This report comes with 10% free customization, enabling you to add data that meets your specific business needs.

1h Free Analyst TimeSpeak directly to the analyst to clarify any post sales queries you may have.

Environmental sustainability is also an important area in cattle feed market and industry players would try to adopt relevant practices which aim to reduce carbon footprint by using local ingredients to reduce transportation emissions and waste reduction strategies in feed production among others. Efforts to increase feed crop productivity will also be important, particularly in regions suffering from severe water scarcity. At its heart is the International Feed Industry Federation, which accounts for more than 80% of total compound animal feed produced worldwide and collaborates with organizations such as the FAO in developing safe standards.

To challenge the sustainable animal feeding strategy, the European region has, at its heart, the European Feed Manufacturers' Federation (FEFAC), while the American Feed Industry Association (AFIA) is the mouthpiece of the U.S. feed industry. The Global Feed LCA Institute also emphasizes environmental sustainability through life cycle assessments. Growing competition among livestock farmers in terms of yield and better quality products is forcing them to adopt advanced cattle feed formulations all over the world.

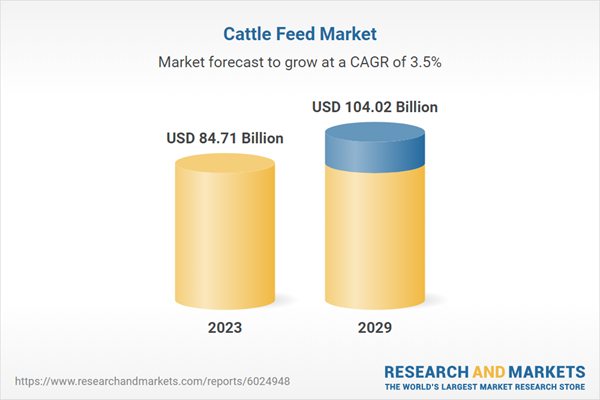

According to the research report, “Global Cattle Feed Market Outlook 2029” the market is anticipated to cross USD 100 Billion by 2029, increasing from USD 84.71 Billion in 2023. The market is expected to grow with a 3.45% CAGR from 2024 to 2029. The growing awareness of diseases that can hit livestock is catalyzing the use of specialized cattle feeds with added medicines or supplements as precautionary measures. Besides that, the growing availability of more online selling places for farm inputs directly to the pasture, where cattle feed is easier to reach distant or small farmers, is pushing the market in a more positive way.

Apart from that, the growing influence of social media that helps in creating consumer preferences and spreading awareness about ethical farming and animal welfare is also driving the growth of this market. Higher industrialization of cattle husbandry will lead to the implementation of sophisticated management practices, such as compound feed in suitable dosage.

Innovations in nutrition are also changing feed for cattle, which now enables farmers to more effectively enhance the health and productivity of their livestock. Another subject that has received significant interest is the application of functional ingredients such as probiotics, prebiotics, and phytogenics for gut health improvement as well as better general animal performance.

Cattle feed supply is also influenced by international trade dynamics, where countries increasingly import and export feed products and feedstuffs. These are countries with strong agricultural sectors, like the U.S., Brazil, and Argentina, which are major exporters of cattle feed and feed ingredients, and regions with developing or growing livestock industries, for example, Asia-Pacific, which are major importers.

Market Drivers

- Advancements in feed technology: Technological advancements in feed production are transforming the cattle feed industry. Innovations such as precision nutrition, which tailors feed formulations to the specific dietary needs of livestock, are gaining traction. Furthermore, the development of feed additives like enzymes and probiotics has shown significant benefits in improving feed digestibility and nutrient absorption. These enhancements not only promote better animal growth but also lead to reduced environmental impacts by improving feed conversion ratios. As the industry continues to embrace these advancements, the overall efficiency of livestock production is expected to improve, further driving market growth.

- Growing awareness of animal nutrition: With a growing emphasis on sustainable livestock farming, producers are becoming increasingly aware of the critical role nutrition plays in animal health and productivity. This heightened awareness is prompting a shift toward more specialized and high-quality feed products that support the overall well-being of cattle. Moreover, educational programs and resources are becoming more available, empowering farmers to make informed decisions regarding their livestock's nutritional needs. This trend not only improves the health of the animals but also enhances the quality of meat and dairy products, thus appealing to consumers who prioritize high-quality animal products.

