This report comes with 10% free customization, enabling you to add data that meets your specific business needs.

1h Free Analyst TimeSpeak directly to the analyst to clarify any post sales queries you may have.

The market has evolved to include a variety of designs, materials, and features, catering to diverse consumer preferences and the growing emphasis on fashion among students. Key players in the global school bags market include prominent brands such as Nike, Adidas, Samsonite, and Delsey, which are leveraging innovative strategies and collaborations to enhance their market presence. The Asia Pacific region dominates the market, accounting for a significant share due to its large student population and increasing disposable incomes, particularly in countries like China and India.

Innovations in ergonomic design have become increasingly significant, with manufacturers prioritizing comfort through padded straps and back support to enhance the user experience. Additionally, the incorporation of sustainable materials, such as recycled plastics, is gaining traction as environmental awareness increases among consumers. The COVID-19 pandemic has also influenced the school bags market, as remote learning reduced the need for traditional backpacks. However, as educational institutions return to in-person learning, there is a renewed focus on versatile and tech-friendly bags that accommodate laptops and tablets, reflecting the changing landscape of education.

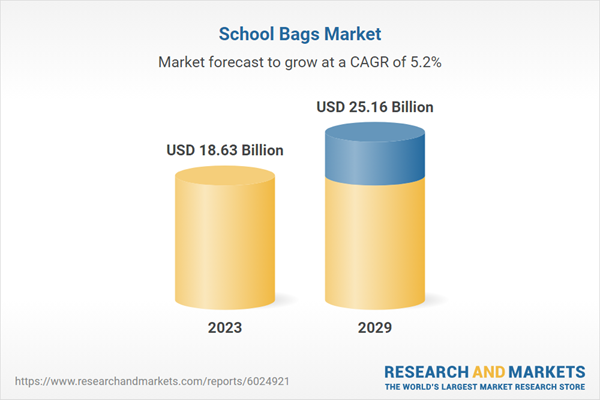

According to the research report, “Global School Bags Market Outlook 2029” the market is anticipated to cross USD 25 Billion by 2029, increasing from USD 18.63 Billion in 2023. The market is expected to grow with a 5.24% CAGR from 2024 to 2029. One of the key drivers of market growth is the increasing number of school-going children worldwide. According to the report on United Information System for Education Plus (UDISE+) 2019-20 for School Education in India, the Gross Enrollment Ratio of school education in India has improved significantly in 2019-20 compared to 2018-19. This growth in student enrollment ratio fuels the demand for school bags, propelling the market forward.

The market is highly competitive, with a large number of players operating in the industry. Some of the key players in the global school bags market include NIKE, Inc., Puma SE, Delsey SA, Targus Inc., VIP Industries Ltd., VF Corp., Oasis Bags, Herschel Supply Company, Samsonite International SA, and LVMH Moët Hennessy - Louis Vuitton. As environmental awareness increases among consumers, particularly parents, there is a rising preference for school bags made from recycled, organic, and biodegradable materials.

Trends in the market include a growing preference for sturdy, spacious school backpacks with trendy designs, as well as a rising demand for lightweight bags to accommodate the increasing use of tablets, laptops, and other electronic gadgets. The market is also witnessing a shift towards eco-friendly materials, such as recycled plastics, as environmental awareness increases among consumers.

Eco-friendly school bags are becoming more widely available, driving sales growth in the global market as consumers are willing to pay more for bags that align with their environmental values. However, the increasing demand for leather has also resulted in improper disposal of tanning agents, further fueling the need for sustainable leather alternatives in the school bags market.

b style="color:orange">Market Drivers

Increasing Student Enrolment: Growing student enrolment rates globally, especially in developing countries, drive demand for school bags as essential accessories for education. As more children enter schools, the need for functional and durable school bags rises, fueling market growth.Rising Disposable Income: Increasing disposable income among families enables spending on high-quality school bags that emphasize functionality, comfort, and style. As living standards improve, particularly in emerging economies, consumers are willing to invest in premium school bags.

Market Challenges

Health and Environmental Concerns: The ergonomic design of school bags must balance comfort and weight to prevent potential health issues arising from heavy loads. Additionally, environmental consciousness restricts the use of certain materials, prompting a shift towards sustainable and eco-friendly options, which can be more expensive.Competition from Alternative Entertainment: The school bags market faces competition from other forms of entertainment, such as streaming services, social media, and video games, which can divert attention away from education and reduce the demand for school supplies.

