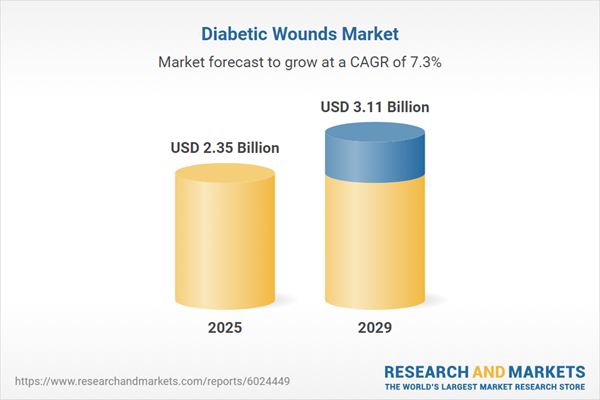

The diabetic wounds market size has grown strongly in recent years. It will grow from $2.18 billion in 2024 to $2.35 billion in 2025 at a compound annual growth rate (CAGR) of 7.6%. The growth in the historic period can be attributed to the increasing prevalence of diabetes, rise in advancements in wound care technology, growing awareness of diabetic wound management, improvements in healthcare infrastructure, rise in aging population.

The diabetic wounds market size is expected to see strong growth in the next few years. It will grow to $3.11 billion in 2029 at a compound annual growth rate (CAGR) of 7.3%. The growth in the forecast period can be attributed to the rising prevalence of diabetes, growing technological innovations in wound care, growing demand for personalized treatment solutions, advancements in wound healing materials, increasing investment in research and development. Major trends in the forecast period include the development of smart wound care products, integration of advanced biomaterials, use of regenerative medicine technologies, telehealth and remote monitoring, and advancements in nanotechnology for wound healing.

The rise in obesity cases is anticipated to drive the growth of the diabetic wounds market in the coming years. Obesity, a condition characterized by excessive body fat storage that can negatively impact health, is becoming increasingly common as people lead more sedentary lifestyles, spending more time sitting and less time engaging in physical activity. Obesity is associated with diabetic wounds because excess body fat can lead to insulin resistance, impairing blood sugar control and slowing the wound healing process. For instance, in May 2024, the UK’s Office for Health Improvement and Disparities reported that from 2022 to 2023, an estimated 26.2% of adults were living with obesity, a slight increase from 25.9% in the previous year (2021 to 2022). Thus, the rise in obesity cases is contributing to the expansion of the diabetic wound market.

Leading companies in the diabetic wounds market are focusing on the development of 3-D hydrocellular wound dressings to improve the management and treatment of diabetic wounds. These dressings feature a unique three-dimensional structure that effectively manages moisture and absorbs exudate, creating an optimal environment for wound healing. For instance, in October 2022, Healthium Medtech, a medical device company based in India, launched Theruptor Novo, an innovative wound dressing designed for chronic wounds such as diabetic foot ulcers. It uses patented technology to physically kill microbes, reducing resistance and providing protection for up to 7 days. The 3-D hydrocellular design of the dressing also effectively manages moisture, promoting better healing.

In May 2023, LifeNet Health, a regenerative medicine solutions company based in the U.S., acquired the wound care division of Bioventus Inc. for $85 million. This acquisition aims to strengthen LifeNet Health's wound care solutions by incorporating Bioventus Inc.’s product, TheraSkin, and positioning the company as a stronger global leader in regenerative medicine. Bioventus Inc., a U.S.-based biotechnology company, specializes in advanced wound care, including TheraSkin, which enhances the healing process in diabetic foot ulcers.

Major companies operating in the diabetic wounds market are 3M Health Care, Medline Industries Inc., B. Braun Melsungen AG, Smith & Nephew plc, Coloplast A/S, Hartmann Group, ConvaTec Group Plc, Mölnlycke Health Care AB, Integra LifeSciences Holdings Corporation, Hollister Incorporated, Wright Medical Group N.V., Organogenesis Inc., MiMedx Group Inc., LifeNet Health, Biosense Webster Inc., Derma Sciences Inc., Kerecis, DermaRite Industries LLC, MediWound Ltd., Tissue Regenix Group plc, Systagenix Wound Management, XenoTherapeutics, Alliqua BioMedical Inc.