Market Challenges

- Disease outbreaks in livestock:Outbreaks of livestock diseases, such as bovine spongiform encephalopathy (BSE) and foot-and-mouth disease (FMD), pose serious challenges to the cattle feed market. Such diseases can lead to substantial declines in livestock populations, consequently reducing the demand for cattle feed. To mitigate these risks, livestock producers must invest in comprehensive disease management and prevention measures, which can escalate costs associated with veterinary care and biosecurity. Additionally, the introduction of stringent regulations on feed formulations in response to health crises complicates compliance for feed manufacturers, further impacting the market.

- Competition from plant-based alternatives:The rise of plant-based diets and alternative protein sources has introduced significant competition for traditional livestock feed. As consumers become increasingly concerned about sustainability and animal welfare, many are opting for plant-based alternatives over meat products. This shift in dietary preferences can affect the demand for cattle feed, as some livestock producers may respond by reducing herd sizes. Consequently, feed manufacturers may need to adapt their products to incorporate more sustainable or alternative ingredients to remain competitive and address evolving consumer expectations.

Market Trends

- Focus on Organic and Non-GMO Feeds: There is a significant shift towards organic and non-GMO feed products in response to rising consumer demand for organic meat. Health-conscious consumers prefer meat products that are free from synthetic additives and genetically modified organisms. This trend is prompting feed manufacturers to adapt their offerings, increasing the production of organic ingredients to meet market demands. While this shift opens up new market opportunities, it may also lead to higher production costs and price premiums for organic feed, influencing overall market dynamics.

- Growing adoption of technology-driven: Advances in precision agriculture, including the use of data analytics, artificial intelligence, and machine learning, are enabling farmers and feed manufacturers to optimize feed efficiency and performance. These technologies allow for real-time monitoring of cattle health, behavior, and nutritional needs, leading to tailored feed strategies that enhance growth rates and reduce waste. Additionally, the integration of smart feeding systems can automate the delivery of feed, ensuring that cattle receive the right nutrients at the right time. This trend not only improves the overall efficiency of cattle farming operations but also contributes to sustainability by minimizing overfeeding and environmental impact. The industry is likely to see enhanced productivity and profitability while addressing the challenges of feeding a growing global population.

Beef cattle is leading in the market as there is an increased global demand for high-quality beef and meat products, following the growth in population, increase in income, and dietary preference shifts around the world.

Convergence of such various factors that reflect the changing consumption patterns as well as the economic environment has been the other growth driver for beef cattle. With the increase in population size and related rural-to-urban migration rates in the developing countries, an increasing need for protein-based diets, such as beef, has been witnessed.According to the United Nations Food & Agriculture Organization (FAO), the demand for beef products is expected to increase by 70% in 2050 compared to other meat categories. This increase is partly due to the expanding population, but it is also because of rising incomes that permit the disposable income necessary for buying better-quality meat products.

Beef consumption is so deeply ingrained in the diet of North America and parts of Asia that more contributes to the current surge in demand. Advances in cattle farming also meant increased population sizes and improved feed efficiency that would allow producers to meet the growing demand effectively. More importantly, integration of technology into the feed formulations enhances the nutritional value of the feed, thus making them more attractive to producers aiming at maximum growth rate and herd's overall health.

It also brings better feed solutions in the growing awareness of consumers relative to food safety and quality for more improved health and productivity of livestock. This is further encouraged with industrialized livestock production with an emphasis on efficient management practices, together with high-quality feed formulations that are customized to meet specific nutritional requirements.

Forages is dominating the market of cattle feed primarily because of rising global demand for such good-quality animal-based products. This act mainly forces the farmers to focus upon more nutritious forage for their livestock.

The importance of the market has been fueled by the growing demand for dairy and meat products. Livestock producers are compelled to enhance nutritional quality in cattle feed as populations expand and dietary preferences shift toward protein-rich foods. With a farmer's shift from subsistence farming into more commercial agriculture, they increasingly realize that high-quality forage can significantly improve yield and overall health in animals. Another area related to the evolution of forages is the advancement in processing technologies that enabled the fortification of forages and enhancement of their nutritional profiles.These innovations help not only to upgrade the feed quality but also increase its shelf life and make it convenient to store and distribute. For that reason, producers are more likely to invest in a specialized type of forage that would specifically cater to the nutrition of their livestock. For example, high-protein forages such as silages and hay are used widely by ruminant producers focused on producing high-quality milk products.

Further, the dynamics of competition in the market are changing by the existing players introducing novel ideas and technologies that are associated with forage into their activities so as to maintain major shares and enhance the environment around farming. It is also of high concern to the consumer besides food production concerning the environmental issues.