Market Trends

Technological Innovations: School bags are incorporating smart features like compartments for laptops and tablets, GPS tracking systems, built-in charging ports, and RFID blocking technology to meet the technological demands of contemporary students and improve convenience and security.Sustainable and Eco-Friendly Materials: As environmental awareness grows, consumers are increasingly seeking school bags made from organic fabrics, recycled materials, and biodegradable substitutes. Manufacturers are responding by offering eco-friendly options and integrating sustainable practices into their production processes.

Customization and Personalization: Customization and personalization options are becoming more popular, allowing students to express their unique personalities by selecting the type, color, and accessories of their bags. This trend highlights the significance of identity and self-expression in the school bag purchasing process.

The backpack segment is the leading type in the global school bags market due to its versatility, comfort, and alignment with consumer trends.

Backpacks serve multiple purposes, functioning not only as school bags but also as travel and recreational gear, which increases their appeal among students of all ages. Their large storage capacity and multiple compartments allow students to efficiently carry books, stationery, laptops, and personal items, addressing the practical needs of modern learners.Recent developments include the integration of smart features such as built-in charging ports and compartments for electronic devices, addressing the needs of tech-savvy students. The demand for sustainable materials is also rising, with manufacturers increasingly using recycled fabrics and eco-friendly designs to appeal to environmentally conscious consumers.

Messenger bags are favored for their stylish and professional appearance, making them suitable for older students and those in tertiary education. They typically feature a single shoulder strap and are designed for easy access to contents. The market for messenger bags is evolving, with trends leaning towards customization and personalization options that allow students to express their individuality. Innovations such as anti-theft features and water-resistant materials are also becoming common, enhancing security and durability. Laptop bags are specifically designed to protect electronic devices, reflecting the growing trend of digital learning.

These bags often include padded compartments for laptops and tablets, as well as additional pockets for accessories. The rise in remote learning and the use of technology in education has propelled the demand for laptop bags. Manufacturers are focusing on lightweight materials and ergonomic designs to ensure comfort and ease of transport, catering to the increasing number of students using laptops for their studies.

Polyester is the leading fabric type in the global school bags market, primarily due to its durability, affordability, and versatility.

Polyesters hold the largest share of the school bags market due to their strength and durability. This fabric is waterproof, making it suitable for various weather conditions and ensuring that contents remain dry. Innovations in polyester manufacturing have led to the development of lighter and more resilient materials, enhancing comfort for students who carry heavy loads. The trend towards using recycled polyester is also on the rise, aligning with the growing consumer preference for sustainable products. Canvas is a durable and versatile fabric commonly used in school bags. It is favored for its sturdiness and ability to withstand wear and tear, making it ideal for daily use by students.Recent trends show an increasing demand for eco-friendly canvas options, as manufacturers are exploring organic and recycled materials to appeal to environmentally conscious consumers. Nylon is known for its lightweight and high tensile strength, making it a popular choice for school bags that require portability without sacrificing durability. The fabric's resistance to abrasion and water further enhances its appeal. Recent advancements in nylon technology have led to the creation of breathable and weather-resistant variants, which are increasingly sought after in the market. Leather bags are often marketed as premium products, appealing to older students and professionals.

However, concerns about environmental sustainability and animal welfare are influencing the market, leading to a rise in synthetic leather alternatives. The trend towards luxury and high-quality leather bags remains strong, but manufacturers are now focusing on ethical sourcing and production practices to address consumer concerns. The "others" segment includes various synthetic and natural fabrics that cater to niche markets. Innovations in fabric technology, such as the use of lightweight composites and smart materials, are emerging, offering additional features like built-in charging capabilities and enhanced durability.

The offline distribution channel remains dominant due to its established presence and consumer trust.

