This report comes with 10% free customization, enabling you to add data that meets your specific business needs.

1h Free Analyst TimeSpeak directly to the analyst to clarify any post sales queries you may have.

The printer ink cartridge market has undergone significant evolution over the past few decades, driven by technological advancements and changing consumer behaviors. The introduction of inkjet printers in the 1980s revolutionized home and office printing, leading to a surge in demand for ink cartridges, while the emergence of laser printers in the 1990s created a distinct market for toner cartridges tailored to high-volume needs. As digital communication became more prevalent, overall print volumes declined, prompting manufacturers to adapt their strategies and focus on more efficient and cost-effective printing solutions, such as print-on-demand services.

The market has also seen an increase in competition between original equipment manufacturers (OEMs) and third-party suppliers, resulting in a broader range of products, including remanufactured and eco-friendly cartridges. Sustainability has become a critical focus, with manufacturers developing refillable cartridges and recycling programs in response to growing environmental concerns. Additionally, the rise of e-commerce has transformed purchasing behaviors, with consumers increasingly opting for online platforms that offer convenience and competitive pricing. Emerging markets present new growth opportunities, driven by increased internet penetration and digitalization.

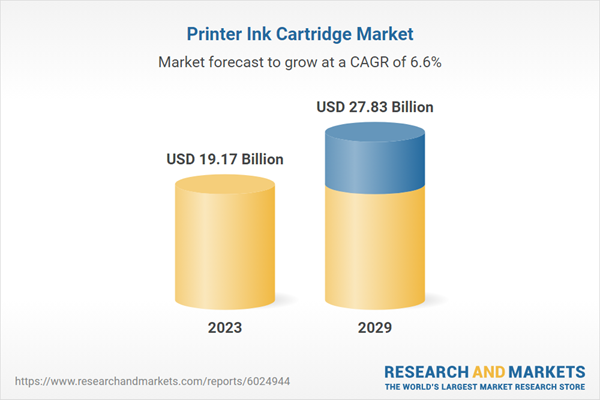

According to the research report, “Global Printer Ink Cartridge Market Outlook, 2029” the market is anticipated to cross USD 25 Billion by 2029, increasing from USD 19.17 Billion in 2023. The market is expected to grow with a 6.55% CAGR from 2024 to 2029. The rise of online shopping has significantly impacted the printer ink cartridge market. Consumers increasingly prefer the convenience of purchasing cartridges online, driving growth for e-commerce platforms that specialize in printer supplies. This shift has also led to increased competition among suppliers, pushing them to offer better prices and services.

Many companies are adopting subscription-based services for ink cartridges, allowing customers to receive cartridges automatically based on their usage. This model not only ensures a steady supply of ink but also fosters customer loyalty and convenience. Environmental concerns are prompting manufacturers to develop more sustainable products. This includes the production of refillable cartridges and the use of recycled materials in cartridge manufacturing. Companies are also promoting recycling programs to reduce waste and appeal to environmentally conscious consumers.

Innovations in printing technology, such as the development of high-capacity cartridges and advanced ink formulations, are changing the landscape of the industry. These advancements improve print quality, reduce costs, and enhance the overall user experience. As industries like photography, graphic design, and marketing grow, the demand for high-quality prints increases. This drives consumers toward premium ink cartridges that promise better color accuracy and durability.

Market Drivers

- Technological advancements: The printer ink cartridge market is significantly influenced by continuous technological advancements. Innovations in printing technology have led to the development of high-capacity cartridges that reduce the frequency of replacements and improve the overall user experience. Enhanced ink formulations have resulted in better print quality, including sharper images and more vibrant colors. Additionally, the introduction of smart cartridges equipped with sensors that monitor ink levels and usage patterns provides users with real-time information, helping them avoid unexpected shortages. These advancements not only enhance the efficiency and effectiveness of printing but also attract both consumers and businesses seeking reliable and high-quality printing solutions.

- E-commerce growth: The rapid growth of e-commerce has fundamentally changed how consumers purchase printer ink cartridges. Online shopping provides greater convenience, allowing users to compare prices, read reviews, and access a wide variety of products from different suppliers without leaving their homes. Many retailers are now offering subscription services for ink cartridges, enabling customers to automate their purchases based on their usage patterns. This model enhances customer loyalty and ensures that users always have ink on hand. Additionally, e-commerce platforms often feature competitive pricing and promotions, which can attract price-sensitive consumers. The ability to reach a broader audience through online sales channels is a crucial driver for growth in the ink cartridge market.

Market Challenges

- Price competition: The printer ink cartridge market faces significant challenges due to intense price competition, particularly from third-party suppliers that offer low-cost alternatives to original equipment manufacturer (OEM) products. This competition has made it difficult for OEMs to maintain their profit margins, as many consumers are increasingly price-sensitive and willing to switch to cheaper options. The proliferation of remanufactured and compatible cartridges further exacerbates this challenge, creating a highly competitive landscape. OEMs must innovate and differentiate their products through quality and additional features to justify their higher price points. The need for competitive pricing while maintaining quality can strain resources and affect profitability.

- Declining print volume: As digital communication continues to replace traditional printing methods, the overall demand for printed materials has been declining. This trend poses a significant challenge for the printer ink cartridge market, as reduced print volumes directly impact cartridge sales. Businesses and consumers are increasingly adopting digital alternatives, such as e-documents and cloud storage, leading to a decrease in the frequency of printing. To adapt to this shift, manufacturers must diversify their product offerings and explore new markets or applications where printing remains essential. This could involve focusing on specialized printing needs, such as packaging or high-quality photo printing, to sustain revenue streams in a changing market.

Market Trends

- Sustainability and eco-friendly products: Growing environmental awareness among consumers is driving a significant trend toward sustainability in the printer ink cartridge market. Many consumers are now seeking eco-friendly printing solutions, prompting manufacturers to develop products that minimize environmental impact. This includes the production of refillable cartridges, which reduce waste by allowing users to reuse their cartridges multiple times. Manufacturers are also incorporating recycled materials into cartridge production and implementing recycling programs to encourage consumers to return used cartridges for proper disposal. As businesses increasingly adopt sustainable practices, companies that prioritize eco-friendly initiatives will likely gain a competitive advantage and attract environmentally conscious consumers.

- Shift toward subscription models: The adoption of subscription-based services for ink cartridges is a notable trend reshaping the market. This model allows customers to receive cartridges automatically based on their usage, providing convenience and ensuring they never run out of ink. Subscription services often come with benefits such as discounts or exclusive offers, which can enhance customer loyalty. As more consumers become accustomed to subscription models in other areas of their lives (such as streaming services), the ink cartridge market is capitalizing on this trend by offering flexible and user-friendly subscription options. This shift not only helps manufacturers maintain steady revenue streams but also creates a more personalized customer experience that aligns with modern purchasing habits.

Aqueous ink is leading in the printer ink cartridge market due to its superior environmental safety, versatility, and high-quality output, making it the preferred choice for a wide range of applications.

Aqueous ink has become the dominant player in the printer ink cartridge market primarily because of its environmental safety and performance characteristics. Unlike solvent-based inks, aqueous inks are water-based, containing fewer volatile organic compounds (VOCs), which makes them safer for both the environment and human health. This characteristic aligns well with the growing consumer demand for sustainable and eco-friendly products, as businesses and individuals increasingly prioritize environmentally responsible choices in their purchasing decisions.The versatility of aqueous inks further enhances their appeal; they can be used on various substrates, including paper, cardboard, and certain types of plastics, making them suitable for a broad range of applications, from home printing to professional graphics and packaging. Additionally, aqueous inks are known for producing high-quality prints with vibrant colors and fine detail, which is crucial for industries that require precise and visually appealing outputs, such as photography, marketing, and art reproduction.

The rapid advancements in ink formulations have also improved their performance, ensuring excellent adhesion and durability while maintaining print quality. This combination of environmental benefits, versatility, and superior print quality positions aqueous ink as a leading choice for consumers and businesses alike, driving its continued growth in the printer ink cartridge market.

The commercial segment is leading in the printer ink cartridge market due to the increasing demand for high-volume printing solutions and the necessity for cost-effective, high-quality outputs across various industries.

The commercial segment is at the forefront of the printer ink cartridge market primarily because it caters to the growing demand for high-volume printing solutions essential for businesses across multiple sectors. As companies strive to produce marketing materials, reports, packaging, and other printed products at scale, the need for reliable, efficient, and cost-effective printing solutions becomes paramount. Commercial printing applications often require a significant volume of output, which drives the demand for ink cartridges that can deliver high page yields at lower costs per page.Furthermore, advancements in printing technology have led to the development of specialized inks and cartridges designed for commercial use, such as high-capacity toner and inkjet cartridges that provide superior performance and longer-lasting results. The emphasis on quality in commercial printing cannot be overstated; businesses require consistent, high-quality prints that meet professional standards to effectively communicate their brand image and message. This demand has prompted ink cartridge manufacturers to innovate continuously, producing cartridges that enhance color vibrancy, improve print durability, and reduce the risk of smudging or fading.

Additionally, the shift toward digital and on-demand printing has further solidified the position of commercial applications in the market, as businesses look for agile solutions that can adapt to changing printing needs while maintaining cost-effectiveness. As a result, the commercial segment remains a key driver in the growth of the printer ink cartridge market, as it aligns with the broader trends of digital transformation and increased operational efficiency.

The offline distribution channel is leading in the printer ink cartridge market due to the immediate availability of products, the opportunity for personalized customer service, and the ability to provide hands-on product demonstrations.

