This report comes with 10% free customization, enabling you to add data that meets your specific business needs.

1h Free Analyst TimeSpeak directly to the analyst to clarify any post sales queries you may have.

They have applications in steel, cement, glass, ceramics, and petrochemical industries. There is a long history of refractory materials-from ancient times when people used it in pottery and kilns. The discovery of fire-clay bricks during the 19th century enormously propelled refractory technology. This generally resulted in building stronger furnace constructions.

High-temperature materials were in greater demand when the Industrial Revolution elevated the use of steel and glass products. Post World War II, the market witnessed new innovations with the discovery of new materials like zirconia and magnesia for improved performance. Today, this market for refractory has gone miles ahead, so to speak, especially in the burgeoning economies of China and India, because of industrialization. The U.S. has enacted laws governing the disposal of the waste generated from refractory and rules and regulations regarding the handling of these materials to promote chrome-based refractory recycling, as the demand for refractory is extremely high in the iron & steel industry.

Other studies such as Review and improvement of testing Standards for Refractory products (ReStaR) are undertaken across Europe to ensure that the current testing standards of refractories in the continent are valid and reliable. Such a strict environmental regulation and rule towards the use of refractory material is sure to have a downturn effect on the refractories market growth rate.

For instance, in the European Union, a modest steel consumption recovery persists while improving economic mood and investment climate. However, uncertainties associated with its political landscape, especially with regards to the refugee crisis and Brexit, are considered risks to the financial situation. The reprocessed refractory materials, which are further recycled to form optional products, are termed as recalcitrant grogs.

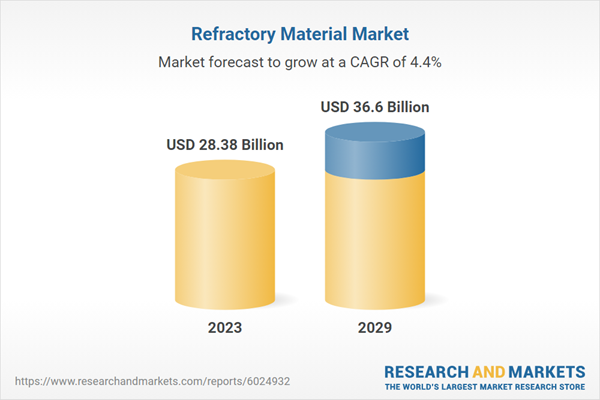

According to the research report, “Global Refractory Materials Market Outlook 2029” the market is anticipated to cross USD 35 Billion by 2029, increasing from USD 28.38 Billion in 2023. The market is expected to grow with a 4.42% CAGR from 2024 to 2029. The increasing emphasis on advanced manufacturing techniques, the rising demand for high-performance refractories are driving the growth of the refractory materials market. The reused refractories depend upon the refractories genuineness nature. All the reused refractories with a great quality can be used in various cycles, while only 0-30% of reused refractories can be used which are gained from low-quality refractories.

The worldwide economy and economic and industrial activities were temporarily paused after because of COVID-19 lockdown in several countries. The backlash the refractories market also felt during this period was in the form of production and demand from the related end-user industries of iron and steel, cement, energy and chemicals, ceramics, etc. However, in the post-pandemic scenario, the end-user industries are expanding as the demand for the products increases once the economies open up. Significant developments lie in the design of insulating refractories to reduce energy use by minimizing the loss of heat in industrial processes.

Furthermore, the integration of digital technologies, such as artificial intelligence and machine learning, is improving manufacturing processes, predictive maintenance, and quality control. Also, the increment in government expenditure, dovish policies, and ease in mobility restrictions has increased the production of steel. For instance, according to a report released by the Indian Steel Association, ISA, the demand for steel grew by 7.2% in the year 2020-21.

This has resulted in the expansion of the refractory material market growth in the developing iron & steel industry. The different regulatory authorities like the U.S. Environmental Protection Agency (U.S. EPA), have implemented National Emissions Standards for Hazardous Air Pollutants (NESHAP) Act for the production and use of refractory products in various end-user industries.

Market Drivers

- Energy Efficiency and Cost Reduction Goals: The global emphasis on energy efficiency and cost reduction is driving the adoption of advanced refractories in high-temperature operations. Industries are increasingly seeking materials that offer superior thermal insulation properties to minimize energy losses during production processes. By utilizing these advanced refractories, companies can achieve significant operational cost savings while simultaneously improving their environmental footprint. Additionally, the transition towards low-emission technologies is prompting the development of refractories that can withstand cleaner combustion processes, aligning with sustainability goals and reducing greenhouse gas emissions across various sectors.

