset reliability platforms function effectively only when supplied with continuous, high-fidelity data streams from industrial equipment. However, a vast portion of the global industrial base consists of aging machinery designed without native connectivity or standardized communication protocols. This incompatibility creates a physical barrier to adoption, as potential buyers face the substantial cost and complexity of retrofitting sensors or manually bridging the gap between analog hardware and digital analytics tools.This disconnect fundamentally undermines the value proposition of reliability software, which relies on automation to predict failures. The inability to seamlessly extract data leads to prolonged implementation timelines and diminished returns on investment, causing organizations to delay procurement. According to the National Association of Manufacturers, in 2024, 70% of manufacturers still collected operational data manually rather than through automated digital systems. This high prevalence of manual processes indicates that the necessary digital foundation for reliability software is frequently absent, directly restricting the market's expansion as companies struggle to modernize their existing plant environments.

Market Trends

The transition toward cloud-native and SaaS-based delivery models is a defining trend reshaping the Global Asset Reliability Software Market. Historically, industrial sectors relied on heavy, on-premise installations that were difficult to scale and maintain. The market is now rapidly shifting toward cloud-native architectures which offer superior flexibility, allowing organizations to centralize asset data from multiple sites and deploy updates seamlessly. This migration reduces the burden on internal IT teams and facilitates the integration of diverse industrial applications. According to IFS, in the 'State of Service 2025: Manufacturing Transformation Report' from October 2025, 63% of manufacturers are now prioritizing cloud infrastructure to support future growth and technology integration, signaling a decisive move away from traditional static deployment methods.Concurrently, the incorporation of sustainability and energy efficiency metrics into asset analytics is altering how companies evaluate equipment performance. Asset reliability is no longer solely about preventing mechanical failure; it increasingly focuses on optimizing energy consumption and reducing carbon footprints. Modern software platforms are evolving to correlate asset health data with energy usage patterns, enabling operators to identify inefficiencies that contribute to excessive emissions. This alignment of maintenance strategies with environmental, social, and governance (ESG) goals has become a strategic imperative. Reflecting this shift, according to Rockwell Automation’s '10th Annual State of Smart Manufacturing Report' from June 2025, 55% of manufacturers state that improving operational efficiency is their primary driver for pursuing sustainability initiatives, underscoring the critical role of reliability tools in achieving green objectives.

Key Players Profiled in the Asset Reliability Software Market

- Schneider Electric SE

- Fluke Corporation

- IBM Corporation

- Oracle Corporation

- SAP SE

- Ramco Systems Limited

- Infor

- ABB Limited

- Dude Solutions, Inc.

- Bentley Systems

Report Scope

In this report, the Global Asset Reliability Software Market has been segmented into the following categories:Asset Reliability Software Market, by Industry Vertical:

- Manufacturing

- Oil & Gas

- Utilities

Asset Reliability Software Market, by End-Users:

- Large Enterprises

- Small & Medium Enterprises (SMEs)

Asset Reliability Software Market, by Application:

- Predictive Maintenance

- Asset Performance Management (APM)

- Reliability-Centered Maintenance (RCM)

Asset Reliability Software Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Asset Reliability Software Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Asset Reliability Software market report include:- Schneider Electric SE

- Fluke Corporation

- IBM Corporation

- Oracle Corporation

- SAP SE

- Ramco Systems Limited

- Infor

- ABB Limited

- Dude Solutions, Inc.

- Bentley Systems

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 181 |

| Published | January 2026 |

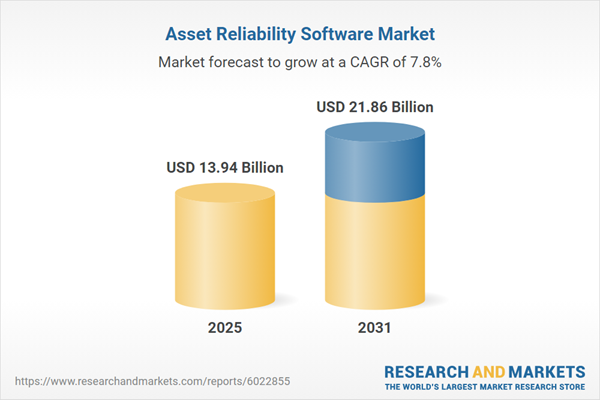

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 13.94 Billion |

| Forecasted Market Value ( USD | $ 21.86 Billion |

| Compound Annual Growth Rate | 7.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |