This report comes with 10% free customization, enabling you to add data that meets your specific business needs.

1h Free Analyst TimeSpeak directly to the analyst to clarify any post sales queries you may have.

Advances in feed formulation have included much more tailored, specific feeding methods to the needs of various poultry breeds, growth stages, or even production goals such as meat versus eggs. In terms of precision feeding technologies-in that sense, delivering exactly the right amount, at the right time-they are primarily embraced by larger poultry farms where it becomes critical for efficiency and least possible waste. Enzyme additives are gaining popularity too as they break down various complex feed ingredients, making more nutrients available, which means better feed conversion ratios.

Rising incomes and changing diets in most emerging economies are dramatically increasing the demand for more meat, with poultry being the most consumed meat globally. However, several key associations influence the global poultry feed market. The IFIF supports sustainability and safety standards, hence presently representing approximately 80% of the global compound animal feed produced. Working together with such bodies as FAO and WOAH, IFIF finds a way to influence regulation.

Regional associations, mostly in the Asia-Pacific region, also come in handy, with increasing demand for poultry farm and feed optimization; there is more drive toward developing poultry farming. Companies like Alltech and ADM Animal Nutrition are also doing innovation in the form of developing specialty feed products that help boost poultry health and productivity.

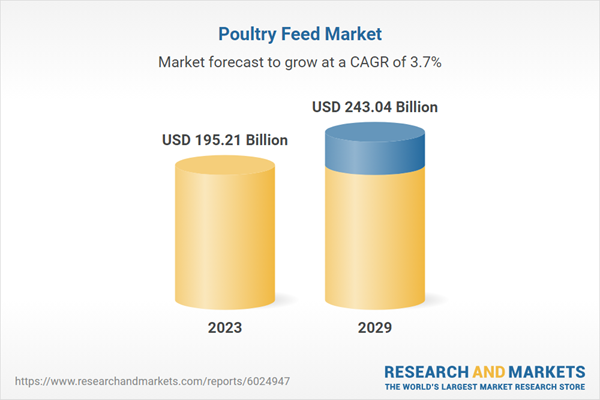

According to the research report, “Global Poultry Feed Market Outlook 2029” the market is anticipated to cross USD 240 Billion by 2029, increasing from USD 195.20 Billion in 2023. The market is expected to grow with a 3.68% CAGR from 2024 to 2029. Demands for poultry meat products are growing increasingly rapid. Poultry also is one of the cheapest sources of protein, because of this factor, poultry products like eggs and meat show positive growth in demand always. The growing consumer incomes and increasing level of urbanization in the Asia-Pacific region are driving demand for poultry products, contributing to the growth of this market.

COVID-19 pandemic in 2020 negatively affected the poultry feed market as its growth rate reduced. The novel virus outbreak has led to an interruption in the supply chain, and this is one of the significant factors having a great impact on the poultry feed industry. Besides that, rumors regarding the potential infection of COVID-19 through the consumption of poultry and poultry products restricted poultry and poultry product sales. Among the most challenging tasks facing poultry feed companies at this point is sustainability. So with this growing concern, feed production is becoming a growing environmental strain.

Traditional feed ingredients and its associated aspects include soy and corn linked to deforestation, greenhouse gas emissions, and loss of biodiversity. To go around these factors, feed manufacturers look into new ingredients such as algal meal, insect protein, and single-cell proteins that have much lesser environmental impacts. There is the rise of the circular economy approach whereby companies use food waste and by-products from other industries to produce feedstuffs. DSM-firmenich accounts for an increased prevalence of viral arthritis-leg weakness in poultry birds.

The trend toward antibiotic-free and organic feed has given the chance for natural alternatives, including essential oils and extracts of plants that promote gut health and disease resistance. Countries like China, the U.S., Brazil, and India are the biggest producers and consumers of poultry products and will thus create demand for quality feed. Protein diets have been on an upward trajectory in Asia and Africa, and this is likely to force the higher growth of poultry feed market.

Market Drivers

- Increasing focus on animal welfare: Rising concerns about animal welfare are prompting poultry farmers to adopt more humane practices. Consumers and regulators are pushing for improved living conditions for poultry, such as free-range or cage-free systems, which require higher-quality feed to ensure the health and productivity of the birds. Feed tailored to these systems, such as those supporting natural growth rates and immune system health, is in growing demand.

- Urbanization and changing consumer preferences: As urbanization accelerates, especially in developing countries, more people are moving away from rural areas where traditional farming practices were prevalent. Urban consumers tend to have higher disposable incomes and prefer convenience-oriented and packaged poultry products, leading to an increased demand for high-quality meat and eggs. This urbanization is driving commercial poultry farming operations, which, in turn, increases the demand for scientifically formulated, high-performance feed to meet the quality expectations of urban consumers.

Market Challenges

- Disease outbreaks in poultry: Poultry farming is susceptible to diseases such as avian influenza, Newcastle disease, and coccidiosis. Outbreaks can disrupt poultry production, reduce demand for poultry feed, and increase costs related to biosecurity measures. Disease outbreaks often lead to a sharp decline in poultry consumption, which negatively impacts the feed market. Additionally, the feed industry must invest in formulating feeds that strengthen poultry immunity, adding to development costs.

- Environmental and sustainability regulations: Poultry feed production, particularly related to the sourcing of raw materials like soybeans and corn, is facing increased scrutiny due to its environmental impact. Deforestation, land use changes, and carbon emissions associated with feed crop cultivation are key concerns. Governments and international organizations are implementing sustainability standards that require feed manufacturers to adopt more eco-friendly practices, which can increase operational costs and affect profitability.

Market Trends

- Adoption of alternative protein sources for feed: As part of the drive towards sustainability, feed manufacturers are increasingly turning to alternative protein sources such as insect meal, algae, and plant-based proteins. Insect protein, for example, has a much smaller environmental footprint compared to soy or fishmeal. These alternatives not only reduce reliance on traditional feed ingredients but also offer better nutritional profiles. This trend is gaining popularity, especially in Europe and North America, where sustainability is a key focus.

- Personalized and functional poultry feed: There is a growing trend toward personalized feed formulations based on the specific needs of different poultry breeds and production purposes (meat or egg production). Functional feeds are being designed to target particular aspects of poultry health, such as gut health, disease resistance, or enhanced growth rates. Feed manufacturers are using precise nutrient mixes and innovative ingredients to create functional feeds that maximize the performance and health of poultry.

Cereals dominated the list of poultry feed, mainly due to their energy content and the fact that they are cost-effective. Thus, they are imperative for achieving optimal growth in poultry as well as meeting poultry production efficiency.

Dominated by cereal grains, specifically corn, this poultry feed cannot be compared in nutritional value and economic benefits. Corn is basically a source of carbohydrates which also provides the most critical energy required for poultry growth as well as reproduction and health maintenance. Clearly, cereal grains are relatively cheap compared to other sources of proteins; thus, poultry farmers prefer them, particularly for poultry farming areas where feed costs exert big pressure on the profitability of the business. Over time, the increasing global consumption of chicken has been driven by the process of urbanization and changing dietary preferences of the population.As such, the demand for corn-based feed will probably increase proportionately. The grains themselves have also become nutritionally more valuable and better digestible as a result of better agricultural practice and feed formulation technology. This can be attributed to the use of a type of cereal grains, such as wheat, barley, and sorghum, which contribute to different feeds formulations tailored for particular dietary needs of poultry species. Flexibility is allowed on the part of the farmer for optimizing their feeding strategies at various growth stages and production goals. The primary reason for this is that many consumers have shown high interest in organic and sustainable farming activities.

Organic cereals for poultry feeding, made from a healthier food material to benefit the consumer, offer a lot of opportunity for this sector. With growing awareness concerning animal welfare and environmental sustainability, it would be expected that the poultry market will continue to change in order to practice more responsible feeding practices based on high-quality cereal grains.

The pellet feed is fast gaining the front of the poultry feed market mainly on account of its better nutritional efficiency and ease of handling which effectively increase feed utilization and healthier poultry growth.

The response to the nutritional requirement of birds and to the production requirements of the farmer. Pellet feed provides a balance that is concentrated and therefore feeds the bird with a much faster rate of absorption than mash or crumbs feeding. This efficiency translates into poultry growth rates and health conditions that are improved, which is crucial for such farmers who want to maximize productivity in a very competitive market. Pellet feed also makes it easy for birds to consume them easily with minimum waste and ensures that the feed is completely used. The production process of pellet feed involves high temperatures that kill all harmful bacteria, thus protecting the poultry from diseases.In addition, there are some merit factors in pellets in terms of logistics. Among feeds, pellets have lighter weight, compactness-thus light and space-saving, easy to store, and easy to transport. Such properties are very advantageous for farmers, as they have high inventory management by maintaining the quality of feed across long periods. Reduced storage space requires agile management, and indeed, farmers can stockpile feeds without worries regarding degradation. Demand for poultry products has increased through consumers, indicating that consumers become aware of the health benefits that proteins yield. As such, more fuel is added to the market for high-quality poultry feeds such as pellets.

High leading position in the poultry feed market for broilers, is owing to the rising demand world-wide for chicken meat which tends to gain popularity mainly because it is affordable and has a rich content of protein.

The largest segment is covered by the broiler breed that is mainly raised for meat, and it is a fast-growing breed with high feed conversion efficiency. It has a strong customer preference for chicken as a source of protein that still comes cheaper than any other meat. This demand is further driven by a rising global population and changing dietary preferences, particularly within developing regions. Moreover, higher incomes increase the propensity for consumers to spend on protein-rich food products. Chicken is a favorite because it is relatively inexpensive and can be prepared in so many ways.Further, productivity in broiler production has been advanced in terms of better adoption of poultry farming practices and feed formulations in recent times. Today, better feed available in the market makes sure that everything a bird needs to stay healthy and gain weight quickly is given. Another improvement is seen in profitability for farmers but also helps with keeping pace with the rising consumer requirements. Increased urbanization and busy lifestyles have resulted in a heightened demand for chicken as food, and it is necessary to have efficient farming practices that can keep pace with that requirement.

Another trend, which further supports animal health and productivity, goes into the integration of additives and probiotics with broiler feed. This segment has grown along with vital roles that broilers have undertaken in feeding an ever-growing population while supporting the economic orientation of poultry farming. For instance, in August 2023, Novus International, Inc. launched a new program aimed at enhancing the financial success of broiler producers. The scale-up program for broilers was focused on improving meat production, carcass quality, and the quality of nutrition.

The boom in the poultry feed market in APAC (Asia-Pacific) is majorly because of an increase in demand for poultry meat and eggs primarily due to shifting preferences in diets and increasing population.

For the APAC region, higher rising affluence and urbanization are directly attributed to a significant change in consumer preferences that positively reflects in the increased demand for protein-rich foods, particularly poultry meat and eggs. Its visibility can be seen in the economies of China, India, and the Southeast Asian countries that are linked with economic growth and higher disposable incomes, which enable their consumers to include more poultry products in their diets. This demand is further fueled by relatively lower cost compared with other meats, its versatility, and lower environmental impact. The Poultry industry of APAC is rapidly expanding and modernizing in response to this growing demand.High-technology farming techniques, including improved feed formulation, are becoming increasingly prevalent as methods that make the flocks more productive, healthier, and better grown. Use of nutritionally balanced and high-quality poultry feed optimizes poultry performance with food safety and best profitability results. Efficiency and quality are further enhancing the growth of the poultry feed market in the region. APAC is mainly witnessing several government supports and initiatives that contribute to the growth of the poultry feed market. Most governments in the region have put in place policies that enhance food security, increase livestock production, and improve animal health.

Such policies will enhance the viability of the poultry industry as it stimulates the use of quality feed and other modern farming technologies. Disease control and farmer education programs as well as other infrastructural undertakings further the development of the market. This can be further fortified by the fact that feed ingredients in the APAC region are diverse and in abundance such as grains, oilseeds, and agricultural by-products.

A strong agricultural infrastructure would then enable low-cost, nutritious poultry feed production, attracting domestic as well as international investments. Finally, in terms of strategic location, it offers an advantage in trade on feed ingredients and finished feed products since it may import feed ingredients or export feed products to other regions.

- In November 2023, Refit Animal Care, a manufacturer and supplier of high-quality animal feed and supplements, launched two new products of pigeon feed supplements to enhance poultry health and productivity.

- In December 2023, Alltech organized a poultry school in Karnal, Haryana, India, to share recent studies, innovative solutions and best feed milling practices with its poultry customers.

- In April 2022, Cargill invested USD 50 million toward developing R&D in China, near Elk River, Minnesota, and a facility in the Netherlands to research and build animal nutrition and feeds.

- In January 2022, Nutreco announced the confirmation of a partnership with Unga Group Plc to form two joint ventures in East Africa to provide high-quality protein in the region. Both ventures are named Tunga Nutrition, and the development helps increase market share in the animal nutrition markets.

Considered in this report

- Historic year: 2018

- Base year: 2023

- Estimated year: 2024

- Forecast year: 2029

Aspects covered in this report

- Poultry Feed market Outlook with its value and forecast along with its segments

- Various drivers and challenges

- On-going trends and developments

- Top profiled companies

- Strategic recommendation

By Ingredients

- Cereal/Grain

- Oilseed Meal

- Fish Meal & Bone Meal

- Others

By Form

- Pallet

- Mash

- Crumbles

- Others

By Livestock

- Broiler

- Layers

- Others

The approach of the report:

This report consists of a combined approach of primary and secondary research. Initially, secondary research was used to get an understanding of the market and list the companies that are present in it. The secondary research consists of third-party sources such as press releases, annual reports of companies, and government-generated reports and databases.After gathering the data from secondary sources, primary research was conducted by conducting telephone interviews with the leading players about how the market is functioning and then conducting trade calls with dealers and distributors of the market. Post this; we have started making primary calls to consumers by equally segmenting them in regional aspects, tier aspects, age group, and gender. Once we have primary data with us, we can start verifying the details obtained from secondary sources.

Intended audience

This report can be useful to industry consultants, manufacturers, suppliers, associations, and organizations related to the Poultry Feed industry, government bodies, and other stakeholders to align their market-centric strategies. In addition to marketing and presentations, it will also increase competitive knowledge about the industry.Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Cargill, Incorporated

- Archer-Daniels-Midland Company

- Land O'Lakes, Inc

- Alltech

- De Heus Animal Nutrition

- Royal DSM N.V.

- BRF S.A.

- Tyson Foods, Inc.

- ForFarmers N.V.

- Kemin Industries Inc.

- Nutreco N.V.

- Charoen Pokphand Group Co., Ltd

- ForFarmers N.V.

- Godrej Agrovet Limited

- Evonik Industries AG

- Chr. Hansen A/S

- MFA Incorporated

- Nova Feeds

- Adisseo

- Novus International, Inc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 174 |

| Published | October 2024 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 195.21 Billion |

| Forecasted Market Value ( USD | $ 243.04 Billion |

| Compound Annual Growth Rate | 3.6% |

| Regions Covered | Global |