The offline distribution channel dominates the school bags market, accounting for approximately 80% of total sales. This channel includes retail stores, supermarkets, hypermarkets, and specialty shops, allowing consumers to physically inspect products before purchase. The growth of offline sales is attributed to the increasing number of retail outlets and the preference for in-person shopping, where customers can assess the quality and design of bags firsthand. Additionally, local unorganized players leverage retail shops to boost sales, enhancing market accessibility. Despite the rise of online shopping, the tactile experience of offline purchasing remains significant for many consumers, particularly parents buying for children.The online distribution channel is emerging as the fastest-growing segment in the school bags market. This growth is driven by the increasing penetration of smartphones and internet access among consumers, particularly millennials. The convenience of online shopping, characterized by features such as doorstep delivery, easy returns, and a wider selection of products, appeals to busy parents and students. E-commerce platforms are increasingly offering customizable options and eco-friendly products, aligning with consumer preferences for sustainability. As a result, online sales are expected to grow significantly, reflecting broader trends in retail where digital channels are becoming essential for reaching tech-savvy consumers.

Asia Pacific dominates the global school bags market primarily due to its large student population and rising disposable incomes, particularly in countries like China and India.

The Asia Pacific region's dominance in the school bags market can be attributed to several key factors. Firstly, the region has a massive student population, with countries like China and India accounting for a significant portion of the world's school-going children. According to the United Nations Educational, Scientific and Cultural Organization (UNESCO), the Asia Pacific region had the highest number of out-of-school children of primary school age in 2020, at around 15 million. This large student population directly translates into a high demand for school bags, as each child requires a bag to carry their supplies.Another important factor contributing to Asia Pacific's market leadership is the region's economic growth and rising disposable incomes. As countries like China and India continue to develop and their middle class expands, more families have the financial means to invest in quality school bags for their children. This growing purchasing power enables consumers to prioritize factors such as durability, comfort, and style when selecting school bags, driving demand for premium products. Government initiatives aimed at promoting education in the region have also played a significant role in boosting the school bags market.

Many Asia Pacific countries have made concerted efforts to increase school enrollment and reduce dropout rates, particularly among girls. For instance, in March 2022, the Indian government launched the "Kanya Shiksha Pravesh Utsav" campaign in partnership with UNICEF to bring out-of-school adolescent girls back into the education system. Such initiatives not only improve access to education but also create a larger market for school supplies, including bags.

- In May 2022, Tsuchiya Kaban Co., an office furniture manufacturer formed a capital and business alliance with Bolt Threads (US) to develop the leather alternative derived from mycelium for the first time in Japan. Tsuchiya Kaban announced the release of six product prototypes after developing a variety of samples, including bags, small goods, and randoseru (school bags)

Considered in this report

- Historic year: 2018

- Base year: 2023

- Estimated year: 2024

- Forecast year: 2029

Aspects covered in this report

- School Bags market Outlook with its value and forecast along with its segments

- Various drivers and challenges

- On-going trends and developments

- Top profiled companies

- Strategic recommendation

By Types

- Backpack

- Messenger Bag

- Laptop bags

- Others

By Fabric

- Polyesters

- Canvas

- Nylon

- Leather

- Others

By Distribution Channel

- Offline

- Online

The approach of the report:

This report consists of a combined approach of primary and secondary research. Initially, secondary research was used to get an understanding of the market and list the companies that are present in it. The secondary research consists of third-party sources such as press releases, annual reports of companies, and government-generated reports and databases.After gathering the data from secondary sources, primary research was conducted by conducting telephone interviews with the leading players about how the market is functioning and then conducting trade calls with dealers and distributors of the market. Post this; we have started making primary calls to consumers by equally segmenting them in regional aspects, tier aspects, age group, and gender. Once we have primary data with us, we can start verifying the details obtained from secondary sources.

Intended audience

This report can be useful to industry consultants, manufacturers, suppliers, associations, and organizations related to the School Bags industry, government bodies, and other stakeholders to align their market-centric strategies. In addition to marketing and presentations, it will also increase competitive knowledge about the industry.Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Nike, Inc

- Adidas AG

- VF Corporation

- Under Armour, Inc

- Fjällräven AB

- Puma SE

- Targus

- Samsonite International S.A.

- VIP Industries Ltd

- Herschel Supply Co

- Osprey Packs, Inc,

- Belmil

- Delsey

- Dolce & Gabbana S.R.L.

- Khadim India Ltd

- Deuter Sport

- RIVACASE

- L.L.Bean

- Lyle & Scott Limited,

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 183 |

| Published | September 2024 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 18.63 Billion |

| Forecasted Market Value ( USD | $ 25.16 Billion |

| Compound Annual Growth Rate | 5.2% |

| Regions Covered | Global |