- Demand for Advanced Ceramics:The growing use of advanced ceramics in sectors such as aerospace, automotive, and electronics is influencing the refractory materials market significantly. Advanced ceramics require high-performance refractory materials that exhibit exceptional thermal stability and mechanical properties to endure extreme conditions. This surge in demand is bolstered by significant investments in research and development (R&D) focused on creating new ceramic formulations that cater to high-temperature applications. Consequently, refractory manufacturers are responding to these evolving needs by enhancing their product offerings, driving overall market growth.

Market Challenges

- Environmental Impact of Raw Material Extraction :The extraction of raw materials for refractory production often involves environmentally detrimental mining practices. This has led to scrutiny from regulators and consumers, necessitating companies to invest in sustainable mining practices and find alternative sourcing strategies. The disposal of refractory materials poses environmental challenges, as traditional methods can lead to pollution. Companies must navigate these issues while developing strategies for recycling and reusing refractories at the end of their lifecycle.

- Technological Obsolescence: The rapid pace of technological change in the refractory industry poses a significant challenge, as certain products can quickly become obsolete. Companies must continually innovate to keep pace with market demands and technological advancements, which can strain resources, especially for smaller manufacturers with limited R&D capabilities. The need for sustained investment in research and development to create next-generation materials adds another layer of complexity, as firms must balance innovation with operational efficiency. Those unable to adapt swiftly may find themselves at a competitive disadvantage in a market characterized by fast-evolving technologies.

Market Trends

- Sustainability and Circular Economy: The global shift towards sustainability is driving the refractory materials industry to adopt circular economy practices. This involves a focus on reusing and recycling materials to minimize waste and environmental impact. Manufacturers are increasingly exploring strategies to reclaim and repurpose refractory materials at the end of their lifecycle, contributing to a more sustainable production model. Additionally, the adoption of Life Cycle Analysis (LCA) has become more prevalent, enabling companies to assess the environmental impacts of their products from raw material extraction to disposal. This trend encourages refractory manufacturers to enhance their sustainability initiatives while appealing to environmentally conscious clients who prioritize eco-friendly practices.

- Custom Formulations and Product Development: The demand for tailored refractory solutions is on the rise as industries seek materials that meet specific operational needs. This trend is prompting manufacturers to develop customized formulations that enhance performance in particular applications, thereby fostering innovation in the sector. In response to this growing demand, collaborative innovation between manufacturers and end-users is also becoming more common. These partnerships facilitate joint product development initiatives, allowing companies to co-create solutions that address precise customer requirements, ultimately leading to higher levels of satisfaction and loyalty.

Shaped refractory materials are dominating the global market for refractory materials, mainly because of its flexibility and due to their role as absolutely essential to high-temperature industrial applications, mainly being the iron and steel sector.

Shaped refractories would be the key driving growth in the global refractory market. Made from bricks and special constituents that are formed specifically for certain applications requiring exact fitting, refractory brick is part of the shaped group. Their dominance is primarily due to their excellent properties in thermal insulation and high resistance to extreme temperature conditions, making them "must-haves" in manufacturing iron and steel, cement, and glass. The demand for refractory solutions also is expected to surge with the growing demand for the use of steel, which is further aided by rapid urbanization and growth of infrastructure in the emerging economies such as China and India.In fact, shaped refractories represented a large market share, representing the critical role of such lining in furnaces, kilns, and reactors where high thermal resistance is at the top. At the same time, shaped refractories are flexible in being applied in various configurations and settings, increasing their value across several sectors. Growing infrastructural investments globally add weight to the demand for these materials also.

Advances in material formulation improve, therefore, strength and service life of molded refractories addressing emerging needs of such industries that require chemical stability along with high-temperature resistance. This trend reflects a wider shift towards more complex refractory solutions that not only can operate under extreme conditions but are also starting to play a key role in energy efficiency and sustainability goals.

The basic segment is market leader in terms of the global market for refractory material, and it's essentially because they're indispensably used for high temperature industrial processes, mainly in industries like metallurgy, oil and gas and chemical manufacturing.

