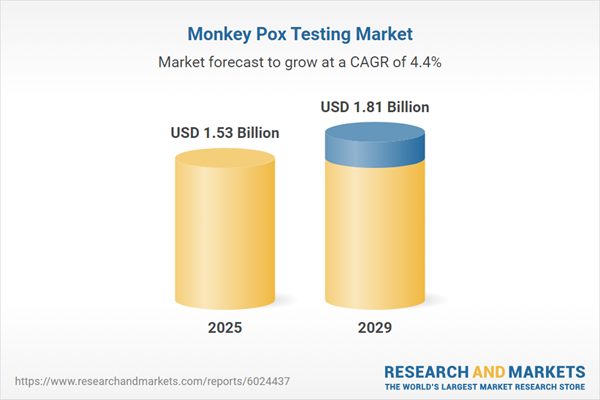

The monkey pox testing market size has grown steadily in recent years. It will grow from $1.46 billion in 2024 to $1.53 billion in 2025 at a compound annual growth rate (CAGR) of 4.8%. The growth in the historic period can be attributed to increasing government funding and initiatives, increasing demand to provide rapid tests, increasing testing capacity, increasing research and development, and increasing public awareness campaigns.

The monkey pox testing market size is expected to see steady growth in the next few years. It will grow to $1.81 billion in 2029 at a compound annual growth rate (CAGR) of 4.4%. The growth in the forecast period can be attributed to rising healthcare expenditures, development of point-of-care (POC) tests, growth in at-home testing kits, focus on accessibility and affordability, and healthcare infrastructure improvement. Major trends in the forecast period include integration of testing with surveillance systems, integration with digital health tools, technological advancements, integration into public health systems and advancements in diagnostic research.

The rising incidence of monkeypox is expected to drive growth in the monkeypox testing market moving forward. Monkeypox is a rare viral disease caused by the monkeypox virus, which belongs to the orthopoxvirus genus, closely related to the smallpox virus. The increase in monkeypox cases is attributed to heightened human-to-human transmission, global travel, and decreased immunity due to the cessation of smallpox vaccination programs. Monkeypox testing plays a crucial role by enabling early identification of infected individuals, facilitating timely treatment and isolation to curb further spread, and aiding in tracking outbreaks and understanding transmission patterns. For example, in May 2022, the European Centre for Disease Prevention and Control (ECDC), a Sweden-based government agency, reported 1,152 suspected monkeypox cases from January to April 2022, resulting in 55 deaths and a case-fatality rate of 4.8%, across 54 health zones in 14 provinces. This represents an increase of 138 suspected cases and 14 deaths compared to the same period in 2021, leading to a higher case-fatality rate of 10.1%. Consequently, the growing incidence of monkeypox is driving the expansion of the monkeypox testing market.

Major companies in the monkeypox testing market are focusing on developing advanced diagnostic solutions, such as saliva-based monkeypox tests, to improve accuracy, convenience, and accessibility. Saliva-based monkeypox testing is a method that detects the monkeypox virus using saliva samples. For example, in July 2022, Flow Health, a US-based medical laboratory, introduced a saliva-based PCR test for monkeypox. This innovative test offers a more convenient and non-invasive method for virus detection, featuring high sensitivity and specificity, rapid genetic material amplification, and adaptability for various uses. It enables quantitative analysis of viral loads and direct pathogen detection while simplifying sample collection. A significant advantage of this test is its ability to detect the virus before visible lesions appear, which is crucial for early detection and reducing the spread of the virus.

In September 2023, BioNTech, a UK-based biotechnology firm, entered into a partnership with the Coalition for Epidemic Preparedness Innovations (CEPI) for an undisclosed amount. This collaboration aims to accelerate the development of effective vaccines for mpox (formerly known as monkeypox), a disease that has gained significant attention due to recent outbreaks. The Coalition for Epidemic Preparedness Innovations (CEPI) is a UK-based public-private entity dedicated to advancing vaccine development.