The offline distribution channel remains dominant in the printer ink cartridge market primarily because it offers immediate access to products and the convenience of purchasing on-site. Many consumers and businesses prefer to buy ink cartridges from brick-and-mortar stores, such as office supply retailers and electronics shops, where they can quickly find the cartridges they need without the wait time associated with online orders. This immediacy is particularly critical for commercial users who rely on consistent and timely printing operations; running out of ink unexpectedly can disrupt workflow and lead to delays.Furthermore, offline channels allow customers to benefit from personalized service, where knowledgeable staff can provide recommendations based on specific printing needs and assist with product selection. This personalized interaction helps consumers feel more confident in their purchases, especially for those who may be unfamiliar with the various cartridge options available. Additionally, offline stores often provide opportunities for hands-on product demonstrations, allowing customers to see the quality and performance of different inks before making a purchase. The ability to physically inspect products and receive real-time assistance contributes to a more informed buying decision.

Moreover, offline distribution channels also often run promotions and discounts, providing an attractive incentive for consumers to purchase in-store. Consequently, the combination of immediate availability, personalized service, and hands-on experiences reinforces the offline distribution channel's leading position in the printer ink cartridge market, catering to both individual and commercial customers seeking reliable and efficient printing solutions.

North America is leading in the printer ink cartridge market due to the high adoption of advanced printing technologies, a robust infrastructure for e-commerce, and a strong emphasis on quality and innovation in printing solutions.

North America holds a prominent position in the printer ink cartridge market largely due to its high adoption rate of advanced printing technologies and equipment across various sectors, including commercial, educational, and government institutions. The region's businesses are increasingly investing in cutting-edge printing solutions that demand high-quality output and efficiency, leading to a steady demand for high-performance ink cartridges. Additionally, North America benefits from a well-established infrastructure for e-commerce, allowing consumers to access a wide variety of ink cartridges from multiple brands easily.The convenience of online shopping, combined with the ability to compare prices and read reviews, drives consumer preferences toward purchasing ink cartridges online. However, traditional retail channels still play a significant role, as consumers appreciate the immediate availability of products and personalized service in physical stores. Moreover, the North American market places a strong emphasis on quality and innovation, with consumers willing to invest in premium products that deliver superior print results.

This demand has prompted manufacturers to continuously innovate their ink formulations and cartridge designs, focusing on aspects such as sustainability, efficiency, and compatibility with a wide range of printing devices. With an increasing focus on environmentally friendly solutions, there is a growing trend towards sustainable inks and cartridges in North America.

- In January 2024, ink world magazine reported on the latest development in the inkjet ink market highlighting the growth of digital packaging and textile segments as well as the innovation of ink formulations, print heads and substrates.

- In December 20 23 report was Published by the ink magazine stating that day shift from ink cartridge printer to high-capacity ink tank printers as well as the increasing demand for multi-functional printers.

- In July 2022, Marabu announced to launch printing inks with energy-saving capabilities, and small carbon footprint, and a digital varnish for customizable haptic effects.

- In August 2021, Canon India introduced MAXIFY GX6070 and MAXIFY GX7070 ink tank printers with a user-replaceable maintenance cartridge. The product contains a water-resistant ink cartridge to reduce downtime and provide high-quality prints.

Considered in this report

- Historic year: 2018

- Base year: 2023

- Estimated year: 2024

- Forecast year: 2029

Aspects covered in this report

- Printer Ink Cartridge market Outlook with its value and forecast along with its segments

- Various drivers and challenges

- On-going trends and developments

- Top profiled companies

- Strategic recommendation

By Ink Type

- Aqueous Ink

- Dry Sublimation Ink

- Solvent Ink

- Others (Latex Ink, etc.)

By End-Use

- Commercial

- Office use

- Residential

- Others

By Distribution Channel

- Offline

- Online

The approach of the report:

This report consists of a combined approach of primary and secondary research. Initially, secondary research was used to get an understanding of the market and list the companies that are present in it. The secondary research consists of third-party sources such as press releases, annual reports of companies, and government-generated reports and databases.After gathering the data from secondary sources, primary research was conducted by conducting telephone interviews with the leading players about how the market is functioning and then conducting trade calls with dealers and distributors of the market. Post this; we have started making primary calls to consumers by equally segmenting them in regional aspects, tier aspects, age group, and gender. Once we have primary data with us, we can start verifying the details obtained from secondary sources.

Intended audience

This report can be useful to industry consultants, manufacturers, suppliers, associations, and organizations related to the Printer Ink Cartridge industry, government bodies, and other stakeholders to align their market-centric strategies. In addition to marketing and presentations, it will also increase competitive knowledge about the industry.Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Hewlett-Packard Company

- Seiko Epson Corporation

- Canon Inc

- Dell Technologies Inc

- Xerox Holdings Corporation

- Lexmark International, Inc

- Ricoh Company, Ltd.

- Samsung Electronics Co., Ltd

- Brother Industries, Ltd

- Konica Minolta, Inc

- Toshiba Corporation

- Ritter GmbH

- Ninestar Corporation

- Clover Imaging Group

- Oki Electric Industry Co., Ltd.,

- Kyocera Corporation

- Pelikan Holding AG

- Clover Imaging Group

- Edding Tech

- LD Products, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 176 |

| Published | October 2024 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 19.17 Billion |

| Forecasted Market Value ( USD | $ 27.83 Billion |

| Compound Annual Growth Rate | 6.5% |

| Regions Covered | Global |