The basic refractory materials are resistant to the highest temperature and chemical corrosion. Owing to this feature, they are being critical components for use in molten metal processes and aggressive chemical conditions. Basic refractory materials are used by steel industry and several others as furnace and kiln linings and reactor linings while ensuring structural strength to continue uninterrupted with the activities. With the increasing scale of global industrial activities, the requirement of resistant materials that could withstand intense heat and hostile conditions is on the rise. Apart from the application in high-temperature use, fundamental refractories can be applied in many various ways with their versatility.For instance, in cement production, it is paramount that they are able to maintain high performance, for instance, in rotary kilns, the case of clinker production. Trends in manufacturing techniques and continuous process improvements create a demand for even more efficient refractory material than ever for the interest of increased productivity with fewer days under downtime.

The increasing trend about sustainability and energy efficiency has pushed industries to seek refractory materials that do not only have good performance but also add up to the overall reduction in energy usage. Basic refractories thus meet some of these stipulations since they enhance thermal insulation and reduce losses of heat through any process.

Fireclay is the leading refraction material in the global market. Its widespread popularity and consumption in the market are primarily due to the fact that it is cost-effective and flexible in most of its applications, making it an indispensable choice in high-temperature industrial applications.

High market share of fireclay, hydrated aluminum silicate, is attributed to its peculiar properties to suit the stern demands of most industries. Some reasons why these refractories are considered vital include the resistance to thermal shock which consists of extreme high-temperature application in the manufacture of iron and steel, cement production, and glassmaking.This type of industry needs materials that can withstand not only the high heat but also the mechanical stresses involved in the processes of their manufacturing. The composition of fireclay allows it to withstand such conditions while maintaining its structural integrity, hence it is widely used as linings in furnaces, kilns, among other high temperature applications.

Besides thermal stability, fireclay refractories are pliable and easy to mold into different shapes for specific operations, which is very important for industries that require customized solutions. As the global infrastructure projects keep spreading their wings, related increases in demand for greater volumes of steel and cement within many developing economies, the steady rising need for reliable refractory materials can only continue to grow.

Fireclays are also cheaper than the alternatives such as high-alumina or magnesia refractories, making cheaper production without compromise on quality. The continued investment in fireclay refractories-consuming industries supports the market position of fireclay refractories. Since these units have evolved in terms of newer technologies and higher production capacities, the consumption volume of fireclay refractories shall increase manifold over the next two years.

The sector of metals and metallurgy dictates trends in the global refractory material market mainly due to the significant demand for high-performance materials that could be resilient under extreme temperatures and harsh operating conditions.

The scope of industrial applications has been really very high, especially in the sphere of iron and steel. Industry's overall movements for efficiency enhance the need for materials that can sustain thermal stress along with chemical corrosion. In steel production, there are refractories that are indispensable to proper furnaces, converters, and ladles where operations are always carried out while maintaining good quality. Therefore, it becomes essential that the use of refractories is critical to operational excellence for these types of applications. This accelerating urbanization and infrastructure development in the emerging economies have further fuelled the demand for steel, elevating the requirements for refractory material.Countries that are still in their primitive stages of industrial sectors have paid focus on the efforts to help them improve their production skills that generally impacts the refractory industry. Improvements in technology and its related manufacturing processes have brought new refractory solutions with capabilities to enhance performance while optimizing costs.

This dynamic environment encourages coordination among the industries, partnering with each other towards a common goal of seeking to enhance their technological capacities and to expand their market reach. In essence, the domination of the metals and metallurgy sector in the refractory material market means the good interplay between industrial demand, technological innovations, and strategic investments.

The APAC region is currently the main driver in the global refractory material market due primarily to the fast industrialization and urbanization.

Countries like China and India, demanding large quantities of refractory material in most industries. This is because many major factors are experienced in the APAC region. The growth in infrastructure development, manufacturing, and construction, all of which require refractory materials for high-temperature applications, characterizes this region. The refractory material's user industries namely, the steel, cement, and glass industries within the region are the most rapidly developing, as refractory materials are lined in furnaces, kilns, and other similar equipment used at high temperatures.The APAC region has some of the world's largest refractory material producers who get the cost advantage of low labor cost and near-proximity raw material sourcing, thereby helping them get a competitive price. Other regional governments are also investing deeply in industrial development and infrastructural projects. These investments will, therefore create an increased demand for refractory materials. Other than the need for refractory materials in industrial development and infrastructural projects, the APAC region is increasingly witnessing an advanced adoption of refractory materials due to the quest for high-performance, energy efficiency, and environmental sustainability.