Major companies operating in the monkey pox testing market are F. Hoffmann-La Roche AG, Thermo Fisher Scientific Inc., Abbott Laboratories, Becton Dickinson and Company, Mayo Clinic Laboratories, Laboratory Corporation of America Holdings, Quest Diagnostics Incorporated, Sonic Healthcare Limited, bioMérieux S.A., Bio-Rad Laboratories Inc., QIAGEN N.V., Cepheid Inc., Aegis Sciences Corporation, Chembio Diagnostics Inc., Flow Health Inc., SeraCare Life Sciences Inc., BioGX Inc., Applied DNA Sciences Inc., CerTest Biotec S.L., Altona Diagnostics GmbH, Creative Biogene Inc., ACON Biotech (Hangzhou) Co Ltd.

North America was the largest region in the monkey pox testing market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the monkey pox testing market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the monkey pox testing market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Monkeypox testing refers to the diagnostic process used to detect the presence of the monkeypox virus in an individual. This testing is crucial for identifying and confirming cases of monkeypox, a viral zoonotic disease that can be transmitted from animals to humans and between humans.

The main technologies for money pox testing are polymerase chain reaction (PCR), lateral flow assay (LFA), and others. Polymerase Chain Reaction (PCR) is a molecular technique used to amplify and detect the DNA of the monkeypox virus in patient samples, making it a key tool for accurate and early diagnosis of the disease. It enables rapid identification of viral genetic material, crucial for controlling outbreaks. Testing modes include laboratory testing and point-of-care testing, with end users such as hospitals and clinics, diagnostic laboratories, and others.

The money pox testing market research report is one of a series of new reports that provides money pox testing market statistics, including the money pox testing industry's global market size, regional shares, competitors with a money pox testing market share, detailed money pox testing market segments, market trends and opportunities, and any further data you may need to thrive in the money pox testing industry. This money pox testing market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The monkey pox testing market consist of revenues earned by entities by providing services such as laboratory testing, diagnostic consultation, sample collection, result reporting, contact tracing, and follow-up. The market value includes the value of related goods sold by the service provider or included within the service offering. The monkey pox testing market also includes of sales of serological testing equipment, centrifuges, refrigeration units, biosafety cabinets, automated nucleic acid extractors, and microscopes. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Monkey Pox Testing Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on monkey pox testing market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for monkey pox testing ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The monkey pox testing market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Technology: Polymerase Chain Reaction (PCR); Lateral Flow Assay (LFA); Other Technologies2) By Mode: Laboratory Testing; Point of Care Testing

3) By End-Use: Hospitals and Clinics; Diagnostic Laboratories; Other End-Uses

Subsegments:

1) By Polymerase Chain Reaction (PCR): Real-Time PCR (qPCR); Reverse Transcription PCR (RT-PCR); Multiplex PCR2) By Lateral Flow Assay (LFA): Immunochromatographic Lateral Flow Assays; Rapid Antigen Detection Kits

3) By Other Technologies: ELISA (Enzyme-Linked Immunosorbent Assay); CRISPR-based Testing; Serological Tests (Antibody Detection); Nucleic Acid Sequence-Based Amplification (NASBA)

Key Companies Mentioned: F. Hoffmann-La Roche AG; Thermo Fisher Scientific Inc.; Abbott Laboratories; Becton Dickinson and Company; Mayo Clinic Laboratories

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The major companies featured in this Monkey Pox Testing market report include:- F. Hoffmann-La Roche AG

- Thermo Fisher Scientific Inc.

- Abbott Laboratories

- Becton Dickinson and Company

- Mayo Clinic Laboratories

- Laboratory Corporation of America Holdings

- Quest Diagnostics Incorporated

- Sonic Healthcare Limited

- bioMérieux S.A.

- Bio-Rad Laboratories Inc.

- QIAGEN N.V.

- Cepheid Inc.

- Aegis Sciences Corporation

- Chembio Diagnostics Inc.

- Flow Health Inc.

- SeraCare Life Sciences Inc.

- BioGX Inc.

- Applied DNA Sciences Inc.

- CerTest Biotec S.L.

- Altona Diagnostics GmbH

- Creative Biogene Inc.

- ACON Biotech (Hangzhou) Co Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | April 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 1.53 Billion |

| Forecasted Market Value ( USD | $ 1.81 Billion |

| Compound Annual Growth Rate | 4.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 23 |