The growth of APAC (Asia-Pacific) in the cattle feed market is primarily influenced by the rise in animal protein, along with its subsequent growth rate in the livestock sector.

Significant demographic and geographic changes within the APAC region, including rising population and urbanization, have resulted in an enormous shift in dietary preferences towards meat and dairy products. The better off consumers are, the more animal protein is consumed in their diet, and then, in turn, fuels the demand for premium-quality cattle feed to establish and stabilize the livestock industry. China, India, and the Southeast Asian countries are burgeoning economically; it follows, then, that economies whose disposable incomes are rising are now increasing their demand for beef, milk, and other dairy products.As such, agricultural modernization is set to change the course of this sector, particularly if the aspect of livestock productivity and efficiency continues to take the front seat. Further development of cattle feeding practice and technology will be considered in advancing the efficiency of farming and raising livestock. Nutritionally balanced feed formulations are some of the critical factors that are necessary for optimal animal performance and quality of the meat and dairy products. Government support and investment in the agricultural sector also drive the market for cattle feed in APAC.

Many governments within the APAC region have policies and initiatives that support the development of livestock farming, improved animal health, and greater food security. Such supportive measures promote modernized farming techniques and high-quality feeds and boost the market growth. The diversity of the feed ingredients such as grains, oilseeds, and other agricultural by-products needed for the production of cattle feed makes the APAC region quite promising. The agriculture infrastructure in the region is robust and allows for the production of cost-effective and nutritious feed products. This usually attracts domestic and international investments, thus fueling market growth.

- In January 2023, De Heus Animal Nutrition announced it had established a new greenfield animal feed factory in Ivory Coast with an initial capacity to produce 120,000 metric tonnes of feed for animals, including cattle.

- In May 2022, Archer Daniel Midland Co. buys a feed mill in Southern Mindanao, the Philippines to expand its Animal Nutrition footprint in the country.

- In November 2021, De Heus Vietnam has signed a strategic partnership with Masan, through which De Heus acquired 100% ownership in the feed-related business of MNS Feed. MNS Feed's feed business comprises of thirteen animal feed mills with an aggregate production capacity of nearly 4 million metric ton, further consolidating De Heus' leading position in Southeast Asia's largest animal feed market.

Considered in this report

- Historic year: 2018

- Base year: 2023

- Estimated year: 2024

- Forecast year: 2029

Aspects covered in this report

- Cattle Feed market Outlook with its value and forecast along with its segments

- Various drivers and challenges

- On-going trends and developments

- Top profiled companies

- Strategic recommendation

By Type

- Dairy Cattle

- Beef Cattle

- Calves

- Others

By Ingredients

- Cereals/Grains

- Protein Meals/ Cackles

- Additives

- Forages

- Others

The approach of the report:

This report consists of a combined approach of primary and secondary research. Initially, secondary research was used to get an understanding of the market and list the companies that are present in it. The secondary research consists of third-party sources such as press releases, annual reports of companies, and government-generated reports and databases.After gathering the data from secondary sources, primary research was conducted by conducting telephone interviews with the leading players about how the market is functioning and then conducting trade calls with dealers and distributors of the market. Post this; we have started making primary calls to consumers by equally segmenting them in regional aspects, tier aspects, age group, and gender. Once we have primary data with us, we can start verifying the details obtained from secondary sources.

Intended audience

This report can be useful to industry consultants, manufacturers, suppliers, associations, and organizations related to the Cattle Feed industry, government bodies, and other stakeholders to align their market-centric strategies. In addition to marketing and presentations, it will also increase competitive knowledge about the industry.Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Cargill Incorporated

- Archer-Daniels-Midland Company

- Land O'Lakes, Inc

- Nutreco N.V.

- Royal DSM N.V.

- Kemin Industries Inc.

- De Heus Animal Nutrition

- ForFarmers N.V.

- Godrej Agrovet Limited

- Alltech

- Charoen Pokphand Group Co., Ltd

- Kent Corporation

- The J. R. Simplot Company

- Balchem Corporation

- Perdue Farms

- Adisseo

- Japfa Ltd

- BENEO GmbH

- National Feed and Flour Production and Marketing

- Evonik Industries AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 147 |

| Published | October 2024 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 84.71 Billion |

| Forecasted Market Value ( USD | $ 104.02 Billion |

| Compound Annual Growth Rate | 3.4% |

| Regions Covered | Global |