All these facets lead to rising concern over emission reductions as well as efficiency in operations and thus have a demand for a number of different innovative refractory solutions. The geographical location of the region, which is strategically strong enough to allow excellent export trade of refractory material to other parts of the world, puts it in pole position among the markets.

- In June 2023, IntoCast AG agreed to acquire Italy-based EXUS Refractories S.p.A. This acquisition will increase its holdings of refractory products.

- In April 2023, RHI Magnesita has offered to acquire the U.S., India, and Europe operations of Seven Refractories, a specialist supplier of non-basic monolithic refractory with record revenue of USD 110 million and PBT of USD 12 million in 2022. The company maintains an impressive portfolio of diversified end-use applications across global markets. This will bring in innovative product categories and technology that will deliver major change in consumer offerings.

- In February 2023, The Vesuvius Group said it would pump in USD 61 million over three to five years to take its bases across India to manufacture refractory materials. This will boost the company's monthly production capacity by 35%. This will be achieved with the expansion of the plant at the Taratala unit in Kolkata.

- In October 2022, Imerys has expanded its operations in terms of volume, R&D, and sustainability activities at its Visakhapatnam, Andhra Pradesh, India, manufacturing facility. By the year 2030, it hopes to increase its production capacity from the 30,000 tons of earlier years to 50,000 tons. It also continues to invest an additional USD 1.4 million in streamlining its operations to produce the Secar 71. Because of increased demand for this material at refractory and construction sites on Indian grounds, the company will ramp up its production of calcium aluminate binder.

- In September 2021, Plibrico Company, LLC has agreed to close the acquisition of Redline Industries, Inc. It is a company in the field of innovative products in furnace protection for high-temperature processing and energy efficiency enhancement. This will enable Plibrico to support its customers with trusted refractory solutions while developing its product line and expanding into a more competitive market.

Considered in this report

- Historic year: 2018

- Base year: 2023

- Estimated year: 2024

- Forecast year: 2029

Aspects covered in this report

- Refractory Material market Outlook with its value and forecast along with its segments

- Various drivers and challenges

- On-going trends and developments

- Top profiled companies

- Strategic recommendation

By Form

- Shaped

- Unshaped

By Chemistry

- Basic

- Acidic

- Neutral

By Chemical Composition

- Fireclay

- Alumina

- Magnesia

- Silica

- Others

By End Use

- Metals & Metallurgy

- Cement

- Glass & Ceramics

- Power Generation

- Others

The approach of the report:

This report consists of a combined approach of primary and secondary research. Initially, secondary research was used to get an understanding of the market and list the companies that are present in it. The secondary research consists of third-party sources such as press releases, annual reports of companies, and government-generated reports and databases.After gathering the data from secondary sources, primary research was conducted by conducting telephone interviews with the leading players about how the market is functioning and then conducting trade calls with dealers and distributors of the market. Post this; we have started making primary calls to consumers by equally segmenting them in regional aspects, tier aspects, age group, and gender. Once we have primary data with us, we can start verifying the details obtained from secondary sources.

Intended audience

This report can be useful to industry consultants, manufacturers, suppliers, associations, and organizations related to the Refractory Material industry, government bodies, and other stakeholders to align their market-centric strategies. In addition to marketing and presentations, it will also increase competitive knowledge about the industry.Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Compagnie de Saint-Gobain S.A.

- AGC Inc.

- RHI Magnesita N.V.

- IMERYS S.A.

- Krosaki Harima Corporation

- Shinagawa Refractories Co., Ltd.

- Morgan Advanced Materials plc

- Puyang Refractories Group Co.,Ltd.

- IFGL Refractories Ltd.

- Intocast AG

- HarbisonWalker International, Inc

- CoorsTek, Inc.

- Vitcas Ltd

- Alsey Refractories Co

- Vesuvius plc

- Lhoist Group

- HÖGanÄS Borgestad Ab

- Saudi Refractory Industries

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | September 2024 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 28.38 Billion |

| Forecasted Market Value ( USD | $ 36.6 Billion |

| Compound Annual Growth Rate | 4.4% |

| Regions Covered | Global |