North America was the largest region in the diabetic wounds market in 2024. The regions covered in the diabetic wounds market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the diabetic wounds market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Diabetic wounds are slow-healing wounds that frequently affect individuals with diabetes. These wounds arise due to a combination of factors, such as neuropathy, poor circulation, and elevated blood sugar levels, which disrupt the healing process and increase the risk of infection and complications.

The products designed for diabetic wounds include wound care dressings, wound care devices, skin grafts and substitutes, growth factors, and others. Wound care dressings are specialized materials used directly on diabetic wounds to protect them from contamination and facilitate healing. The different types of wounds include neuropathic ulcer wounds, ischemic ulcer wounds, and neuro-ischemic ulcer wounds, with various end-users such as hospitals, specialty clinics, and others.

The diabetic wounds market research report is one of a series of new reports that provides diabetic wounds market statistics, including diabetic wounds industry global market size, regional shares, competitors with a diabetic wounds market share, detailed diabetic wounds market segments, market trends and opportunities, and any further data you may need to thrive in the diabetic wounds industry. This diabetic wounds market research report delivers a complete perspective on everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The diabetic wounds market consists of sales of antibacterial creams, gels, negative pressure wound therapy (NPWT) systems, and wound cleansers. Values in this market are ‘factory gate’ values, that is, the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Diabetic Wounds Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on diabetic wounds market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for diabetic wounds ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The diabetic wounds market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product Type: Wound Care Dressings; Wound Care Devices; Skin Grafts and Substitutes; Growth Factors; Other Products2) By Wound Type: Neuropathic Ulcer Wounds; Ischemic Ulcer Wounds; Neuro-Ischemic Ulcer Wounds

3) By End-User: Hospitals; Specialty Clinics; Other End Users

Subsegments:

1) By Wound Care Dressings: Hydrocolloid Dressings; Foam Dressings; Alginate Dressings; Film Dressings; Hydrogels; Antimicrobial Dressings2) By Wound Care Devices: Negative Pressure Wound Therapy (NPWT) Devices; Electric Stimulation Devices; Hyperbaric Oxygen Therapy (HBOT) Devices

3) By Skin Grafts and Substitutes: Autografts; Allografts; Xenografts; Synthetic Skin Substitutes

4) By Growth Factors: Platelet-Derived Growth Factor (PDGF); Epidermal Growth Factor (EGF); Fibroblast Growth Factor (FGF); Vascular Endothelial Growth Factor (VEGF)

5) By Other Products: Wound Cleansers; Antiseptics; Debridement Products; Bandages and Tapes

Key Companies Mentioned: 3M Health Care; Medline Industries Inc.; B. Braun Melsungen AG; Smith & Nephew plc; Coloplast a/S

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The major companies featured in this Diabetic Wounds market report include:- 3M Health Care

- Medline Industries Inc.

- B. Braun Melsungen AG

- Smith & Nephew plc

- Coloplast A/S

- Hartmann Group

- ConvaTec Group Plc

- Mölnlycke Health Care AB

- Integra LifeSciences Holdings Corporation

- Hollister Incorporated

- Wright Medical Group N.V.

- Organogenesis Inc.

- MiMedx Group Inc.

- LifeNet Health

- Biosense Webster Inc.

- Derma Sciences Inc.

- Kerecis

- DermaRite Industries LLC

- MediWound Ltd.

- Tissue Regenix Group plc

- Systagenix Wound Management

- XenoTherapeutics

- Alliqua BioMedical Inc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | April 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 2.35 Billion |

| Forecasted Market Value ( USD | $ 3.11 Billion |

| Compound Annual Growth Rate | 7.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 24 |